High Voltage Industrial Switchgear Market Outlook:

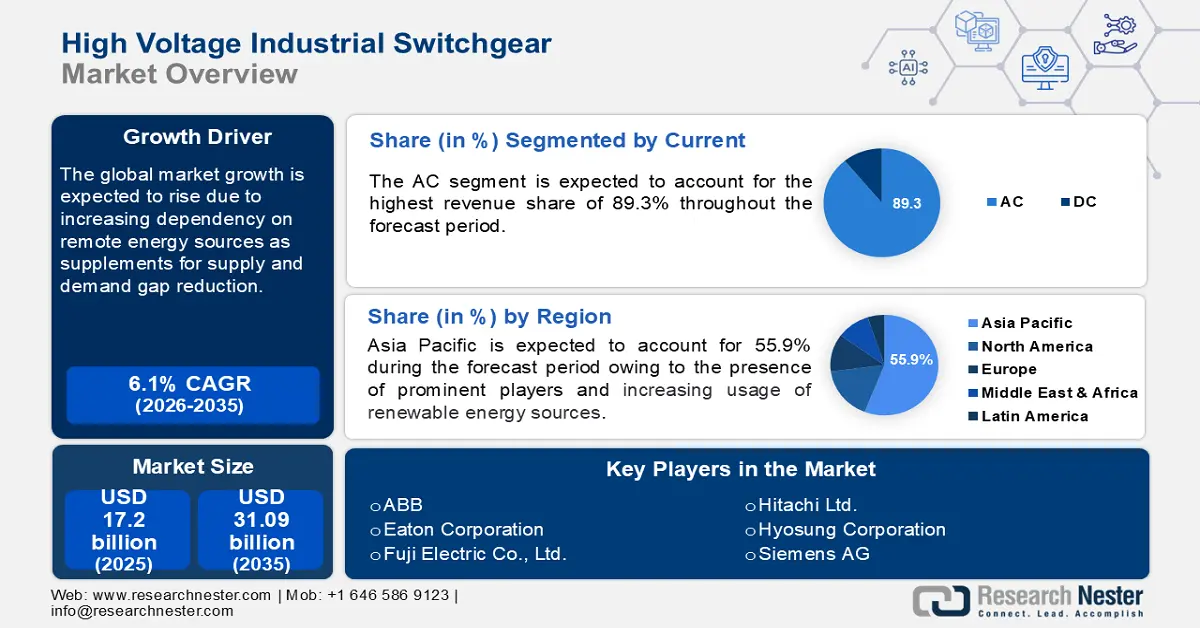

High Voltage Industrial Switchgear Market size was over USD 17.2 billion in 2025 and is anticipated to cross USD 31.09 billion by 2035, witnessing more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of high voltage industrial switchgear is estimated at USD 18.14 billion.

The globally increasing need for reliable electricity distribution, fueled by rapid urbanization, industrial expansion, and the rising demand for power in emerging economies, is significantly boosting the high voltage industrial switchgear market growth. Additionally, the ongoing shift toward renewable energy sources and the development of digital switchgear systems are also projected to bring further expansions and advances.

Moreover, increased investment in infrastructure projects, particularly in sectors including oil and gas, and transportation, is propelling market growth. Furthermore, the growing adoption of smart switchgear that integrates with IoT, and AI systems, offering real-time data analytics and predictive maintenance capabilities are some of the future trends showcased in the high voltage industrial switchgear market. In October 2023, Siemens Smart Infrastructure announced the expansion of its range of sustainable and digital switchgear in support of the decarbonization of present power grids. Focusing on industrialized and high-end ratings up to 24kV and 2500A, the company has launched the 8DAB 24 and upgraded the NXPLUS C 24.

