Hemodynamic Monitoring Systems Market Outlook:

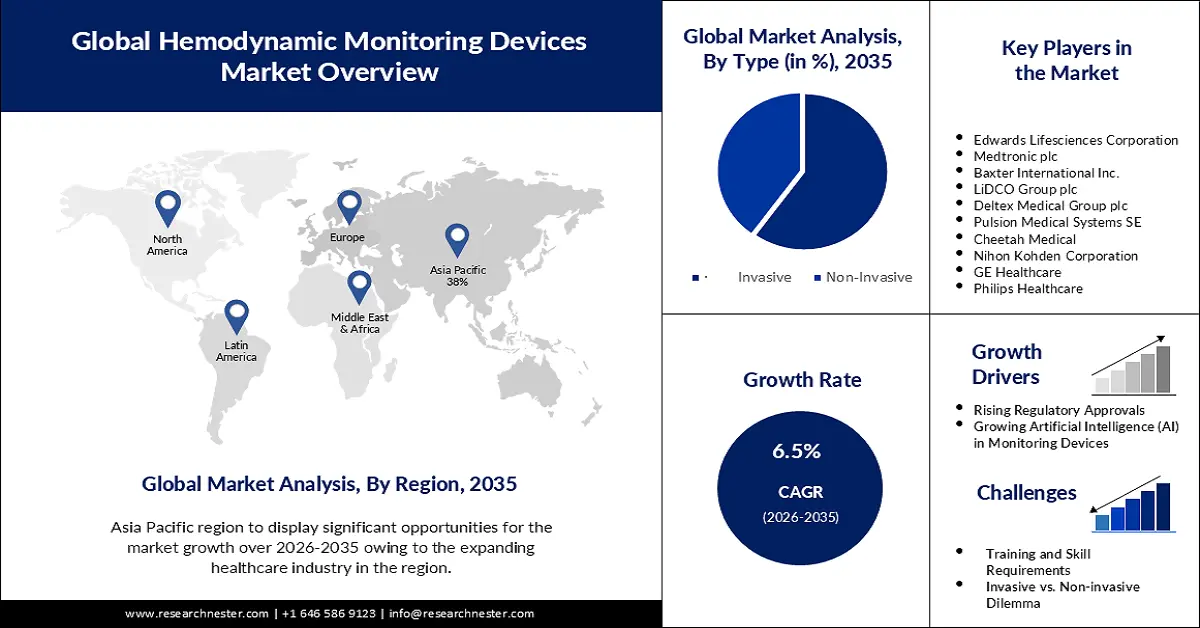

Hemodynamic Monitoring Systems Market size was over USD 1.42 billion in 2025 and is projected to reach USD 2.67 billion by 2035, growing at around 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hemodynamic monitoring systems is evaluated at USD 1.5 billion.

In the year 2025, the industry size of hemodynamic monitoring systems is assessed at USD 1.76 billion. The primary reason for the hemodynamic monitoring systems expansion is the swift advancement of technology to diagnose cardiac issues across the world.

The field of cardiovascular healthcare is changing dramatically as a result of technological breakthroughs that have ushered in a new era of sophisticated and accurate monitoring systems. For instance, over 6.5 billion individuals own smartphones globally, and there is a rapidly growing opportunity to provide patients with cardiac diseases with digital healthcare. Numerous randomized controlled trials have now shown that different noninvasive digital health technologies just like hemodynamic monitoring systems can affect patient behaviors in the primary and secondary prevention of coronary artery disease as well as the prevention and management of heart failure.

In addition, the hemodynamic monitoring systems landscape will encounter a significant surge during the forecast period on account of the quick modification in the surgical techniques globally. To illustrate, the field of healthcare is quickly adopting 3D printing technologies. In contrast to just three in 2010, more than 110 US hospitals had point-of-care 3D manufacturing facilities in 2020. Made-to-measure prosthetics, replacement joints, and dental implants are all being produced using this technology. There is also ongoing research on the use of 3D printers to create skin tissue, organs, and even pharmaceuticals. The upgradation of the latest technological devices therefore directly fuels the amelioration of the hemodynamic monitoring systems market share.

