Hemorrhoid Drugs Market Outlook:

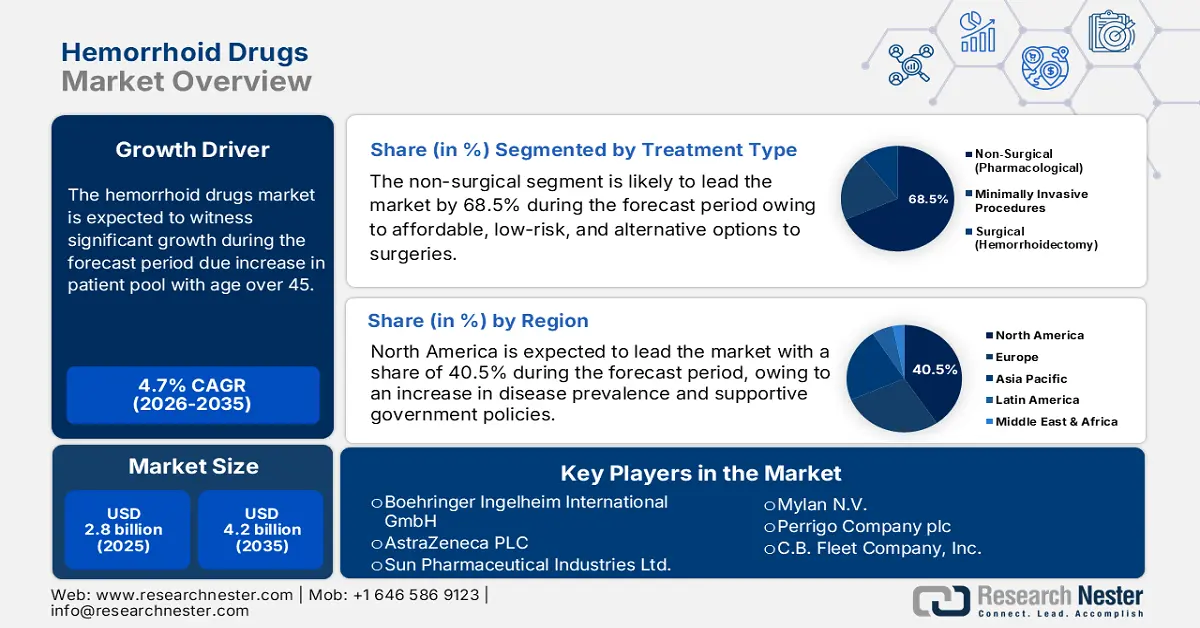

Hemorrhoid Drugs Market size was over USD 2.8 billion in 2025 and is estimated to reach USD 4.2 billion by the end of 2035, expanding at a CAGR of 4.7% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of hemorrhoid drugs is estimated at USD 2.9 billion.

The worldwide hemorrhoidal drugs market is continuously increasing, with a surge in the patient pool, readily affected by hemorrhoids. According to an article published by WebMD in June 2025, hemorrhoids are extremely common, particularly among the older population, and almost 1 in 20 people in the U.S. suffer from these, affecting more than half of people over 50 years. In addition, most people aged more than 45 years are also affected every year, with conditions such as analgesics, vasoconstrictors, and corticosteroids. Besides, the supply chain of hemorrhoid drugs comprises active pharmaceutical ingredients (APIs), which are readily manufactured in India and China. As per an article published by the USP Organization in April 2025, generic drugs cater to 90% of prescription volume in the U.S., while 43% of branded API originate from Europe.

Furthermore, medical devices, including hemorrhoid banding tools, are generally manufactured in regulatory infrastructures with imported components from East Asia and Europe. Besides, as per an article published by NLM in February 2024, internal hemorrhoids cater to an estimated 15% to 20% of the resting anal pressure and offer essential sensory information, thereby permitting the differentiation between liquid, gas, and solid. Meanwhile, the pharmaceutical preparation’s producer price index depicts a moderate growth in the market, based on the U.S. Bureau of Labor Statistics. According to its September 2025 data report, the PPI covers 69% of services, along with 17% of construction, as measured by 2017 Census revenue, thus suitable for the market’s development.

