High-speed Engine Market Outlook:

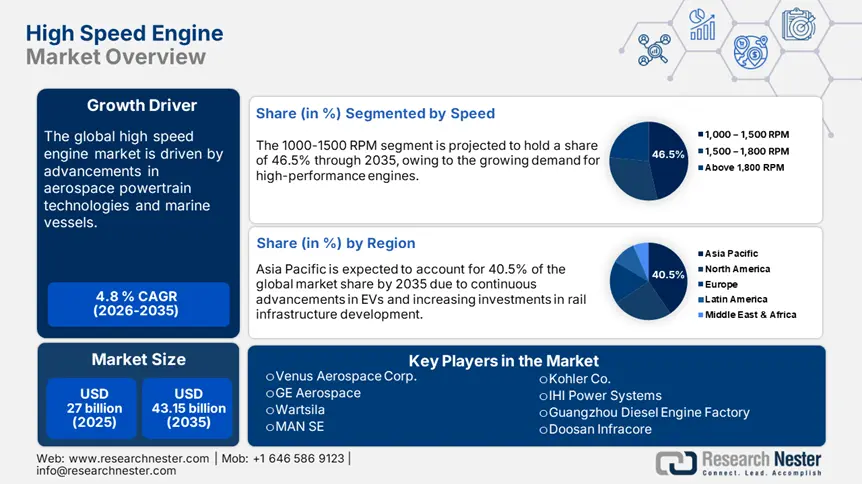

High-speed Engine Market size was over USD 27 billion in 2025 and is projected to reach USD 43.15 billion by 2035, growing at around 4.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of high-speed engine is evaluated at USD 28.17 billion.

The automotive and transportation sectors are primarily influencing the sales of high-speed engines globally. The infrastructure and urban growth in developing economies are poised to offer lucrative opportunities to high-speed engine manufacturers in the coming years. The increasing demand for enhanced power and speed technologies from industries such as aerospace, automotive, and railway is set to promote the adoption of high-speed engines. The smart city initiatives are pushing investments in the development of metro and bullet trains, which are directly increasing the applications of high-speed engines. The High-speed Rail Alliance discloses that the world speed record-holding train is the French TGV at 574.8 km/h (357.2 mph). China has the longest routes for high-speed rail. Morocco stands in 8th position, just behind Germany and ahead of South Korea. The study by the Global Infrastructure Outlook states that the current investment trends in rail are nearly USD 10 trillion. The investment need is estimated to increase from USD 426 billion in 2025 to USD 537 billion by 2037.

The increasing demand for performance cars and motorcycles is pushing the installation of high-speed and power-output engines. The advancements in engine tuning and turbocharging are emerging as significant growth drivers. Furthermore, the increasing popularity of electric and hybrid powertrains is creating room for innovations for high-speed engine manufacturers. The growth of the EV market is expected to fuel the sales of high-speed engines in the years ahead. With nearly 14.0 million electric car sales in 2023, the EV segment is set to dominate the automotive market in the coming years. The International Energy Agency (IEA) report highlights that the electrification strategy implemented by automakers increased the number of EV car models by 15.0% year-on-year in 2023. For instance, in March 2025, BYD Auto Industry Co., Ltd introduced the Super e-Platform that offers megawatt flash charging for EVs. The charging power of 1000 kW with a speed of 2 km/s is the latest advancement for mass-produced vehicles.

Key High-speed Engine Market Insights Summary:

Regional Highlights:

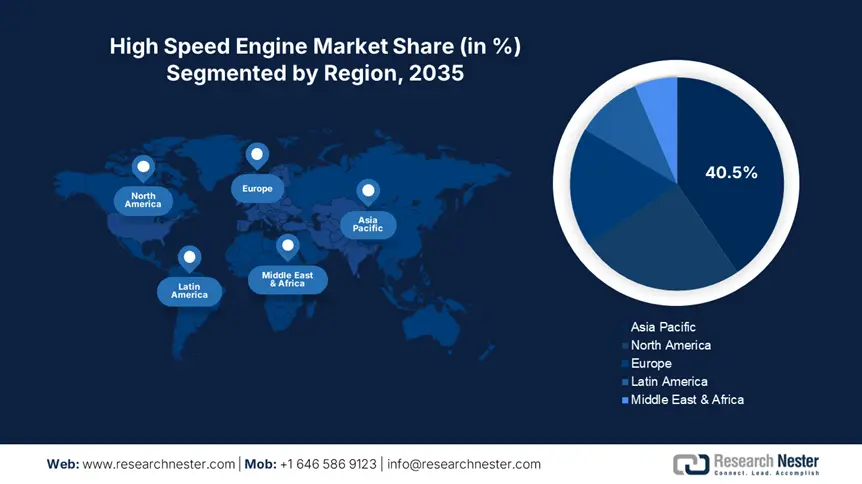

- Asia Pacific dominates the High-speed Engine Market with a 40.5% share, fueled by the swiftly increasing automotive market and strong presence of automakers, enhancing its leadership through 2035.

