High Temperature Polyamides Market Outlook:

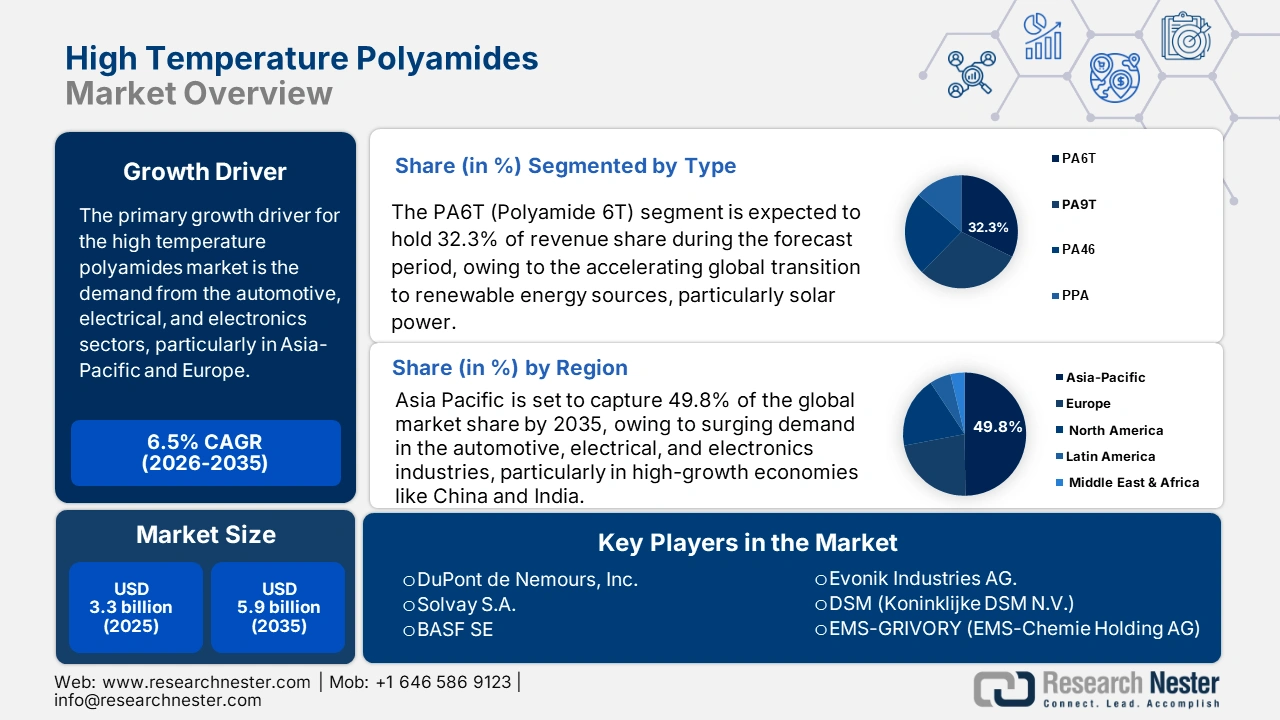

High Temperature Polyamides Market size was valued at USD 3.3 billion in 2025 and is projected to reach USD 5.9 billion by the end of 2035, rising at a CAGR of 6.5% during the forecast period, from 2026 to 2035. In 2026, the industry size of high temperature polyamides is evaluated at USD 3.8 billion.

The global high temperature polyamides market is expected to witness significant growth over the forecast period, primarily driven by the rising demand from the automobile, electric, and electronics segments, particularly in Asia-Pacific and Europe. The United States, Germany, and China exported polyamide-6 and allied polyamides in the highest amount of USD 1,997,961.17 thousand (557,341,000 kg), USD 1,901,020.76 thousand (468,001,000 kg), and USD 11,428,405.99 thousand (628,653,000 kg), respectively, in 2023, according to the World Bank WITS polyamide exports data. This is a strong export business in line with the high growth expectations in the high temperature polyamides market, propelled by rising demand in the automobiles, aerospace, and electronics industries, where high thermal stability and durability of these materials are vital to the use of such materials in sophisticated applications.

Additionally, in 2023, India exported USD 27.3 million of polyamides nylons (29th in the world) and imported USD 617 million, which places India as 5th among the global major importers. China, Chinese Taipei, South Korea, the United States, and Thailand were the major importers with USD 275 million, USD 82.3 million, USD 58.8 million, USD 56.3 million, and USD 42.6 million, respectively. The statistics demonstrate higher industrial application and align with government‐published data in national trade balances to demonstrate a positive correlation between the application of high‐performance polymers and domestic industrial development.

