High Barrier Packaging Films Market Outlook:

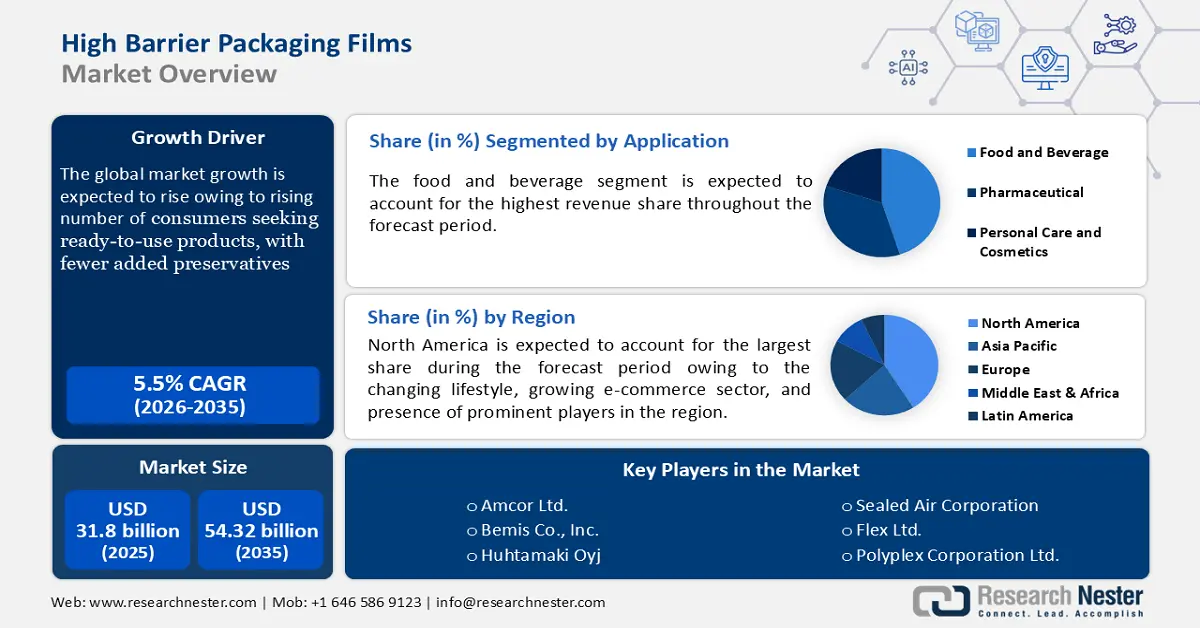

High Barrier Packaging Films Market size was valued at USD 31.8 billion in 2025 and is likely to cross USD 54.32 billion by 2035, expanding at more than 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of high barrier packaging films is assessed at USD 33.37 billion.

Busier consumer lifestyles have boosted a significant demand for processed foods with extended shelf-life, including food, beverage, and pharmaceutical products.

In many cases, plastics have failed to maintain the quality and safety of products packed for a longer period. The high-barrier packaging films are hence developed to offer superior protection against oxygen, moisture, light, and other environmental factors. With consumers seeking ready-to-use products, several packaging films have been made available commercially to protect the products and maintain their freshness and quality, with fewer added preservatives. For instance, Eurocast launched a series of high-barrier mono-material films without an EVOH barrier layer, named CRYSTA-LINE. The series is developed with transparent aluminum oxide (AIOx) coating technology, reducing both the use of raw materials and the weight of the packaging.