Key Hemorrhoid Drugs Market Insights Summary:

Regional Highlights:

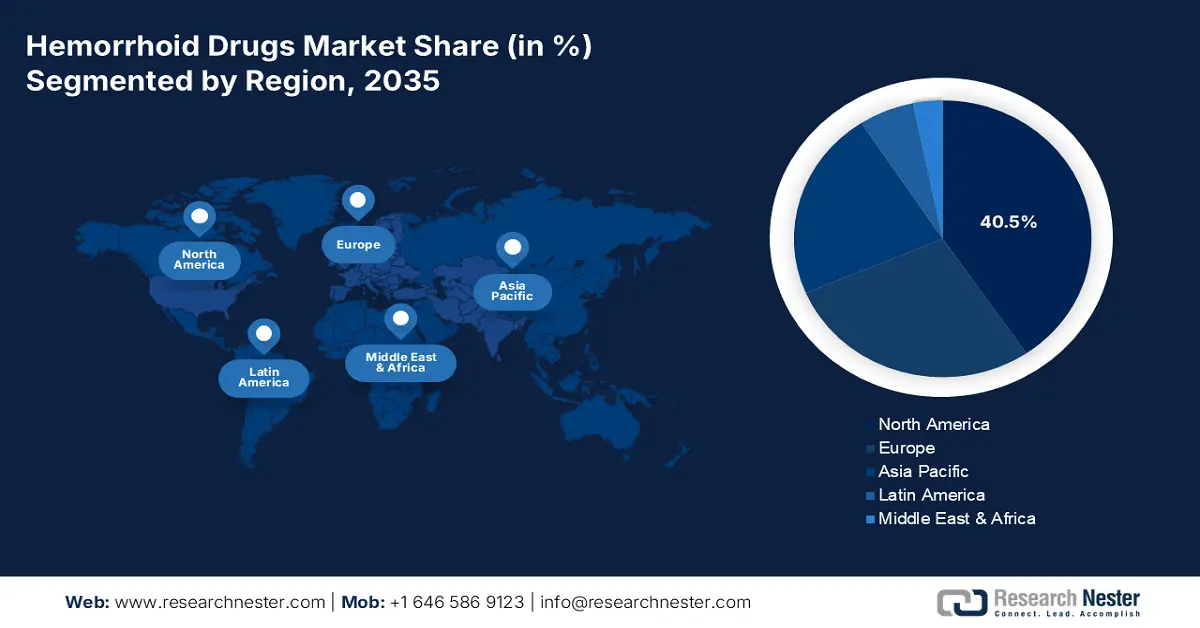

- North America is projected to hold a 40.5% share by 2035 in the hemorrhoid drugs market, driven by rising disease prevalence, healthcare funding, and supportive government policies.

- Asia Pacific is expected to register the fastest growth from 2026–2035, fueled by population size, improved healthcare access, and increasing risk factors.

Segment Insights:

- Non-surgical segment is forecasted to secure a 68.5% share by 2035 in the hemorrhoid drugs market, supported by its low-risk and minimally invasive treatment options.

- Grade I and II segment is expected to achieve the second-largest share by 2035, propelled by its high prevalence and suitability for pharmacological management.

Key Growth Trends:

- Government spending through Medicare and Medicaid

- Expansion in over-the-counter (OTC) product portfolio and customer accessibility

Major Challenges:

- Generic competition and patent expiries

- Low treatment-seeking behavior and social stigma

Key Players: Bayer AG (Germany), Pfizer Inc. (U.S.), GlaxoSmithKline plc (U.K.), Johnson & Johnson (U.S.), Sanofi S.A. (France), Takeda Pharmaceutical Company Limited (Japan), Novartis AG (Switzerland), Prestige Consumer Healthcare Inc. (U.S.), Boehringer Ingelheim International GmbH (Germany), AstraZeneca PLC (U.K.), Sun Pharmaceutical Industries Ltd. (India), AbbVie Inc. (U.S.), Mylan N.V. (U.S.), Perrigo Company plc (Ireland), C.B. Fleet Company, Inc. (U.S.), Cook Medical Inc. (U.S.), Medtronic plc (Ireland), Suzhou Zhonghua Pharmaceuticals (China), Hikma Pharmaceuticals PLC (U.K.), Aspen Pharmacare Holdings Limited (South Africa)

