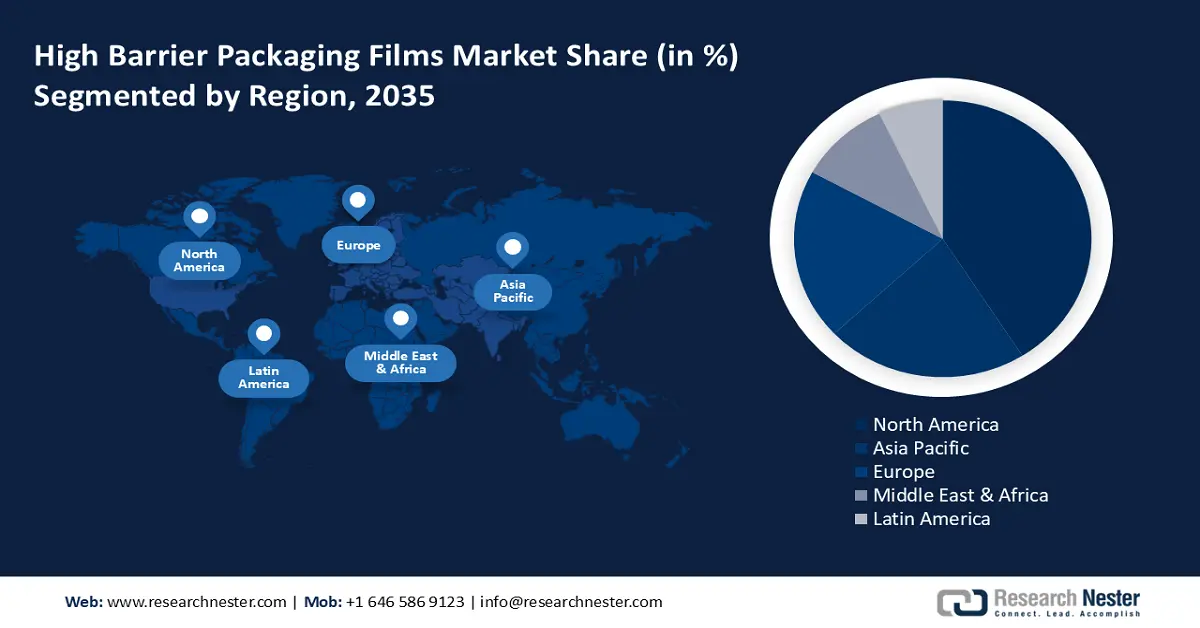

High Barrier Packaging Films Market Regional Analysis:

North America Market Insights

North America industry is predicted to dominate majority revenue share by 2035. Growing e-commerce and changing preferences for convenient foods are encouraging manufacturers in the region to develop superior-quality packaging films. For instance, in October 2022, Toppan added their series of GL BARRIER1 brand products to meet the growing demand for mono-material solutions, particularly in North America.

Rising engagement in online shopping and home delivery services are two of major the driving factors for the high barrier packaging films market in the U.S. It is further fueled by the demand for snacks, and ready-to-eat meals owing to the busy lifestyle of the citizens. According to the U.S. Department of Agriculture, in April 2024, agriculture, food, and related industries contributed 5.6% to U.S. gross domestic product in 2023. This signifies that owing to the high demand for food-related products and services, the U.S. market will witness notable growth in North America.

Canada's government is focusing on reducing plastic waste and encouraging the use of recyclable and compostable materials. This is expected to accelerate biodegradable high-barrier packaging film developments in the country. Additionally, the country is witnessing a rising demand for frozen food, mainly in the dairy and meat sectors, which is further boosted by the e-commerce sector expansion. Consumers in the country also prefer fresh and locally sourced products with effective packing. Factors like these suggest a rise in the high barrier packaging films market in Canada with a considerable share.

APAC Market Insights

APAC is expected to register a healthy CAGR, driven by ongoing urbanization, increasing disposable income, and the rise of e-commerce, leading to innovations in packaging technologies. Driven by the massive consumer base, China and India are the largest contributors to the growth of the region. Companies in the region are likely to focus on sustainable solutions to align with global environmental standards.

Advancements in material science have unlocked ways for the development of more efficient and sustainable packaging solutions in India. This includes the development of biodegradable and recyclable high-barrier films. Companies are also shifting their focus to sustainable films to gain a bigger consumer base. For instance, in March 2024, TOPPAN Inc. along with India-based TOPPAN Speciality Films Private Limited (TSF) announced the launch of GL-SP, a barrier film for sustainable packaging. GL-SP uses biaxially oriented polypropylene (BOPP) as the substrate. These films are eco-friendly packaging that caters to strict regulatory requirements that further contribute to the market growth.

The increasing middle-class population in China is driving the demand for packaged food with a longer shelf-life, leading to a higher need for packaging films. The e-commerce in China is at a boom, in addition to an expansion of the pharmaceutical sector due to the rapidly aging population. These sectors demand high-barrier packaging films to protect their products from environmental damage factors. Furthermore, the Plastic Ban Policy in China, aimed at plastic waste reduction is prompting the industry to develop alternative and sustainable materials.