High-performance Lubricants Market Outlook:

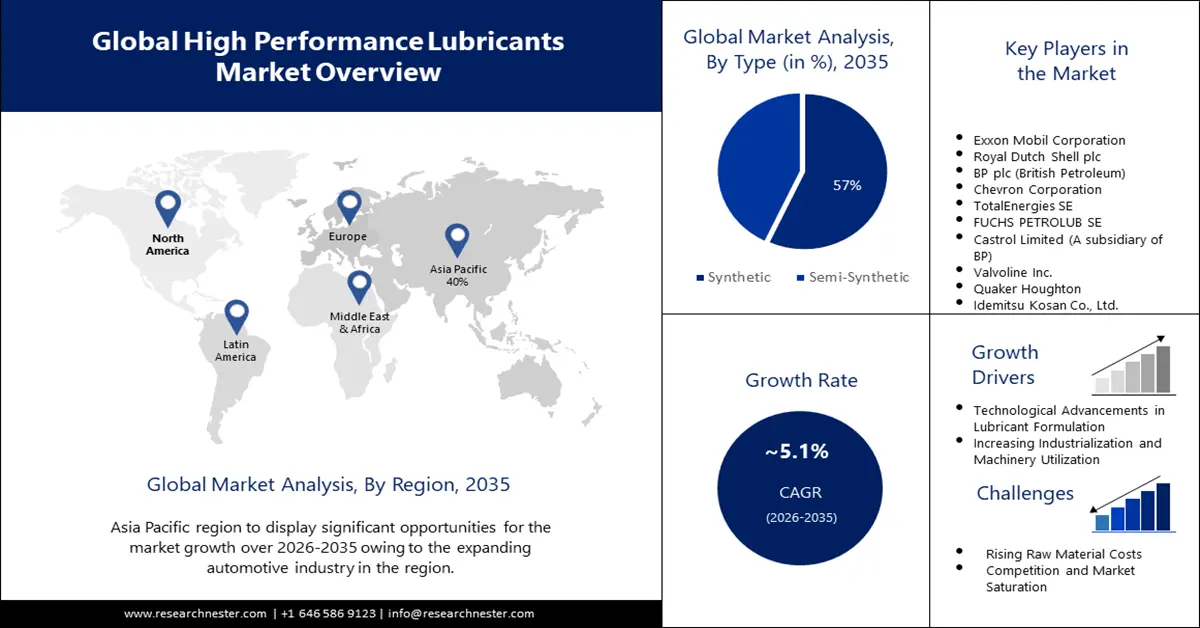

High-performance Lubricants Market size was valued at USD 6.77 billion in 2025 and is expected to reach USD 11.13 billion by 2035, expanding at around 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of high-performance lubricants is evaluated at USD 7.08 billion.

The advancement of 4.0 industrialization has increased the adoption of automatic machines, which in turn is expected to drive market growth. According to the World Economic Forum, the rate of automation of industrial machines was around 47% in 2020 and it is projected to rise to nearly 47% in 2025. Automatic industrial machines often have moving parts, such as gears and bearings, that require lubrication to minimize friction.

The high-performance lubricants market refers to a segment within the broader lubricants industry that focuses on the production and sale of advanced lubricants designed to meet the stringent requirements of various industrial applications and machinery. These lubricants are formulated to deliver superior performance in terms of reducing friction, minimizing wear and tear, improving efficiency, and extending the service life of equipment and machinery. Also, lubricants are formulated to provide effective protection from wear and tear and reduce friction.

Key High-Performance Lubricants Market Insights Summary:

Regional Highlights:

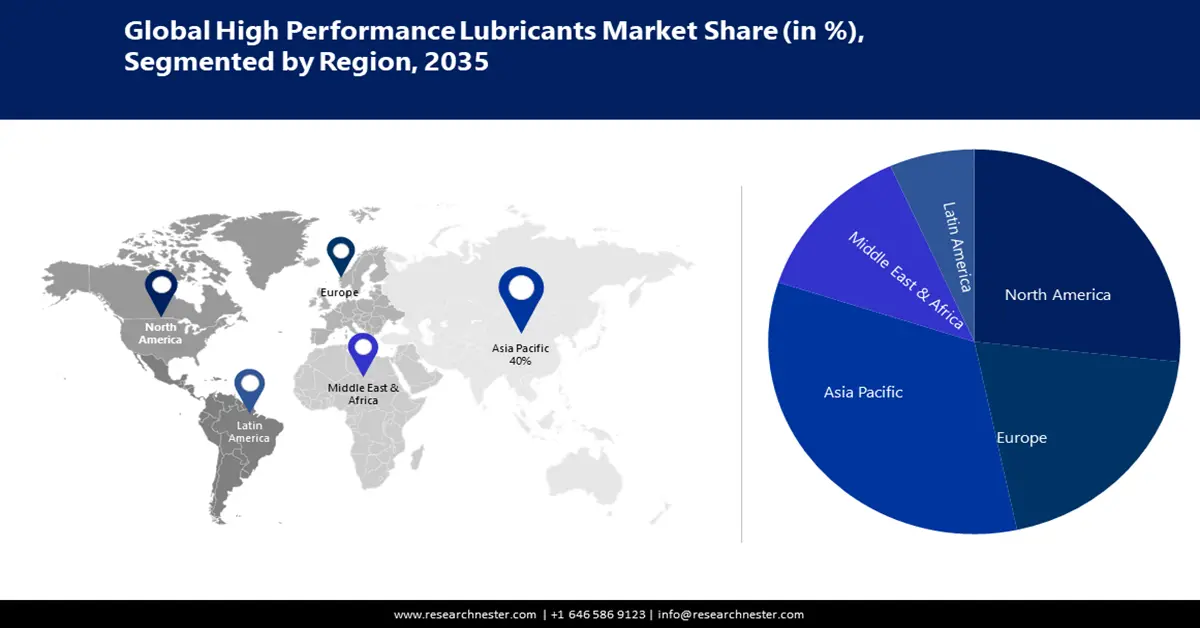

- The Asia Pacific high-performance lubricants market is projected to capture a 40% share by 2035, fueled by booming construction and infrastructure sectors creating demand for lubricants.

- The North America market is expected to secure the second largest share by 2035, attributed to a thriving automotive and industrial sector and technological advancements.

Segment Insights:

- The synthetic segment in the high-performance lubricants market is expected to capture the largest share by 2035, driven by the superior performance and long-term cost savings of synthetic lubricants.

- The automotive segment in the high-performance lubricants market is expected to hold a significant share by 2035, driven by the focus on fuel efficiency and sustainability in the automotive industry.

Key Growth Trends:

- Technological Advancements in Lubricant Formulation

- Increasing Industrialization and Machinery Utilization

Major Challenges:

- Environmental Regulations and Sustainability Concerns

- Rising Raw Material Costs

Key Players: Exxon Mobil Corporation, Royal Dutch Shell plc, BP plc (British Petroleum), Chevron Corporation, TotalEnergies SE.

Global High-Performance Lubricants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.77 billion

- 2026 Market Size: USD 7.08 billion

- Projected Market Size: USD 11.13 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, Indonesia

Last updated on : 11 September, 2025

High-performance Lubricants Market Growth Drivers and Challenges:

Growth Drivers

- Technological Advancements in Lubricant Formulation: Technological advancements have led to the creation of lubricants with improved performance characteristics. Advanced formulations can withstand extreme temperatures, high pressures, and harsh operating conditions. Over the past decade, research and development investments in lubricant technology have yielded remarkable results. For instance, synthetic lubricants now account for approximately 40% of the high-performance lubricants market, thanks to their ability to withstand extreme conditions and deliver superior performance.

- Increasing Industrialization and Machinery Utilization: With the ongoing industrialization and growth of manufacturing sectors worldwide, the demand for high-performance lubricants has surged. These lubricants are essential for maintaining the efficiency and reliability of industrial machinery. As industries expand, so does the need for lubricants that can meet the increasing demands of heavy machinery.

- Regulatory Compliance and Environmental Concerns: Stringent environmental regulations and growing environmental awareness have driven the development of eco-friendly high-performance lubricants. These lubricants are designed to have reduced emissions and lower environmental impact. As governments and industries prioritize sustainability, the demand for such lubricants continues to grow.

- Expansion of Renewable Energy Sources: The growing shift towards renewable energy sources, such as wind and solar power generation, presents a significant growth driver for the high-performance lubricants market. Wind turbines and solar installations rely on precision-engineered machinery and components that demand reliable lubrication. High-performance lubricants play a pivotal role in ensuring the efficient operation of these systems. With renewable energy installations on the rise, the demand for specialized lubricants that can withstand the unique challenges of these applications is increasing. According to a report by the International Energy Agency (IEA), renewable energy capacity is expected to expand by 50% by 2024, with wind and solar energy accounting for a significant portion of this growth. This expansion creates a substantial market for high-performance lubricants to maintain the reliability and efficiency of renewable energy infrastructure.

