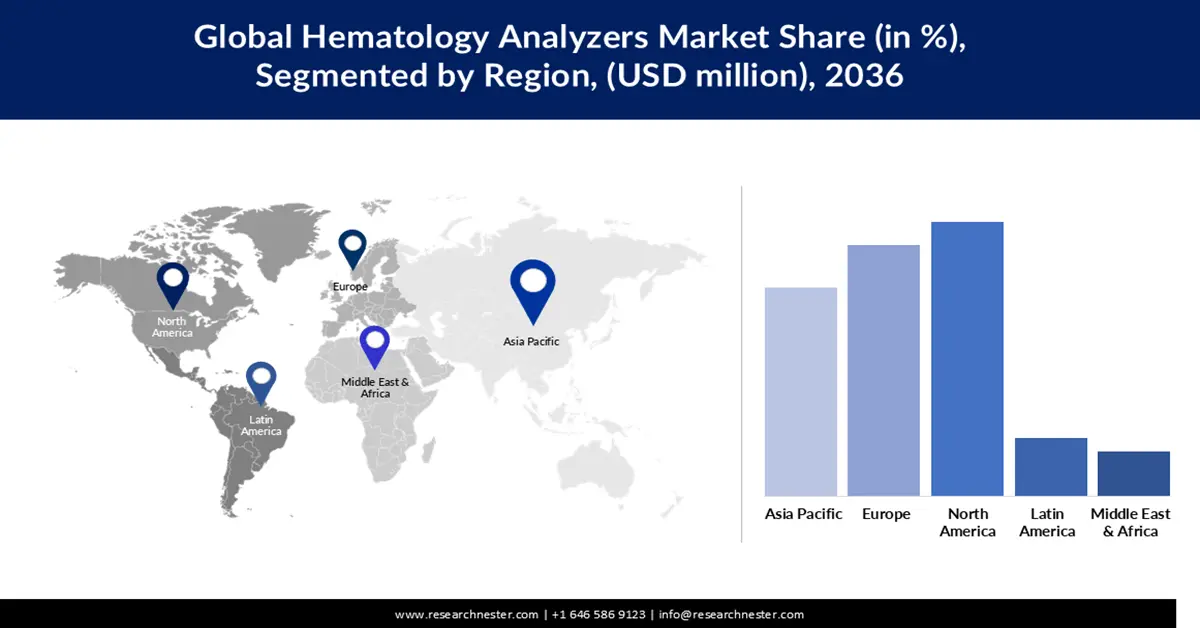

Hematology Analyzers Market - Regional Analysis

North America Market Insights

North America market is expected to acquire a significant revenue share between 2026 and 2036, owing to the rising prevalence of hematological and chronic diseases. According to the study by the National Library of Medicine, published in July 2025, high-income North America had recorded the highest age-standardized death rate of 2.8% per 100,000 people in 2021, caused by hematological malignancies. This indicates a strong demand for hematology analyzers to measure high-throughput blood count and generate data regarding cell population while carrying out monitoring and diagnosis of diseases repeatedly. Organizations operating within the region are also involved in driving AI-related innovations in hematology analyzers, which can lead to continuous advancement of the medical device.

The U.S. hematology analyzers market is expected to witness significant expansion throughout the forecast period, attributed to the rising prevalence of blood disorders, expected to accelerate the consumption of the medical device exponentially. Continuous initiatives by the government to develop the healthcare infrastructure also influence the adoption of a greater number of hematology analyzers in different healthcare settings, including laboratories and hospitals, in the upcoming business years. The Centers for Medicare & Medicaid Services in June 2025 reported that around 32% of the total health spending was sponsored by the federal government in 2023. These facts indicate that bearing the costs of adopting and operating hematology analyzers cannot be challenging for small-scale laboratories and healthcare organizations since they have access to adequate financial support from the government.

The hematology analyzers market in Canada is set to experience a robust CAGR from 2026 to 2036, owing to the aging population, influence an increase in the prevalence of hematological and chronic diseases in the near future. As updated by Statistics Canada in September 2025, around 19.5% of the overall population of the country was aged 65 and over as of July 2025. In addition, the median age in the country increased to 40.6 years in July 2025 from 40.3 years in July 2024. This indicates the likelihood of an accelerated consumption of hematology analyzers in the treatment of chronic diseases in the years to come. People in Canada have also started to prefer early disease detection and prevention, boosting the demand for hematology analyzers.

Europe Market Insights

Europe market is poised to acquire a remarkable revenue share between 2026 and 2036, owing to the regulatory guidelines that encourage advancements in the treatment of hematological and chronic disorders. For instance, in March 2023, the European Union enacted the Regulation (EU) 2023/607. The law extended the transitional period for a range of medical devices used to perform in vitro diagnostics. Therefore, the suppliers of hematology analyzers within the region have more time to alter the traditional medical devices with new sets in different healthcare settings. The growing prevalence of blood disorders is also estimated to boost the demand for hematology analyzers. Strategic events are also organized within the region to promote the advancements of the medical device. For instance, the 2nd European Hematology and Blood Disorder Congress is going to take place in November 2025, where the stakeholders of the industry can get the opportunity to exchange knowledge, which can help to drive innovation in hematology analyzers.