Global Hemorrhoid Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.8 billion

- 2026 Market Size: USD 2.9 billion

- Projected Market Size: USD 4.2 billion by 2035

- Growth Forecasts: 4.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: India, China, South Korea, Brazil, Mexico

Last updated on : 3 November, 2025

Hemorrhoid Drugs Market - Growth Drivers and Challenges

Growth Drivers

- Government spending through Medicare and Medicaid: The investment initiative that the U.S. government spends on prescription drugs for painkillers, corticosteroids, and hemorrhoids is accurately tracked under Medicare Part D, which is driving the market. According to an article published by CMS in August 2024, the overall Medicare expenditure catered for almost 8.8 million of the 54 million in the Part D coverage, with standard drugs. In addition, these drugs accounted for USD 56.2 billion in the total Part D gross prescription drug expenses, denoting an estimated 20% as of 2023. Within the same duration, patients with this drug coverage spent USD 18.9 billion in out-of-pocket expenses, which included USD 3.9 billion for these drugs.

List of Drugs Under the Medicare Part D (2022)

|

Drug Name |

Laboratory Information System (LIS) |

Non-LIS |

All |

|||

|

|

Total LIS Enrollees |

LIS Enrollees Share |

Total Medicare Part D Enrollees |

LIS Enrollees Share |

Total Enrollees Taking Drug |

Share |

|

Eliquis |

1,013,000 |

6.8% |

2,492,000 |

6.5% |

3,505,000 |

6.6% |

|

Jardiance |

562,000 |

3.8% |

759,000 |

2.0% |

1,321,000 |

2.5% |

|

Xarelto |

370,000 |

2.5% |

941,000 |

2.5% |

1,311,000 |

2.5% |

|

Januvia |

426,000 |

2.8% |

459,000 |

1.2% |

885,000 |

1.7% |

|

Farxiga |

280,000 |

1.9% |

359,000 |

0.9% |

639,000 |

1.2% |

|

Entresto |

203,000 |

1.4% |

318,000 |

0.8% |

521,000 |

1.0% |

Source: ASPE

- Expansion in over-the-counter (OTC) product portfolio and customer accessibility: The primary growth driver of the market, which is separate from demographic transitions and governmental expenditure, is the tactical extension and strong consumer access for over-the-counter hemorrhoid treatments. Besides, pharmaceutical organizations are increasingly making investments in the marketing and development of innovative OTC drugs that provide optimized efficiency, multi-symptom relief, and huge comfort. This comprises products that combine soothing agents, protectants, and relievers, such as witch hazel and aloe vera.

- Increasing disease prevalence and aging population: The market is expanding with a large patient pool, especially in areas of North America and Europe. According to an article published by NLM in April 2025, hemorrhoids are one of the most common conditions, which are encountered by surgeons, with an approximate international prevalence ranging between 2.9% to 29.7%. Additionally, an estimated 10% of these incidences successfully receive surgical treatment, based on which there is a huge demand for the market across different countries.

Therapeutic Mechanisms and Possible Indications of Representative Treatment Methods of Hemorrhoids (2025)

