High Voltage Capacitors Market Outlook:

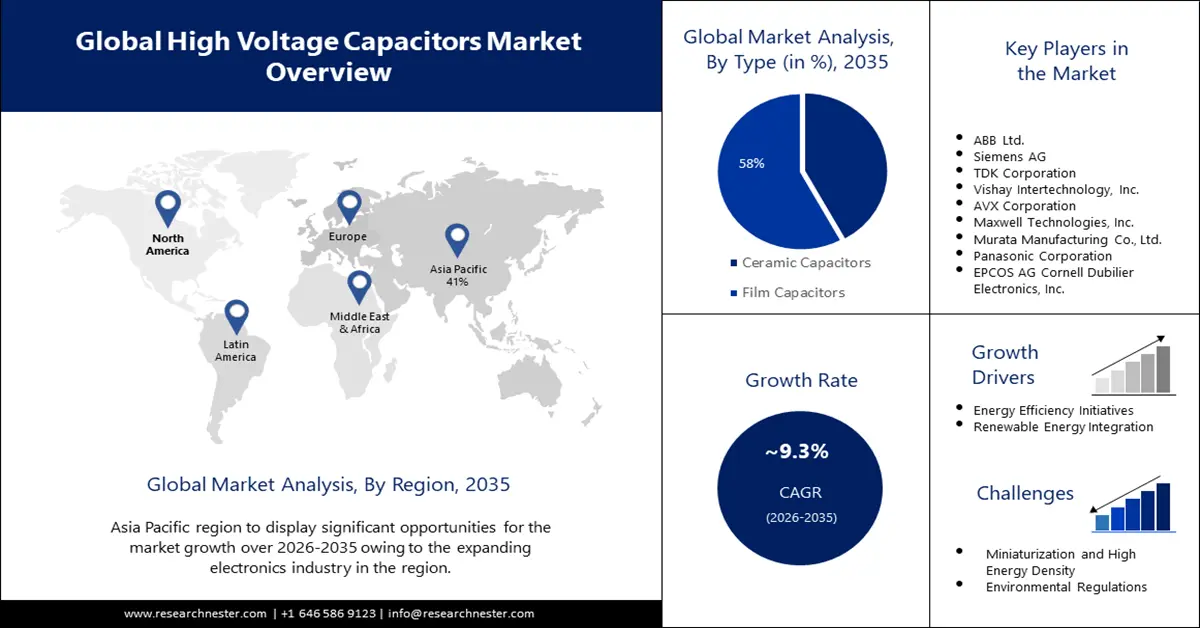

High Voltage Capacitors Market size was valued at USD 15.26 billion in 2025 and is likely to cross USD 37.13 billion by 2035, registering more than 9.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of high voltage capacitors is assessed at USD 16.54 billion.

High voltage capacitors are used in power electronics to enhance energy efficiency and reduce power loss during the transmission and distribution of electricity. With the increasing adoption of renewable energy sources such as solar and wind, there is a growing need for high voltage capacitors to manage and stabilize power fluctuations.

High voltage capacitors are devices used to store and release electrical energy in high-voltage applications. They play a crucial role in various industries, including power generation and distribution, aerospace, automotive, medical equipment, and more. High voltage capacitors are utilized in aerospace and defense for various applications like radar systems, satellite communication, and electronic warfare equipment.

