High Density Interconnect PCB Market Outlook:

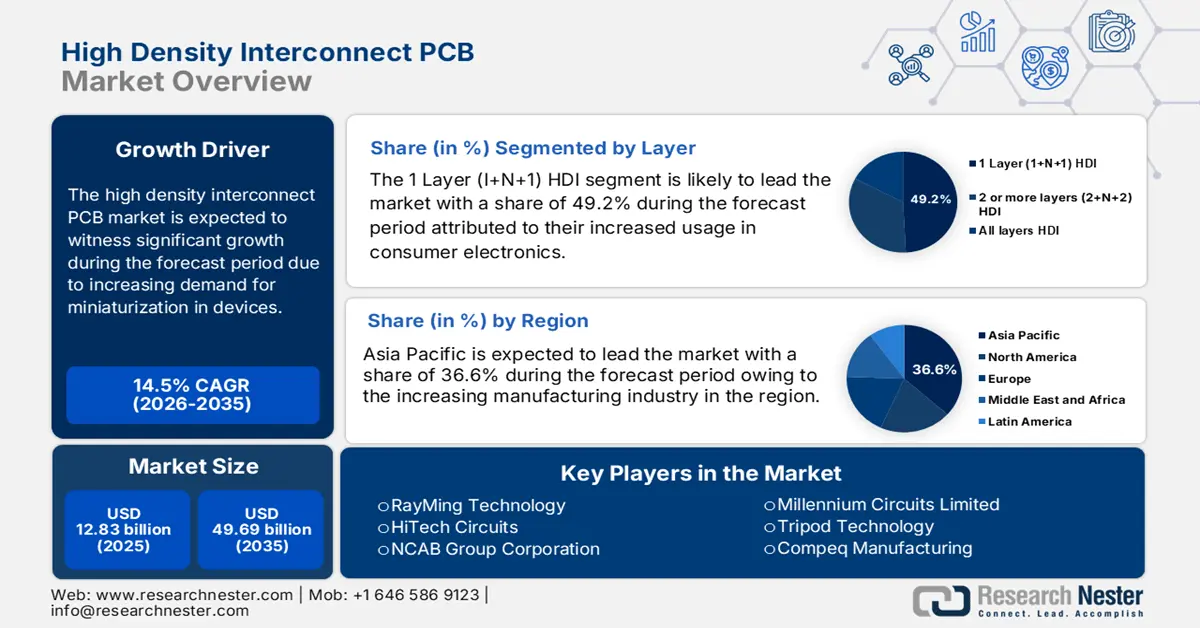

High Density Interconnect PCB Market size was valued at USD 12.83 billion in 2025 and is likely to cross USD 49.69 billion by 2035, registering more than 14.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of high density interconnect PCB is assessed at USD 14.5 billion.

The rising adoption of electric vehicles and advanced driver-assistance systems has led to an increased demand for high density interconnect PCBs in automotive electronics. In ADAS, HDI PCBs facilitate complex electronic circuits, that enable certain necessary functions including self-parking and collision avoidance, to ensure vehicle safety and autonomy. In June 2021, Meiko Electronics announced its investment plans, catering to expanding the capacity of automotive PCBs, to meet the robust demand for electric vehicle and ADAS applications. The giant has planned to invest USD 453.72 million in the 2021-2024 fiscal years and build a brand-new automotive PCB manufacturing plant in Vietnam by 2028.

Key High Density Interconnect PCB Market Insights Summary:

Regional Highlights:

