High Flow Oxygen Therapy Devices Market Outlook:

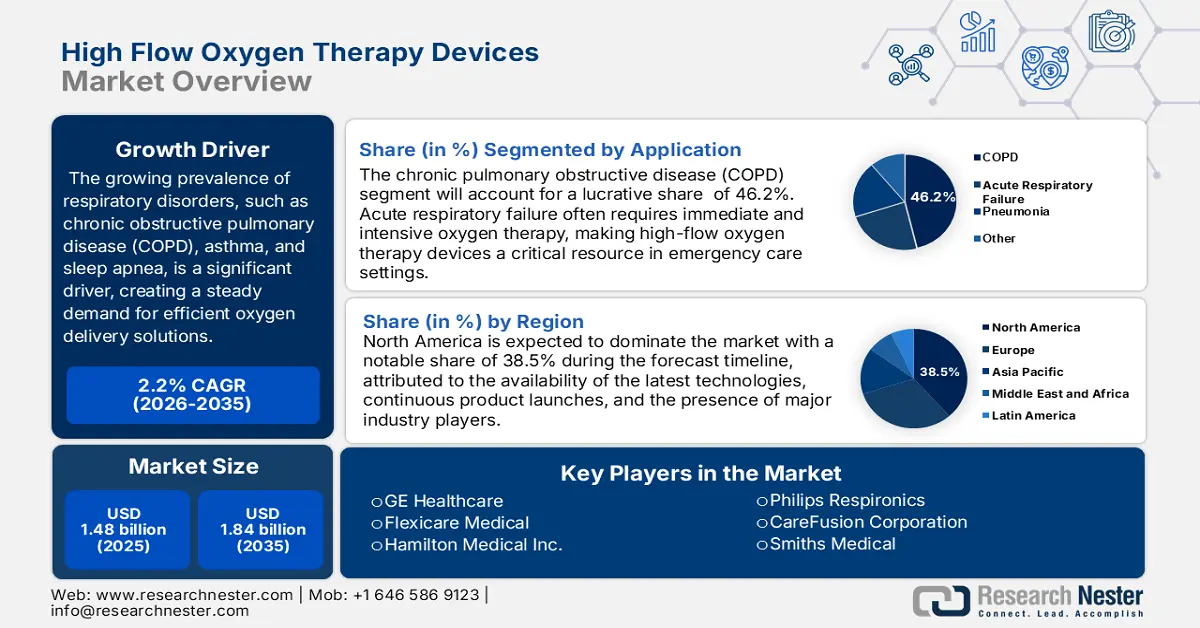

High Flow Oxygen Therapy Devices Market size was valued at USD 1.48 billion in 2025 and is expected to reach USD 1.84 billion by 2035, registering around 2.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of high flow oxygen therapy devices is evaluated at USD 1.51 billion.

The global market for high-flow oxygen therapy devices is driven by a robust growth trajectory, further fueled the product innovation, improved comfort for the patient, and improved mechanisms of oxygen delivery. The innovations address evolving needs both of home and hospital care, thereby opening up new markets of application for high-flow oxygen therapy. For instance, in March 2024, the report unveiled by the National Library of Medicine stated that, The RSVPreF3 and RSVPreF vaccinations are significant new instruments to lower RSV-related morbidity and mortality in newborns and older individuals. For these vaccines to be administered safely and effectively, interdisciplinary cooperation and good communication between medical professionals are essential.

Moreover, the mounting COPD burden causes these machines to be in continuous demand. Increasing geriatric population, increased awareness and availability of good diagnostic equipment also raise the incidence of COPD and thus fuel the market growth. For instance, in November 2024, over 14 million persons in the US suffer from COPD, and many more are unaware that they have it. Women make up over half of those with diagnoses. In addition, in June 2024, CDC revealed COPD affects around 16 million adults in the United States, and many more are unaware that they have it. Breathing issues are brought on by COPD, which stops air from reaching the lungs.

Key High Flow Oxygen Therapy Devices Market Insights Summary:

Regional Highlights:

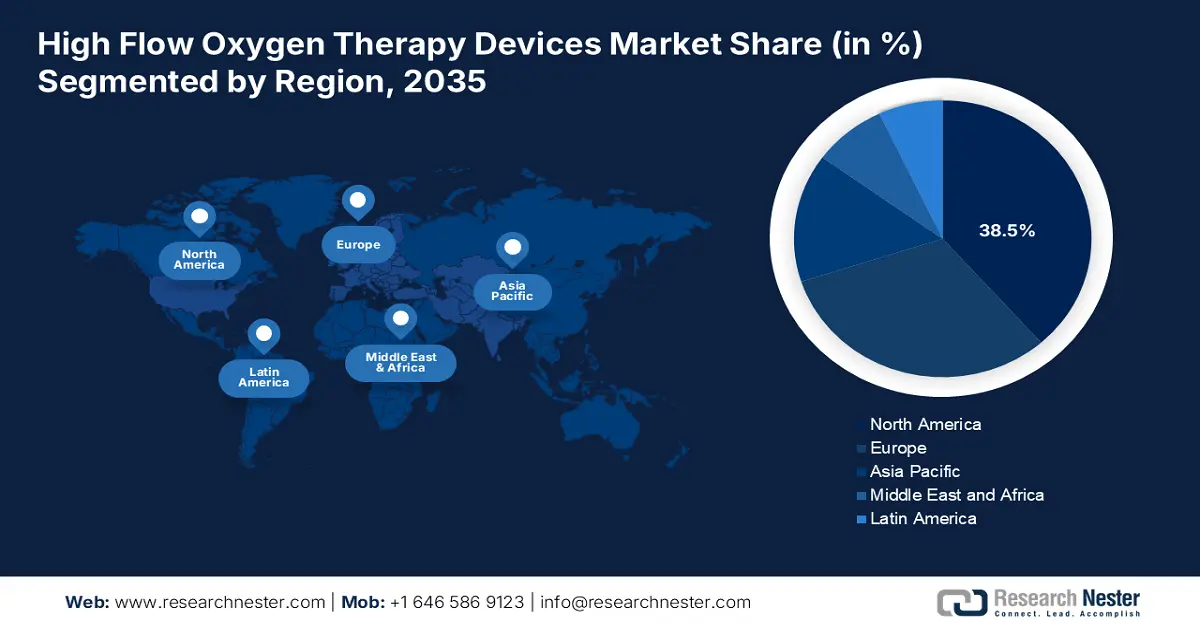

- North America holds a 38.5% share in the High Flow Oxygen Therapy Devices Market, driven by tech innovation in respiratory treatment devices, supporting growth through 2035.

- Asia Pacific's high flow oxygen therapy devices market anticipates rapid growth by 2035, fueled by portable, user-friendly device developments.

Segment Insights:

- The Chronic Obstructive Pulmonary Disease (COPD) segment is projected to capture 46.2% market share by 2035, driven by the high global prevalence of chronic respiratory conditions and home-care device innovations.

Key Growth Trends:

- Post-surgical respiratory support

- Home healthcare growth

Major Challenges:

- Need for skilled personnel

- Competition from alternative therapies

- Key Players: GE Healthcare, CareFusion Corporation, Invacare Corporation, Smiths Medical, Philips Respironics, Teleflex Medical GmBH and more.

Global High Flow Oxygen Therapy Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.48 billion

- 2026 Market Size: USD 1.51 billion

- Projected Market Size: USD 1.84 billion by 2035

- Growth Forecasts: 2.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

High Flow Oxygen Therapy Devices Market Growth Drivers and Challenges:

Growth Drivers

- Post-surgical respiratory support: Utilization of high-flow oxygen therapy devices post-surgery is one of the driving factors of the high flow oxygen therapy devices market. Enhanced device performance in terms of precise oxygen delivery and patient comfort makes effective management of post-operative respiratory disorders possible. For instance, in June 2023, Avanos Medical, Inc. and SunMed reached a final agreement whereby SunMed will purchase Avanos’ respiratory health division, which includes the BALLARD, MICROCUFF, and endOclear product lines. This increased application of high-flow oxygen therapy in post-operative management thus proves its effectiveness in optimizing respiratory function and patient outcome.

- Home healthcare growth: The high flow oxygen therapy devices market is driven by a high rate of home healthcare treatment and the generation of sophisticated technology within homecare settings. Improved device portability along with easier use interfaces facilitate smoother integration in the home environment and thus enable accessibility to patients. Remote monitoring capacity also enters into the scene in which clinicians manage the patient breathing status effectively without hospitals. For instance, in November 2024, as per the data revealed by the Bureau of Labor Statistics, in 2023, 80% of personal care aides and 87% of all home health aides were female.

Challenges

- Need for skilled personnel: The demand for skilled personnel is an enormous growth constraint of the market for high flow oxygen therapy devices market. Optimal patient outcomes are facilitated by trained health workers able to operate the device and monitor the patient. Requiring special training to control titration of the oxygen flow rate and humidification settings is an additional source of complexity. Having a shortage of trained health professionals is, consequently, a hurdle to global utilization and effective usage of high-flow oxygen therapy, particularly in settings with limited resources.

- Competition from alternative therapies: A strong obstacle in the high flow oxygen therapy devices market is represented by competition from other respiratory therapies in the marketplace. Traditional modalities such as non-invasive ventilation (NIV) and traditional oxygen delivery systems are clinically effective alternatives in some groups of patients. Respiratory support selection is dependent on the individual patient and clinical guideline, thereby developing a competitive market. Therefore, it is important that there is strong clinical evidence and cost-effectiveness analysis to establish the superior efficacy of high-flow oxygen therapy over these established alternatives.

High Flow Oxygen Therapy Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

2.2% |

|

Base Year Market Size (2025) |

USD 1.48 billion |

|

Forecast Year Market Size (2035) |

USD 1.84 billion |

|

Regional Scope |

|

High Flow Oxygen Therapy Devices Market Segmentation:

Application (Chronic Obstructive Pulmonary Disease (COPD), Acute Respiratory Failure, Pneumonia)

Chronic obstructive pulmonary diseases segment is expected to dominate around 46.2% high flow oxygen therapy devices market share by the end of 2035, attributed to the high prevalence of chronic respiratory diseases instances across the globe. Furthermore, the intervention of easy-to-use devices invented for home care settings have fueled the segment growth. For instance, in November 2021, the Luisa ventilator—a portable, small home ventilator intended for both invasive and non-invasive breathing, including high-flow oxygen therapy—was introduced in the U.S. by Movair.

Product Type (High-flow Nasal Cannulas, High-flow Oxygen Masks, Breathing Circuits, Heated Humidifiers, Accessories)

The high flow nasal cannulas segment is rightfully spearheading the high flow oxygen therapy devices market its capability of offering the superior comfort in respiratory control as compared to the traditional devices. Moreover, these devices have clinical evidences of being supportive with high efficacy in critical cases related to respiratory conditions. For instance, in May 2022, Fisher & Paykel Healthcare Corporation Limited declared today that the Airvo 3 high flow system is now available. Building on the market-leading Airvo 2, the new respiratory device offers a wider range of capabilities and more sophisticated technology.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

High Flow Oxygen Therapy Devices Market Regional Analysis:

North America Market Statistics

North America in high flow oxygen therapy devices market is likely to capture over 38.5% revenue share by 2035, characterized by the innovation in treating the respiratory disorders with the state-of-the-art technologies being discovered by the companies. For instance, in April 2024, Dynarex Corporation announced the addition of a new range of portable devices to its cutting-edge respiratory therapy line, Dynarex Resp-O2TM. It is a transportable solution for nebulization therapy, suction care, and oxygen administration.

The most significant growth driver in the U.S. high flow oxygen therapy devices market due to effortless approvals that fuels more prompt interventions for novel therapeutic drugs and devices. For instance, in July 2023, Beyfortus (nirsevimab-alip) was approved by the U.S. Food and Drug Administration to prevent lower respiratory tract disease caused by the Respiratory Syncytial Virus (RSV) in newborns and infants born during or beginning their first RSV season, as well as in children up to 24 months of age who are still at risk of developing severe RSV disease during their second RSV season.

In Canada the growth in the high flow oxygen therapy devices market is growing rapidly due to the revolutions that key players within the country are focusing on to provide efficacy in treatments. For instance, in February 2025, Hamilton Medical reported that the HAMILTON-HF90, its most recent invention, is now offered in all CE marketplaces. This innovative, stand-alone high flow oxygen therapy device is an extension to its portfolio that will revolutionize patient care discovered through closely working with medical experts to streamline clinical procedures.

Asia Pacific Market Analysis

The Asia Pacific high flow oxygen therapy devices market is expanding at a rapid pace owing to the technological developments that have significantly enhanced the functionality and design of high-flow oxygen therapy equipment. These treatments are becoming more widely available and easier to use due to the development of smaller, more portable devices with better user interfaces. Furthermore, the market is growing as a result of these advancements, which draw patients and healthcare providers.

In India, the high flow oxygen therapy devices market is revolutionizing due to the cordial relationships that exist between the authoritative organizations present in the market for the purpose of strengthening healthcare facilities in the country. For instance, in June 2021, in order to expedite the establishment of Medical Oxygen Plants (MOP) in the nation, Honeywell announced that its collaboration with the Defense Research Development Organization (DRDO) and the Council of Scientific and Industrial Research–Indian Institute of Petroleum (CSIR–IIP), Government of India, to supply molecular sieve adsorbents (zeolites).

In China, the high flow oxygen therapy devices market is witnessing substantial growth owing to the development of novel therapies to cure the respiratory problems. For instance, in March 2022, Advanced Oxygen Therapy Inc. (AOTI) today that is has received Chinese National Medical Products Administration (NMPA) approval for its unique cyclically pressurized Topical Wound Oxygen (TWO2) therapy. Making it the only advanced sustained wound healing therapeutic to have achieved such a designation and allowing the company to commence marketing in China with its local partner.

Key High Flow Oxygen Therapy Devices Market Players:

- GE Healthcare

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CareFusion Corporation

- Invacare Corporation

- Smith Medical

- Philips Respironics

- Teleflex Medical GmBH

- Fisher & Paykel Corporation Ltd.

- Flexicare Medical

- Hamilton Medical Inc.

The strong presence of the prominent key players in the high flow oxygen therapy devices market is revolutionizing the landscape through their strategic acquisitions to leverage expertise and to secure a solidify the market position. For instance, in August 2024, Johnson & Johnson finalized a deal to acquire V-Wave Ltd. For USD 600 million up front for V-Wave, subjected to normal adjustments. It is anticipated that J&J’s position will be strengthened with structural interventional cardiologists and heart failure specialists and expedite its transition into high-growth and high-opportunity high flow oxygen therapy devices markets.

Here's the list of some key players:

Recent Developments

- In October 2024, Philips Respironics released a voluntary correction concerning the usage of in-line nebulizers for the Trilogy Evo, Trilogy Evo O2, Trilogy Evo Universal, and Trilogy EV300 ventilators.

- In August 2023, GE Healthcare announced the development of a portable HFO therapy tool designed especially for home care environments, which has the potential to greatly enhance patient mobility and quality of life.

- Report ID: 7468

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.