Key High Voltage Capacitors Market Insights Summary:

Regional Highlights:

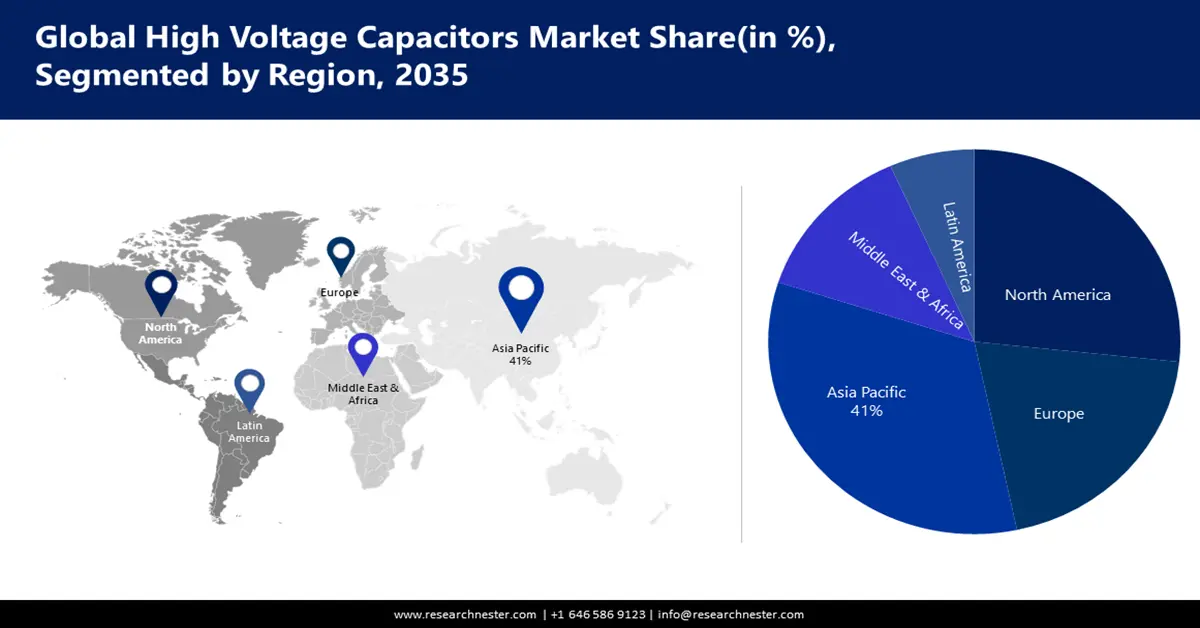

- The Asia Pacific high voltage capacitors market will hold over 41% share by 2035, driven by the robust electronics industry and rapid infrastructure development and urbanization in the region.

Segment Insights:

- The automotive end user segment in the high voltage capacitors market is expected to capture a significant share by 2035, driven by the global shift towards electrification in the automotive industry.

- The film capacitors segment in the high voltage capacitors market is forecasted to capture the largest share by 2035, driven by the growth of the electronics industry and adoption in renewable energy applications.

Key Growth Trends:

- Energy Efficiency Initiatives

- Renewable Energy Integration

Major Challenges:

- High Manufacturing Costs

- Miniaturization and High Energy Density

Key Players: ABB Ltd., Siemens AG, TDK Corporation, Vishay Intertechnology, Inc., AVX Corporation, Maxwell Technologies, Inc., Murata Manufacturing Co., Ltd., Panasonic Corporation, EPCOS AG, Cornell Dubilier Electronics, Inc.

Global High Voltage Capacitors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.26 billion

- 2026 Market Size: USD 16.54 billion

- Projected Market Size: USD 37.13 billion by 2035

- Growth Forecasts: 9.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 9 May, 2025

High Voltage Capacitors Market Growth Drivers and Challenges:

Growth Drivers

- Energy Efficiency Initiatives: The demand for energy-efficient solutions has driven the adoption of high voltage shunt capacitors in power electronics, reducing power loss during electricity transmission and distribution. According to the International Energy Agency (IEA), global energy efficiency investment is expected to reach USD 120 billion by 2025.

- Renewable Energy Integration: As the world continues to focus on renewable energy sources, the demand for high voltage capacitors to stabilize power fluctuations and improve grid efficiency has increased.

- Electric Vehicle (EV) Market Expansion: The rising adoption of electric vehicles has driven the need for high voltage capacitors in EV charging infrastructure and power management systems.