The high-temperature polyamides (HTPA) value chain continues to rely heavily on petrochemical feedstocks such as adipic acid and caprolactam. Production capacity for these key raw materials is expanding significantly in Asia and North America, supporting the regional growth of HTPA manufacturing. The Producer Price Index of Artificial Fibers and Filaments Manufacturing is at 157.075 in August 2025, and this figure has a firm level, which shows that the industry is active. Meanwhile, the Producer Price Index of the Textile Products and Apparel of polyamide and other noncellulosic fibers was 124.106 in May 2022, and it has been increasing steadily. The increased prices are indicative of the growing consumption of thermally resistant polyamides that are required in high-performance applications. Furthermore, RDD investment is reflected in the collaboration of government and academia, e.g., material research grants by the U.S. National Science Foundation (NSF) and EU Horizon programs for innovative high-performance polymer and recyclability. With enhanced global assembly capacity and robust import/export dynamics, these trends reflect an emerging market supported by robust trade dynamics and focused capital investment.

Key High Temperature Polyamides Market Insights Summary:

Regional Highlights:

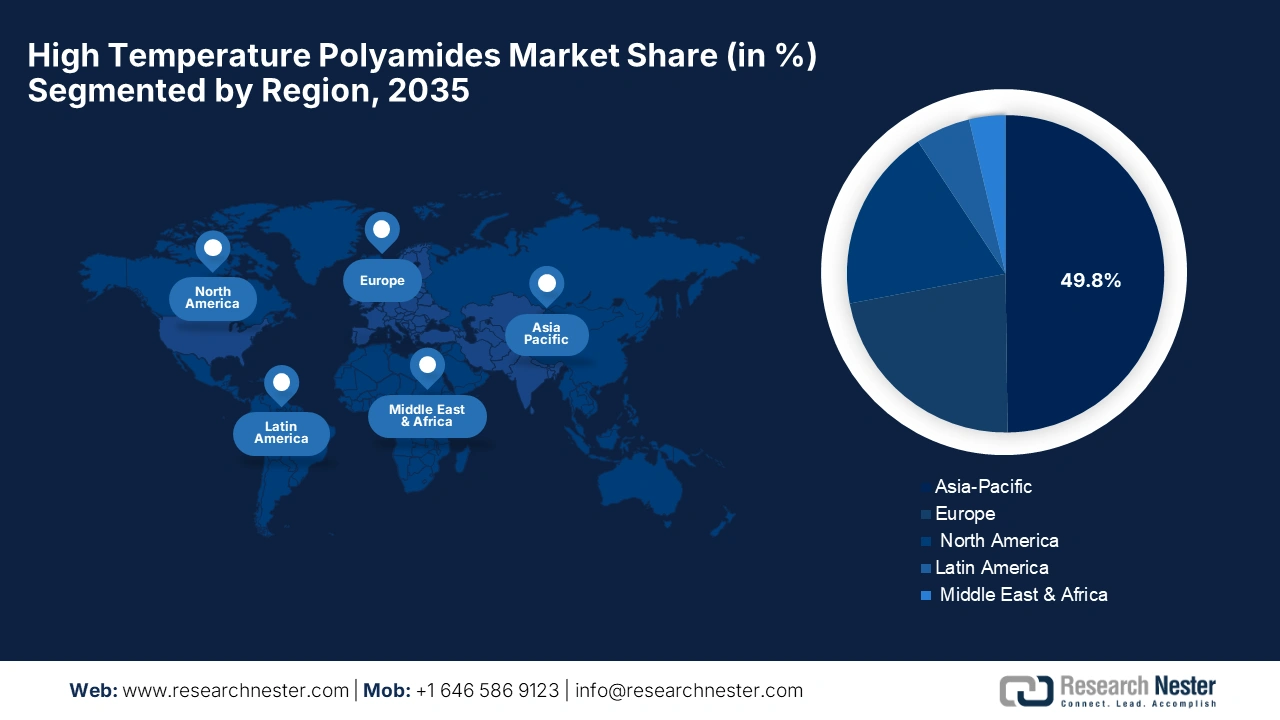

- The Asia Pacific region is expected to dominate the high temperature polyamides market with a 49.8% share by 2035, owing to expanding automotive and electronics industries alongside rising government investments in renewable raw materials and sustainable manufacturing technologies.

