Hexyl Acetate Market Outlook:

Hexyl Acetate Market size was valued at USD 105.51 million in 2025 and is set to exceed USD 160.74 million by 2035, registering over 4.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hexyl acetate is estimated at USD 109.59 million.

The construction and infrastructure development activities across the world are creating lucrative opportunities for hexyl acetate manufacturers. The big projects such as the NEOM the City of Tomorrow, the Regional Environmental Sewer Conveyance Upgrade Program (RESCU), HS2, Grand Paris Express, and Brenner Base Tunnel (Austria-Italy) drive the sales of paints and coatings, and ultimately hexyl acetate. The growing demand for residential structures in both developed and developing regions majorly due to the rise in migration activities is also fueling the consumption of hexyl acetate.

Hexyl acetate’s swiftly expanding use in the fragrance sector is poised to propel the hexyl acetate market shares of key players in the coming years. The rising use of fragrance and perfume across the world irrespective of the spending power of individuals is estimated to push the sales of hexyl acetate during the foreseeable period.

Key Hexyl Acetate Market Insights Summary:

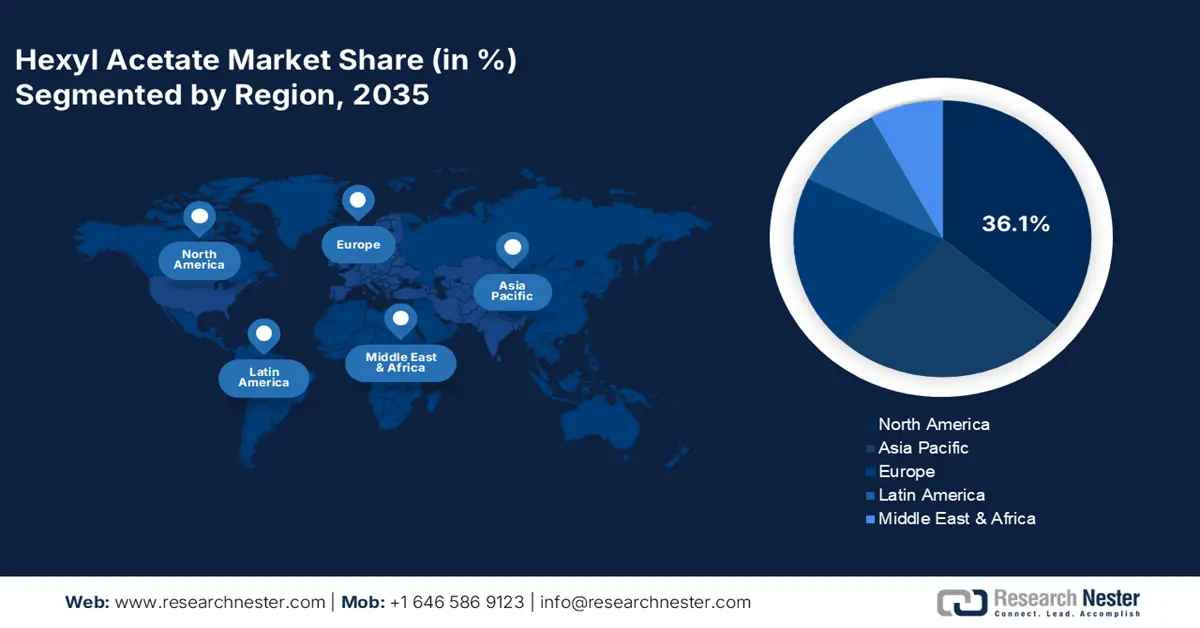

Regional Highlights:

- North America leads the Hexyl Acetate Market with a 36.1% share, propelled by food & beverage expansion, pharmaceutical R&D, and demand for paints and coatings, supporting growth through 2035.

- Asia Pacific’s hexyl acetate market is expected to see robust growth by 2035, attributed to industrial activities, government initiatives, and growing demand from food, pharma, and construction sectors.

Segment Insights:

- The flavoring agent segment is expected to secure a 32.2% share by 2035 in the hexyl acetate market, propelled by rising demand for flavoring solutions in food and personal care industries.

- The Catalyzed Reactive Distillation Synthesis segment of the Hexyl Acetate Market is anticipated to capture a 72.50% share from 2026 to 2035, propelled by technological advancements and greener synthesis methods.

Key Growth Trends:

- Food and beverage a high-growth marketplace for hexyl acetate producers

- Personal care and cosmetics driving sales of hexyl acetate

Major Challenges:

- Alternatives challenging hexyl acetate usage in certain applications

- Stringent regulation affects sales of hexyl acetate

Key Players: Thermo Fisher Scientific, Penta International Corporation, BOC Sciences, and Sigma-Aldrich.