Key Hemodynamic Monitoring Systems Market Insights Summary:

Regional Highlights:

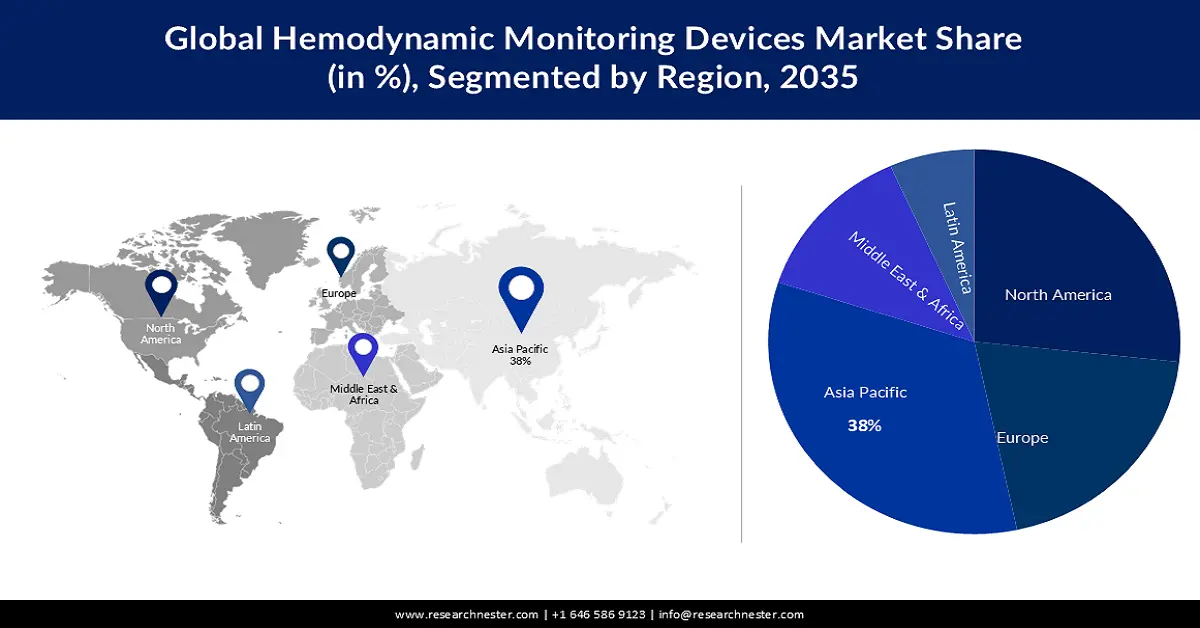

- Asia Pacific hemodynamic monitoring systems market achieves a 38% share by 2035, attributed to the increasing healthcare industry in countries like Japan and China.

Segment Insights:

- The invasive segment in the hemodynamic monitoring systems market is forecasted to hold a 60% share by 2035, driven by the escalating global burden of cardiovascular diseases requiring advanced monitoring.

Key Growth Trends:

- Aging population and increasing cardiovascular diseases - People who are older and more experienced are more vulnerable to cardiovascular disease. In adults, age is a risk factor in and of itself for cardiovascular disease (CVD); however, other variables such as frailty, obesity, and diabetes exacerbate these risks. It is well recognized that these variables exacerbate and worsen cardiac risk factors linked to the onset of advanced age. Over two-thirds of individuals over 70 years old who have CVD also have concomitant noncardiovascular illnesses, according to recent research. Seventy percent of such individuals will develop CVD. A comprehensive nationwide study of Medicare enrollees 65 years of age or older revealed that CVD was commonly co-occurring with diabetes (37

- Integration of artificial intelligence (AI) in monitoring systems

Major Challenges:

- Massive cost of hemodynamic monitoring systems

- Invasive vs. Non-invasive Dilemma

Key Players: Edwards Lifesciences Corporation, Medtronic plc, Baxter International Inc., LiDCO Group plc, Deltex Medical Group plc, Pulsion Medical Systems SE, Cheetah Medical, Nihon Kohden Corporation, GE Healthcare, Philips Healthcare.