- North America is projected to capture a 20.7% revenue share by 2035, encouraged by stringent fuel-economy and emissions regulations promoting the adoption of lightweight, heat-resistant polymers in vehicle design.

Segment Insights:

- The PA6T segment is projected to hold a 32.3% share by 2035 in the high temperature polyamides market, propelled by its superior heat stability, mechanical strength, and suitability for advanced automotive and electronic applications.

- The automotive and transportation industry is anticipated to secure a 30.2% share by 2035, impelled by growing electrification trends and the increasing need for lightweight, heat-resistant materials in mobility applications.

Key Growth Trends:

- Regulatory stringency and chemical safety compliance

- Innovation in green production and chemical recycling

Major Challenges:

- Stringent U.S. Air Emission Standards (EPA, 2024 NESHAP Update)

- Mandatory safer technology reviews

Key Players: DuPont de Nemours, Inc. (United States), Solvay S.A. (Belgium/France), BASF SE (Germany), Evonik Industries AG (Germany), DSM (Koninklijke DSM N.V.) (Netherlands), EMS-GRIVORY (EMS-Chemie Holding AG) (Switzerland), Arkema S.A. (France), Kuraray Co., Ltd. (Japan), Mitsui Chemicals, Inc. (Japan), RTP Company (United States), Kingfa Science & Technology Co., Ltd. (China), Genius Group Co., Ltd. (Taiwan), Radici Group (Italy), Toray Industries, Inc. (Japan), Formosa Plastics Corporation (Japan).

Global High Temperature Polyamides Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.3 billion

- 2026 Market Size: USD 3.8 billion

- Projected Market Size: USD 5.9 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (49.8% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: South Korea, Brazil, Mexico, Thailand, Indonesia

Last updated on : 30 September, 2025

High Temperature Polyamides Market - Growth Drivers and Challenges

Growth Drivers

- Regulatory stringency and chemical safety compliance: The high temperature polyamides market is highly impacted by recent regulations under the Toxic Substances Control Act promulgated by the U.S. EPA. For instance, the January 2024 rule by the EPA designates about 328 PFAS compounds as "inactive," hence requiring their full safety review before reintroduction, essentially pushing compliance costs for polymer producers. This consists of testing, documentation, and possible reformulation costs. Such a move is in line with REACH restrictions in the European Union on organophosphates and high-temperature aromatic amides, thus increasing the cost of compliance and associated testing. These regulatory changes push producers toward investing in safer non-PFAS alternatives and environmentally compliant additives that can sustain their initial costs but provide them with an EPA-compliant chemical platform ready for the future.

- Innovation in green production and chemical recycling: Investment in green production, along with catalytic depolymerization-based chemical recycling, is an ongoing endeavor made to improve not only the cost-effectiveness but also the green credentials. In addition, Ames National Laboratory attracted the attention of researchers who made a zirconia-based catalyst that is highly efficient in breaking down polyolefin plastics without using precious metals, and thus, the performance of upcycling is matched by the platinum-based system. This technology helps in promoting the economics of circular polymer and is in line with the increase of high-performance engineering plastics, such as high-temperature polyamides, where advanced recycling pathways are imperative in achieving sustainable material sourcing. Companies ushering in greener grades of polyamides with renewable feedstocks or with chemically recycled content are now seeing better B2B acceptance, backed by carbon footprint regulations such as the EU’s Green Deal and U.S. low-carbon purchasing mandates.

- Growing polymer demand in major industries: The Ministry of Chemicals and Fertilizers of the Indian government has estimated that the chemicals market in India was worth the tune of USD 220 billion in 2023. It is estimated to reach between USD 400 and USD 450 billion by 2030, fueled by excessive industrialization, urbanization, and infrastructural growth. This tremendous increase drives the increase in demand in several of the most important sectors, including automotive, construction, and electronics, where high-temperature polyamides are an important part of the solution. These polymers are used to give thermal stability, mechanical strength, and chemical resistance needed in automotive parts, electrical, and construction materials. In turn, this growing polymer demand also leads to the growing high temperature polyamides market, which would coincide with the overall growth and modernization of industries.

