Hemocytometer Market Outlook:

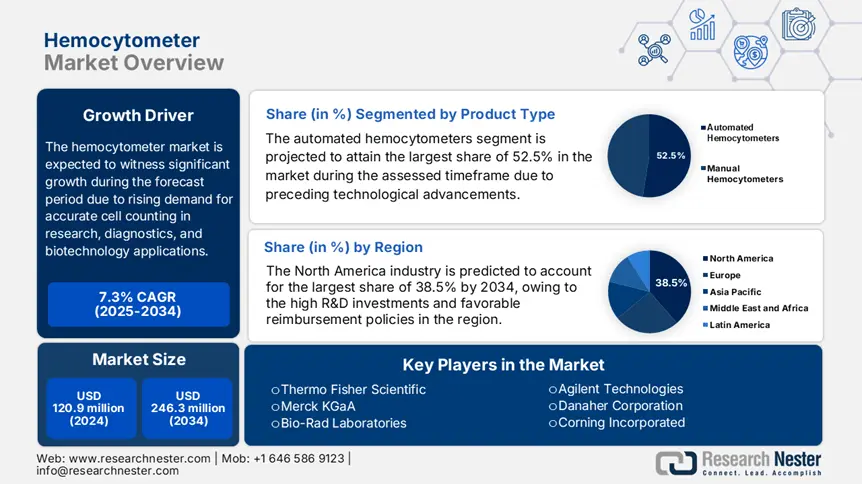

Hemocytometer Market size was valued at USD 120.9 million in 2024 and is projected to reach USD 246.3 million by the end of 2034, rising at a CAGR of 7.3% during the forecast period, i.e., 2025-2034. In 2025, the industry size of hemocytometer is estimated at USD 129.2 million.

The increasing adoption in pharmaceutical R&D, academic research, and clinical diagnostics is our key factor behind the significant growth of the worldwide market. It also serves a vast patient pool requiring cell-based diagnostics, particularly in terms of oncology, immunology, and infectious disease research. In this regard, the National Institute of Health reported that an estimated 17.6 million new cancer cases are being diagnosed yearly across all nations, thereby fueling the demand for precise cell counting tools in clinical as well as research settings. In addition, the supply chain of these hemocytometers comprises raw material procurement, precision manufacturing, and distribution through medical device wholesalers.

Furthermore, the U.S. Bureau of Labor Statistics stated that the Producer Price Index for laboratory equipment demonstrated a 3.4% increase from 2023 to 2024, owing to the rising costs of specialized materials and a skilled workforce. Simultaneously, the Consumer Price Index for laboratory devices has increased by 2.9% year-over-year in 2024, per the U.S. Bureau of Economic Analysis, due to the inflation in precision manufacturing. Therefore, the presence of all of these factors underscores the importance of balanced pricing models throughout the value chain.

Hemocytometer Market - Growth Drivers and Challenges

Growth Drivers

- Public and private investments: As government and private entities invest more in extensive research, the market experiences significant progress. Particularly, the amplifying focus on cell therapies is extending the reach in this field. For instance, in 2024, the National Institute of Health stated that it invested USD 5.9 billion for cell therapy research, out of which 32.5% was assigned towards counting technologies. On the other hand, Pfizer announced a partnership with Harvard Medical School that aims to develop AI-based hemocytometers with a prime focus on a 15.4% reduction in drug development costs.

- Automation and integration of AI: The notable efficiencies gained through the advancements in terms of automation and AI integration readily propel growth in the market. In this regard, the U.S. FDA data revealed that Thermo Fisher’s automated hemocytometer reduces counting errors by a significant 35.6%. On the other hand, the Centers for Medicare & Medicaid Services (CMS) noted that 60.5% of labs in the U.S. are currently prioritizing AI-enhanced hemocytometers to meet the CLIA compliance standards, thus denoting a positive market outlook.

Challenges

- High out-of-pocket costs in emerging nations: Despite the presence of a reliable consumer base, the hemocytometer market still faces hurdles in terms of exacerbated product costs. This makes it challenging for patients from price-sensitive regions to leverage them. In this regard, the World Health Organization notes that in India, 82.4% of patients pay USD 220 to USD 500 for manual hemocytometers, making it unaffordable for rural health clinics. However, Merck addressed this with the launch of a USD 50 per month leasing model in Brazil, thus improving access by a significant 20.5%.

- Trade tariffs and localization policies: The growing presence of considerable trade tariffs and localization policies is fostering hesitation among global pioneers to expand into all nations. As evidence, China implemented a Buy Local Rule that imposed a 15.4% tariff on imported hemocytometers over the past few years. On the other hand, India leverages the Production Linked Incentive (PLI) scheme that necessitates 40.4% domestic manufacturing for tax breaks, creating an unavoidable restraint for the global leaders to operate in this landscape.

