High-k and CVD ALD Metal Precursors Market Outlook:

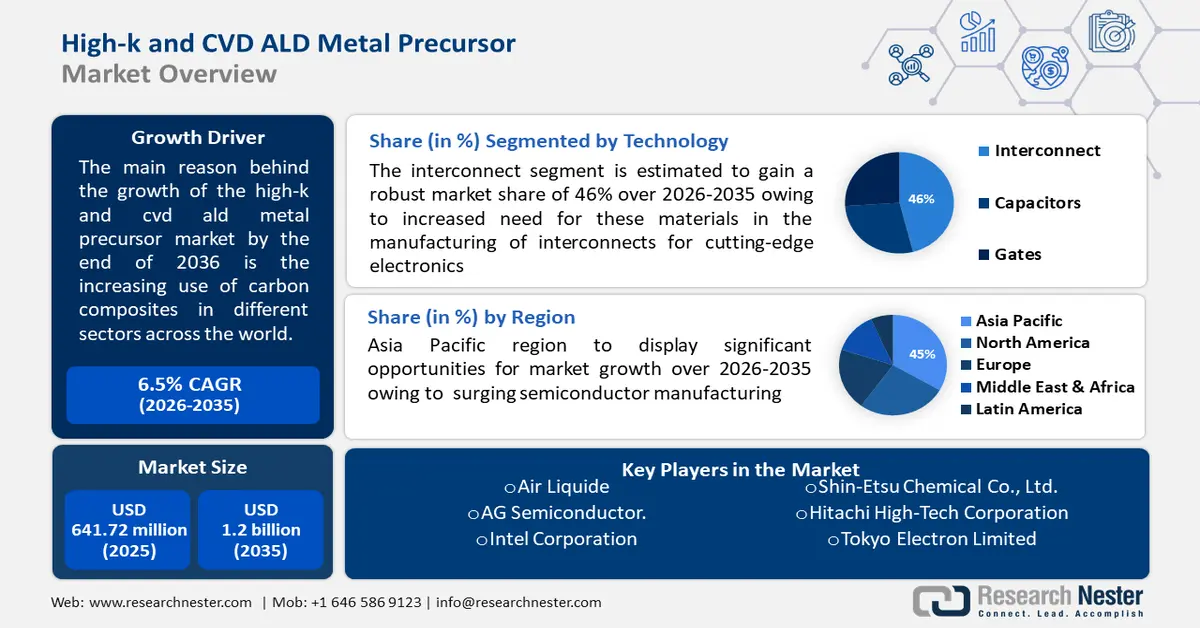

High-k and CVD ALD Metal Precursors Market size was over USD 641.72 million in 2025 and is projected to reach USD 1.2 billion by 2035, growing at around 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of high-k and CVD ALD metal precursors is evaluated at USD 679.26 million.

Escalating demand for semiconductor technologies is propelling the market growth from High-k and CVD ALD Metal Precursors. The relentless need for high-performance electronic devices across diverse industries propels the adoption of High-k dielectrics and CVD ALD metal precursors.

These materials are essential in semiconductor manufacturing, enabling smaller feature sizes, enhanced transistor performance, and improved energy efficiency. As emerging technologies, such as 5G, artificial intelligence, and IoT, become integral to various applications, High-K and CVD ALD technologies play a pivotal role in meeting the unique requirements of these advancements. The high-k and CVD ALD metal precursors market is further driven by global expansion in semiconductor manufacturing, stringent environmental regulations, rising investments in research & development, and collaborative efforts across the industry to push the boundaries of semiconductor capabilities. The revenue of the Semiconductor Industry is expected to increase by 64% by the end of 2024.

In addition to these factors, continuous advancements in semiconductor manufacturing technologies have led to the development of more complex and efficient devices. High-k and CVD ALD metal precursors are at the forefront of these innovations, enabling manufacturers to achieve smaller feature sizes, higher integration densities, and improved performance in semiconductor components.

Key High-k and CVD ALD Metal Precursors Market Insights Summary:

Regional Highlights:

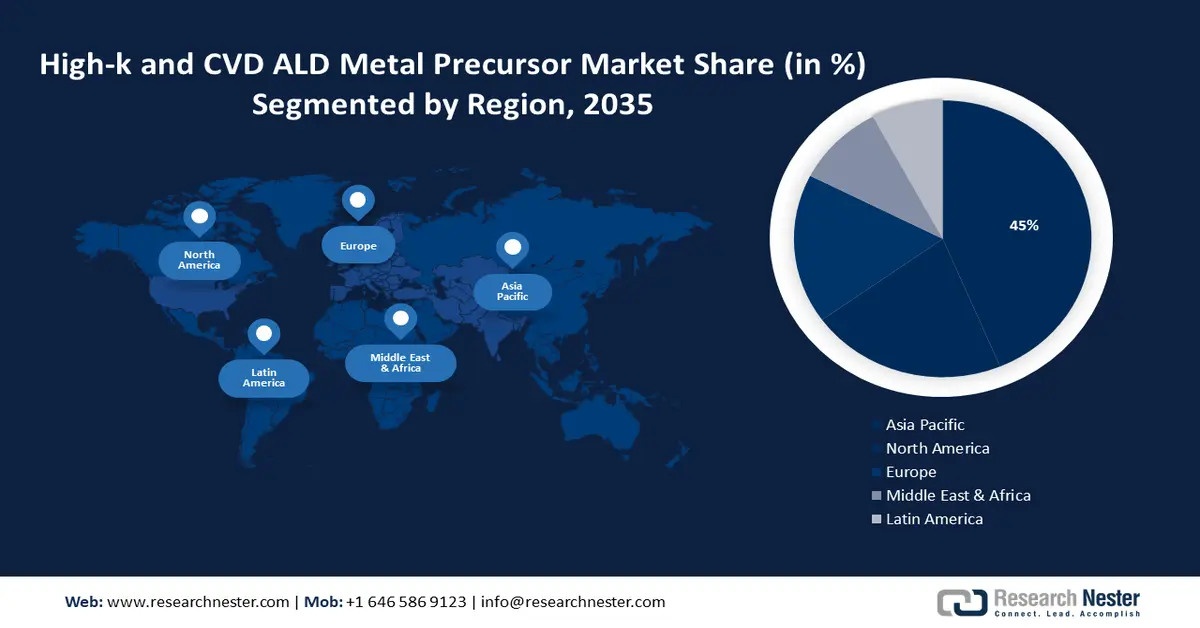

- Asia Pacific high-k and cvd ald metal precursors market leads with a 45% share, fueled by surging semiconductor manufacturing, forecast period 2026–2035.

- North America market will register huge CAGR, fueled by rising investments in R&D in the semiconductor sector, forecast period 2026–2035.

Segment Insights:

- The interconnect segment in the high-k and cvd ald metal precursors market is projected to experience significant growth through 2035, driven by demand for materials in manufacturing interconnects for cutting-edge electronics.

- The consumer electronics segment in the high-k and cvd ald metal precursors market is anticipated to secure a significant share by 2035, driven by rising demand for cutting-edge electronics with improved performance.

Key Growth Trends:

- Increasing investments in research & development

- Growing adoption of 3D transistors and advanced memory technologies

Major Challenges:

- Limited availability of raw materials

- The high cost of raw materials poses a challenge to widespread adoption, especially in cost-sensitive industries.

Key Players: Air Liquide, AG Semiconductor., AFC Industries, Inc., ADEKA CORPORATION, Air Products and Chemicals, Inc., Dynamic Network Factory, Inc., Merck KGaA, Linde plc, DuPont, JSR Corporation.

Global High-k and CVD ALD Metal Precursors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 641.72 million

- 2026 Market Size: USD 679.26 million

- Projected Market Size: USD 1.2 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, South Korea, Japan, Germany

- Emerging Countries: China, India, South Korea, Thailand, Mexico

Last updated on : 16 September, 2025

High-k and CVD ALD Metal Precursors Market Growth Drivers and Challenges:

Growth Drivers

- Increasing investments in research & development - Companies and research institutions are investing significantly in the research & development of new materials and processes for semiconductor manufacturing equipment. This includes the exploration and optimization of high-k and CVD ALD metal precursors to enhance their properties and meet the evolving requirements of cutting-edge semiconductor devices.

Also, high-k and CVD ALD metal precursors find applications beyond traditional semiconductor manufacturing, including in emerging technologies such as quantum computing and neuromorphic computing. As these technologies gain traction, the demand for specialized materials that can meet the unique requirements of these applications is expected to drive the growth of the high-k and CVD ALD metal precursors market. - Growing adoption of 3D transistors and advanced memory technologies - The adoption of 3D transistors and advanced memory technologies, such as NAND and DRAM, is on the rise. High-k and CVD ALD metal precursors are essential in the fabrication of these advanced structures, supporting the industry’s transition to more efficient and compact semiconductor devices and improved performance and energy efficiency. In consideration to this, the high-k CVD ALD metal precursors market is estimated to witness growth.

- Stringent environmental and safety regulations - Increasing awareness of environmental and safety concerns in manufacturing processes has led to a demand for materials that are not only high-performing but also comply with stringent regulations. High-k and CVD ALD metal precursors, when designed to meet these standards, become attractive options for semiconductor manufacturers looking to align with sustainable and regulatory requirements.

Challenges

- Limited availability of raw materials- Some high-k materials and specialized CVD ALD metal precursors may have limited availability due to constraints in the supply chain. This can lead to price volatility and potential disruptions in production if there are shortages or difficulties in sourcing the required raw materials.

- The high cost of raw materials poses a challenge to widespread adoption, especially in cost-sensitive industries.

- The semiconductor industry is subjected to stringent regulations concerning environmental and safety standards, restricting the high-k and CVD ALD metal precursors growth.

