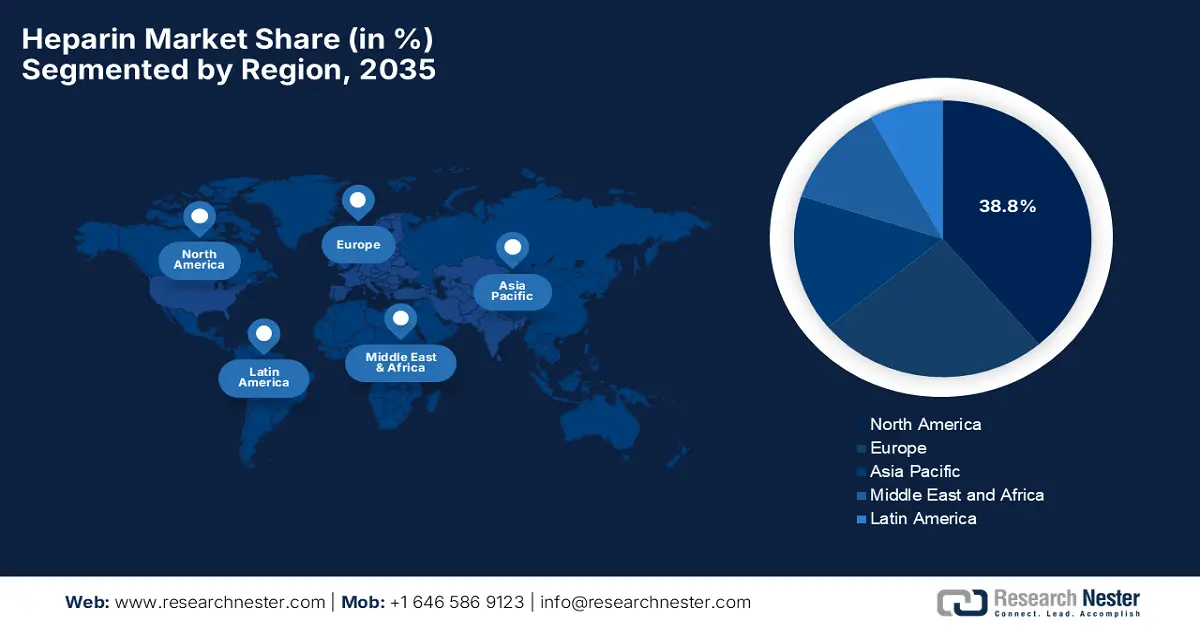

Heparin Market - Regional Analysis

North America Market Insights

The North America heparin market is expected to command the largest revenue share of 38.8% by the end of 2035. The focus on advanced healthcare infrastructure and increasing adoption of anticoagulant therapies are the key factors behind the region’s leadership. Hospitals and specialty clinics in this region integrate heparin into surgical procedures, cardiology, and critical care, whereas the regulatory oversight ensures high-quality standards for both raw materials and finished products. As of the U.S. FDA data from January 2026, it is encouraging the reintroduction of bovine-sourced heparin in the U.S. to diversify the heparin supply and address risks associated with porcine heparin shortages or contamination. The agency also continues to support manufacturers through pre-IND engagement, thereby emphasizing rigorous chemistry, manufacturing, and control standards to safeguard public health, hence denoting a positive heparin market outlook.

The U.S. heparin market holds a leading position in the regional landscape owing to the continuous improvements in manufacturing, safety protocols, and monitoring practices that readily enhance patient outcomes. The presence of leading pharmaceutical manufacturers and stringent FDA regulations contributes to consistent product quality, allowing an increased uptake in the country. In February 2022, Techdow USA announced the launch of its heparin sodium injection, USP in the country by providing hospitals and healthcare networks with an affordable and reliable source of heparin. The company emphasized its vertically integrated supply chain to ensure consistent availability despite the existence of challenges in sourcing raw materials. In addition, Techdow also highlighted the safety profile of heparin, which includes adverse reactions such as hemorrhage, thrombocytopenia, and hypersensitivity by positioning itself as a long-term, dependable supplier in the country’s market.

The Canada heparin market is propelled by strong public healthcare support and adherence to Health Canada regulations. Hospitals in the country prioritize anticoagulation therapies for surgical and high-risk patients, with a prime focus on patient safety and efficacy. Simultaneously, the collaborative research with international institutions supports the development of heparin derivatives and optimized administration routes by ensuring increased clinical adoption. In this regard Drug and Health Product Portal reported that heparin sodium injection USP by Sterimax Inc. is actively marketed, with its Health Canada approval reported to be September 2024. The product consists of 5,000 units per 0.5 mL, is authorized for safe and effective use in clinical settings, supported by a detailed product monograph for healthcare professionals and patients. In addition, Health Canada also provides channels for reporting side effects, ensuring ongoing monitoring of safety and promoting regulated adoption of heparin in the country’s hospitals.