Challenges

- Stringent U.S. Air Emission Standards (EPA, 2024 NESHAP Update): The National Emission Standards for Hazardous Air Pollutants (NESHAPs) were altered in 2024, with a focus on polymer and chemical synthesis plants, by the EPA. The regulation requires drastic reductions in emissions of hazardous air pollutants (HAPs) such as formaldehyde and methylene chloride, which are essential to high-temperature polyamide. These changes would require huge capital investments for the buildings and equipment, and for filtration upgrades, an online air pollution emissions monitoring system, and more sophisticated tools for detecting leaks. Initial one-time compliance costs were assessed as exceeding $401–601 million annually in the industry for all polyamide producers, especially the SMEs. Higher operating expenses reduce profit margins and deter new entrants, especially those based on outmoded factory facilities.

- Mandatory safer technology reviews: The 2024 revision of the EPA's Risk Management Program (RMP) mandates chemical producers to perform a Safer Technology and Alternatives Analysis (STAA) for operations involving hazardous or reactive chemicals. The fees that the EPA may charge for EPA-initiated risk evaluation are as high as USD 4,287,000 per chemical, with other fees charged on premanufacture notices and significant new use notices totaling 37,000 each. The net effect of this vast documentation, testing, and third-party audit requirements is a collective financial cost to the polymer industry in the form of hundreds of millions of dollars each year. This regulatory climate poses a challenge to manufacturers in the form of cost structure escalation and the delay of innovation cycles, which affect the expansion and rivalry of the high-temperature polyamide. From a financial perspective, these cost-ineffective activities delay approvals for new projects, raise per-unit production costs, and lower world competitiveness, particularly due to the competition from nations with less restrictive regulations regarding safety.

High Temperature Polyamides Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 3.3 billion |

|

Forecast Year Market Size (2035) |

USD 5.9 billion |

|

Regional Scope |

|

High Temperature Polyamides Market Segmentation:

Type Segment Analysis

The PA6T segment is anticipated to retain the largest share of 32.3% during the forecast years, owing to its better heat stability, mechanical properties, and dimensional stability when exposed to long-term high temperatures. PA6T has also achieved greater preference in high-performance uses like under-the-hood parts in automotive, charging connectors in electric vehicles, and industrial electronics, where conventional polyamides fail to deliver. Greater hydrolytic and chemical resistance also ensures long-term reliability, particularly in high-voltage platforms of electric vehicles and in small designs. The rising demand for heat-resistant, micro-sized components for 5G devices and EVs continues to drive adoption in Europe and Asia-Pacific, thereby positioning the segment as a key growth engine in the global high temperature polyamides market.

High-temperature polyamides based on PA6T have extensive applications in the field of thermal and mechanical stability. The Grivory HT6 series of EMS-Grivory, of its official PA6T/6I product line, is designed for high-heat resistance, and the highest heat deflection temperature (HDT) is 280°C at 1.8 MPa. These grades are strong and stiff even when they are subject to thermal cycling, and hence, they are applicable in the automotive and electronic sectors. Grades like Grivory HT1V-4 HY black 9205 (GF40) with tensile strengths of 230 Mpa and a modulus of 15Gpa in the glass fiber-reinforced sub-segment have better dimensional stability and creep resistance. The metals can be replaced with these properties in structural and under-the-hood parts, as well as enhance efficiency without the loss of performance.

End User Segment Analysis

The automotive and transportation industry is projected to command a substantial revenue high temperature polyamides market share of 30.2% by 2035, as the demand for lightweight heat-resistant materials has grown with mobility applications. HTPAs are mostly used in the manufacturing of under-the-hood automotive components and parts in powertrain systems and battery housings, where durability and thermal stability are ensured. Electrification for passenger and commercial vehicles has provided an additional impetus to the use of HTPA. Apart from transportation, industrial machinery, consumer goods, and building construction are also some of the end-use industries that create demand for HTPA for mechanical strength, chemical resistance, and long-term performance in a high-temperature working environment.

The electric vehicle battery systems and lightweight structural components of the Automotive and Transportation (incl. EV) segment are the key growth drivers of the global high temperature polyamides market. The expansion in the manufacturing of electric vehicles is increasing the call to find materials to use in the battery systems, which are durable and heat-resistant. The Grivory HT1VA grade provided by EMS-Grivory shows this trend with nearly 3.4 times higher breaking stress after a period of around 8,000 hours of a 1:1 water-glycol mixture at 110 0 C than hydrolyzed PA66, and thus is suited to Electric vehicle battery systems, including battery cooling modules and housings. Meanwhile, the Amodel Supreme PPA of Solvay promotes the trend of Lightweighting, where metals are substituted in lightweight structural components such as shift forks and clutch cylinders, so that the manufacturers can lower the weight of the vehicle and improve its efficiency. Together, these subsegments play a crucial role in the emerging market in the automotive sector.

