High-nickel Cathode Materials Market Outlook:

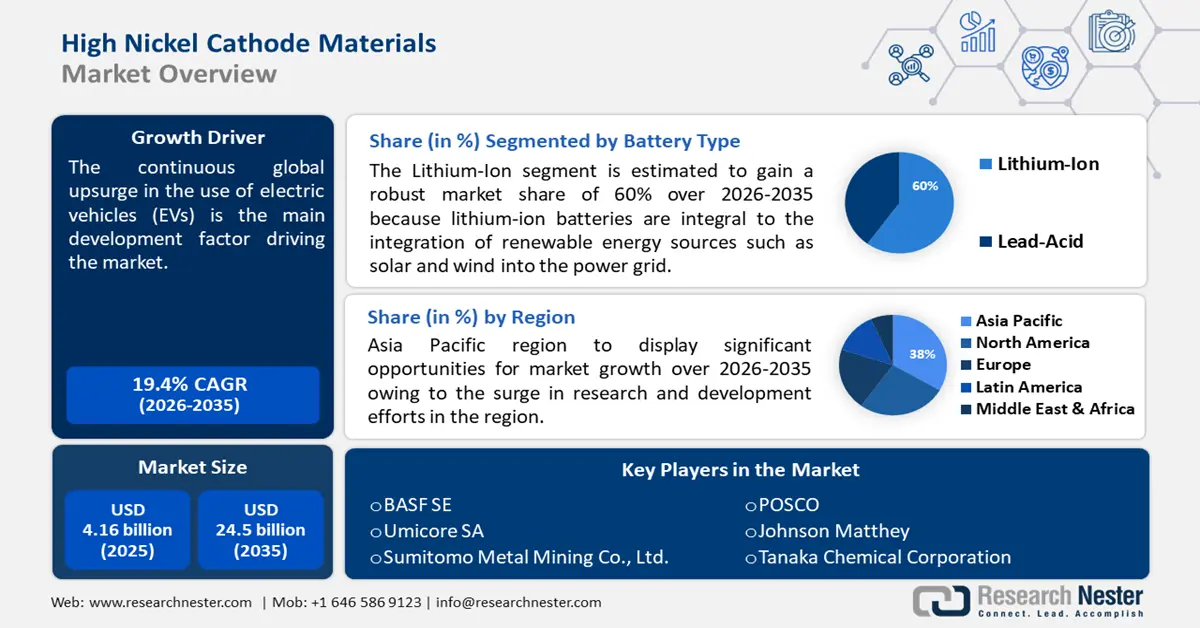

High-nickel Cathode Materials Market size was over USD 4.16 billion in 2025 and is poised to exceed USD 24.5 billion by 2035, growing at over 19.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of high-nickel cathode materials is estimated at USD 4.89 billion.

The primary growth driver propelling the market is the relentless surge in the adoption of electric vehicles (EVs) worldwide. As nations and consumers intensify their commitment to sustainable and eco-friendly transportation solutions, the demand for high-performance lithium-ion batteries, in which high-nickel cathodes play a pivotal role, has reached unprecedented levels.

The electric vehicle revolution is reshaping the automotive landscape, with consumers and governments alike prioritizing cleaner alternatives to traditional internal combustion engine vehicles. High-nickel cathode materials, known for their superior energy density and performance characteristics, have become indispensable in lithium-ion batteries, the powerhouses driving the electric mobility paradigm.

Electric vehicles (EVs), consumer electronics, and renewable energy storage systems all depend substantially on high-nickel cathode materials. These materials are vital to lithium-ion batteries. The cathode materials for these types of batteries often determine their energy density and performance. The high-nickel cathode materials market demand is estimated to surge owing to the growing acceptance of electric vehicles across the globe. Grown energy density and enhanced performance are two key advantages of high-nickel cathodes for lithium-ion batteries making them an adequate fit for electric vehicles.

Key High-nickel Cathode Materials Market Insights Summary:

Regional Highlights:

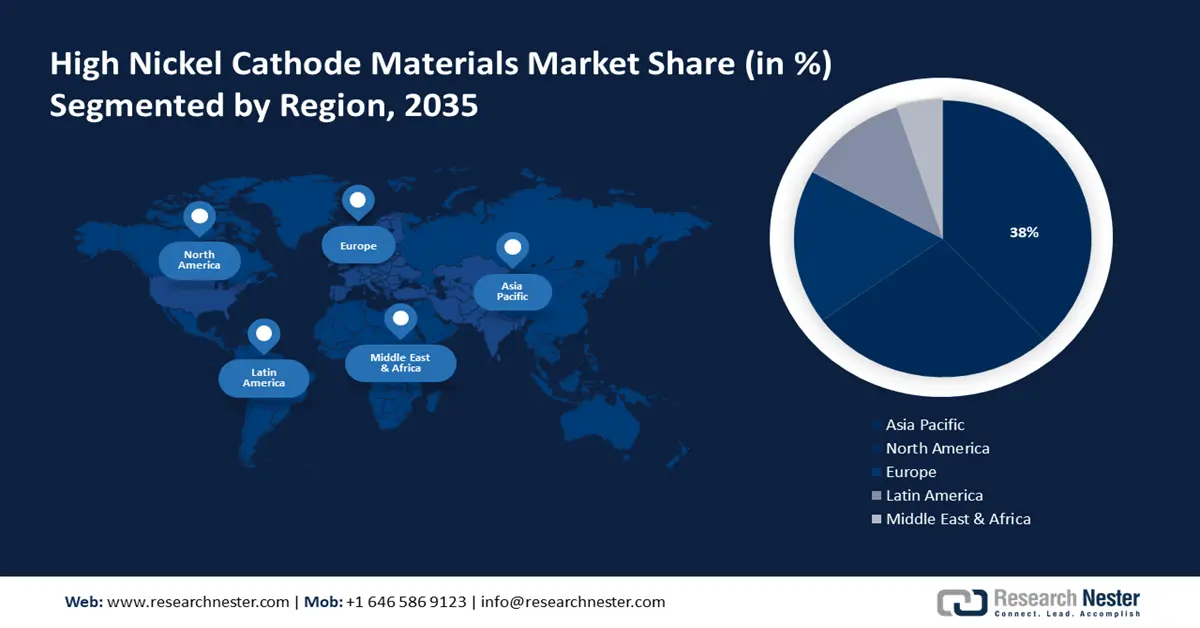

- Asia Pacific high-nickel cathode materials market leads with a 38% share, driven by international collaboration and the strengthening of the supply chain for crucial minerals, forecast period 2026–2035.

- North America market will hold the second largest share, fueled by the construction of massive battery production facilities such as Tesla's Gigafactory, increasing output for electric vehicle demand, forecast period 2026–2035.

Segment Insights:

- The lithium-ion segment in the high-nickel cathode materials market is forecasted to capture a 60% share by 2035, attributed to rising demand for energy storage solutions in renewable energy and electronics.

- The automotive segment in the high-nickel cathode materials market is projected to capture a significant share by 2035, fueled by increasing urban mobility trends and adoption of lightweight materials.

Key Growth Trends:

- Surging sales of electric vehicle (EV)

- Advancements in material science and technology

Major Challenges:

- Raw material supply and pricing volatility

- Cobalt Dependency Reduction

Key Players: BASF SE, Umicore SA, Sumitomo Metal Mining Co., Ltd., POSCO, Johnson Matthey, Tanaka Chemical Corporation.

Global High-nickel Cathode Materials Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.16 billion

- 2026 Market Size: USD 4.89 billion

- Projected Market Size: USD 24.5 billion by 2035

- Growth Forecasts: 19.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, South Korea, Japan, Germany

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 16 September, 2025

High-nickel Cathode Materials Market Growth Drivers and Challenges:

Growth Drivers

- Surging sales of electric vehicle (EV) - The exponential growth in electric vehicle adoption has become a primary catalyst for the market. As governments worldwide intensify their focus on decarbonizing transportation and consumers embrace eco-friendly alternatives, the demand for high-performance lithium-ion batteries, where high-nickel cathodes play a crucial role, has surged.

Enhanced energy density and improved performance make high-nickel cathode materials essential for meeting the evolving needs of the electric vehicle industry. According to the International Energy Agency (IEA), global electric car sales witnessed a remarkable increase of 41% in 2020, reaching over 3 million units. The total global electric car stock surpassed 10 million units in the same year, indicating a robust and accelerating shift towards electric mobility. - Renewable energy storage expansion - The expansion of renewable energy sources necessitates effective energy storage solutions. High-nickel cathode materials contribute significantly to the development of advanced lithium-ion batteries used in stationary energy storage systems. The ability to store excess renewable energy and release it when needed enhances the stability and reliability of renewable energy grids, further driving the demand for high-nickel cathode materials.

- Advancements in material science and technology - Ongoing research & innovation in material science are pivotal in shaping the market. Breakthroughs, such as achieving higher energy densities, are instrumental in enhancing the overall performance of lithium-ion batteries. Collaborations between research institutions and industry players contribute to the continuous evolution of cathode materials, providing a competitive edge in the high-nickel materials market market.

Concerns over supply chain vulnerabilities have prompted a renewed focus on achieving resilience and diversification. High-nickel cathode materials heavily rely on -nickel, cobalt, and other critical minerals. Efforts to secure a stable and diversified supply chain contribute to the sustainability of the market, mitigating potential disruptions.

Challenges

- Raw material supply and pricing volatility - High-nickel cathode materials rely on raw materials such as -nickel, cobalt, and lithium. The mining and extraction processes for these materials can be environmentally sensitive, and geopolitical factors or supply chain disruptions can lead to volatility in prices and availability. Fluctuations in raw material prices and potential shortages can affect production costs, impacting the overall competitiveness of high-nickel cathode materials market. The mining of critical minerals, including-nickel and cobalt, is associated with environmental and ethical concerns. Issues such as child labor, unsafe working conditions, and environmental degradation in mining regions can affect the market's reputation.

- Cobalt Dependency Reduction

- Technology and Performance Optimization

High-nickel Cathode Materials Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

19.4% |

|

Base Year Market Size (2025) |

USD 4.16 billion |

|

Forecast Year Market Size (2035) |

USD 24.5 billion |

|

Regional Scope |

|

High-nickel Cathode Materials Market Segmentation:

Battery Type

In high-nickel cathode materials market, lithium-ion segment is poised to account for around 60% share by 2035. For renewable energy sources like solar and wind to be integrated into the power system, lithium-ion batteries are essential. Effective energy storage technologies are necessary to balance supply and demand since renewable energy output is intermittent. As the energy environment shifts to one that is cleaner and more sustainable, lithium-ion batteries offer a dependable and scalable option.

The International Renewable Energy Agency (IRENA) reports that additions to the world's renewable capacity in 2020 totaled 260 gigawatts, a 50% rise from the year before. The growth of the renewable energy industry highlights the necessity of efficient energy storage technologies, of which lithium-ion batteries are a key component.

The prevalence of consumer electronics highlights the significance of lithium-ion batteries in supplying power to these apparatuses. An rising number of sophisticated products, such as wearables and smartphones, require lightweight and energy-dense battery solutions.

End User

The automotive segment in high-nickel cathode materials market is expected to garner a significant share in the year 2035. Evolving consumer preferences, especially in urban areas, are impacting how people view vehicle ownership. The rise of ride-hailing services, car-sharing platforms, and other mobility-as-a-service models is reshaping the automotive landscape.

Automakers are adapting to these trends by exploring new business models and developing vehicles tailored to meet the needs of urban mobility, contributing to the ongoing growth and transformation of the automotive segment. The automotive industry's focus on improving fuel efficiency and reducing carbon emissions has led to a shift towards lightweight materials.

Light weighting is crucial for achieving regulatory fuel efficiency standards and enhancing the performance of electric vehicles. Automotive manufacturers are incorporating materials such as high-strength steel, aluminum, and composite materials to reduce vehicle weight while maintaining structural integrity, contributing to the market growth in the automotive segment.

Our in-depth analysis of the global market includes the following segments:

|

Battery Type |

|

|

End user |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

High-nickel Cathode Materials Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is poised to dominate majority revenue share of 38% by 2035. International collaboration is a prominent factor driving the market in the Asia Pacific region. Partnerships between nations, such as Australia and India, underscore the significance of joint efforts to strengthen the supply chain for crucial minerals.

Collaborations facilitate awareness exchange, technological enhancement, and resource access, resulting in a conducive environment for the steady growth of the high-nickel cathode materials market. Government initiatives as well as investments play an important role in the expansion of the Asia Pacific market.

Regional nations such as China are extensively promoting the adoption of electric vehicles and renewable energy sources. China announced plans to invest approximately USD 60 billion in renewable energy projects, which includes electric vehicle (EV) infrastructure, as part of its commitment to reach at level of carbon neutrality by 2060.

North American Market Insights

The high-nickel cathode materials market in the North America region is projected to hold the second largest share during the forecast period. The construction of massive battery production facilities, such as Tesla's Gigafactory, is an indication of a dedication to increasing output to fulfill the market demand for electric cars. These facilities produce sophisticated lithium-ion batteries using high-nickel cathode materials.

By guaranteeing a consistent supply of batteries for the developing electric vehicle industry, investments in such manufacturing facilities support the expansion of the market in North America. One major factor propelling the market in North America is consumers' growing demand for electric automobiles.

Customers are increasingly likely to select electric vehicles as awareness of environmental challenges and the advantages of electric mobility grows. High-nickel cathode materials are being included by the automotive sector in response to this need, which will improve the efficiency and range of electric vehicles.

High-nickel Cathode Materials Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Umicore SA

- Sumitomo Metal Mining Co., Ltd.

- POSCO

- Johnson Matthey

- Tanaka Chemical Corporation

- 3M Company

- LG Chem Ltd.

- Hitachi Chemical Co., Ltd.

- Showa Denko K.K.

Recent Developments

- BASF acquired Solvay's polyamide business. This major acquisition strengthens BASF's position in the high-performance polyamides market, expanding their product portfolio and geographic reach.

- BASF announced the launch of "Care Creations" sustainable beauty ingredients platform. This new platform offers customers a range of sustainable and responsible ingredients for the personal care industry, aligning with the growing demand for eco-friendly products.

- Report ID: 5776

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.