APAC Market Insights

The Asia Pacific heparin market is expected to represent the fastest growth owing to the increasing healthcare expenditure, rising awareness of thromboembolic disorders, and expanding hospital networks. Local governments across the region encourage modernization of pharmaceutical manufacturing facilities and compliance with international quality standards. In September 2024, Sysmex Corporation announced the launch of the HISCL HIT IgG assay kit, which is especially designed to measure IgG antibodies against platelet factor 4‑heparin complexes for the rapid detection of heparin-induced thrombocytopenia. The kit is compatible with Sysmex’s CN-6500 and CN-3500 automated blood coagulation analyzers, and it offers high specificity and sensitivity, reducing false positives and speeding up clinical decision-making. Furthermore, it enables faster, more accurate diagnosis and improves workflow efficiency in hospitals. The product supports safer heparin therapy and optimized patient care.

China heparin market is efficiently driven by the huge domestic production capacity and strong demand in cardiovascular and orthopedic care. The country’s market also benefits from large API manufacturers, and regulatory agencies oversee the sourcing of raw materials, particularly porcine-derived heparin, ensuring quality and safety. The continued innovations in anticoagulant therapies and collaborations between local producers and global pharmaceutical companies are rearranging the growth dynamics of the country. In July 2025, Shenzhen Hepalink Pharmaceutical Group announced the first subject enrollment and dosing for its Phase I clinical trial of H1710 Injection, which is an innovative heparin derivative targeting heparanase for advanced solid tumors. The company also notes that H1710 is designed as a highly selective heparanase inhibitor consisting of low anticoagulant activity and potential anti-tumor effects. The open-label, dose-escalation study will assess safety, tolerability, and preliminary efficacy in approximately 36 patients across three research centers.

The India heparin market is continuously growing along with the growth of tertiary care hospitals and surgical procedures requiring anticoagulation. The country’s market is a significant exporter of raw heparin, wherein the manufacturers are focused mainly on sustainable sourcing and compliance with global pharmacopeia standards. In this context, the government of India’s production-linked incentive schemes for pharmaceuticals have strengthened domestic manufacturing of critical APIs, KSMs, and DIs, reducing import dependency by thousands of crores and supporting exports. As of September 2025, 26 KSMs/APIs and 191 other APIs were produced under the schemes, generating huge amounts of domestic sales and global exports. In addition to the initiatives, including bulk drug parks in Andhra Pradesh, Gujarat, and Himachal Pradesh, it also promotes research, infrastructure development, and high-value drug production, hence increasing the potential of the heparin industry.

Europe Market Insights

The Europe heparin market is backed by well-established healthcare systems and high standards for pharmaceutical manufacturing. Simultaneously, continuous innovation in heparin derivatives and formulations, along with strict EU regulatory oversight, ensures consistent quality and safety across the region’s vast geography. In September 2025, the EDQM reported that it had established a heparin low-molecular-mass calibration CRS batch 6 for use in determining molecular mass distribution of low-molecular-weight heparins under the European Pharmacopoeia monograph. The batch’s fitness for use was confirmed through studies conducted by the EDQM’s biological standardisation programme by ensuring high-quality standards for heparin products across Europe. Furthermore, this reference material, adopted by the European Pharmacopoeia Commission, supports consistent manufacturing, regulatory compliance, and safe clinical use in surgeries, dialysis, and cardiovascular care, hence making it suitable for standard heparin market growth.

Germany heparin market is growing on account of its advanced clinical applications and integration of heparin in most of the critical care procedures. Pharmaceutical manufacturers in the country maintain quality standards, whereas hospitals emphasize evidence-based protocols for anticoagulation therapy. Collaboration between research institutions and industry players accelerates innovation in low-molecular-weight heparins and safer administration methods. In the country, the updated Rili‑BAEK 2023 guidelines specify that for certain lab tests, including potassium measurement, heparin‑plasma or whole blood must be used rather than serum to avoid erroneous results. These pre-analytical requirements are mainly aimed at ensuring accurate laboratory testing for patient care, and must be fully implemented within three years of publication, reinforcing high standards in hospital and diagnostic laboratory procedures where heparin monitoring is highly critical.

The UK heparin market is mainly focused on efficient anticoagulation management within NHS hospitals and specialized care units. Regulatory authorities in the country enforce strict compliance with manufacturing and safety standards. Simultaneously, there has been an increased adoption of low-molecular-weight heparins for predictable dosing, whereas ongoing research and clinical trials aim to optimize patient outcomes and reduce adverse events. In May 2025, NHS England published a procurement notice for the national supply of low molecular weight heparins in which the contracts are running from March 2026 to February 2028 and are extendable to 2030. It also mentioned that the estimated contract value is £73.2 million (USD 90 million), including VAT by covering multiple regions across England. Hence, this official pipeline notice highlights the NHS’s commitment to securing LMWH therapies for consistent anticoagulation management in hospitals and specialized care units.