High-k and CVD ALD Metal Precursors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 641.72 million |

|

Forecast Year Market Size (2035) |

USD 1.2 billion |

|

Regional Scope |

|

High-k and CVD ALD Metal Precursors Market Segmentation:

Technology Segment Analysis

In high-k and CVD ALD metal precursors market, interconnect segment is likely to capture over 46% share by 2035. The segment growth can be attributed to the increased need for materials in the manufacturing of interconnects for cutting-edge electronics. A semiconductor device's interconnects are utilized to link its numerous components together. By using high-k and CVD ALD metal precursors, these interconnects can function better and more efficiently.

Furthermore, the need for high-k and CVD ALD metal precursors in the interconnect segment is being driven by the growing trend towards the miniaturisation of electronic components and the increasing need for smaller and more efficient interconnects in electronic components.

End-User Segment Analysis

The consumer electronics segment in the high-k and CVD ALD metal precursors market is poised to garner significant market share. The market is expanding as a result of consumers' increased desire for cutting-edge electronics with improved performance and reduced power usage. The manufacturing of memory chips, microprocessors, and other semiconductor devices that power a variety of consumer gadgets including laptops, tablets, and smartphones frequently uses high-k materials.

Also, the consumer electronics sector is seeing a surge in demand for high-k and CVD ALD metal precursors due to the increasing use of these gadgets and the ongoing innovation in their features and functionalities. As observed by Research Nester's analysis, it was predicted that between 2023 and 2028, the worldwide consumer electronics industry would generate a total of USD 125.1 billion in revenue. The consumer electronics segment is predicted to reach USD 1.2 trillion, a new top in 2028.

Our in-depth analysis of the global High-k and CVD ALD metal precursors market includes the following segments:

|

Technology |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

High-k and CVD ALD Metal Precursors Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is expected to hold largest revenue share of 45% by 2035. The market growth in the region is also expected on account of surging semiconductor manufacturing.

The Asia-Pacific semiconductor industry brought in about 342 billion dollars in revenue in 2021. Countries such as China, South Korea, and Taiwan emerged as key players in the global semiconductor industry, contributing to the heightened demand for advanced materials like high-k dielectrics and CVD ALD metal precursors.

The Asia Pacific region capitalized on the growing consumer electronics sector, increasing demand for smartphones, and rapid technological advancements. Semiconductor manufacturers in the region integrated High-k and CVD ALD metal precursors to achieve higher performance and energy efficiency in their devices.

Furthermore, government initiatives, coupled with significant investments in research & development, propelled the region's semiconductor industry forward, fostering innovation and positioning Asia Pacific as a major hub for semiconductor technology. This growth underscored the crucial role of High-k and CVD ALD metal precursors in shaping the technological landscape of the Asia Pacific semiconductor industry.

North America Market Insights

The North American region will also encounter huge growth for the high-k and CVD ALD metal precursors market during the projection period and will hold the second position owing to rising investments in R&D in the semiconductor sector. Technological hubs such as Silicon Valley played a pivotal role in advancing semiconductor manufacturing processes, fostering a high demand for innovative materials like High-k dielectrics and CVD ALD metal precursors. The region's semiconductor manufacturers embraced these advanced materials to enhance the performance and efficiency of their electronic devices.

Moreover, collaborations between industry leaders, research institutions, and start-ups contributed to the development of cutting-edge deposition techniques and materials. The North American market prioritized research and development initiatives, addressing challenges such as cost-effectiveness and scalability. This commitment to innovation solidified North America's position as a key player in the global semiconductor landscape, with High-k and CVD ALD metal precursors playing a crucial role in shaping the region's semiconductor technology advancements.

High-k and CVD ALD Metal Precursors Market Players:

- The Dow Chemical Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Air Liquide

- AG Semiconductor.

- Intel Corporation

- AFC Industries, Inc.

- Silicon Box Pte Ltd

- Air Products and Chemicals, Inc.

- Dynamic Network Factory, Inc.

- Merck KGaA

- Linde plc

- DuPont

Recent Developments

- Intel Corporation signed a Memorandum of Understanding with Siemens AG, one of the world's leading technology companies, to cooperate on digitalization and the sustainability of microelectronics production.

- Silicon Box Pte Ltd unveiled its USD 2 billion advanced semiconductor manufacturing foundry. This launch was aimed to revolutionize the chip manufacturing industry, strengthen Singapore's standing as a global hub for semiconductor manufacturing, and develop local capabilities.

- Hitachi High-Tech Corporation launches GT2000, a high precision electron beam metrology system for meeting the needs of semiconductor devices, mass production, and development in the HighNA EUV Generation.

- Shin-Etsu Chemical Co., Ltd., a Japanese manufacturer of semiconductor materials, announced an investment of roughly 83 billion yen ($545 million) for a new manufacturing unit in Gunma Prefecture. The facility will generate the lithography materials needed to make microchips.

- Report ID: 5785

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

High-k and CVD ALD Metal Precursors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.