Key High Barrier Packaging Films Market Insights Summary:

Regional Highlights:

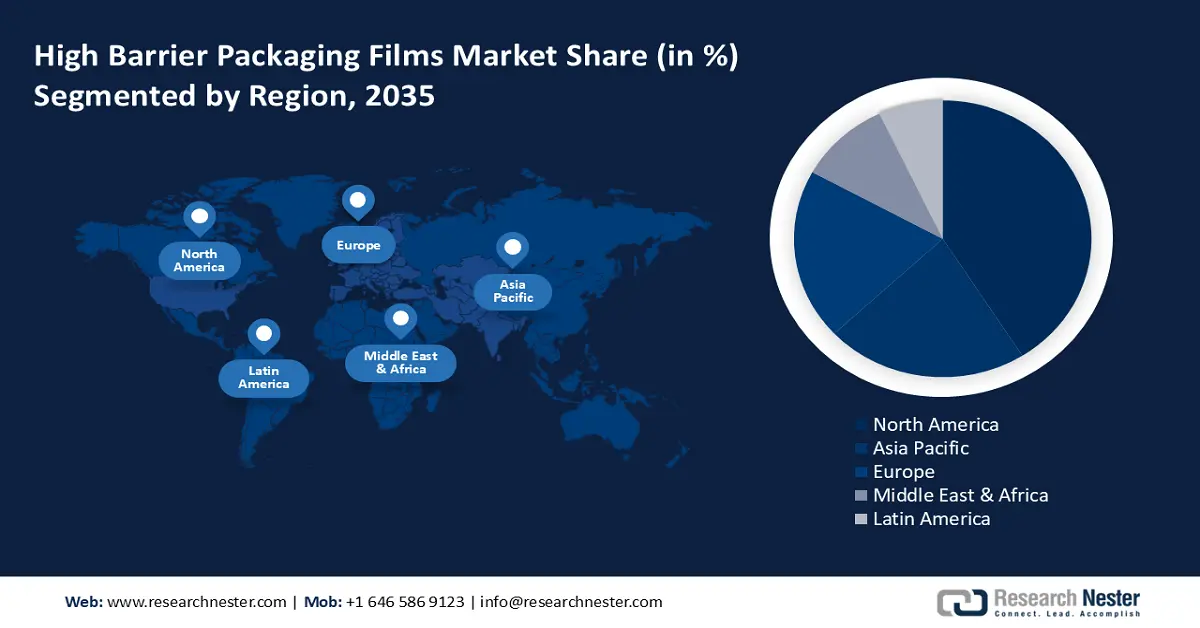

- North America high barrier packaging films market holds the largest share by 2035, driven by demand for convenient food and sustainable packaging.

Segment Insights:

- The bags and pouches segment in the high barrier packaging films market is expected to experience significant growth till 2035, attributed to their convenience in packaging across multiple industries.

- The food and beverage segment in the high barrier packaging films market is projected to hold the highest market share by 2035, driven by the need to prevent spoilage and ensure product quality.

Key Growth Trends:

- Multi-layer packaging demand increase

- Rising pharmaceutical and medical device packaging

Major Challenges:

- Susceptibility to degradation

- Fluctuation in raw materials prices

Key Players: Amcor plc, Bemis Company, Inc. (Amcor), Mondi Group, Sealed Air Corporation, Berry Global Group, Inc., Huhtamäki Oyj, Toppan Printing Co., Ltd., Jindal Poly Films Ltd., Mitsubishi Chemical Corporation, Glenroy, Inc.

Global High Barrier Packaging Films Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 31.8 billion

- 2026 Market Size: USD 33.37 billion

- Projected Market Size: USD 54.32 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 18 September, 2025

High Barrier Packaging Films Market Growth Drivers and Challenges:

Growth Drivers

- Multi-layer packaging demand increase: Multi-layer packaging combines different layers of material with specific properties to offer enhanced protection, mainly against moisture, UV light, and oxygen. This packaging provides necessary protection to the products, without compromising on durability and transparency. As industries focus on meeting both performance and sustainability requirements, multi-layer packaging with high-barrier properties continues to drive growth in the high barrier packaging films market. For instance, in September 2020, Amcor and Nestle announced their plans to launch the world’s first recyclable flexible retort pouch, the Purina wet cat food brand, in the Netherlands.