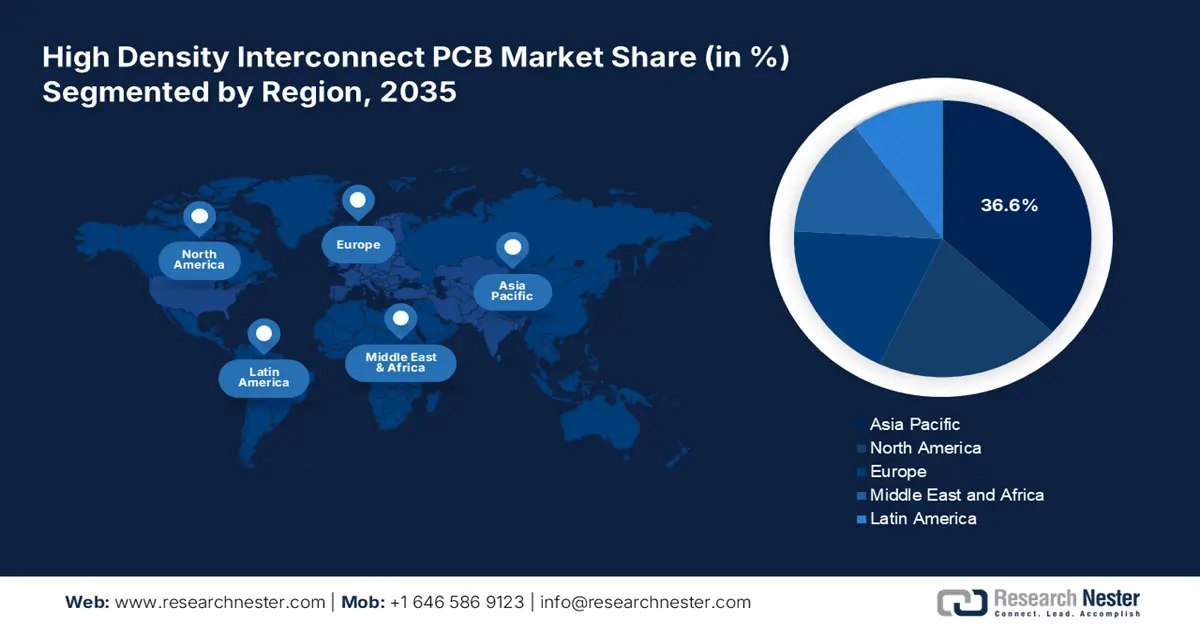

- Asia Pacific commands the High Density Interconnect PCB Market with a 36.6% share, propelled by expansion in consumer electronics manufacturing and adoption of electric vehicles requiring HDI PCBs, driving growth through 2026–2035.

Segment Insights:

- The Consumer Electronics segment is projected to experience substantial growth by 2035, driven by technological advancements and rising residential demand for compact, high-performance devices.

- The 1 Layer (1+N+1) HDI Segment is projected to hold a 49.2% share by 2035, fueled by demand for thinner, lightweight electronics.

Key Growth Trends:

- Growth of connected devices and IoT

- 5G and telecommunication infrastructure

Major Challenges:

- Longer development cycles

- High initial investment

- Key Players: RayMing Technology, HiTech Circuits, NCAB Group Corporation, Millennium Circuits Limited, and Tripod Technology.

Global High Density Interconnect PCB Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.83 billion

- 2026 Market Size: USD 14.5 billion

- Projected Market Size: USD 49.69 billion by 2035

- Growth Forecasts: 14.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, South Korea, United States, Germany

- Emerging Countries: China, Japan, South Korea, Taiwan, India

Last updated on : 13 August, 2025

High Density Interconnect PCB Market Growth Drivers and Challenges:

Growth Drivers

- Growth of connected devices and IoT: The advent of IoT technology in smart homes, industry automation, and smart cities has led to a rise in the requirement for high density interconnect PCBs. These advanced PCBs enable the enhanced functionality and miniaturization required in modern IoT applications. The compact design of these devices makes it possible to incorporate more components within limited spaces and also allows them to easily interconnect and work smoothly in various environments. This is well evident in the recent development scenarios.

- 5G and telecommunication infrastructure: HDI PCBs are essential in 5G-enabled infrastructure and devices, facilitating fast data transmission, low latency, and enhanced signal quality. The portable structure and the ability to connect numerous devices make them suitable for 5G system requirements for higher connectivity densities and higher rates. This helps further evolve smaller, and enhance the necessary network fundamentals for the implementation of 5G. This trend proves that HDI PCBs are as relevant as ever in the context of the 5G technology advancement. In July 2021, Cadence released the Allegro X Design Platform which is the first system design engineering platform for 5G PCBs, comprising schematic, layout, analysis, design collaboration, and data management. This results in quicker design cycles adding to the enhanced quality and reliability of intricate 5G PCBs.