|

Treatment Type |

Differentiation from the original technique |

Vascular Control Height |

Vascular Control Circularity |

Mass Control Degree |

Possible Indication |

|

Modified RBL |

Negative pressure and elastic coil application |

Feeding artery 1 to 3 cm above the dentate line |

Each lesion |

Ligation including mucosa |

I to III |

|

BANANA Clip |

Nonabsorbable polymer ligating clip application |

Over 1 to 2 cm proximally from the dentate line |

Each lesion |

Ligation including mucosa |

I to III |

|

HET |

Biopolar energy source |

1 cm above the internal hemorrhoids |

Each lesion or 3 essential feeding direction |

Mucosal and sub-mucosal physical and chemical reactions |

I to II |

|

Tissue Selection Therapy |

Segmental purse-string rather than circumferential |

1 to 4 cm above the dentate line |

Each lesion |

Both mucosal and sub-mucosal resection |

II to IV |

|

Mixed Therapy |

Combined procedure |

2 to 4 cm above the dentate line |

Only circumferential |

Mucosal and sub-mucosal, and external hemorrhoid resection |

Significant internal and external hemorrhoids |

|

Operative Treatment |

Combined process |

2 to 3 cm above the dentate line |

Circumferential |

Mucosal and submucosal resection |

III to IV |

Source: NLM

Challenges

- Generic competition and patent expiries: One of the major roadblocks in the market is the absence of patent protection for notable and branded drugs, resulting in intensified generic competition. When an outstanding hemorrhoid treatment’s patent expires, different manufacturers are able to produce bioequivalent generic versions at a certain portion of the cost. This has dramatically eroded the revenue and the market share of the original innovator organization. Besides, the aspect of price sensitivity of both healthcare providers and consumers, particularly for a condition with different OTC options, denotes rapid adoption of cheap generics.

- Low treatment-seeking behavior and social stigma: One of the most fundamental challenges in the market is the low treatment-seeking and underreporting behavior, owing to embarrassment and social stigma connected to hemorrhoids. Numerous patients suffer in silence, depending on enduring symptoms and home remedies, in comparison to purchasing OTC products and consulting physicians. This particular stigma has limited volume sales as well as market penetration, which has effectively caused a hindrance in the market’s development internationally.

Hemorrhoid Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.7% |

|

Base Year Market Size (2025) |

USD 2.8 billion |

|

Forecast Year Market Size (2035) |

USD 4.2 billion |

|

Regional Scope |

|

Hemorrhoid Drugs Market Segmentation:

Treatment Type Segment Analysis

The non-surgical segment is anticipated to garner the largest share of 68.5% by the end of 2035. The segment’s exposure is primarily attributed to its provision of cost-effective, lower-risk, and less invasive alternatives to surgery, especially for early-stage hemorrhoids. According to an article published by Emedicine Medscape in May 2022, nonoperative techniques, including the rubber band ligation, effectively produce recurrence rates ranging between 30% to 50% within 5 to 10 years. However, these particular recurrences are usually addressed with suitable nonoperative treatments, thereby suitable for uplifting the overall segment.

Severity Segment Analysis

The Grade I and II segment is projected to account for the second-highest share during the predicted period. The segment’s growth is highly driven by its suitability and prevalence for pharmacological management. These particular stages are readily characterized by mild prolapse or painless bleeding that spontaneously diminishes, thereby displaying the majority of diagnosed incidences. This develops a recurring and substantial patient pool, initially managed with conventional treatment options. Besides, both prescription topical medication and over-the-counter (OTC) medications, including suppositories, ointments, and creams with corticosteroids and astringents, are considered the first-line therapy.

Distribution Channel Segment Analysis

The retail and hospital pharmacies segment is expected to constitute the third-largest share by the end of the forecast duration. The segment’s development is fueled by its vital role as the primary access point for both prescribed medications and immediate OTC relief. For the massive OTC field, retail pharmacies provide the option, immediate availability, and convenience for pharmacist consultation, which is essential for self-treating patients. Meanwhile, hospital pharmacies dispense medications that are readily prescribed following surgeries, procedures, and physician consultations, thus capturing the high-value prescription segment.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Treatment Type |

|

|

Severity |

|

|

Distribution Channel |

|

|

Drug Class |

|

|

Product Type |

|

|

Formulation |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hemorrhoid Drugs Market - Regional Analysis

North America Market Insights

North America is anticipated to account for the highest share of 40.5% in the hemorrhoid drugs market by the end of 2035. The market’s upliftment in the overall region is primarily attributed to an increase in the disease prevalence, expansion in healthcare funding, and supportive government policies. For instance, according to an article published by the KFF Organization in May 2025, the international health fund in the U.S. was offered an ongoing resolution by maintaining the prior year's amount of USD 12.4 billion. Besides, the presence of Medicaid and Medicare has readily expanded its health insurance, covering hemorrhoid drug reimbursements, thus suitable for the market’s growth.