- North America's High-speed Engine Market is set for rapid growth through 2035, driven by booming public investments, aerospace and marine sector expansion, and clean energy trends.

Segment Insights:

- The Power Generation segment is set to hold a dominant share from 2026 to 2035, driven by the critical role of high-speed engines in gas turbines and internal combustion for energy generation.

- The 1,000 – 1,500 RPM segment of the High-speed Engine Market is projected to hold over 46.5% share by 2035, fueled by increasing adoption in the automotive, marine, and aerospace sectors for fuel efficiency.

Key Growth Trends:

- Advancement in aerospace technologies

- Marine sector emerging as a game changer

Major Challenges:

- Advanced technologies available at premium costs

- Complexity in maintenance

- Key Players: Venus Aerospace Corp., GE Aerospace, Wartsila, MAN SE, and Kohler Co.

Global High-speed Engine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 27 billion

- 2026 Market Size: USD 28.17 billion

- Projected Market Size: USD 43.15 billion by 2035

- Growth Forecasts: 4.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 12 August, 2025

High-speed Engine Market Growth Drivers and Challenges:

Growth Drivers

-

Advancement in aerospace technologies: The rising investments in supersonic air travel and innovative military aircraft are set to double the revenues of high-speed engine producers during the foreseeable period. The increasing interest in commercial supersonic travel and unmanned aerial vehicles is emerging as a lucrative opportunity for high-speed engine manufacturers. For instance, in January 2022, the U.S. Air Force and Boom Supersonic entered into a 3 years strategic partnership for the future of aviation. The USD 60 million collaboration is aimed at the innovation of supersonic capabilities.

-

Marine sector emerging as a game changer: The marine industry is offering a larger scope to high-speed engine companies to expand, owing to the rise in global demand for faster and more efficient transportation. Fast ferries, yachts, and military vessels are in an innovation race for high-speed marine engines. The miniaturization trend is further estimated to introduce fuel-efficient and lightweight engines for sectors such as maritime and aerospace. In January 2025, Deere & Company introduced advanced marine engines JD14 and JD18. These solutions offer a power range from 298 up to 599 kW, enabling heavy-duty cycles for marine customers. Continuous innovations are set to propel the overall high-speed engine market growth in the years ahead.

Challenges

-

Advanced technologies available at premium costs: The production of high-speed engines is a capital-intensive process due to the involvement of complex research and development activities. The integration of advanced technologies and specialized materials increases the costs of final products. This acts as a major barrier to smaller and budget-conscious end users. Continuous research focused on the cost-effectiveness of the product is likely to aid in overcoming these issues in the years ahead.

-

Complexity in maintenance: The maintenance and operation of high-speed engines is a complex and time-consuming process. Companies with critical operational uptime often find high-speed engine maintenance as a limitation to their production growth. The small operators in the marine and aviation sectors deter investments in high-speed engines owing to their complex maintenance.

High-speed Engine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 27 billion |

|

Forecast Year Market Size (2035) |

USD 43.15 billion |

|

Regional Scope |

|

High-speed Engine Market Segmentation:

Speed (1,000 – 1,500 RPM, 1,500 – 1,800 RPM, Above 1,800 RPM)

1,000 – 1,500 RPM segment is estimated to hold over 46.5% high-speed engine market share by the end of 2035. The high power density and fuel efficiency are augmenting the demand for 1,000 – 1,500 RPM engines in several sectors such as automotive, marine, and aerospace. The standard speed for commercial vehicles is increasing its adoption rates. Cars are prime end users of 1,000 – 1,500 RPM engines owing to quicker acceleration and controlled actions. The expanding passenger car registrations globally are anticipated to boost the sales of 1,000 – 1,500 RPM speed engines. According to the European Automobile Manufacturers Association (ACEA) study, the global sales of cars stood at 74.7 million units in 2024, a hike of 2.5 than the previous year.

End user (Railway, Marine, Power Generation, Oil & Gas, Others)

The power generation segment is estimated to account for a dominant high-speed engine market share throughout the study period. Gas turbines and internal combustion engines with high-speed configurations that effectively convert fuel into mechanical power are widely used for energy generation. Compact designs and significant power outputs aid in achieving high rotational speeds. Innovations are driving the use of high-speed engines as backup generators, which offer stability to the grid at low renewable energy output times. Furthermore, the increasing demand for power utilities is foreseen to propel the sales of high-speed engines during the projected period.