Challenges

- Longer development cycles: The longer development cycles in HDI PCBs can be affiliated to the actual design and manufacturing characteristics of the high density interconnect printed circuit boards. Formation of high density design includes innovative techniques in the microvia insertion, thin tracks, or multilayer interconnections. One has to perform signal integrity tests, tests for reliability as well as tests for standard compliance and all these tests add time to the procedure. Also, the processes include iterative prototyping for correcting or improving inadequacies in designs or performance.

- High initial investment: Substantial capital investment is required to put up production facilities for HDI PCBs, as the technology used involves the use of advanced equipment and technology. Precision tools including laser drilling machines, fine-line etching systems, and machines for sequential lamination are used in making HDI PCBs, which tends to increase the initial costs significantly. Also, the need to keep cleanrooms, high standard of quality control, and engaged technicians add to the costs as well. These high initial cost factors present a huge hurdle to the smaller players in the manufacturing industry, which restricts their chances of getting involved in the growth of HDI PCB market.

High Density Interconnect PCB Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.5% |

|

Base Year Market Size (2025) |

USD 12.83 billion |

|

Forecast Year Market Size (2035) |

USD 49.69 billion |

|

Regional Scope |

|

High Density Interconnect PCB Market Segmentation:

Layer (1 Layer (1+N+1) HDI, 2 Or More Layers (2+N+2) HDI, All Layers HDI)

1 layer (1+N+1) HDI segment is poised to capture over 49.2% high density interconnect PCB market share by 2035. These PCBs are essential in consumer electronics, offering compact design across industries without compromising on the functionality of the gadgets, which have been oriented towards thinner and lightweight products including smartphones, tablets, and wearable technologies. For instance, in June 2023, Apple announced its plans to introduce resin-coated copper materials in its 2024 iPhone models, which signifies a shift towards thinner and more efficient PCBs.

The 1 layer HDI PCBs are more cost-effective than the multi-layer PCBs, which makes them affordable and can offer the best outcomes depending on the manufacturer’s needs. The capacity of 1+N+1 configurations to provide enhanced electrical characteristics including minimal signal attenuation and superior signal quality has made these configurations vital to high speed communication systems and 5G applications. Recent developments and partnerships have been creating ample opportunities for market growth.

Application (Consumer Electronics, Automotive, Military and Defense, Healthcare, Industrial/Manufacturing, Others)

By application, the consumer electronics segment in high density interconnect (HDI) PCB market is expected to register rapid revenue growth during the forecast period owing to rapid expansion of the consumer electronic sector and growing need for thin, light, and high-performance electronics such as mobile phones, tablets and game consoles leads to the increased adoption of HDI PCBs.

The increasing demand for multiple functionalities in a single device including cameras, sensors, and processors has propelled the demand for the latest HDI solutions. The advancements in wearable technology including the smartwatches, fitness trackers, and augmented reality devices also fuel this segment. HDI technology caters to the needs of these product types that require flexible high density and reliable PCBs. Integration of 5G in communication technology and IoT have also intensified demand for HDI PCBs. Owing to the relative capability to support high speed data transfer and robust connectivity, the PCBs are essential for next-generation devices.

Our in-depth analysis of the global high density interconnect PCB market includes the following segments:

|

Layers |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

High Density Interconnect PCB Market Regional Analysis:

Asia Pacific Market Analysis

Asia Pacific in high density interconnect PCB market is set to account for more than 36.6% revenue share by the end of 2035, attributing to the expansion of consumer electronics manufacturing in the region. Countries including India, China, and Japan are the leading producers of consumer electronics. These electronics require high performance, offered by HDI PCBs. The continual surge in the adoption of electric vehicles has leveraged the use of HDI PCBs, to manage complex electronic systems. Manufacturers have been increasingly incorporating the HDI technology to meet the high-performance requirements of the modern-day automotive.