Key High Voltage Industrial Switchgear Market Insights Summary:

Regional Highlights:

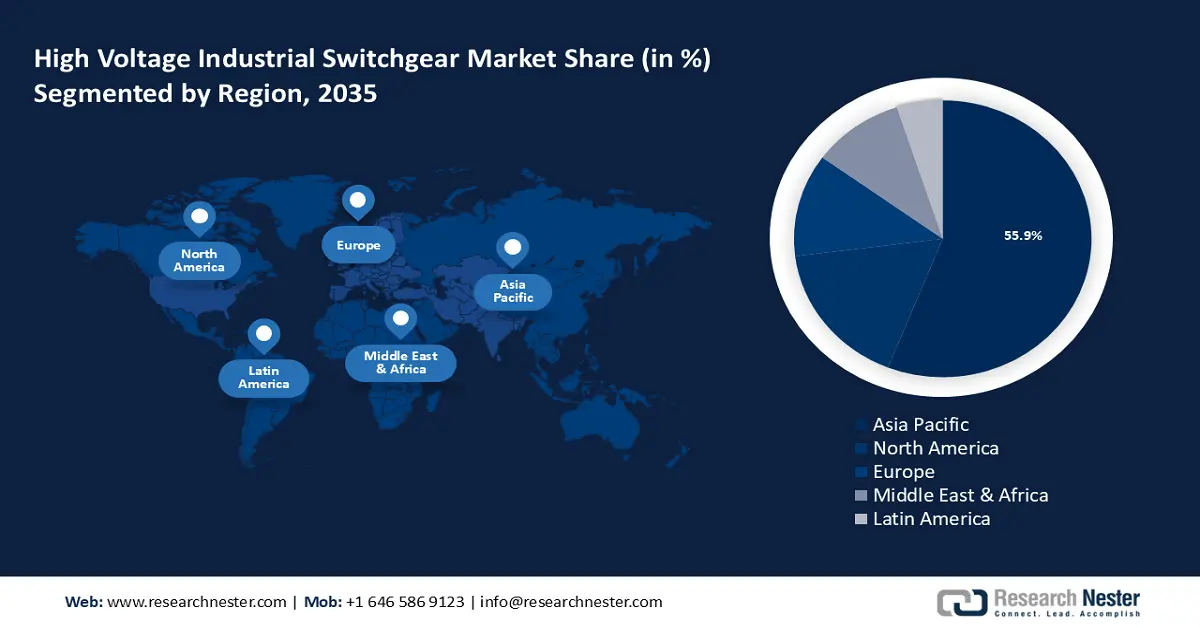

- Asia Pacific dominates the High Voltage Industrial Switchgear Market with a 55.9% share, fueled by substantial investments in renewable energy, industrialization, and rural electrification, ensuring robust growth through 2026–2035.

- North America’s high voltage industrial switchgear market is on track for stable growth by 2035, attributed to power infrastructure modernization, renewable energy integration, and demand for smart grid technologies.

Segment Insights:

- The Vacuum Insulation segment is poised for considerable CAGR growth from 2026 to 2035, attributed to minimal maintenance, arc quenching performance, and eco-friendliness.

- The AC segment of the High Voltage Industrial Switchgear Market is projected to maintain an 89.3% share by 2035, driven by its dominance in long-distance transmission and compatibility with existing infrastructure.

Key Growth Trends:

- Grid modernization and expansion

- Growth in renewable energy projects

Major Challenges:

- High initial investment costs

- Risk of electrical failures and safety concerns

- Key Players: Eaton Corporation, Hyosung Corporation, Hyundai Electric & Energy Systems Co., Ltd..

Global High Voltage Industrial Switchgear Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.2 billion

- 2026 Market Size: USD 18.14 billion

- Projected Market Size: USD 31.09 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (55.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, Japan, Germany, United States

- Emerging Countries: China, India, Brazil, Mexico, Turkey

Last updated on : 14 August, 2025

High Voltage Industrial Switchgear Market Growth Drivers and Challenges:

Growth Drivers

-

Grid modernization and expansion: The shift towards renewable sources, such as solar and wind, is driving the need for grid modernization and expansion. Traditional power grids were designed for centralized generation from fossil fuels, but integrating decentralized renewable sources requires a more flexible and intelligent grid. This has led to the development of smart grids, which utilize high-voltage switchgear for more efficient control, distribution, and monitoring of electricity. Modernizing the grid also involves upgrading outdated infrastructure to handle variable power inputs from renewables, ensuring a stable and renewable energy supply.