Application Segment Analysis

The automotive components segment is likely to grow with a significant revenue high temperature polyamides market share of 27.5% from 2026 to 2035. Polyamides are also proving to be a useful replacement for metals in engine components, especially the high-temperature type with its high thermal stability, chemical resistance, and light weight. For example, polyphthalamide (PPA) grades that can be used in continuous service temperatures of greater than 150 °C, and reinforced grades. It enables the manufacturers to create parts such as the intake manifolds, the valve covers, and the turbocharger parts with better capacity to resist and less weight, leading to high fuel efficiency and lowering the emissions. This has seen the automotive industry move towards light weighting and high emission standards, forcing it towards the use of high-temperature polyamides in engine parts, which is driving the growth of the segment.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegment |

|

Type |

|

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

High Temperature Polyamides Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is anticipated to dominate the global high temperature polyamides market over the projected years from 2026 to 2035 with the largest revenue share of 49.8%, owing to rising demand in the automotive, electrical, and electronics industries, particularly in China and India, two fast-growing economies. APAC governments are significantly investing in green manufacturing, renewable raw materials, and processing technologies. For example, the Green Iron Fund of Australia, which comprises USD 636 million, a portion of a larger USD 1.9 billion investment, assists in the manufacturing and supply chains of heavy industries that are sustainable. This trend in the move towards green materials and processes is similar to the increased demand for high-temperature polyamides in the Asia Pacific, which is influenced by government expenditure in renewable raw materials and new technologies. These efforts are speeding up the use of heat-resistant polymers in the automotive, industrial, and electrical industries in the region. In addition, higher adoption of bio-based HTPAs, high-heat polymer 3D printing, and circular economy demands are leading regional growth. For instance, the PA6 plant of BASF in Shanghai was certified with ISCC PLUS to produce biomass-balanced and cycled PA6 & PA6/6.6 copolymer using bio-circular and recycled feedstocks.

This movement toward sustainable raw materials is in favor of the increasing need of the region to use low-carbon, high-performance polymers. It is also in line with the larger trend in the Asia Pacific into bio-based and circular high-temperature polyamides, which is caused by regulatory pressure and green manufacturing programs. Moreover, extensive applications of HTPAs for automotive lightweight, aerospace components, and industrial equipment fuel market expansion, driven by multilateral funding and trade agreements, leading towards sustainable chemical production.

By 2035, China’s high temperature polyamides market is likely to dominate the Asia Pacific region with the largest share. The market in the country is expanding due to the engineering plastic innovation, which is supported by government policy via Made in China 2025 and the National Development and Reform Commission (NDRC), along with sustainable materials. Additionally, a biomass-to-bioethylene glycol (bio-EG) catalytic reaction with a pilot plant in Puyang, Henan, that used starch and corn stalks as feedstock to generate 1000 tonnes per year was developed by Chinese researchers of the Dalian Institute of Chemical Physics and collaborators. This innovation in green chemical production helps transition to sustainable materials, which will help meet the increasing demand for high-temperature polyamides in China, since industries are interested in high-performance polymers with environmental friendliness. Circular economy goals target recycling 510 million tons of material, including engineering polymers, through 2030. Moreover, ChemChina and the Ministry of Ecology and Environment heavily invest in clean-tech polymers, keeping China ahead in demand and production. Additional expansion in electric vehicles, electronics manufacturing, and aerospace components using HTPAs further establishes its market leadership.

The high temperature polyamides market in India is likely to grow with the fastest CAGR over the forecast years, fueled by rapid industrialization, domestic electronics production, and automotive technology. Additionally, through the Plastic Park Scheme, the Government of India subsidizes up to 50% of the project cost (limited to ₹40 crore per project), and has so far allowed 10 Plastic Parks, such as Tamot (Madhya Pradesh), Paradeep (Odisha), and Tinsukia (Assam). Parks enhance the processing of downstream plastics by infrastructure support, shared facilities, and facilitating clusters of high-tech plastics sectors. This is providing a positive environment to adopt high-temperature polyamides in India through enhancing the infrastructure of the modern plastics, enhancing investment, and the scale and cost competitiveness.

Moreover, the Responsible Care program of the Indian Chemical Council has been adopted by 163 Indian chemical companies as an indication of the increasing industry adoption of green polymer processes. This change assists in the growth of the Indian market of high-temperature polyamides due to the promotion of environmentally friendly manufacturing, the minimization of environmental influence, and the fulfillment of increased demand for environmentally friendly and high-performance polymers. Furthermore, the National chemical parks, sustainability clusters, and Make-in-India initiatives are supporting the scale-up of indigenous HTPA manufacturing and uptake, enabling India to overtake more advanced economies in terms of growth rate.

North America Market Insights

North America’s high temperature polyamides market is expected to grow substantially by 2035, with the revenue share of 20.7%, propelled largely by stricter vehicle fuel-economy and greenhouse-gas emissions regulations, which are pushing the automakers to replace metals with lighter and heat-insulating polymers. For example, a report by the U.S Environmental Protection Agency entitled Automotive Trends Report states that the fuel economy of light-duty vehicles is 27.1 mpg in the 2023 model year, and real-world CO2 emissions have reached a record low of 319 grams per mile, both maintaining long-term goals of lower emissions. This is a tendency that highlights the increasing need for high-performance and lightweight materials in the automotive industry, including high-temperature polyamides (HTPAs), new materials with greater thermal performance and durability. The implementation of HTPAs will aid in designing more fuel-efficient and environmentally friendly vehicles, unlike the industry, whose goal is to cut down on emissions and to have a high fuel economy. In addition, the U.S. Environmental Protection Agency (EPA) has completed new greenhouse gas (GHG) emissions targets in light-duty vehicles that will have a fleet-wide average of 82 grams per mile (g/mi) of CO2 by model year 2032, a 51% reduction of the estimated levels under the existing standards by model year 2026. Such strict rules will push the automakers to embrace more sophisticated materials capable of sustaining higher temperatures, including high-temperature polyamides, to satisfy the performance and durability demands of next-generation cars, as the regulators and the market are leaning toward sustainable high-performance materials.

The high temperature polyamides market in the U.S. is anticipated to expand significantly during the projected years in the North American region, attributed to the fuel economy and emissions rules of advanced materials (high-temperature polyamides) employed in automobile use. An average new light-duty vehicle's real-world CO 2 emissions decreased in model year 2023 to 319 grams per mile (g/mi) (reduced 18 g/mi compared to 2022), and real-world fuel economy rose to 27.1 mpg. These advancements are initiated by the growing manufacturing of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), which contribute to increasing the level of emissions of bigger and more powerful types of vehicles. These trends favor expansion in the high temperature polyamides market in the U.S. due to the increased levels of emission and performance mandates, which compel the automakers to consider those materials capable of sustaining high under-hood/cooling system temperatures, and which are lightweight and durable.

Moreover, research sponsored by NHTSA indicated that the use of advanced plastics and composites in a 2007 Silverado saved the vehicle weight by 19%, 2307 kg to 1874 kg, and 23.6% of the lightweight delivery of the vehicle was comprised of polymers. This transition helps strengthen the increase in the demand for high-temperature polyamides in the U.S., particularly in under-hood and engine uses. With automakers striving towards achieving tougher emissions and fuel economy regulations, heat-resistant lightweight materials are proving to be imperative. These regulatory forces, as well as technological changes (EVs, hybridization), are contributing to the increasing demand for performance polymers.

Canada’s high temperature polyamides market is likely to witness an upward trend from 2026 to 2035, owing to the automotive/transport industry in the country that is moving towards greater efficiency in vehicles and regulation of emissions, and contributes to the advancement of materials such as high-temperature polyamides. Passenger Automobile and Light Truck Greenhouse Gas Emission Regulations, which were initially adopted in 2011 and revised in 2014, set various stricter GHG emission targets on new light-duty vehicles of model years 2017 2025, in line with U.S. EPA standards. Since their enactment, these regulations have already resulted in a 19.2% and 15.5% reduction in GHG emissions of new passenger and light truck automobiles, respectively. This regulatory force encourages more of the heat-resistant and lightweight materials to be used under the hood, which drives the demand for high-temperature polyamides in engines, exhaust, and thermal management applications in the automotive sector in Canada. Natural Resources Canada also offers consumers the official ratings in the 2025 Fuel Consumption Guide to compare models, which increases the transparency and demands high-performing, efficient vehicle components in the market. The automotive trends (SUV/pick-up supremacy) and the compliance with the standards of the U.S. pose a great attraction to the materials, which can endure high temperatures and minimize weight.

Europe Market Insights

The European high temperature polyamides market is projected to grow with a revenue share of 22.7% during the projected years, primarily due to the region's strong automotive, aerospace, and electrical sectors leading the growth, with an emphasis on lightweighting and thermal resistance. Sustainability regulations like the EU's Ecodesign Regulation, enforced in July 2024, and Horizon Europe funding are driving the replacement of bio-based and recycled HTPAS. Also, BASF, Lanxess, and Solvay are among the producers increasing the capacity and developing green-grade HTPAs. For instance, BASF has also started the process of a new hexamethylenediamine (HMD) plant in France in Chalampé, which is projected to raise its capacity of HMD to 260,000 metric tons each year. It is a growth that is included in the strategy of BASF to strengthen its business of polyamide 6.6 in Europe.

Additionally, circular-economy goods under the European Green Deal need to be recyclable and utilize sustainable chemistry, contributing to the market. In 2024, the Federal Ministry for Economic Affairs and Climate Action (BMWK) allocated a significant grant toward sustainable chemical solutions, reflecting rising investment in green chemistry. Demand for green chemicals further grew, signaling strong industrial adoption. Germany's automotive sector, which produced 3.36 million vehicles in 2022, plays a key role in this shift. Similarly, the UK Government Advanced Manufacturing Plan has an investment of £4.5 billion in the coming 2030, with the UK Government investing £3 billion in the automotive industry and aerospace industries, where lightweight and heat-resistant materials can be significantly deployed. This investment assists in the use of high-temperature polyamides in components that need thermal qualities and strength, which speeds up the development of the market in terms of high-performance engineering work.

Key High Temperature Polyamides Market Players:

- DuPont de Nemours, Inc. (United States)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Solvay S.A. (Belgium/France)

- BASF SE (Germany)

- Evonik Industries AG (Germany)

- DSM (Koninklijke DSM N.V.) (Netherlands)

- EMS-GRIVORY (EMS-Chemie Holding AG) (Switzerland)

- Arkema S.A. (France)

- Kuraray Co., Ltd. (Japan)

- Mitsui Chemicals, Inc. (Japan)

- RTP Company (United States)

- Kingfa Science & Technology Co., Ltd. (China)

- Genius Group Co., Ltd. (Taiwan)

- Radici Group (Italy)

- Toray Industries, Inc. (Japan)

- Formosa Plastics Corporation (Japan)

The high temperature polyamides market is highly concentrated, led by DuPont (~18.4%) and Solvay (~16.2%), followed closely by BASF, Evonik, and DSM. Market leaders are investing heavily in sustainability—DuPont expanded its Ohio PA6T facility (+20%) and Solvay added a new Amodel HT line in Belgium. Strategic moves like Germany’s BASF developing recyclable PA9T (emissions -22%) highlight the shift toward circularity. Japanese firms Kuraray, Mitsui, and Toray are strengthening bio-based HTPA technologies, while EMS-GRIVORY and Arkema are scaling lightweight, flame-retardant polymer lines. Overall, capacity expansions, M&A, and green innovation define the current competitive dynamics.

Top Global High Temperature Polyamides Manufacturers:

Recent Developments

- In June 2025, DOMO Chemicals introduced a major update in high-performance polyamides at the K2025 trade fair, unveiling TECHNYLSTAR halogen-free, flame-retardant, high-temperature polyamide grades designed for electric vehicle battery modules, busbars, and electronic components. These new materials offer elevated thermal resistance and enhanced fire safety, aligning with the accelerating demands of e-mobility and advanced electronics. The company also showcased innovations in bio-circular and recycled high-temperature polyamides via their sustainable TECHNYL 4EARTH line.

- In June 2025, BASF formally commissioned a new hexamethylenediamine (HMD) world-size plant in Chalampe, France, which increased its yearly capacity of hexamethylenediamine (HMD) to 260,000 metric tons. The plant is an HMD expansion that helps BASF in the strategic expansion of its production of polyamide 6.6 (PA 6.6) in Europe, and further polymerization of the product is added in Freiburg. The uses of PA 6.6 can be seen in the automotive sector and high-performance fiber, aligning the company to satisfy increased demand for the use of high-performance polymers that are heat-resistant in applications that need thermal sustainability.

- Report ID: 7862

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

High Temperature Polyamides Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.