Global Hexyl Acetate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 105.51 million

- 2026 Market Size: USD 109.59 million

- Projected Market Size: USD 160.74 million by 2035

- Growth Forecasts: 4.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, France

- Emerging Countries: China, Japan, South Korea, India, Brazil

Last updated on : 13 August, 2025

Hexyl Acetate Market Growth Drivers and Challenges:

Growth Drivers

- Food and beverage a high-growth marketplace for hexyl acetate producers: Food and beverage companies are prime end users owing to the high use of hexyl acetate as a flavoring agent in their products. Continuous innovation in the flavoring agents and booming foodservice sector is backing the sales of hexyl acetate. For instance, in March 2023, the report by the Global Food Research Program stated that around 60.0% of food items in America contain food additives including preservatives and flavoring agents, representing a 10.0% rise since 2001. Furthermore, the Federal Reserve Bank of St. Louis reveals that the producer price index by commodity: processed foods and feeds: flavoring extracts, emulsions, liquid flavors, and food colorings amounted to 346.067 in December 2024.

- Personal care and cosmetics driving sales of hexyl acetate: Personal care and cosmetic products such as deodorants, perfumes, and body sprays are exhibiting high sales, globally. The rise in the disposable income of individuals is the primary aspect fueling the sales of personal care products and cosmetics, and subsequently the consumption of hexyl acetate. For instance, in June 2024, the Personal Care Products Council revealed that the cosmetics and personal care products market added USD 308.7 billion to the national economy. Research Nester’s study projects that the global beauty and personal care market is poised to be valued at USD 677.2 billion in 2025, while in per-person revenue terms, globally the value is estimated to be evaluated at USD 86.68 in the same year.

Challenges

- Alternatives challenging hexyl acetate usage in certain applications: Hexyl acetate manufacturers are witnessing competition from alternative esters and synthetic chemicals in certain applications such as fragrance and flavoring. Apart from this, the rising popularity of bio-based alternatives is anticipated to hinder the sales of hexyl acetate to some extent in the coming years. These solutions drive the attention of end users owing to their cost-effectiveness and similar properties, hampering the revenue growth of hexyl acetate manufacturers.

- Stringent regulation affects sales of hexyl acetate: Long-term intake or exposure to hexyl acetate leads to health and safety concerns. Regulatory agencies impose stringent rules on the excess use of hexyl acetate in food and beverages and personal care products, limiting the overall hexyl acetate market growth. Each region has its unique set of regulations and complying with them creates major financial and production challenges for hexyl acetate manufacturers.

Hexyl Acetate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.3% |

|

Base Year Market Size (2025) |

USD 105.51 million |

|

Forecast Year Market Size (2035) |

USD 160.74 million |

|

Regional Scope |

|

Hexyl Acetate Market Segmentation:

Type (Catalyzed Reactive Distillation Synthesis, Lipase-Catalyzed Ester Synthesis)

Catalyzed reactive distillation synthesis segment is poised to hold hexyl acetate market share of over 72.5% by the end of 2035. Continuous innovation in the synthesis process is enhancing the efficiency of hexyl acetate. The eco-friendliness of the catalyzed reactive distillation synthesis process mitigates the need for multiple processes and contributes to more greener aspect. The rise in automation and advanced control systems in the catalyzed reactive distillation systems further allow for better monitoring and optimization, scaling the hexyl acetate production growth. Overall, technological advancements and the integration of advanced systems in catalyzed reactive distillation synthesis are poised to boost the efficiency of hexyl acetate.

Application (Flavoring Agent, Fragrance Ingredient, Industrial Applications, Pharmaceutical Industry, Others)

In hexyl acetate market, flavoring agent segment is expected to account for revenue share of around 32.2% by 2035. Hexyl acetate finds high applications in flavoring solutions owing to its versatility and taste-enhancing quality. The boasting use of flavoring agents in nutraceuticals, pharmaceuticals, and food & beverages is estimated to promote the consumption of hexyl acetate. The swiftly expanding flavor and fragrance market is majorly driven by the rising consumer trends aimed at luxury and exotic food and personal care products.

Our in-depth analysis of the global hexyl acetate market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hexyl Acetate Market Regional Analysis:

North America Market Forecast

North America in hexyl acetate market is expected to capture around 36.1% revenue share by the end of 2035. The swiftly expanding food & beverage industry is backing the sales of hexyl acetate. The rising industrial activities, particularly in chemicals, textiles, and plastics are also augmenting the consumption of hexyl acetate. The U.S. and Canada’s advanced and dominant pharmaceutical companies are contributing to the hexyl acetate trade. The booming construction actions coupled with paint and coating demand are promoting the applications of hexyl acetate.