Germany is set to become the fastest-growing hematology analyzers market in Europe during the study period, due to the robust healthcare ecosystem of the country. A report by the International Trade Administration, published in August 2025, reveals that, as the third largest medical technology market, the value of Germany was USD 44 billion in 2025. The healthcare market of the country generated a year-on-year economic output worth USD 838 billion. Adhering to all these facts, one can adapt to the scenario that healthcare organizations have an adequate financial situation to adopt advanced diagnostic technologies like hematology analyzers and increase their market accessibility. Around 24.9% of the population of the country was aged 65 and older in 2023. This indicates the probability of a strong prevalence of hematological and chronic disorders, which can fuel the demand for hematology analyzers.

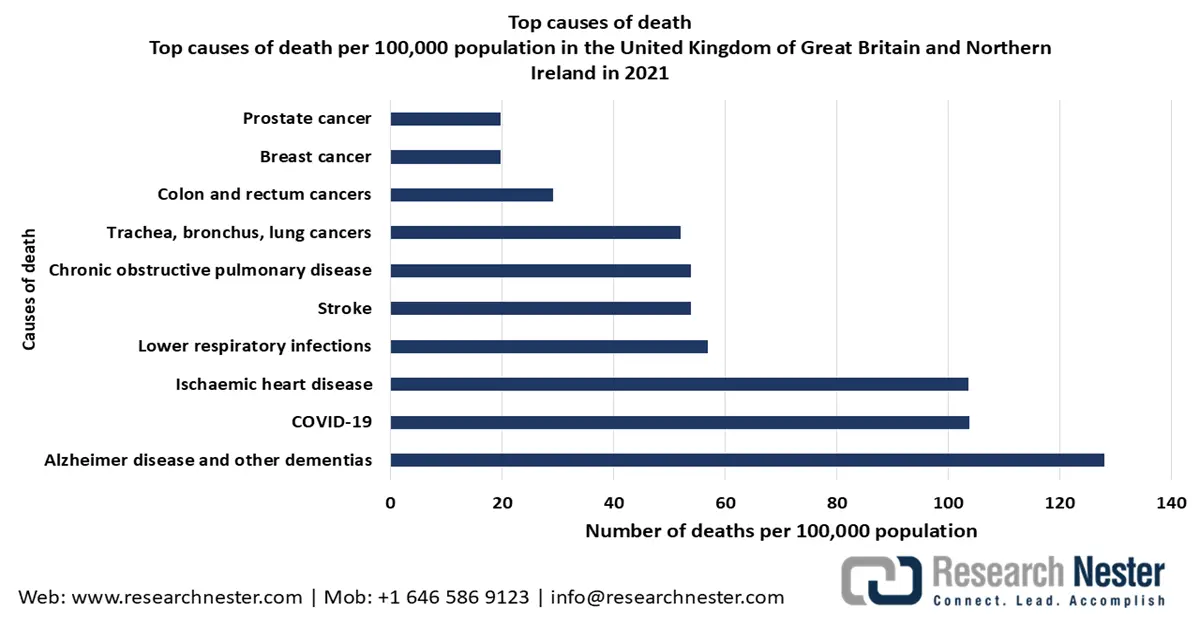

The UK hematology analyzers market is projected to hold an extensive revenue share during the stipulated timeframe, on account of the growing prevalence of chronic diseases, leading to drastic amounts of deaths. This is influencing the demand for advanced medical devices like hematology analyzers to detect and prevent diseases at their early stages of development. As reported by the Health Foundation in July 2023, around 9.1 million of the population in England are estimated to live with major illnesses by 2040. An aging population within the country is driving a surge in the prevalence of hematological disorders, such as leukemia and anemia, which can boost the use of the medical device in performing blood tests regularly in the upcoming years. As disclosed by Leukaemia UK, approximately 3,100 individuals are diagnosed with Acute Myeloid Leukemia each year, and 42% of the cases are among patients aged 75 and over.

Source: WHO

Asia Pacific Market Insights

The Asia Pacific hematology analyzers market is projected to account for a significant revenue share by the end of 2036, as a consequence of the rising government investments across different countries for the development of healthcare infrastructure. This indicates the likelihood of a high adoption of advanced and automated medical devices, including hematology analyzers. The demand for medical devices is also expected to surge with the growing prevalence of chronic and infectious diseases. According to the Asian Development Bank in June 2025, people of over 20 nations of the region are vulnerable to a 20% risk of dying prematurely because of chronic diseases.

China can emerge as a steadily expanding hematology analyzers market at an extensive CAGR during the forecast timeline, owing to lucrative investment opportunities. Potential investors interested in the production of hematology analyzers can get adequate financial support from the government. As reported by the International Trade Administration in September 2025, China emerged as the second-largest healthcare market globally in 2024. The market value surpassed USD 1 trillion and is expected to reach USD 1.5 trillion in 2029. Around 60% of health expenses are initiated by the government under the Healthy China 2030 initiative. This is expected to drive further expansion of the sector, which increases the chances of an accelerated adoption of hematology analyzers in clinical settings.

The hematology analyzers market in India is likely to witness exponential growth, owing to the susceptibility of a large pool of the population to blood disorders. This is also a significant factor driving the need for blood across the country. A study, published by the Observer Research Foundation (ORF) in October 2025, states that the parliament was informed regarding an annual blood requirement of a projected 14.6 million units by the government. During the financial year 2024-2025, 14,601,147 units of blood were consumed, an increase 15% from 12,695,363 units in 2023. As a result, the demand for hematology analyzers can rise dramatically to perform blood cell analysis.