- Aerospace and Defense Innovations: The aerospace and defense industries are continually advancing with innovations in aircraft design, propulsion systems, and military equipment. These advancements demand lubricants that can withstand extreme conditions, including high temperatures, pressures, and speeds. High-performance lubricants are essential to ensure the safety and reliability of aerospace and defense systems. With ongoing developments and upgrades in these sectors, the demand for cutting-edge lubricants tailored to these applications is on the rise.

Challenges

- Environmental Regulations and Sustainability Concerns: Increasingly stringent environmental regulations require lubricant manufacturers to develop eco-friendly products that have lower emissions and reduced environmental impact.

- Rising Raw Material Costs

- Competition and Market Saturation

High-performance Lubricants Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 6.77 billion |

|

Forecast Year Market Size (2035) |

USD 11.13 billion |

|

Regional Scope |

|

High-performance Lubricants Market Segmentation:

Type Segment Analysis

High-performance lubricants market from the synthetic segment is estimated to gain the largest revenue share in the year 2035. Although synthetic lubricants have a higher upfront cost than conventional oils, their longer service life and reduced maintenance requirements result in significant long-term cost savings. For instance, using synthetic lubricants can extend oil change intervals by up to 50%. The synthetic lubricants segment is experiencing robust growth due to its superior performance characteristics, increased demand in automotive and industrial applications, environmental regulations, technological advancements, energy efficiency focus, expansion in emerging markets, and the promise of long-term cost savings. Emerging markets, particularly in Asia-Pacific, are witnessing rapid industrialization. This growth is accompanied by a rising demand for high-performance synthetic lubricants to ensure equipment reliability and longevity. Asia-Pacific is anticipated to be the fastest-growing market for synthetic lubricants.

End User Segment Analysis

The automotive segment in the high-performance lubricants market is expected to garner a significant share in the year 2035. The automotive industry's growing emphasis on fuel efficiency and sustainability drives the demand for lubricants that reduce energy losses through friction and contribute to lower emissions. These lubricants help automakers meet evolving environmental standards. The automotive lubricants segment is poised for substantial growth due to factors such as increasing vehicle production and ownership, emissions regulations, the transition to electric vehicles, engine downsizing trends, longer oil change intervals, engine protection requirements, technological advancements, and the industry's focus on fuel efficiency and sustainability. Lubricants play a pivotal role in protecting engines from wear and corrosion. Manufacturers and consumers alike prioritize lubricants that extend engine life. The demand for high-quality lubricants that provide superior engine protection is a driving force in the market.

Our in-depth analysis of the global high-performance lubricants market includes the following segments:

|

Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

High-performance Lubricants Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is set to account for largest revenue share of 40% by 2035, The construction and infrastructure sectors in Asia Pacific are booming, creating a need for high-performance lubricants in construction machinery and equipment. These lubricants ensure reliable operation and extend the lifespan of heavy machinery used in construction projects. Ongoing research and development efforts in the region have led to innovative lubricant formulations. These formulations offer improved thermal stability, resistance to oxidation, and protection against wear and corrosion. Market leaders invest significantly in research to develop advanced lubricant solutions. The APAC high-performance lubricants market encompasses a range of specialized lubricating products designed to meet the rigorous demands of various industries and applications. These lubricants are formulated to deliver exceptional performance, protection, and efficiency under challenging operating conditions, contributing to improved equipment reliability and longevity.

North American Market Insights

The high-performance lubricants market in the North America region is projected to hold the second-largest share during the forecast period. The industry growth is attributed to factors such as a thriving automotive and industrial sector, technological advancements, energy efficiency initiatives, aviation and aerospace development, stringent environmental regulations, construction and infrastructure projects, and the recognition of long-term cost savings. The region's industrial growth, particularly in the United States and Canada, drives the demand for high-performance lubricants used in various industrial applications, including machinery, metalworking, and manufacturing processes. The North American industrial lubricants sales are projected to reach USD 9 billion by the year 2025.

High-performance Lubricants Market Players:

- Exxon Mobil Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Royal Dutch Shell plc

- BP plc (British Petroleum)

- Chevron Corporation

- TotalEnergies SE

- FUCHS PETROLEUM SE

- Castrol Limited (A subsidiary of BP)

- Valvoline Inc.

- Quaker Houghton

- Idemitsu Kosan Co., Ltd.

Recent Developments

- ExxonMobil acquired Norwegian oil and gas company Statoil's assets in the Gulf of Mexico for USD 2.5 billion.

- In 2019, ExxonMobil acquired Brazilian oil and gas company Petrobras' assets in the Sergipe Basin for USD 2.6 billion.

- Report ID: 5087

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

High-Performance Lubricants Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.