Historical Period of the U.S. Global Health Funding

|

Years |

Regular Appropriations (USD Billion) |

Emergency Supplement Funding (USD Billion) |

|

2016 |

10.5 |

- |

|

2017 |

10.7 |

- |

|

2018 |

10.9 |

- |

|

2019 |

10.9 |

- |

|

2020 |

12.5 |

1.2 |

|

2021 |

21.0 |

9.4 |

|

2022 |

12.2 |

- |

|

2023 |

12.9 |

- |

|

2024 |

12.4 |

- |

|

2025 |

12.4 |

- |

Source: KFF Organization

The hemorrhoid drugs market is set to rise in the U.S. with a rising prevalence of anorectal disorders, mostly seen in aging people and their lifestyle factors. As per a data report published by the CDC in October 2024, the per capita national health spending amounts to USD 11,582, with the overall expenditure being USD 3.8 trillion. In addition, the total health expenditure in terms of the gross domestic product (GDP) is 17.7%. Besides, the domestic health spending for care in retirement communities as well as nursing care facilities constitutes 4.5%, along with 3.0% for home healthcare, 20.3% for clinical and physician services, and 9.7% for retail prescription drugs, thereby bolstering the market’s growth in the country.

The hemorrhoid drugs market in Canada is also growing significantly, owing to the existence of the universal public healthcare system to govern cost-control and drug accessibility. In addition, an increase in the dependency on provincial drug formulations to administer treatment pathways, a focus on affordable generic and OTC prescriptions, and direct federal provision of funds are also responsible for the market’s development. Besides, according to an article published by the Government of Canada in November 2022, there has been an announcement of offering USD 5 million to provide intense support for patients residing with rare pain and to expand the Pain Canada Network, which is suitable for uplifting the market.

APAC Market Insights

Asia Pacific in the hemorrhoid drugs market is projected to emerge as the fastest-growing region during the predicted timeline. The market’s development in the region is driven by the huge population base, an increase in health and medical accessibility, and a rise in risk factors, such as urbanization and sedentary lifestyles. For instance, in developed economies, such as South Korea and Japan, the aging population is one of the primary drivers, while in India and China, the market is growing due to a surge in diagnosis rates and health awareness. Besides, governments across the entire region are making healthcare provisions, which benefits the market by optimizing accessibility to treatment options.

The hemorrhoid drugs market in China is gaining increased traction, owing to the massive population and improvements in healthcare facilities. In addition, the National Medical Products Administration (NMPA) has readily streamlined drug acceptances, along with an increase in the availability of both global and national treatment options. According to an article published by NLM in June 2022, the prevalence of constipation in the country ranges between 3% to 11%, with 13% to 32.6% prevalence among the elderly population. Therefore, with the objective of combating these incidents, there is a huge demand for the market in the overall country.

The hemorrhoid drugs market in India is also developing due to an upsurge in disease awareness, along with the presence of an underserved and large population. In addition, the development of governmental schemes, such as Ayushman Bharat, has optimized accessibility to healthcare, thereby driving the increasing demand for pharmaceuticals. Besides, as stated in the April 2025 NLM article, a clinical study was conducted on 3,689 patients in the country to evaluate gastrointestinal mobility disorder. This resulted in 55% patients with mild symptoms, 33% with mild, and 8% with critical symptoms, which is readily boosting the market’s demand in the country.

Europe Market Insights

Europe in the hemorrhoid drugs market is also projected to grow steadily by the end of the forecast duration. The market’s growth in the overall region is fueled by an increase in aging demographics, an upsurge in health and medical spending, and a rising incidence of hemorrhoidal disease. Additionally, a significant budget allocation by the region’s countries for their healthcare budgets to hemorrhoid treatments, which makes the market grow in demand. The region has prioritized access through funding and innovation to hemorrhoid therapies, with funding exceeding and supporting R&D related to the pharmaceutical sector. The key drivers are government-related healthcare programs, patient awareness, and reimbursement policies.

The hemorrhoid drug market in Germany is gaining increased exposure, owing to investments in pharmaceutical innovation, and reimbursement policies are supported by the Federal Ministry of Health to meet the market demand. The country is considered the largest market in Europe, as it has an extensive healthcare infrastructure and an aging population. The aging population in the nation contributes to the rise in disease prevalence and increases the need for effective treatments. Some innovative formulations enhance the appeal, for instance, minimally invasive drug delivery systems and natural extract-based formulations market the market.

