High Performance Alloys Market Outlook:

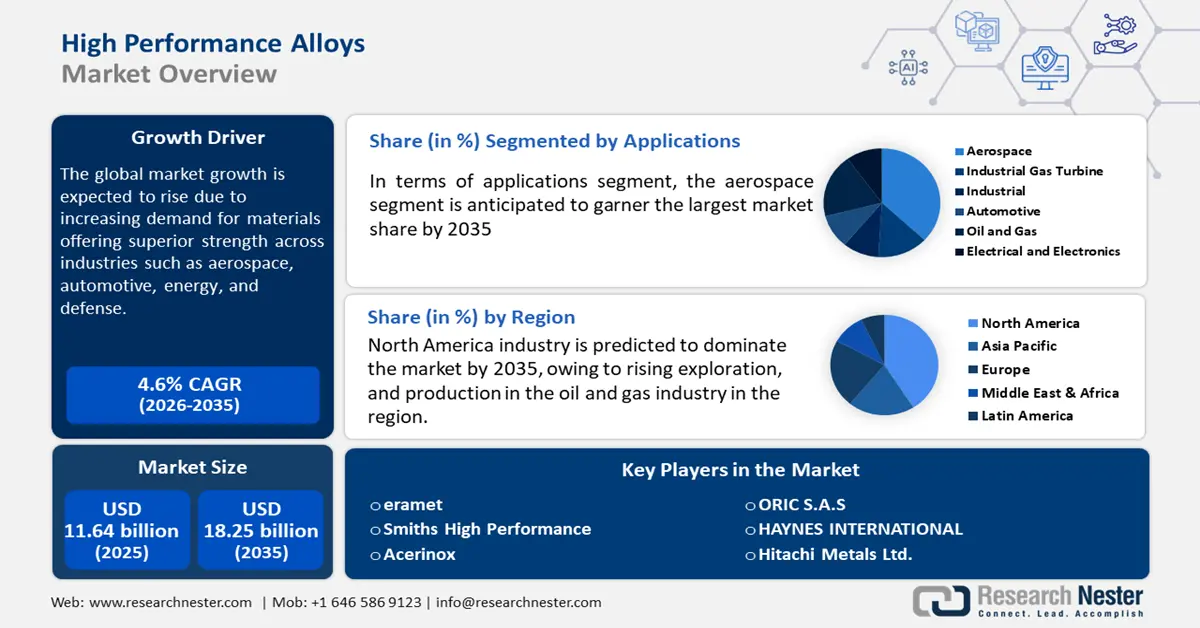

High Performance Alloys Market size was over USD 11.64 billion in 2025 and is anticipated to cross USD 18.25 billion by 2035, witnessing more than 4.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of high performance alloys is assessed at USD 12.12 billion.

The high performance alloys market growth is driven by the increasing demand for materials offering superior strength, corrosion resistance, and durability, across industries such as aerospace, automotive, energy, and defense. These alloys include titanium, nickel, aluminum, and stainless steel, and are essential in applications requiring high tolerance in extreme temperatures and pressures. The energy sector, particularly oil and gas relies heavily on corrosion-resistant alloys for harsh operational environments. Additionally, the automotive industry’s push for fuel efficiency and EV development is increasing the use of lightweight alloys.

Rising R&D investments, coupled with sustainability and recyclability, further accelerate the demand for these advanced materials. In June 2023, Carpenter Technology Corporation announced the expansion of its additive manufacturing (AM) capabilities with a new AM powder facility. The development focuses on producing high-quality, gas-atomized metal powders for several industries. This new facility is aimed to meet the demand for advanced materials in 3D printing, while the move underscores the increasing importance of innovation in the high performance alloys market.

Key High Performance Alloys Market Insights Summary:

Regional Highlights:

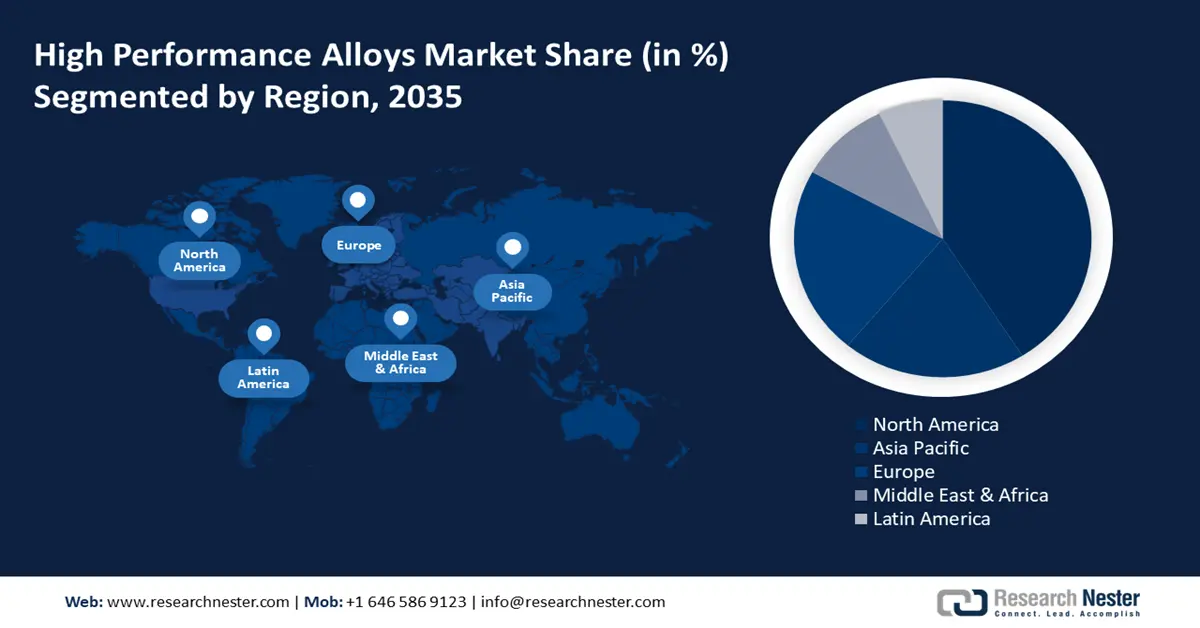

- North America high performance alloys market will account for 36% share by 2035, driven by defense spending, the oil and gas sector's demands, and stringent regulations encouraging the adoption of advanced materials.

- Asia Pacific market will exhibit the highest CAGR during 2026-2035, driven by significant investments in infrastructure, defense, and advanced manufacturing, as well as a strong presence in the mining and metallurgy industries.

Segment Insights:

- The aluminum segment in the high performance alloys market is anticipated to achieve the largest share by 2035, driven by lightweight, high strength properties and demand in aerospace and automotive.

- The aerospace segment in the high performance alloys market is forecasted to capture a dominant share by 2035, driven by stringent material requirements and advancements in aerospace technologies.

Key Growth Trends:

- Rising Construction Industry

- Increase in Automobile Production

Major Challenges:

- Raw Materials Price Fluctuation

- Supply Chain Disruptions

Key Players: Allegheny Technologies Incorporated (ATI), Carpenter Technology Corporation, VDM Metals GmbH, Precision Castparts Corp. (Berkshire Hathaway), Haynes International, Inc., Aperam S.A., Thyssenkrupp AG, Special Metals Corporation (PCC), Outokumpu Oyj, Nippon Steel Corporation.

Global High Performance Alloys Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.64 billion

- 2026 Market Size: USD 12.12 billion

- Projected Market Size: USD 18.25 billion by 2035

- Growth Forecasts: 4.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 18 September, 2025

High Performance Alloys Market Growth Drivers and Challenges:

Growth Drivers

- Rising Construction Industry: Increased demand for robust, and durable materials for the construction industry significantly boosts the high performance alloys market. These are crucial for constructing structures that can endure heavy loads and harsh environments, such as bridges, skyscrapers, and other infrastructure projects. High performance alloys ensure safety, longevity, and structural integrity in modern construction. For instance, in March 2021, ArcelorMittal announced the launch of its first three XCarb initiatives designed for construction applications, with a lower carbon footprint.

- Increase in Automobile Production: Automakers seek advanced materials to enhance vehicle performance and safety. High performance alloys provide strength and lightweight properties needed for critical automotive components, improving fuel efficiency and overall vehicle durability. As vehicle standards evolve and safety regulations become stricter, the demand for these alloys in automotive manufacturing continues to grow. For instance, in July 2023, General Motors and Mercedes Benz signed an agreement with ArcelorMittal North America for the supply of its green steel for the production of their vehicles.

Challenges

- Raw Materials Price Fluctuation: This poses a challenge as materials including nickel, chromium, and manganese are highly volatile to factors such as geopolitical instability, supply chain disruptions, and changes in demand. These fluctuations can lead to increased production costs and affect the pricing strategies of the manufacturers. Consequently, it is a challenge for companies to continuously adapt their sourcing strategies, manage inventory efficiently, and explore alternative materials.

- Supply Chain Disruptions: Interruptions as such can arise from various factors including geopolitical tensions, natural disasters, trade restrictions, and logistics issues. These disruptions lead to delayed deliveries of raw materials, increased costs, and production stoppages. This makes manufacturers invest in diversifying their supply sources and develop a resilient supply chain strategy to minimize the impact of such disruptions to a certain extent.

High Performance Alloys Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.6% |

|

Base Year Market Size (2025) |

USD 11.64 billion |

|

Forecast Year Market Size (2035) |

USD 18.25 billion |

|

Regional Scope |

|

High Performance Alloys Market Segmentation:

Material

The aluminum segment is expected to hold the largest high performance alloys market share during the forecast period owing to its properties such as lightweight, high strength, and excellent corrosion resistance. These qualities make it a preferred material across industries including aerospace, automotive, and construction. Growing demand for fuel-efficient vehicles and advancements in aerospace technologies are significantly driving the segment's growth. Companies are announcing sevral developments in this segment. For instance, in September 2022, Alcoa Corporation announced innovations in alloy development and deployment- A210 ExtruStrong. It is a high-strength 6000 series alloy, with applications in industries such as transportation and construction.

In addition, the rising shift towards lightweight materials to reduce energy consumption and carbon emissions in various sectors is an ongoing global trend promoting market growth. The aluminum recycling process is energy-efficient making it a cost-effective and environmentally friendly option, aligning it with the sustainability need. These factors collectively ensure the dominance of aluminum in the high performance alloys market.

Application

The aerospace segment is expected to dominate the high performance alloys market during the forecast period owing to the industry’s stringent requirements for materials. Aerospace demands materials that can withstand extreme temperatures, high stress, and corrosive environments while maintaining strength and lightweight properties. High performance alloys, particularly titanium, aluminum, and nickel-based alloys are critical components of manufacturing aircraft components including engines, turbine blades, and structural airframes.

Advancements in aerospace technologies, including fuel-efficient aircraft, space exploration, and defense applications further drive the adoption of alloys. In December 2022, Elementum 3D acquired NXG XII 600 and entered a material development agreement with SLMSolutions. The agreement is majorly aimed at enhancing material offerings for aerospace and space customers, producing high performance parts using high-quality alloys. As the aerospace sector continues to grow with increasing air travel and defense investments, the demand for high-performance alloys is further expected to surge during the forecast period.

Our in-depth analysis of the high performance alloys market includes the following segments:

|

Product |

|

|

Material |

|

|

Alloy Type |

|

|

Applications |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

High Performance Alloys Market Regional Analysis:

North America Market Insights

North America industry is set to hold largest revenue share of 36% by 2035. Defense spending in the region fuels demand for advanced alloys in aircraft, missiles, and military equipment. Furthermore, the region’s robust oil and gas sector, with large offshore drilling and exploration projects is driving the need for corrosion-resistant and high-strength alloys. The region also witnesses stringent regulations on energy efficiency and emissions which further encourages the adoption of materials that help reduce environmental impact.

Presence of major aerospace manufacturers such as Boeing and Lockheed Martin, in addition to significant defense spending by the U.S. government, is fueling the high performance alloys market growth. The country’s demand is driven by strong R&D investments and an extensive oil and gas sector. According to the Environmental Protection Energy, oil and gas supply 65 percent of U.S. energy. Additionally, US Energy Information Administration states that Alaska owns 4th largest proven crude oil reserves of any state, at 3.2 billion barrels.

Canada’s robust natural resources sector, particularly in mining and energy, drives demand for specialized alloys used in harsh environments. Additionally, the country’s commitment to innovation and sustainability fosters the development of advanced materials, strengthening its position in the global market. The high performance alloys market in Canada is also supported by thriving aerospace and defense industries.

APAC Market Insights

APAC high performance alloys market is anticipated to expand at the highest CAGR by 2035 as countries including China, India, and Japan are investing heavily in infrastructure development, defense, and advanced manufacturing. This in turn is boosting high-strength and corrosion-resistant alloys demand. Additionally, Asia Pacific’s strong presence in the mining and metallurgy industries supports a steady supply of raw materials, positioning the region as a key player in the market.

India government’s Make in India initiatives promote domestic manufacturing and have spurred investments in advanced materials, including high-performance alloys for critical applications. In addition, India’s rising focus on defense capabilities has led to higher consumption of specialized alloys for aircraft, military equipment, and space exploration projects. For instance, in July 2023, HAL announced the development of new high-performance alloys for use in defense and aviation projects., aiming at enhancing their durability and performance in extreme conditions.

China is investing heavily in developing materials that support domestic aircraft manufacturing, and defense programs. The country’s focus on building sustainable infrastructure, mainly in the coastal regions and areas with extreme climates has further increased the demand for high performance alloys. Government support through initiatives such as Made in China 2025 also emphasizes the development and production of high performance alloys to reduce reliance on imports and strengthen its technological capabilities.

High Performance Alloys Market Players:

- High Performance Alloys, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- eramet

- Smiths High Performance

- Acerinox

- ORIC S.A.S

- HAYNES INTERNATIONAL

- HIFraser

- Maher Limited

- Modison Limited

Companies existing in the high performance alloys market are adopting various strategic initiatives to stay competitive and drive market growth. These include investing in research and development to create innovative materials with enhanced strength, corrosion resistance, and durability for several industries. The rising number of global oil and gas projects is a driving factor for the key players. Additionally, many are expanding global footprints through mergers, and acquisitions to strengthen supply chains. For instance, in January 2022, Adani Total Gas Ltd (ATGL), a joint venture between the Adani Group and TotalEnergies, obtained licenses for the expansion of its City Gas Distribution (CGD) network to 14 new Geographical Areas (GAs).

Recent Developments

- In March 2024, Emirates Global Aluminium announced the acquisition of a German aluminum recycling firm, Leichtmetall Aluminium Giesserei Hannover GmbH

- In January 2022, Desktop Metal announced the launch of DM HH Stainless Steel (DM HH-SS) which combines high strength and hardness with corrosion resistance, eliminating the need for low-alloy steels, and additional plating processes

- Report ID: 6447

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

High Performance Alloys Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.