Global Hemodynamic Monitoring Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.42 billion

- 2026 Market Size: USD 1.5 billion

- Projected Market Size: USD 2.67 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 16 September, 2025

Hemodynamic Monitoring Systems Market Growth Drivers and Challenges:

Growth Drivers

- Aging population and increasing cardiovascular diseases - People who are older and more experienced are more vulnerable to cardiovascular disease. In adults, age is a risk factor in and of itself for cardiovascular disease (CVD); however, other variables such as frailty, obesity, and diabetes exacerbate these risks. It is well recognized that these variables exacerbate and worsen cardiac risk factors linked to the onset of advanced age.

Over two-thirds of individuals over 70 years old who have CVD also have concomitant noncardiovascular illnesses, according to recent research. Seventy percent of such individuals will develop CVD. A comprehensive nationwide study of Medicare enrollees 65 years of age or older revealed that CVD was commonly co-occurring with diabetes (37–47%), anemia (39–51%), and arthritis (41–46%). As hemodynamic monitoring systems directly help in monitoring cardiovascular conditions the demand for these devices is constantly in surge globally. - Demand for minimally invasive monitoring - Because of comorbidities and age, more and more patients need accurate intraoperative hemodynamic monitoring. Appropriate threshold settings are necessary to avoid unfavorable outcomes from intraoperative hypotension or hypoperfusion. Patient-to-patient variations in these settings are common. Flow monitoring is the norm for perioperative fluid management in goal-directed treatment strategies.

To evaluate and treat a patient's cardiovascular function, minimally invasive hemodynamic monitoring (MIHM) devices measure and track a number of hemodynamic parameters, such as blood pressure, cardiac output, and oxygen saturation. The incorporation of wireless and remote monitoring features into MIHM devices, enabling the transfer of data in real-time and remote patient information access is further propelling the hemodynamic monitoring systems market to touch the projected gains. - Integration of artificial intelligence (AI) in monitoring systems - Through the analysis of enormous volumes of patient data gathered from wearables, sensors, and patient-reported information, AI algorithms are essential to early detection. Vital indicators including blood pressure, heart rate, breathing rate, and others are included in this data.

After processing this data, AI models create unique baselines for every patient, taking into consideration their age, gender, medical history, and current state of health. With the unification of AI with hemodynamic monitoring systems these devices provide more accurate data that help in treatment. This further helps the market to multiply its gains.

Challenges

- Massive cost of hemodynamic monitoring systems - One of the main causes of the current biodiversity issue is biological invasions. The magnitude of invasions' economic effects is often overlooked. There are many unanswered questions about the economic costs incurred by invading alien species (IAS), especially for developing nations, which have the fastest-growing economy in the world. Because these technologies are expensive and require a skilled workforce to run, some healthcare facilities may find it challenging to implement them. As a result, the hemodynamic monitioring devices market is estimated to have slow growth.

- Hemodynamic monitoring can lead to many problems, such as deep vein thrombosis, lung infarction, infection, catheter knotting, balloon rupture, and dysrhythmias. The market is hampered by additional consequences such as arterial lines, thrombosis, and occlusion.

- Invasive vs. Non-invasive Dilemma

Hemodynamic Monitoring Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 1.42 billion |

|

Forecast Year Market Size (2035) |

USD 2.67 billion |

|

Regional Scope |

|

Hemodynamic Monitoring Systems Market Segmentation:

Type Segment Analysis

The invasive segment in the hemodynamic monitoring systems market is estimated to gain the largest revenue share of 60% in the year 2035. The escalating global burden of cardiovascular diseases necessitates advanced monitoring techniques for accurate diagnosis and timely interventions and this will help to augment this segment in the market revenue. According to a recent World Heart Federation (WHF) report, the number of deaths from cardiovascular disease (CVD) increased from 12.1 million in 1990 to 20.5 million in 2021 on a global scale. Invasive hemodynamic monitoring systems, capable of providing detailed cardiovascular parameters, are crucial in managing complex cardiovascular conditions, such as heart failure and sepsis.