The hemorrhoid drug market in France is also growing, owing to its wide-ranging and state-funded healthcare system that provides extended reimbursement for pharmaceuticals. This particular system has lowered the financial gap for patients, and encouraged treatment-seeking behavior, along with ensuring high volume sales. Besides, according to an article published by Leem Organization in June 2025, the R&I spending in the country remained unchanged, amounting to €5.9 billion as of 2024. In addition, the country also remains the region’s third-best nation for conducting clinical trials, thereby making it suitable for the hemorrhoid drugs market’s growth.

Key Hemorrhoid Drugs Market Players:

- Bayer AG (Germany)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pfizer Inc. (U.S.)

- GlaxoSmithKline plc (U.K.)

- Johnson & Johnson (U.S.)

- Sanofi S.A. (France)

- Takeda Pharmaceutical Company Limited (Japan)

- Novartis AG (Switzerland)

- Prestige Consumer Healthcare Inc. (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- AstraZeneca PLC (U.K.)

- Sun Pharmaceutical Industries Ltd. (India)

- AbbVie Inc. (U.S.)

- Mylan N.V. (U.S.)

- Perrigo Company plc (Ireland)

- C.B. Fleet Company, Inc. (U.S.)

- Cook Medical Inc. (U.S.)

- Medtronic plc (Ireland)

- Suzhou Zhonghua Pharmaceuticals (China)

- Hikma Pharmaceuticals PLC (U.K.)

- Aspen Pharmacare Holdings Limited (South Africa)

- Bayer AG is one of the international leaders in the hemorrhoid treatment space, through its outstanding Preparation H brand, which is one of the most recognized over-the-counter lines worldwide. Owing to this, as per its 2024 annual report, the company’s sales amounted to €46,606 million, with €8,712 million as EBITDA, along with a net income of €2,552 million.

- Pfizer Inc. readily contributes to the overall market through its diverse portfolio, which comprises both generic and branded pharmaceutical products. While not completely focused on this field, its massive distribution network, along with manufacturing abilities, has ensured a suitable supply of topical treatments as well as systemic pain relievers.

- GlaxoSmithKline plc is considered a standard key competitor with its established Anusol brand, providing a wide range of topical preparations that offer symptomatic relief from discomfort and itching. Besides, as per its 2024 annual report, the research and development amounted to £6.4 billion, along with 37 different manufacturing locations, and 18,000 suppliers operating directly with the company.

- Johnson & Johnson, through its consumer health division, offers extensive hemorrhoid care products, including the Balneol brand, which focuses on soothing and gentle cleansing. The organization’s increased retail presence, as well as trusted brand reputation has made its products highly accessible to customers in supermarkets and pharmacies internationally.

- Sanofi S.A. effectively maintains a key presence in the market, with a portfolio that comprises both venotonic and topical treatment drugs, such as those comprising Diosmin, which are utilized to diminish symptoms and optimize venous tone. Their tactical focus on vascular health offers an outstanding position in the market, thereby allowing patients to seek both underlying vascular support and symptomatic relief.

Here is a list of key players operating in the global market:

At present, the majority control over the revenue generation in the market is controlled by key pioneers, including NeoPharm, Pfizer, Servier, Astellas Pharma, and others. Additionally, the strategic PPPs and new launches are expanding the reach of this sector worldwide, even across underserved regions. The efforts to make associated products more affordable through cost-optimized manufacturing and resource localization are also propelling growth in this merchandise and attracting other developers related to mental health to invest in this category. For instance, in December 2024, Novo Holdings declared that it has successfully led a USD 100 million Series C Financing of SiteOne Therapeutics for aiding acute pain as well as other conditions, thus suitable for uplifting the hemorrhoid drugs market.

Corporate Landscape of the Hemorrhoid Drugs Market:

Recent Developments

- In January 2025, Vertex Pharmaceuticals Incorporated notified that the U.S. FDA has successfully cleared JOURNAVX, which is a non-opioid, highly selective, and oral NaV1.8 pain signal inhibitor for treating adult patients with moderate-to-severe acute pain.

- In May 2024, Gunderson Dettmer represented its client Brixton Biosciences in the USD 33 million Series B financing, which was led by Schooner Capital, with the intention of developing notable therapies to cater to the essential and unmet demands in the pain management field.

- Report ID: 3057

- Published Date: Nov 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hemorrhoid Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.