High-voltage switchgear plays a key role in this modernizing process by enhancing grid resilience and enabling safe transmission of electricity over long distances. In September 2024, Canada’s utility SaskPower announced plans to invest USD 1.6 billion in the provincial electricity system for the fiscal year of 2024-25. The investment is aimed at grid maintenance and upgrades, new generation, smart meter deployments, growth projects, and more. Such investments are projected to further push the growth of the high voltage industrial switchgear market. -

Growth in renewable energy projects: As the global push for cleaner energy intensifies, large-scale renewable energy projects, such as offshore wind farms and solar parks, are being developed to meet rising electricity demands. These projects often generate electricity in remote locations, far from consumption centers, necessitating high voltage transmission systems to efficiently transport power over long distances. High-voltage switchgear is critical in managing and controlling the flow of electricity from these renewable sources to the main grid.

In August 2024, the U.S. Department of State announced the launch of the Clean Energy Transition Accelerator (CETA) project in Argentina, aiming to reduce greenhouse gas emissions and accelerate clean energy transition. The U.S. will provide the government of Argentina with USD 500,000 in technical assistance from the U.S. Department of Energy’s Pacific Northwest National Laboratory and National Renewable Energy Laboratory. Such projects on renewable energy are anticipated to boost the high voltage industrial switchgear market growth during the forecast period.

Challenges

-

High initial investment costs: The installation of high voltage switchgear systems requires significant upfront capital due to the complexity and scale of the equipment. Additionally, the need for skilled professionals to properly install and test the systems adds to the overall expense. Maintenance of these systems is also expensive as they require regular inspections, upgrades, and the replacement of critical components to ensure reliability and safety. These factors pose a threat to the high voltage industrial switchgear market, challenging its speed of growth during the forecast period.

-

Risk of electrical failures and safety concerns: These systems operate under extreme electrical conditions, increasing the risk of failures such as short circuits, insulation breakdowns, or equipment malfunctions. Any failure in such systems can lead to dangerous situations, including fires, explosions, or widespread power outages, posing significant risks to both personnel and infrastructure. Ensuring the safety of these systems involves stringent design standards, regular monitoring, and the use of advanced protective devices. However, the potential for accidents remains a significant challenge for the high voltage industrial switchgear market.

High Voltage Industrial Switchgear Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 17.2 billion |

|

Forecast Year Market Size (2035) |

USD 31.09 billion |

|

Regional Scope |

|

High Voltage Industrial Switchgear Market Segmentation:

Current (AC, DC)

AC segment is projected to account for around 89.3% high voltage industrial switchgear market share by 2035 owing to its widespread use in power transmission and distribution systems. AC switchgear is preferred for its efficiency in transmitting electricity over long distances, as it allows voltage levels to be easily adjusted with transformers, minimizing energy loss. Additionally, the existing infrastructure globally is heavily built around AC systems, making upgrades and maintenance more feasible. Hence, the segment is projected to witness a significant rise during the forecast period.

In March 2022, State Grid Corporation of China launched two major ultra-high voltage alternative current (AC) power line construction projects, namely, Fuzhou-Xiamen and Zhumadian-Wuhan 1000kV UHV AC projects. Moreover, the demand for renewable energy integration, where AC transmission is commonly used, is witnessing a considerable rise. This further reinforces the dominance of AC in this segment, driving continuous investments in AC technologies in the high voltage industrial switchgear market.

Insulation (Air, Gas, Oil, Vacuum)

Based on insulation, the vacuum segment is projected to register considerable growth during the forecast period owing to its minimal maintenance requirements and superior performance in arc quenching. These switchgear are highly efficient at interrupting electric arcs, making them ideal for applications that require frequent switching and high reliability. In addition to these, vacuums also offer advantages such as compact design, longer lifespan, and environmental safety.

Unlike other insulation types which commonly use greenhouse gases such as SF6, vacuums do not require the usage of these gases. Vacuum insulations rather eliminated the need for SF6 while still offering high insulation strength and safety. The increasing focus on eco-friendly solutions and the need for reliable power distribution in industrial and utility sectors are driving the growth of vacuum insulation in the high voltage industrial switchgear market segment.

Our in-depth analysis of the market includes the following segments:

|

Insulation |

|

|

Current |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

High Voltage Industrial Switchgear Market Regional Analysis:

APAC Market Statistics

Asia Pacific industry is expected to account for largest revenue share of 55.9% by 2035, driven by diverse factors across different countries, during the forecast period. Substantial investments in renewable energy projects, industrialization, and urbanization are a few of the key factors of growth. Grid modernization and government initiatives for rural electrification are also boosting the market growth significantly. Upgrading aging infrastructure, and adoption of smart grid technologies are two of the most prominent trends visible among the countries in the Asia Pacific.

India market is fueled by the rapidly increasing electricity demand, urbanization, and ongoing developments in terms of infrastructure upgradation. Companies are actively participating in the high voltage industrial switchgear market in India. In November 2023, Siemens Limited announced the expansion of two of its factories in India, in addition to the Power Transformer factory in Kalwa and the Vacuum Interrupter factory in Goa capacity expansions. The expansion is aimed at meeting the rapidly growing need for critical components of the industry, infrastructure, and power distribution sectors.

China is anticipated to register considerable growth driven by extensive infrastructure development., and a strong focus on expanding the nation’s power grid. In August 2022, China's State Grid announced investments of over USD 22 billion in the second half of 2022 in ultra-high voltage (UHV) power transmission lines. The projects were aimed to drive demand for raw materials such as copper and aluminum and help China rev up its economic growth. Factors as such this are boosting the high voltage industrial switchgear market in the country.

North America Market Analysis

The high voltage industrial switchgear market in North America is driven by modernization efforts of aging power infrastructure and the region’s increasing focus on renewable energy integration. Growing demand for energy efficiency, along with investments in smart grid technologies, is propelling the market. In 2022, U.S. total primary energy consumption was nearly 100.4 quadrillion, which was a 3% increase from that of 2021. Additionally, regulations emphasizing energy security and sustainability are creating opportunities for advanced switchgear solutions.

In the U.S., the high voltage industrial switchgear market is bolstered by large scale infrastructure investments and grid upgrades. The transition to renewable energy sources like solar and wind, particularly in states with ambitious clean energy goals, is driving the demand for efficient, high voltage systems. The need to replace outdated power infrastructure is another key factor supporting market growth. Hence, these factors are further driving the need for high voltage switchgear adoption in a wide number of growth and development strategies.

Canada high voltage industrial switchgear market is expanding owing to the country’s focus on renewable energy projects, such as hydropower and wind farms. Investments in modernizing the power grid, especially in remote and rural areas, along with government initiatives to reduce carbon emissions, are stimulating demand for advanced high-voltage switchgear systems. Additionally, the country’s push for grid resilience to handle harsh weather conditions and its efforts to phase out aging infrastructure further drive the market growth.

Key High Voltage Industrial Switchgear Market Players:

- ABB

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eaton Corporation

- Hyosung Corporation

- Hyundai Electric & Energy Systems Co., Ltd.

- Lucy Group Ltd.

- Powell Industries

- Regal Rexnord Corporation

- Schneider Electric

- Skema S.p.A.

Companies are increasingly adopting growth strategies to capitalize on emerging trends such as the shift towards renewable energy, smart grid technology, and infrastructure modernization. Product launches, mergers, acquisitions, and collaborations are some of the most adopted growth strategies of the prominent high voltage industrial switchgear market players. In September 2023, ABB announced the launch of its 500 mm panel version of the UniGear ZS1, which is the company’s latest in air-insulated medium-voltage switchgear technology.

Recent Developments

- In June 2024, Siemens Smart Infrastructure invests USD 110 million in a 3.5-hectare site to expand the existing switchgear factory facility in Frankfurt’s Ostend district. The investment is further projected to strengthen the factory with high-speed warehouse and expanded production.

- In July 2022, Hitachi Energy announced the supply of the groundbreaking WindSTAR™ transformers and high-voltage hybrid switchgear Plug and Switch System (PASS) to the Tuci offshore wind power project in China.

- Report ID: 6584

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

High Voltage Industrial Switchgear Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.