The U.S. food and beverage industry is developing at a healthy pace, generating lucrative opportunities for material and chemical suppliers. The country's food and drink industry is estimated to generate a revenue of USD 1.8 billion by 2029. The consistent rise in this sector represents a healthy demand for hexyl acetate during the foreseeable period. The rise in construction activities is also projected to boost the revenues of hexyl acetate manufacturers in the coming years. As per the analysis by the U.S. Census Bureau in 2024, the total construction spending totaled USD 2192.2 billion. The hexyl acetate market is backed by both residential and commercial structures.

Canada’s pharmaceutical sector is positively influencing the sales of specialized chemicals including hexyl acetate. Technological advancements and increasing investments in research and development activities are fueling the consumption of hexyl acetate. For instance, the report by Innovative Medicines Canada reveals that around USD 3.0 billion were invested in R&D and the value added to the economy was over USD 16.0 billion in 2024. Innovations in treatment, vaccines, and medicines are estimated to propel the pharmaceutical market growth and subsequently hexyl acetate consumption.

Asia Pacific Market Statistics

The Asia Pacific hexyl acetate market is anticipated to rise at a robust pace during the forecast period. The rapidly increasing industrial activities across the region are set to propel the demand for hexyl acetate. Various initiatives such as positive foreign direct investments, supportive regulatory policies, and public investments employed by governments to uplift the economy are expected to fuel the production and supply of chemicals including hexyl acetate. China, India, Japan, and South Korea are the most dynamic marketplaces for hexyl acetate manufacturers.

China’s rise in plastic and polymer production is foreseen to positively influence hexyl acetate sales. The infrastructure development projects are fueling the sales of paints and coatings and subsequently hexyl acetate consumption. The International Trade Administration (ITA) states that China is the world’s largest market for construction. The country’s 14th Five-Year Plan (2021 to 2025) is poised to reach USD 4.2 trillion. The World Paint and Coatings Industry Association (WPCIA) states that in 2022, the sales of paints and coatings in China surpassed UD 45.0 billion.

India’s strong food processing industry is offering profitable opportunities for hexyl acetate manufacturers. The India Brand Equity Foundation (IBEF) report states that the country’s food processing market is anticipated to reach a valuation of USS 1274.0 billion by 2027. The high investment in pharmaceutical research and development is also expected to increase the consumption of hexyl acetate. IBEF estimates that India’s pharmaceutical market is set to cross USD 130.0 billion by 2030. Under the Strengthening of Pharmaceutical Industry (SPI) scheme, the ministry with a total financial outlay of USD 60.9 million aims to boost the quality, productivity, and eco-friendliness in the pharma sector.

Key Hexyl Acetate Market Players:

- Thermo Fisher Scientific

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Penta International Corporation

- BOC Sciences

- Sigma-Aldrich

- TCI America, Inc.

- Beijing Lys Chemicals

- Apiscent Labs

- Lanxess AG

- Merck KGaA

- Technip Energies

- M & U International LLC

- Frutarom

- Synerzine

- Lluch Essence

- The Good Scents Company

- Alfrebro

- Augustus Oils Ltd.

- Indukern F&F

- Advanced Biotech Inc.

The leading companies in the hexyl acetate market are employing several organic and inorganic strategies to uplift revenues and reach. Some of these marketing tactics are new product launches, technological innovations, partnerships & collaborations, mergers & acquisitions, and global expansions. Entering into strategic collaboration with other players aids in expanding their product folio and customer base. Untapped hexyl acetate markets often offer high-earning opportunities for hexyl acetate manufacturers.

Some of the key players include:

Recent Developments

- In August 2024, BASF SE and UPC Technology Corporation signed a memorandum of understanding (MOU) to strengthen strategic cooperation on plasticizer alcohols and catalysts. BASF SE plays a major role by supplying 2-Ethylhexanol and N-Butanol to UPC from the Zhanjiang Verbund Site.

- In June 2023, the EU Commission announced the approval of (13Z)-hexadec-13-en-11-yn-1-yl acetate as an active substance for use in biocidal products of product-type 19 in accordance with regulation (EU) No 528/2012 of the European Parliament and the Council by implementing regulation (EU) 2023/1079. This approval is anticipated to expand the use of hexyl acetate and associated chemicals in Europe.

- Report ID: 7182

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hexyl Acetate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.