Hemocytometer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

7.3% |

|

Base Year Market Size (2024) |

USD 120.9 million |

|

Forecast Year Market Size (2034) |

USD 246.3 million |

|

Regional Scope |

|

Hemocytometer Market Segmentation:

Product Type Segment Analysis

The automated hemocytometers segment is projected to attain the largest share of 52.5% in the hemocytometer market during the assessed timeframe. This rigorous dominance is highly attributed to the preceding technological advancements and governing support. As evidence, the data from the U.S. FDA and the National Institute of Health revealed that the FDA’s 2023 Digital Health Policy concentrates on the AI and machine learning integrated devices, wherein USD 2.2 billion was allocated towards automated diagnostics. Besides, Thermo Fisher’s Countess 3 successfully captured 25.2% market share post-FDA approval, thus denoting a wider segment scope.

End user Segment Analysis

The pharmaceutical & biotech companies’ segment is expected to grow at a considerable rate, with a share of 18.5% in the hemocytometer market by the end of 2034. The increased R&D activities and rise in cell therapy, regenerative medicine are the key factors reinforcing the segment's growth over this sector. The World Health Organization notes that the cell therapy market grows at 12.3% CAGR, thereby creating a sustained demand for high precision cell counting. In addition, in 2024, Pfizer announced a partnership with Bio-Rad that scaled hemocytometer use in CAR-T trials, thus creating a positive market outlook.

Our in-depth analysis of the hemocytometer market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Material |

|

|

End user |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hemocytometer Market - Regional Analysis

North America Market Insights

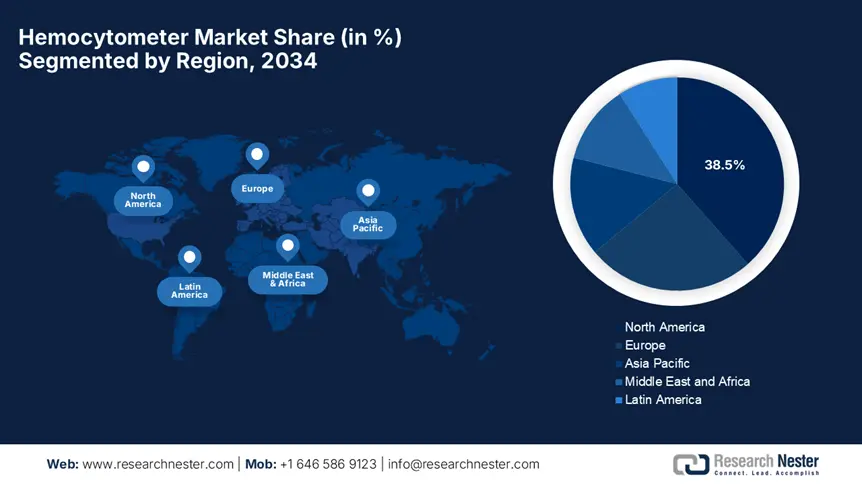

North America in the hemocytometer market is poised to gain the largest share of 38.5% during the forecast timeline. The leadership of the region originates from its advanced healthcare infrastructure, high R&D investments, and favorable reimbursement policies. The prominent countries U.S. and Canada, readily contribute to the region’s upliftment in the global landscape. Besides the rising demand for cell-based therapies, expanding government funding for precision medicine and rapid adoption of automated cell counting technologies further propel growth in the region.

U.S. dominates the North America hemocytometer market on account of strong Medicare and Medicaid coverage expansions. The report from the Centers for Medicare and Medicaid Services revealed that they significantly improved access, with over 45.6% of patients currently receiving coverage, which marks a 35.5% up over the last few years. Automation remains a key trend in the country, wherein the Centers for Disease Control and Prevention reported a 12.3% yearly increase in lab spending on automated cell counters, thus suitable for standard market growth.

Canada in the hemocytometer market is gaining immense exposure owing to the provincial healthcare investments and streamlined regulations. In this regard, Ontario in 2024 made an investment of USD 180.5 million in hemocytometers for hemocytometer use in cancer diagnostics. Meanwhile, Health Canada states that its 2024 fast-track program appreciably reduced device approval times by 32.5%. The country witnessed a 15.6% annual growth in cell therapy trials that increased the demand for precision cell counting, as reported by the Canadian Institute for Health Information (CIHI).

APAC Market Insights

Asia Pacific is emerging as the fastest-growing region in the hemocytometer market, facilitated by the rising cell therapy R&D and biopharma expansion. The landscape is dominated by the prominent countries Japan and China, with a combined 50.7% regional revenue share, with the presence of automation expansion and government-funded research activities. South Korea’s focus on AI-integrated cell counting and Malaysia’s allocation of USD 52.3 million for lab modernization further propels a favorable business atmosphere in the Asia Pacific.

China is steadily consolidating its dominance over the Asia Pacific’s hemocytometer market with the presence of massive governments in biotechnology and pharmaceuticals. In this regard, the National Medical Products Administration observed that there has been a 15.5% yearly rise in lab equipment spending from 2023 that includes hemocytometers, surpassing USD 4.3 billion by the end of 2030. Meanwhile, the biopharmaceutical sector is also displaying steady growth with an estimated 2.3 million cases in a year, necessitating cell-based diagnostics. Further, the Made in China 2025 initiative prioritizes advanced medical devices, thus denoting a positive market outlook.

