High Temperature Coatings Market Outlook:

High Temperature Coatings Market size was over USD 2.48 billion in 2025 and is poised to exceed USD 3.74 billion by 2035, witnessing over 4.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of high temperature coatings is estimated at USD 2.57 billion.

The growing demand from a variety of end-use sectors, including automotive, aerospace, industrial, and construction, is the main factor propelling the global high temperature coatings market. According to the European Automobile Manufacturers Association (ACEA) nearly 76 million cars were produced worldwide in 2023, a significant 10.2% rise over the year before. Positive production patterns that surfaced globally across areas were the driving force behind this boom. Owing to their ability to tolerate high temperatures, corrosion, and chemical exposure, these coatings are crucial for safeguarding surfaces in challenging conditions.

The high temperature coatings market worldwide is brimming with prospects for growth and innovation. A notable prospect is the creation of sophisticated coatings with exceptional heat resistance qualities that can tolerate even greater temperatures without compromising functionality and longevity. High temperature coatings are becoming in demand as a result of industries including aerospace, automotive, and energy generation actively searching for materials that can withstand harsh environments.

Key High Temperature Coatings Market Insights Summary:

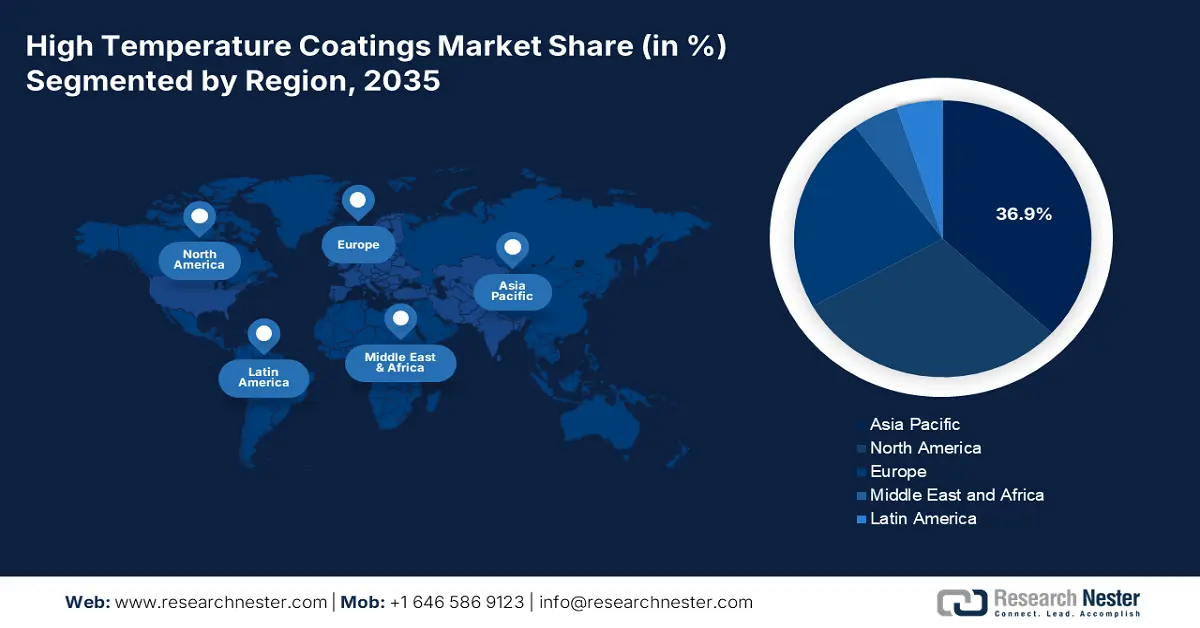

Regional Highlights:

- Asia Pacific leads the High Temperature Coatings Market with a 36.9% share, driven by economic growth, foreign investment, and end-user demand, ensuring strong growth potential through 2035.

- North America's high temperature coatings market is projected to maintain a stable CAGR through 2026–2035, driven by the use of high-temperature coatings in industrial settings and compliance with environmental regulations.

Segment Insights:

- The Acrylic segment is projected to hold a 25.5% share in the High Temperature Coatings Market by 2035, driven by its excellent heat resistance, durability, and demand in automotive, aerospace, and industrial applications.

- The Dispersion/Water-Based segment is likely to secure a noteworthy share by 2035, driven by environmental regulations promoting eco-friendly, low VOC coatings.

Key Growth Trends:

- Creation of composite and hybrid materials

- Growing sustainability objectives and environmental legislation

Major Challenges:

- Reduction in end-use industry growth

- Limited resilience in harsh environments

- Key Players: Belzona International Ltd., Chemco International Ltd, Hempel A/S, Carboline Company, Axalta Coating Systems, LLC, BASF SE, Akzo Nobel N.V., The Sherwin-Williams Company, PPG Industries, Inc.

Global High Temperature Coatings Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.48 billion

- 2026 Market Size: USD 2.57 billion

- Projected Market Size: USD 3.74 billion by 2035

- Growth Forecasts: 4.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

High Temperature Coatings Market Growth Drivers and Challenges:

Growth Drivers

- Creation of composite and hybrid materials: As hybrid and composite materials continue to be developed, the high temperature coatings market is expected to grow. The development of materials with a variety of special qualities, such as increased strength, heat resistance, and decreased weight, offers a bright future for high-temperature coating innovation. The demanding needs of companies operating in harsh environments can be handled by using these cutting-edge materials. Manufacturers can customize formulations to match particular application requirements by combining hybrid and composite materials into high-temperature coatings, providing better performance than conventional coatings.

- Growing sustainability objectives and environmental legislation: The market for high-temperature coatings is expanding significantly as a result of industry' increased focus on sustainability objectives and environmental restrictions. Adoption of coatings that support eco-friendly practices is required by strict rules as governments throughout the world step up their efforts to reduce their influence on the environment. In this situation, high-temperature coatings are essential as they protect equipment from corrosion and increase its thermal resistance, thus prolonging its lifespan and reducing the need for frequent repairs.

- Creation of cutting-edge coatings with excellent thermal resistance: The accumulation of heat as the material absorbs solar energy raises its surface temperature, and the high temperature brought on by solar radiation leads to several annoyances and even issues in daily life and industrial development. To cut down on energy use, researchers and manufacturers are searching for efficient and cutting-edge temperature-resistant coating materials. To meet their energy-saving goals, many businesses are implementing temperature-resistant coatings on an industrial scale. For instance, in heavy-duty gas turbines, the materials along the hot gas path experience higher thermal loadings as a result of continuously rising hot gas temperatures. Temperature-resistant coatings are crucial in this situation as they lower the superalloy's temperature and cooling air requirements.

Challenges

- Reduction in end-use industry growth: High temperature coatings are used in the building and construction industry to protect a building's interior from the effects of outside temperatures. This significantly lowers the building's energy consumption and associated expenses. Even in the absence of crises, the world's largest industry, construction, is not doing well. Changes in market characteristics, such as the scarcity of skilled labor, the ongoing pressure on affordable housing and infrastructure, stricter workplace safety and sustainability regulations, and the evolving complexity and preferences of owners and consumers, are likely to spur structural changes in the upcoming years.

- Limited resilience in harsh environments: The high temperature coatings market may be constrained by the issue of their poor endurance under harsh circumstances. Even though these coatings are made to resist high temperatures and challenging conditions, some extreme conditions that are common in some industrial processes can be too difficult for current formulations to handle. The longevity of high-temperature coatings may become a limiting factor in industries that engage in extremely corrosive or mechanically aggressive activities. Demanding circumstances, such as exposure to harsh chemicals, excessive mechanical stress, or both, can hasten deterioration and eventually jeopardize these coatings' protective qualities.

High Temperature Coatings Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 2.48 billion |

|

Forecast Year Market Size (2035) |

USD 3.74 billion |

|

Regional Scope |

|

High Temperature Coatings Market Segmentation:

Resin (Epoxy, Silicone, Polyethersulfone, Polyester, Acrylic, Alkyd)

The acrylic segment is set to dominate over 25.5% high temperature coatings market share by 2035. Acrylic resin is expected to drive the market due to its excellent heat resistance, durability, and protective properties. Acrylic resins can withstand high temperatures while maintaining their structural integrity, making them ideal for applications in industries like automotive, aerospace, and industrial manufacturing. High temperature coatings with acrylic resins offer superior protection against corrosion, oxidation, and harsh environmental conditions, making them useful in pipelines, refineries, and power plants.

With increasing regulations on volatile organic compounds (VOCs), acrylic resin-based coatings especially waterborne formulations are gaining traction due to their lower environmental impact. Further innovations in acrylic resin formulations, such as hybrid acrylics and heat-resistant acrylic polymers, are further expanding their applications in extreme conditions.

Technology (Solvent-Based, Dispersion/Water Based, Powder Based)

Based on the technology, the dispersion/water-based segment in high temperature coatings market is likely to hold a noteworthy share by the end of 2035. The segment rise is due to increasing environmental regulations and advancements in coating formulations. Stricter environmental regulations, such as those from the U.S. Environmental Protection Agency (EPA) and Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH), are pushing industries toward low VOC and water-based coatings. Water-based coatings are considered more eco-friendly compared to solvent-based alternatives, aligning with global sustainability goals.

Unlike solvent-based coatings, water-based coatings have a lower risk of fire hazards, making them safer to use in industrial settings. While initial formulation costs may be higher, water-based coatings reduce solvent handling costs, disposal fees, and regulatory compliance costs in the long run.

Our in-depth analysis of the global high temperature coatings market includes the following segments:

|

Resin |

|

|

Technology |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

High Temperature Coatings Market Regional Analysis:

Asia Pacific Market Analysis

Asia Pacific in high temperature coatings market is poised to capture over 36.9% revenue share by 2035. High economic growth rate, expanding manufacturing sectors, low labor costs, rising foreign investments, rising end user industry demand, and the global production shift from developed to emerging nations in the region are some of the main factors driving the market's expansion.

One of the biggest markets for construction in the region is China. China's construction industry generated USD 4.34 trillion in 2022, up from USD 4.084 trillion in 2021, according to the National Bureau of Statistics. Furthermore, there is a greater demand for homes utilized as investment properties. By 2030, China is anticipated to invest up to USD 13 trillion in buildings, which bodes well for the high temperature coatings market.

India is currently the region's second-largest producer of automobiles. In FY 2023–24, the industry produced 2.84 crore vehicles, including passenger cars, commercial vehicles, three-wheelers, two-wheelers, and quadricycles, compared to 2.59 crore in FY 2022–2023 alone. Therefore, it is anticipated that the high temperature coatings market will be driven by the increased demand for automotive coatings brought on by the growth in the production of automobiles. Additionally, the petrochemical sector in India has experienced notable expansion in recent years. India's chemical and petrochemical (CPC) sector generated USD 178 billion in 2022 and is projected to grow to USD 300 billion by 2025, according to the Department of Chemicals & Petrochemicals. Therefore, it is anticipated that the nation's need for high temperature coatings will be driven by the expansion of the chemical and petrochemical industries.

North America Market Analysis

North America in high temperature coatings market is expected to experience a stable CAGR during the forecast period due to the extensive use of them in industrial settings. These coatings are essential for protecting vital components from severe temperatures and adverse environmental conditions in sectors including metal processing, power production, and oil & gas. Additionally, North America has strict environmental laws, and using coatings that adhere to these standards such as formulas with low VOCs is becoming important. As a result, the area has seen the development of environmentally acceptable high-temperature coatings.

In the U.S., the expansion of the high temperature coatings market has been greatly aided by the growing use of these products in important end-use sectors such as electronics, automotive, energy, and construction. Product demand in the area is anticipated to be significantly influenced by the renewal of reforms to include environmentally friendly and thermally efficient products. Canada is concentrating on research and development across a range of sectors, such as advanced coatings and materials science. The goal of these initiatives is to create cutting-edge, more economical, ecologically friendly, and efficient high-temperature coating technologies. The use of high-temperature coatings in a variety of applications is therefore given more importance, which raises demand and propels high temperature coatings market expansion.

Key High Temperature Coatings Market Players:

- Weilburger Coatings GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Belzona International Ltd.

- Chemco International Ltd

- Hempel A/S

- Carboline Company

- Axalta Coating Systems, LLC

- BASF SE

- Akzo Nobel N.V.

- The Sherwin-Williams Company

- PPG Industries, Inc.

Long-term alliances with raw material suppliers are among the key tactics these sector participants use to attain economies of scale and, as a result, provide goods at a lower cost than rivals. Innovation in high temperature coatings and ongoing technical developments will support market expansion. To satisfy the changing needs of end users, manufacturers are concentrating on creating coatings with better surface finishes, increased adhesive qualities, decreased curing periods, and increased heat resistance.

Here are some leading players in the high temperature coatings market:

Recent Developments

- In June 2023, PPG announced the introduction of a line of electrocoating (e-coat) products called PPG ENVIRO-PRIME EPIC 200R coatings, which cure at lower temperatures than those of rival technologies. Customers benefit from the products' reduced energy consumption and CO2 emissions at production plants, among other sustainability advantages.

- In May 2023, AkzoNobel Packaging Coatings' new BPA-NI internal coating for beverage can end is a suitable substitute for can manufacturers and coil coaters accelerating their bisphenol-free transition.

- Report ID: 7142

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

High Temperature Coatings Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.