- Rising pharmaceutical and medical device packaging: This driven by the need for secure, protective packaging solutions that ensure product stability and safety. These devices are highly sensitive to environmental factors including, moisture, oxygen, UV light, and contamination. High-barrier films prevent degradation, maintain efficacy, and ensure starility throughtout the supply chain. Furthermore, with stringent regulatory standards from the FDA and EMA, packaging must meet the requirements. Additionally, rising healthcare needs fueled by an aging population accelerates the demand for advanced packaging solutions. In October 2023, Solvay announced the launch of Diofan Ultra736 which is a PVDC coating solution with an ultra-high water vapor barrier that allows carbon footprint reduction for pharmaceutical blister films.

- Shift in preference from unpackaged foods to packaged foods: Consumers are increasingly opting for packaged food products, mainly in urban areas with busy lifestyles. As people become more health conscious and aware of food safety, the demand for packaging that preserves nutrients and prevents contamination is also rising. Additionally, the global shift towards online grocery shopping has boosted the need for durable and effective packaging, further driving the need for high-barrier packaging films. In July 2021, Amcor invested in BOBST MASTER D 1000 S which is a multi-technology laminator. The machine is installed at Amcor’s Sustainability Centre of Excellence in Belgium, for use in the development and testing of new multi-layer product development for the company, worldwide.

Challenges

- Susceptibility to degradation: High-barrier films made from bio-degradable or bio-based materials can be prone to degradation when exposed to extreme heat. Furthermore, it is susceptible to moisture penetration, leading to compromised quality, reduced freshness, shorter shelf-life, or spoilage of the products. Balancing these properties is a key challenge for manufacturers and can lead to increased waste, countering the sustainability goals.

- Fluctuation in raw materials prices: These fluctuations cause unpredictable cost structures which can severely minimize profit margins and complicate pricing strategies. This is often led by supply chain disruptions, shifts in key material costs, and geopolitical issues. This further leads to the comprising of product quality as a result of using comparatively lower-grade materials to match the rising expenses.

High Barrier Packaging Films Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 31.8 billion |

|

Forecast Year Market Size (2035) |

USD 54.32 billion |

|

Regional Scope |

|

High Barrier Packaging Films Market Segmentation:

Product Segment Analysis

The bags and pouches segment in high barrier packaging films market is projected to drive the product segment during the forecast period, owing to their rising demand in transporting and storing processes. These products are used in several industries such as pharmaceuticals, food and beverage, personal care, and cosmetics for packaging and storage of products. Their popularity is majorly driven by their property of convenience. In January 2021, Innovia expanded its Propafilm Strata range of transparent, high-barrier, mono-structure, packaging films with SLF, which is a chlorine-free barrier from moisture, oxygen, and mineral oils. Factors like these are projected to boost the segment’s development, leading to a significant growth rate.

Application Segment Analysis

The food and beverage segment in high barrier packaging films market is anticipated to hold the highest share of the revenue by 2035. This industry uses packaging films with high barriers to store and ship a wide range of products. These include ready-to-eat meals, dairy products, bakery, confectionery, meat, seafood, fruits, and vegetables, in addition to alcoholic and non-alcoholic beverages. These films prevent spoilage and contamination, ensuring that the food and beverage retain their flavor, texture, and nutritional value. Packaging films are particularly essential in packing perishable items, frozen foods, and snacks. Owing to the high demand for products in this segment, it is projected to witness high growth during the forecast period.

Our in-depth analysis of the global high barrier packaging films market includes the following segments:

|

Material |

|

|

Product |

|

|

Application |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

High Barrier Packaging Films Market Regional Analysis:

North America Market Insights

North America industry is predicted to dominate majority revenue share by 2035. Growing e-commerce and changing preferences for convenient foods are encouraging manufacturers in the region to develop superior-quality packaging films. For instance, in October 2022, Toppan added their series of GL BARRIER1 brand products to meet the growing demand for mono-material solutions, particularly in North America.