According to the World Health Organization (WHO), cardiovascular diseases account for approximately 31% of global deaths. The rising incidence of these conditions underscores the critical need for advanced monitoring tools like invasive hemodynamic devices to enhance patient care and outcomes. The demographic shift towards an aging population is associated with an increased prevalence of cardiovascular diseases. Elderly individuals often present with multiple comorbidities, making invasive monitoring essential for precise and individualized care.

End Users Segment Analysis

The hospital segment in the hemodynamic monitoring systems market is expected to garner the highest share of 40% in the year 2035 because of the prevalence of hospitals globally. According to the most recent estimate, 6% of acute care hospitals in Europe have an average daily prevalence of healthcare-associated infections (HAIs), impacting around 3.2 million patients annually. The global increase in the prevalence of cardiovascular diseases, coupled with other critical conditions, necessitates advanced monitoring tools within hospital settings.

Hemodynamic monitoring systems are vital for assessing and managing complex cases, contributing to improved patient outcomes. The growing number of surgical procedures, including cardiac surgeries, vascular interventions, and other complex surgeries, necessitates comprehensive monitoring solutions within hospitals. Hemodynamic monitoring systems play a crucial role in ensuring the stability and safety of patients undergoing various surgical interventions. Considering all these elements, the market in this segment will expand.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

End User |

|

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hemodynamic Monitoring Systems Market Regional Analysis:

APAC Market Insights

The hemodynamic monitoring systems market share in the Asia Pacific region is expected to hold the largest revenue share of 38% by the end of 2035. This expansion will be propelled by the increasing healthcare industry in countries like Japan, China, and the rest of the APAC region. 1.36 billion individuals in China have full-coverage basic medical insurance by the end of 2020, with coverage exceeding 95%.

Further, in Japan, a variety of sectors, including diagnostics, nursing, medical care, and preventative health, are testing and introducing the use of AI. Emerging growth areas include dementia care, medication discovery, genetic medicine, and imaging diagnosis, treatment, and surgical assistance. The Japanese medical industry is expected to have a 15 billion yen (9 billion USD) market size in 2025. The increasing focus on inventing the latest and most effective hemodynamic monitoring systems in the APAC region is propelling the market expansion.

North American Market Insights

The hemodynamic monitoring systems market demand in the North American region is projected to hold the second-largest share during the forecast period. This huge expansion will be noticed due to the quick advancement of the development of wearable Minimally Invasive Hemodynamic Monitoring (MIHM) devices in this region. These movable gadgets provide patients with convenience by enabling them to carry out their regular activities under constant observation.

These gadgets also eliminate the need for intrusive procedures, which lowers the possibility of infections and consequences. New noninvasive and minimally invasive cardiac output monitoring techniques can be used to track hemodynamic trends and are based on a variety of physiological principles. This high demand for wearable minimally invasive hemodynamic monitoring will propel the hemodynamic monitoring systems market revenue.

Hemodynamic Monitoring Systems Market Players:

- Edwards Lifesciences Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Medtronic plc

- Baxter International Inc.

- LiDCO Group plc

- Deltex Medical Group plc

- Pulsion Medical Systems SE

- Cheetah Medical

- Nihon Kohden Corporation

- GE Healthcare

- Philips Healthcare

Recent Developments

- Medtronic acquired INPEN, a leader in disposable insulin pens, for USD 1 billion in August 2023. This move expands Medtronic's diabetes management portfolio beyond pumps and continuous glucose monitoring systems.

- Medtronic partnered with Verily Life Sciences to leverage AI and data analytics for designing and conducting more efficient clinical trials in September 2023. This aims to accelerate bringing new medical technologies to patients.

- Report ID: 5640

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.