Challenges

- High Manufacturing Costs: Manufacturing high voltage capacitors involves using specialized materials and technologies, leading to higher production costs. These costs can impact the final product's pricing and limit market penetration.

- Miniaturization and High Energy Density

- Environmental Regulations

High Voltage Capacitors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.3% |

|

Base Year Market Size (2025) |

USD 15.26 billion |

|

Forecast Year Market Size (2035) |

USD 37.13 billion |

|

Regional Scope |

|

High Voltage Capacitors Market Segmentation:

Type Segment Analysis

The film capacitors segment in the high voltage capacitors market is estimated to gain the largest revenue share in the year 2035. The film capacitors segment benefits from the overall growth of the electronics industry, as these capacitors are widely used in various electronic devices and equipment. According to the International Data Corporation (IDC), worldwide spending on information technology (IT) is projected to reach USD 4.8 trillion in the year 2021. Film capacitors are extensively used in power electronics applications, including power supplies, inverters, and motor drives, due to their excellent electrical properties and high voltage handling capabilities. With the growing adoption of renewable energy sources, film capacitors play a vital role in energy storage and power conversion systems, contributing to the growth of this segment.

End User Segment Analysis

High voltage capacitors market from the automotive segment is expected to garner a significant share in the year 2035. The global shift towards electrification in the automotive industry, including hybrid and electric vehicles, has increased the demand for high voltage capacitors used in various power electronics applications within these vehicles. According to a report by the International Energy Agency (IEA), the global electric car stock surpassed 10 million vehicles in 2020. As the adoption of electric vehicles increases, there is a growing need for EV charging infrastructure. High voltage capacitors are utilized in charging stations for power management and DC-to-DC conversion. Governments and consumers worldwide are increasingly emphasizing energy efficiency and emission reduction in vehicles.

Our in-depth analysis of the global high voltage capacitors market includes the following segments:

|

Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

High Voltage Capacitors Market Regional Analysis:

APAC Market Insights

The high voltage capacitors market in the Asia Pacific region is projected to hold the largest market share of 41% by the end of 2035. The Asia Pacific region is known for its robust electronics industry, and the demand for high voltage capacitors is driven by various electronic devices and equipment manufactured in the region. Rapid infrastructure development and urbanization in the Asia Pacific region create a demand for high voltage capacitors in power generation, transmission, and distribution systems. According to the Asian Development Bank (ADB), infrastructure investment needs in the Asia Pacific region will exceed USD 1.7 trillion per year from 2016 to 2030.

North American Market Insights

The high voltage capacitors market in the North America region is projected to hold the second largest share during the forecast period. North America has been witnessing an increasing shift towards renewable energy sources, such as solar and wind power. High voltage capacitors play a crucial role in energy storage and grid stabilization in these renewable energy systems. The growing adoption of electric vehicles in North America has led to an increased demand for high voltage capacitors in EV power management and charging infrastructure.

High Voltage Capacitors Market Players:

- ABB Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens AG

- TDK Corporation

- Vishay Intertechnology, Inc.

- AVX Corporation

- Maxwell Technologies, Inc.

- Murata Manufacturing Co., Ltd.

- Panasonic Corporation

- EPCOS AG

- Cornell Dubilier Electronics, Inc.

Recent Developments

- Siemens AG and Siemens Energy AG announced their collaboration to develop and commercialize hydrogen systems as part of efforts to decarbonize various industries. The two companies aim to provide solutions that will enable the production, storage, and distribution of green hydrogen.

- Vishay Intertechnology announced that it had expanded its offering of FRED Pt® Ultrafast recovery rectifiers. The expansion included the addition of 15 new 100 V devices in the eSMP® series SlimSMAW (DO-221AD) package. These new devices were designed to provide high reliability and efficiency for automotive and commercial applications.

- Report ID: 5123

- Published Date: May 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

High Voltage Capacitors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.