The high density interconnect PCB market in China is projected to experience robust growth during the forecast period owing to the autonomous driving technology. It is essential to adopt the HDI PCBs for handling multiple sophisticated circuits in the automotive application. Manufacturers are utilizing HDI technology to address high density needs in automotive electronic devices. Strategic collaborations and partnerships among key players in the high density interconnect PCB market is expected to accelerate market growth in the country. For instance, DuPont signed for a strategic cooperation with Zhen Ding Technology Group in October 2024 to advance high-end PCB technology. The collaboration is aimed at enhancing the material performance and promoting sustainable development in the electronics sector.

In India, the high density interconnect PCB industry is anticipated to expand at a robust CAGR throughout the forecast period. This growth can be attributed to the rising need for technologically complex electronics needed in the automotive, telecommunication, and consumer electronics industries. The Government of India with the advent of the Make in India initiative has encouraged production locally. The demand is focused on HDI PCBs with a special emphasis on EVs and healthcare devices, which occupy a considerable amount of high-end capacity. Smartphone ownership and 5G network installation are also driving the high density interconnect (HDI) PCB market for miniaturized, high reliable PCBs. India has also seen some key alliances made to increase capacity. For instance, in October 2024, Amber Enterprises invested in a joint venture with Korea Circuit for HDI and Flexible PCB manufacturing in order to promote Aatmanirbhar Bharat. The partnership is aimed at meeting the local needs as well as to minimize the importation of the same product.

North America Market

The high density interconnect PCB market in North America is expected to be driven by strong electronics manufacturing industry, due to the enhancements in automotive, aerospace, and telecommunication industries. The rising interest in new technologies and research and development spending will help drive the adoption of HDI PCBs for high-performance applications in the region. The high density interconnect PCB market is steadily growing attributed to the expansion of 5G networks and IoT devices. The U.S. giants are leveraging these trends to enhance their HDI production capabilities. The merger, which includes the acquisition of Sunstone Circuits by American Standard Circuits in July 2023, clearly depicts the market’s tendency to establish a consolidated and improved supply chain as well as product range.

The U.S. high density interconnect PCB market is increasing, primarily due to the advanced technological growth within the country and focus on high reliability circuits in various industries. An increase in the usage of electrical vehicles has also resulted in the increased demand for HDI PCBs due to its size and superior performance. Strategic acquisitions have defined the evolution of the U.S. HDI PCB market. For instance, in 2023, Firan Technology Group acquired the IMI Inc. to expand its capacity to deliver RF circuit boards for aerospace and defense industry. This acquisition is in line with increasing needs for developing miniaturized electronics and components specifically for sensitive and stringent applications.

The high density interconnect PCB market in Canada is growing, attributed to the rising focus on advancement of manufacturing and innovation. The increasing acceptance of the IoT devices and the growing production of electric vehicles also increase the need for advanced PCB materials in the country. Canada also benefits from a skilled workforce and strong research institutions, fostering innovation in HDI PCB design and manufacturing. Companies are forming strategic partnerships and investing in advanced technologies, ensuring the continued growth of Canada’s HDI PCB market. Canada also benefits from the advantages of a skilled workforce and research institutions to support the innovation in the development of high-definition interconnect PCB design as well as high end manufacturing. Companies in Canada are entering into strategic partnerships, and are deploying latest technologies, which is making Canada’s market for HDI PCB to grow in future.

Key High Density Interconnect PCB Market Players:

- RayMing Technology

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- HiTech Circuits

- NCAB Group Corporation

- Millennium Circuits Limited

- Tripod Technology

The competitive landscape of the high density interconnect PCB market is rapidly evolving as established key players, automotive giants and new entrants are investing in advanced manufacturing technologies. Key players in the market are focused on developing new technologies and products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global HDI PCB market:

Recent Developments

- In December 2024, Kaynes Tech India Pvt. Ltd., announced to expand the manufacturing of high density interconnect PCBs, in order to enhance the electronic manufacturing landscape in the country.

- In December 2021, NCAB Group acquired 100 percent of the shares in META Leiterplatten GmbH & CO. KG, based in southern Germany’s Villingen-Schwenningen. The company offers PCB solutions in the High-Mix-Low-Volume segment, mainly in the industrial, consumer, and medical sectors.

- Report ID: 7035

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.