Our in-depth analysis of the high-speed engine market includes the following segments:

|

Power Output |

|

|

Speed |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

High-speed Engine Market Regional Analysis:

Asia Pacific Market Forecast

Asia Pacific high-speed engine market is poised to account for revenue share of more than 40.5% by the end of 2035. The swiftly increasing automotive market, owing to the EV trend, is set to maximize the revenue growth of high-speed engine manufacturers. The strong presence of automakers is also backing the sales of high-speed engines. Fundings in research and development activities are also aimed at transforming the high-speed engine landscape. Japan and South Korea high-speed engine markets are likely to offer huge gains to high-speed engine producers due to their know-how strategies. Whereas the booming infrastructure development activities in China and India are set to offer high-earning opportunities for high-speed engine manufacturers.

China’s propelling investments in hypersonic propulsion systems aimed at redefining the limits of air and space travel are set to double the revenues of high-speed engine companies. The ongoing innovations aimed at uplifting the capabilities of high-speed jet engines are increasing the high-speed engine market scope in the country. The robust bullet train network in the country is also backing the sales of high-speed engines and components. Investments in aviation and rail are set to be revenue boosters for global high-speed engine companies.

The supportive government policies and positive foreign direct investments in the automotive sector are backing the sales of high-speed engines in India. The swift rise in the adoption of electric vehicles is likely to promote the application of high-speed engines in powertrains in the coming years. The rail infrastructure developments, particularly in metro cities, are poised to drive innovations in high-speed engines. The India Brand Equity Foundation (IBEF) report highlights that between April 2000 and June 2024, nearly USD 1.41 billion in foreign direct investment inflows were calculated for railway-related components. The capital expenditure in the railway sector stood at USD 30.33 billion in FY 2024-25.

North America Market Statistics

The North America high-speed engine market is anticipated to increase at the fastest CAGR from 2025 to 2037. The booming public investments are creating a lucrative environment for high-speed engine manufacturers to expand their operations. Hefty spending on aerospace and marine sectors is further increasing the trade activities for high-speed engines. Robust automobile production and EV trends are further augmenting the sales of high-speed engines. The clean energy trends are also poised to promote the applications of high-speed engines in the coming years.

The expanding rail activities in the U.S. are likely to propel the revenues of high-speed engine manufacturers in the coming years. In January 2025, the California High-Speed Rail Authority announced its commentary on the advancements in the rail network. This network connecting Las Vegas to California is the top high-speed rail in the U.S. The robust expansion of the rail networks in the country, coupled with public-private investments, is likely to increase the high-speed engine market during the foreseeable period.

Similar to the U.S., Canada is also investing heavily in rail infrastructure and network development. The plan for the 186-mile-per-hour train project is estimated to drive investments in high-speed engine rails. Alto the high-speed rail network connecting Toronto–Quebec is set to witness USD 2.74 billion for design and development in the next six years. Technological innovations and public-private investments are set to be game changers for high-speed engine trade.

Key High-speed Engine Market Players:

- Venus Aerospace Corp.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GE Aerospace

- Wartsila

- MAN SE

- Kohler Co.

- IHI Power Systems

- Guangzhou Diesel Engine Factory

- Doosan Infracore

- CNPC Jichai Power Company Limited

- Caterpillar

- Cummins

- Rolls-Royce Plc

- Volvo Penta

- Weichai Power

- Deutz

- Anglo Belgian Corporation

The key players in the high-speed engine market are employing several organic and inorganic strategies to earn lucrative returns. Some of the leading tactics are new product launches, technological innovations, mergers & acquisitions, partnerships & collaborations, and regional expansion. The leading companies are investing heavily in research and development activities to introduce innovative high-speed engines and stand out in the crowd. They are also forming strategic partnerships with other players and public entities to expand their product portfolios. Entering untapped high-speed engine markets is also estimated to offer double-digit percent revenue growth opportunities to the industry giants.

Some of the key players include:

Recent Developments

- In October 2024, Venus Aerospace Corp. announced the launch of an advanced Rotating Detonation Rocket Engine (RDRE). This ramjet engine offers high-speed and efficiency, allowing swift traveling of vast distances at high altitudes.

- In July 2024, GE Aerospace showcased a successful demonstration of a next-gen high-speed hypersonic dual-mode ramjet. This innovation is aiding the company to diversify its portfolio of hypersonic programs.

- Report ID: 7406

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

High-speed Engine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.