Rising engagement in online shopping and home delivery services are two of major the driving factors for the high barrier packaging films market in the U.S. It is further fueled by the demand for snacks, and ready-to-eat meals owing to the busy lifestyle of the citizens. According to the U.S. Department of Agriculture, in April 2024, agriculture, food, and related industries contributed 5.6% to U.S. gross domestic product in 2023. This signifies that owing to the high demand for food-related products and services, the U.S. market will witness notable growth in North America.

Canada's government is focusing on reducing plastic waste and encouraging the use of recyclable and compostable materials. This is expected to accelerate biodegradable high-barrier packaging film developments in the country. Additionally, the country is witnessing a rising demand for frozen food, mainly in the dairy and meat sectors, which is further boosted by the e-commerce sector expansion. Consumers in the country also prefer fresh and locally sourced products with effective packing. Factors like these suggest a rise in the high barrier packaging films market in Canada with a considerable share.

APAC Market Insights

APAC is expected to register a healthy CAGR, driven by ongoing urbanization, increasing disposable income, and the rise of e-commerce, leading to innovations in packaging technologies. Driven by the massive consumer base, China and India are the largest contributors to the growth of the region. Companies in the region are likely to focus on sustainable solutions to align with global environmental standards.

Advancements in material science have unlocked ways for the development of more efficient and sustainable packaging solutions in India. This includes the development of biodegradable and recyclable high-barrier films. Companies are also shifting their focus to sustainable films to gain a bigger consumer base. For instance, in March 2024, TOPPAN Inc. along with India-based TOPPAN Speciality Films Private Limited (TSF) announced the launch of GL-SP, a barrier film for sustainable packaging. GL-SP uses biaxially oriented polypropylene (BOPP) as the substrate. These films are eco-friendly packaging that caters to strict regulatory requirements that further contribute to the market growth.

The increasing middle-class population in China is driving the demand for packaged food with a longer shelf-life, leading to a higher need for packaging films. The e-commerce in China is at a boom, in addition to an expansion of the pharmaceutical sector due to the rapidly aging population. These sectors demand high-barrier packaging films to protect their products from environmental damage factors. Furthermore, the Plastic Ban Policy in China, aimed at plastic waste reduction is prompting the industry to develop alternative and sustainable materials.

High Barrier Packaging Films Market Players:

- ACG Worldwide Pvt., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amcor Ltd.

- Bemis Co., Inc.

- Berry Global Group, Inc.

- Bischof + Klein GmbH & Co. KG

- Dunmore Corporation

- Flex Ltd.

- Huhtamaki Oyj

- LINPAC Packaging

- Mondi plc

- Polyplex Corporation Ltd.

- ProAmpac

- Sealed Air Corporation

Companies are focused on developing films with superior barrier properties, such as resistance to moisture, oxygen, and light, to further extend product shelf life, and maintain quality. This is majorly done to meet the strict regulations related to packaging safety. For instance, in July 2024, the Council of Scientific and Industrial Research (CSIR), India, launched a national mission on sustainable packaging solutions. Additionally, businesses are investing in sustainable materials and eco-friendly manufacturing processes to meet the demand for greener packaging solutions. For instance, in April 2023, Huhtamaki announced the launch of its Blueloop Mono Materials Solutions. It is an innovative and sustainable mono-material flexible packaging, available in three alternative material solutions: PAPER, PE, and PP.

Some prominent companies include:

Recent Developments

- In December 2023, Amcor announced the launch of new recyclable high-barrier packaging, AmLite. It claims to be the first in line of more sustainable polyolefin-based packaging film products that can replace PET and aluminum layers to reduce the design’s overall carbon footprint by 64%

- In February 2021, Toyobo developed a new biaxially oriented polypropylene (BOPP) film, named DP065. The film has a high gas barrier function that enables mono-material packaging in addition to an excellent processing suitability

- Report ID: 6451

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

High Barrier Packaging Films Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.