High-Speed Interconnects Market Outlook:

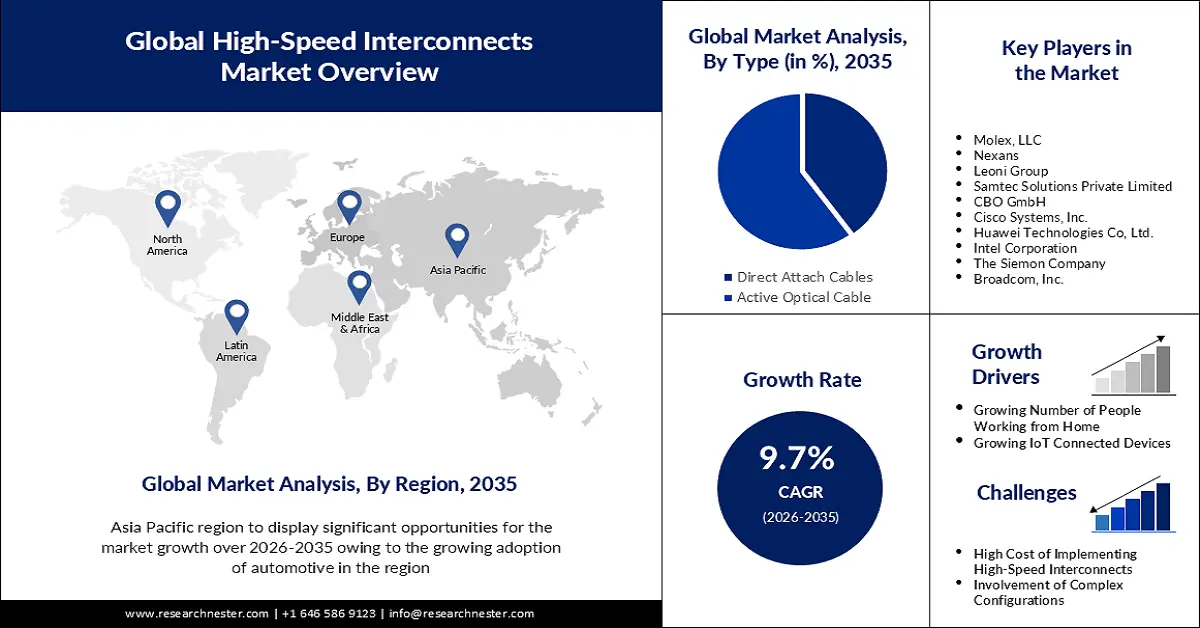

High-Speed Interconnects Market size was over USD 41.6 billion in 2025 and is anticipated to cross USD 104.99 billion by 2035, witnessing more than 9.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of high-speed interconnects is assessed at USD 45.23 billion.

The growth in the market is propelled by the surge in the number of data centers. Currently, there are about 7999 data centers globally. Moreover, there has been a surge in the construction of large-scale and mega-data centers which is also estimated to boost the market demand. Since these data centers require more sophisticated data management tools as well as the architecture, complexity, and configuration of these massive buildings.

Furthermore, high-speed connector and cable assembly vendors are constantly creating new technologies to meet the demands of modern data centers. Thus, increasing the demand for greater signal speeds, higher bandwidth, and higher-density interconnections.

Key High-Speed Interconnects Market Insights Summary:

Regional Highlights:

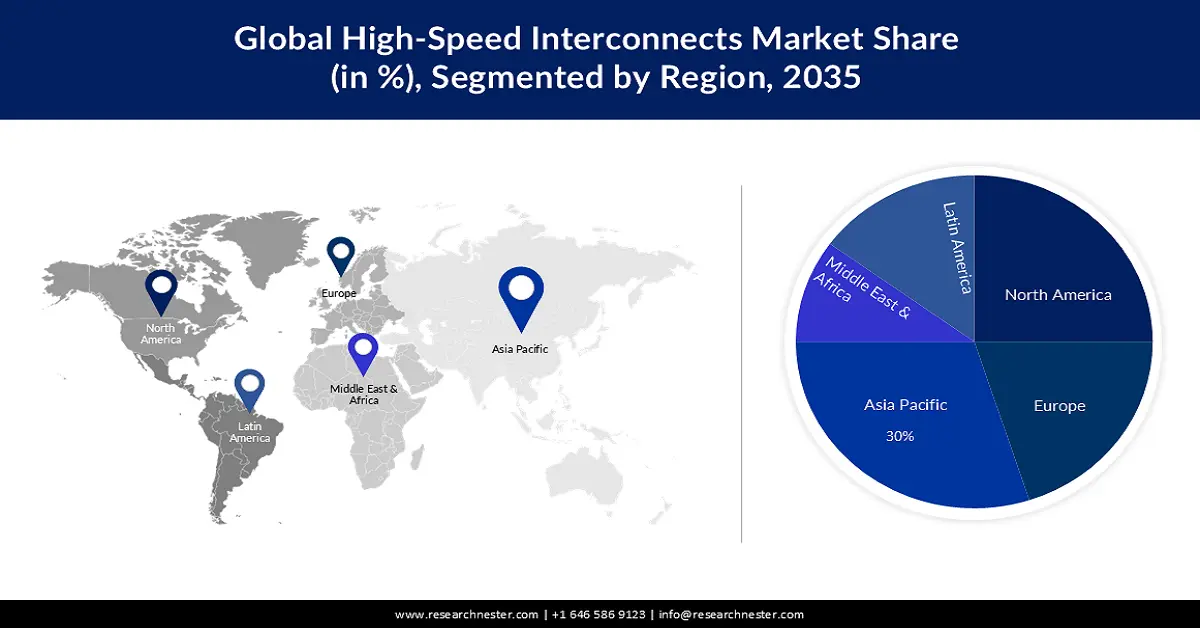

- The Asia Pacific high-speed interconnects market is projected to capture a 30% share by 2035, driven by rising automotive sales, advanced driver assistance systems, vehicle communication needs, and presence of electronic manufacturing.

Segment Insights:

- The consumer electronics application segment in the high-speed interconnects market is projected to hold a 46% share by 2035, driven by increasing need for device interconnectivity and smart home trends.

- The active optical cable type segment in the high-speed interconnects market is expected to capture a 30% share by 2035, driven by superior speed and manageability compared to copper cables.

Key Growth Trends:

- Growth in the Frequency of People Working from Home

- Growing IoT Connected Devices

Major Challenges:

- High Cost of Implementing High-Speed Interconnects

- Involvement of Complex Configurations

Key Players: Molex, LLC, Nexans, Leoni Group, Samtec Solutions Private Limited, CBO GmbH, Cisco Systems, Inc., Huawei Technologies Co, Ltd., Intel Corporation, The Siemon Company, Broadcom, Inc.

Global High-Speed Interconnects Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 41.6 billion

- 2026 Market Size: USD 45.23 billion

- Projected Market Size: USD 104.99 billion by 2035

- Growth Forecasts: 9.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (30% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 11 September, 2025

High-Speed Interconnects Market Growth Drivers and Challenges:

Growth Drivers

- Growth in the Frequency of People Working from Home

A majority of employees across the world are projected to work from home for about one to three days per week by 2022, while approximately 7% of those questioned desired a full-time remote work schedule. An efficient work-from-home arrangement requires high-speed internet to allow smooth Zoom meetings, quick file transfers, and simple access to company applications. Therefore, the need for high-speed interconnects is growing.

- Growing IoT Connected Devices

With the growing adoption of IoT, the need to provide efficient and reliable interconnection is on the rise. In order for the IoT operation system to reach all of its capabilities, an effective connectivity ecosystem has to be established which embraces alternative wireless protocols and high-speed 5G technology and WiFi 6+ networks while taking advantage of their different advantages for certain IoT applications.

- Surge in Video Streaming or Other Social Activities

Video streaming or other activities such as surfing social media creates huge data traffic. Due to the sudden increase in data traffic, especially in cloud infrastructure, considerable improvements in data interface IP speed and latency are required. Therefore, the need for high-speed interconnections is also on boost.

Challenges

- High Cost of Implementing High-Speed Interconnects

- Involvement of Complex Configurations

- High Power Consumption – With the high speed comes the high energy consumption. Moreover, the incorporation of cloud services to the existing widely linked Internet has resulted in an unparalleled increase in sheer processing and storage requirements for data centers. The consumption of energy is directly impacted by this growth. Hence, a large number of the organization are focusing on manufacturing low-speed interconnects which is designed to give high efficiency. Therefore, this element is expected to limit the adoption of high-speed interconnects, hindering the surge in high-speed interconnects market.

High-Speed Interconnects Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.7% |

|

Base Year Market Size (2025) |

USD 41.6 billion |

|

Forecast Year Market Size (2035) |

USD 104.99 billion |

|

Regional Scope |

|

High-Speed Interconnects Market Segmentation:

Application Segment Analysis

The consumer electronics segment is set to generate 46 percent of the high-speed interconnects market revenue by the end of 2035. This growth could be attributed to the growing need to interconnect electronic devices. Various electronic devices such as smartphones, tablets and more perform functions such as transferring data which includes files, videos, and applications that require high-speed interconnects. Furthermore, there has been a growing trend of smart home which is influencing the adoption of smart devices. From smart speakers and lighting to doorbells and televisions, these gadgets deliver comfort, security, and convenience. However, an efficient internet connection is required for a flawless experience. Hence, this element is boosting the market expansion.

Type Segment Analysis

The active optical cable segment in the high-speed interconnects market is estimated to experience a notable revenue of 30 percent over the forecast period. The biggest benefit of implementing AOC cables is their ability to outperform older copper technologies in terms of speed and distance. Additionally, active optical cables are both significantly thinner and lighter than their copper equivalents. Together, these two elements make them easier to manage and store since they don't adhere to the same length limits. Additionally, they do not experience the drawback that occurs with longer-distance travelers, who inevitably grow heavier and more difficult to control. Our in-depth analysis of the global high-speed interconnects market includes the following segments: Type Direct Attach Cables Active Optical Cable Application Data Centers Telecom Consumer Electronics Networking & Computing

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

High-Speed Interconnects Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to dominate majority revenue share of 30% by 2035, backed by the growing adoption of automotive. In the Asia-Pacific region, including the Middle East, it was projected that about 36 million passenger automobiles would be sold in 2022, with roughly 22 million of those sales taking place in China. Automotive consists of advanced driver assistance systems and vehicle-to-vehicle communication systems which necessities high-speed interconnect. Hence, with the growing demand for automotive the market for high-speed interconnects is also growing in the region. Additionally, as a result of the existence of significant electronic manufacturing companies in the Asia Pacific region, particularly in China and Taiwan is predicted to boost the market growth in the region.

North American Market Insights

Additionally, the high-speed interconnects market in North America is set to have significant growth over the forecast period. Data centers have emerged as a key component of modern business and economy in this area as a result of the expanding digitalization trend. The role of data centers is essential in cloud computing, and SMEs are leading the way in North America in adopting this technology as the industry moves towards it due to its cost and operational advantages. Major IT firms and academic institutions in this region also use complex cloud computing operations, which need a data center.

High-Speed Interconnects Market Players:

- Molex, LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nexans

- Leoni Group

- Samtec Solutions Private Limited

- CBO GmbH

- Cisco Systems, Inc.

- Huawei Technologies Co, Ltd.

- Intel Corporation

- The Siemon Company

- Broadcom, Inc.

Recent Developments

- Two new cables for the industrial data transmission standard Single Pair Ethernet (SPE), which may be used in drag chain and torsion applications, have been created by Leoni Group, a global developer of solutions for power and data management in the automotive and other sectors. As a result, Leoni is the first cable producer to introduce these cables to the market globally.

- In order to assist its customers in connecting the roughly 40% of the world's population that is still unconnected or underserved, Cisco System, Inc. recently introduced 800G advancements. These innovations continue to alter the economics and sustainability of the Internet for the Future.

- Report ID: 5088

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

High-Speed Interconnects Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.