India in the hemocytometer market is rapidly growing, which is observed to be the fastest-growing in the Asia Pacific region. The expanding biotechnology research and government-funded healthcare programs are the key growth factors in this landscape. Testifying to this, the Indian Council of Medical Research (ICMR) noted that the funding for diagnostic equipment grew by 18.6% wherein the hemocytometer procurement is projected to reach USD 2.3 billion by 2030. The country witnessed a strong demand for cell analysis in academic and pharmaceutical labs, with the patient pool reaching over 2.8 million cases, thus suitable for standard market upliftment.

Country-wise Government Provinces

|

Country |

Initiative / Policy |

Funding / Budget |

Launch Year |

|

Japan |

PMDA Fast-Track Program |

$351.2 million for MedTech R&D |

2022 |

|

South Korea |

Digital New Deal 2.0 |

$1.8 billion for AI diagnostics |

2023 |

|

Australia |

Medical Research Future Fund (MRFF) |

AUD 502.6 million for precision medicine |

2021 |

|

Malaysia |

12th Malaysia Plan (Healthcare) |

$2101.3 million for lab upgrades |

2022 |

Europe Market Insights

Europe in the hemocytometer market is growing at a rapid pace, propelled by the presence of rapidly aging demographics, precision medicine adoption, and huge support from governments. As evidence, the EU’s Health Data Space initiative allocated an estimated €2.6 billion for hemocytometer-related R&D, reflecting its priority towards this field. Moreover, the region hosts automation and AI as the key trends, wherein 22.5% of the labs in this region adopted automated devices in 2024. Further, the regulatory harmonization accelerates the product’s market entry under the EU Medical Device Regulation.

Germany is readily blistering growth in the hemocytometer market in the Europe landscape, fueled by substantial government investments and its huge biotechnology hub. The country's Federal Ministry of Health (BMG) allocated €1.3 billion to its Precision Medicine Initiative, thereby accelerating the adoption of AI-powered hemocytometers in clinical diagnostics and research aspects. Besides, the country’s pioneers, such as Berlin and Munich, are thriving in the cell & gene therapy sector, creating a sustained demand for high-throughput cell counting. Furthermore, 42.4% of labs in the country currently utilize automated cell counters, with demand being reflected at 9.3% CAGR.

The U.K. is the leader of biopharma innovation, which is growing at a lucrative rate in the hemocytometer market. The market is supported by diagnostic expansion and its regulatory agility. As evidence, the National Health Service noted that for the tenure 2024 to 2030, an estimated £302.2 million was invested in lab infrastructure with a prime focus on automated hemocytometers for cancer and rare disease diagnostics. In addition, the Medicines and Healthcare products Regulatory Agency implemented an innovation Licensing Pathway that reduces approval duration for AI-hemocytometers by 33.2% boosting market entry for startups.

Government Investments, Policies & Funding

|

Country |

Initiative/Policy |

Funding/Budget |

Launch Year |

|

France |

Innovation Health 2030 Plan |

€2.3 billion for MedTech R&D |

2022 |

|

Italy |

PNRR Healthcare Modernization |

€1.5 billion for lab equipment |

2021 |

|

Spain |

Digital Health Strategy 2022 |

€802.2 million for lab automation |

2022 |

|

Sweden |

Nordic Life Sciences Strategy |

€172.6 Million |

2023 |

|

Switzerland |

Swiss MedTech Initiative |

€460.3 Million |

2022 |

Key Hemocytometer Market Players:

- Thermo Fisher Scientific

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck KGaA

- Bio-Rad Laboratories

- Agilent Technologies

- Danaher Corporation (Beckman Coulter)

- Corning Incorporated

- ChemoMetec

- Bulldog Bio

- Paul Marienfeld GmbH

- Narang Medical

- Bioevopeak

- Neubauer Improved

- Hawksley & Sons

- LabTech

- Optika Italy

The international hemocytometer market is majorly dominated by the U.S. and Europe-based pioneers such as Thermo Fisher, Merck, and Bio-Rad, who take control over the maximum revenue share by leveraging automation and AI integration. Meanwhile, the Japan-based players, such as Sysmex and Olympus, compete in terms of precision-engineered devices, whereas India and China-based manufacturers are concentrating on cost-sensitive markets. The global leaders undertake numerous strategies to secure their market positions, such as mergers and acquisitions, regulatory agility, and emerging market focus.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In May 2024, Sysmex announced the launch of the Cellpack XN-1000, an automated hematology analyzer with integrated hemocytometry. The product is adopted by over 200 hospitals in Europe and Japan, and it processes 100 samples per hour, improving lab efficiency by 25.5%.

- In March 2024, Thermo Fisher Scientific unveiled its Countess Pro+, which is an automated hemocytometer featuring AI-driven cell viability analysis. The device reduces counting errors by 40% compared to manual methods, with 15,000 units sold globally in the 2nd quarter of 2024.

- Report ID: 7922

- Published Date: Jul 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hemocytometer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert