Global Hematology Analyzers Market

- An Outline of the Global Hematology Analyzers Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Growth Outlook

- Competitive White Space Analysis – Identifying Untapped Market Gaps

- Risk Overview

- SWOT

- Technological Advancement

- Technology Maturity Matrix for Hematology Analyzers

- Recent News

- Regional Demand

- Hematology Analyzers Market by Geography – Strategic Comparative Analysis

- Strategic Segment Analysis: Hematology Analyzers Demand Landscape

- Hematology Analyzers Demand Trends Driven by Electrification, Downsizing, and Lightweighting (2026-2036)

- Root Cause Analysis (RCA) for discovering problems of the Hematology Analyzers Market

- Porter Five Forces

- PESTLE

- Comparative Positioning

- Global Hematology Analyzers Market – Key Player Analysis (2024)

- Competitive Landscape: Key Suppliers/Players

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share, 2025 (%)

- Business Profile of Key Enterprise

- Abbott Laboratories

- Sysmex Corporation

- Beckman Coulter

- Siemens Healthineers

- Danaher Corporation

- F. Hoffmann-La Roche Ltd.

- Bio-Rad Laboratories

- HORIBA Ltd.

- Mindray Medical International Limited

- Nihon Kohden Corporation

- Boule Diagnostics AB

- Ortho Clinical Diagnostics

- Diatron MI PLC

- Thermo Fisher Scientific Inc.

- Agilent Technologies Inc.

- Business Profile of Key Enterprise

- Global Hematology Analyzers Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Hematology Analyzers Market Segmentation Analysis (2026-2036), By

- Product Type

- 3-Part Differential Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- 5-Part Differential Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- 6-Part and Above/High-End Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- Point-of-Care Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- Hematology Reagents & Consumables, Market Value (USD Million), and CAGR, 2026-2036F

- Modality

- Benchtop, Market Value (USD Million), and CAGR, 2026-2036F

- Floor-Standing, Market Value (USD Million), and CAGR, 2026-2036F

- Application

- Complete Blood Count (CBC), Market Value (USD Million), and CAGR, 2026-2036F

- Reticulocyte Testing, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Automation Level

- Fully Automated Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- Semi-Automated Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- End use

- Hospitals, Market Value (USD Million), and CAGR, 2026-2036F

- Diagnostic Laboratories, Market Value (USD Million), and CAGR, 2026-2036F

- Clinics/Outpatient Centers, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Regional Synopsis, Value (USD Million), 2026-2036

- North America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Asia Pacific Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Middle East and Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Product Type

- Market Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD million), 2026-2036, By

- Product Type

- 3-Part Differential Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- 5-Part Differential Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- 6-Part and Above/High-End Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- Point-of-Care Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- Hematology Reagents & Consumables, Market Value (USD Million), and CAGR, 2026-2036F

- Modality

- Benchtop, Market Value (USD Million), and CAGR, 2026-2036F

- Floor-Standing, Market Value (USD Million), and CAGR, 2026-2036F

- Application

- Complete Blood Count (CBC), Market Value (USD Million), and CAGR, 2026-2036F

- Reticulocyte Testing, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Automation Level

- Fully Automated Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- Semi-Automated Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- End use

- Hospitals, Market Value (USD Million), and CAGR, 2026-2036F

- Diagnostic Laboratories, Market Value (USD Million), and CAGR, 2026-2036F

- Clinics/Outpatient Centers, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- U.S. Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Canada Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Product Type

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD million), 2026-2036, By

- Product Type

- 3-Part Differential Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- 5-Part Differential Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- 6-Part and Above/High-End Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- Point-of-Care Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- Hematology Reagents & Consumables, Market Value (USD Million), and CAGR, 2026-2036F

- Modality

- Benchtop, Market Value (USD Million), and CAGR, 2026-2036F

- Floor-Standing, Market Value (USD Million), and CAGR, 2026-2036F

- Application

- Complete Blood Count (CBC), Market Value (USD Million), and CAGR, 2026-2036F

- Reticulocyte Testing, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Automation Level

- Fully Automated Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- Semi-Automated Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- End use

- Hospitals, Market Value (USD Million), and CAGR, 2026-2036F

- Diagnostic Laboratories, Market Value (USD Million), and CAGR, 2026-2036F

- Clinics/Outpatient Centers, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- UK Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Germany Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- France Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Italy Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Spain Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Netherlands Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Russia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Switzerland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Poland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Belgium Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Product Type

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD million), 2026-2036, By

- Product Type

- 3-Part Differential Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- 5-Part Differential Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- 6-Part and Above/High-End Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- Point-of-Care Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- Hematology Reagents & Consumables, Market Value (USD Million), and CAGR, 2026-2036F

- Modality

- Benchtop, Market Value (USD Million), and CAGR, 2026-2036F

- Floor-Standing, Market Value (USD Million), and CAGR, 2026-2036F

- Application

- Complete Blood Count (CBC), Market Value (USD Million), and CAGR, 2026-2036F

- Reticulocyte Testing, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Automation Level

- Fully Automated Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- Semi-Automated Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- End use

- Hospitals, Market Value (USD Million), and CAGR, 2026-2036F

- Diagnostic Laboratories, Market Value (USD Million), and CAGR, 2026-2036F

- Clinics/Outpatient Centers, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- China Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- India Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Korea Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Australia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Indonesia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Malaysia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Vietnam Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Thailand Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Singapore Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- New Zeeland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Asia Pacific Excluding Japan Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Product Type

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2026-2036, By

- Product Type

- 3-Part Differential Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- 5-Part Differential Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- 6-Part and Above/High-End Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- Point-of-Care Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- Hematology Reagents & Consumables, Market Value (USD Million), and CAGR, 2026-2036F

- Modality

- Benchtop, Market Value (USD Million), and CAGR, 2026-2036F

- Floor-Standing, Market Value (USD Million), and CAGR, 2026-2036F

- Application

- Complete Blood Count (CBC), Market Value (USD Million), and CAGR, 2026-2036F

- Reticulocyte Testing, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Automation Level

- Fully Automated Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- Semi-Automated Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- End use

- Hospitals, Market Value (USD Million), and CAGR, 2026-2036F

- Diagnostic Laboratories, Market Value (USD Million), and CAGR, 2026-2036F

- Clinics/Outpatient Centers, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- Brazil Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Argentina Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Mexico Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Product Type

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2026-2036, By

- Product Type

- 3-Part Differential Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- 5-Part Differential Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- 6-Part and Above/High-End Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- Point-of-Care Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- Hematology Reagents & Consumables, Market Value (USD Million), and CAGR, 2026-2036F

- Modality

- Benchtop, Market Value (USD Million), and CAGR, 2026-2036F

- Floor-Standing, Market Value (USD Million), and CAGR, 2026-2036F

- Application

- Complete Blood Count (CBC), Market Value (USD Million), and CAGR, 2026-2036F

- Reticulocyte Testing, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Automation Level

- Fully Automated Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- Semi-Automated Hematology Analyzers, Market Value (USD Million), and CAGR, 2026-2036F

- End use

- Hospitals, Market Value (USD Million), and CAGR, 2026-2036F

- Diagnostic Laboratories, Market Value (USD Million), and CAGR, 2026-2036F

- Clinics/Outpatient Centers, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- Saudi Arabia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- UAE Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Israel Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Qatar Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Kuwait Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Oman Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Middle East & Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Product Type

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

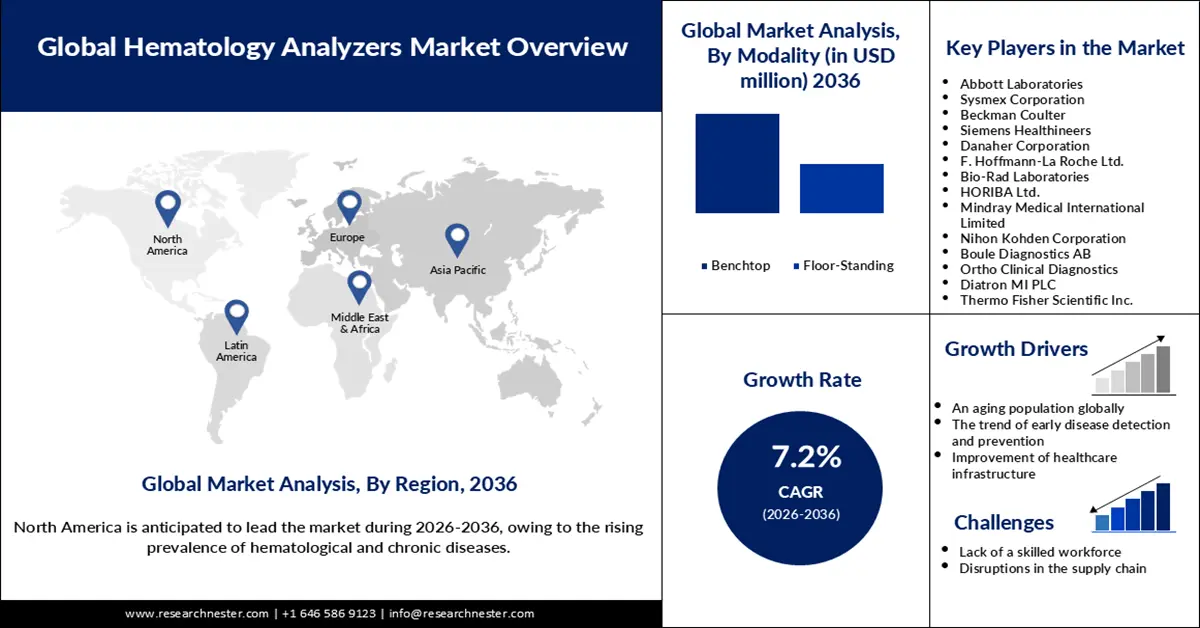

Hematology Analyzers Market Outlook:

Hematology Analyzers Market was valued at USD 8 billion in 2025 and is forecasted to reach a valuation of USD 16.1 billion by the end of 2036, rising at a CAGR of 7.2% during the forecast period, i.e., 2026-2036. In 2026, the industry size of the hematology analyzers is estimated at USD 8.6 billion.

The rapid increase in the prevalence of hematological and chronic disorders is influencing the continuous expansion of the global hematology analyzers market. As estimated by the Leukemia & Lymphoma Society, 187,740 people were diagnosed with such as leukemia, myeloma, and lymphoma in 2024 in the U.S. Among the estimated 2,001,140 new cases of cancer within the country, 9.4% were of leukemia, myeloma, and lymphoma. As disclosed by the American Society of Hematology in May 2025, patients with different hematological disorders are treated by hematologists across all continents. The conditions of hematology practices and access to proper research and development ecosystems vary from region to region. In November 2023, the same reporting authority also predicted that the number of detected hematological malignancies is estimated to increase to around 4,634,937 by 2030 globally. Proper treatment of hematological diseases requires continuous monitoring, driving the demand for advanced and automated analyzers.

Relevant technological advancements are also fueling the hematology analyzers market growth. Modern hematology analyzers are enabled with a range of sophisticated detection methods, AI, automation, and software, shifting the process of blood cell analysis from the use of traditional laboratory equipment to a more appropriate and efficient diagnostic tool. A vast pool of companies is contributing to increasing the market accessibility to advanced hematology analyzers. For instance, in July 2023, Sysmex Corporation launched the XR-Series of hematology analyzers. The new product line was built upon XN-Series technology and its predecessor, and delivers improved throughput to fulfill the laboratory needs.

Key Hematology Analyzers Market Insights Summary:

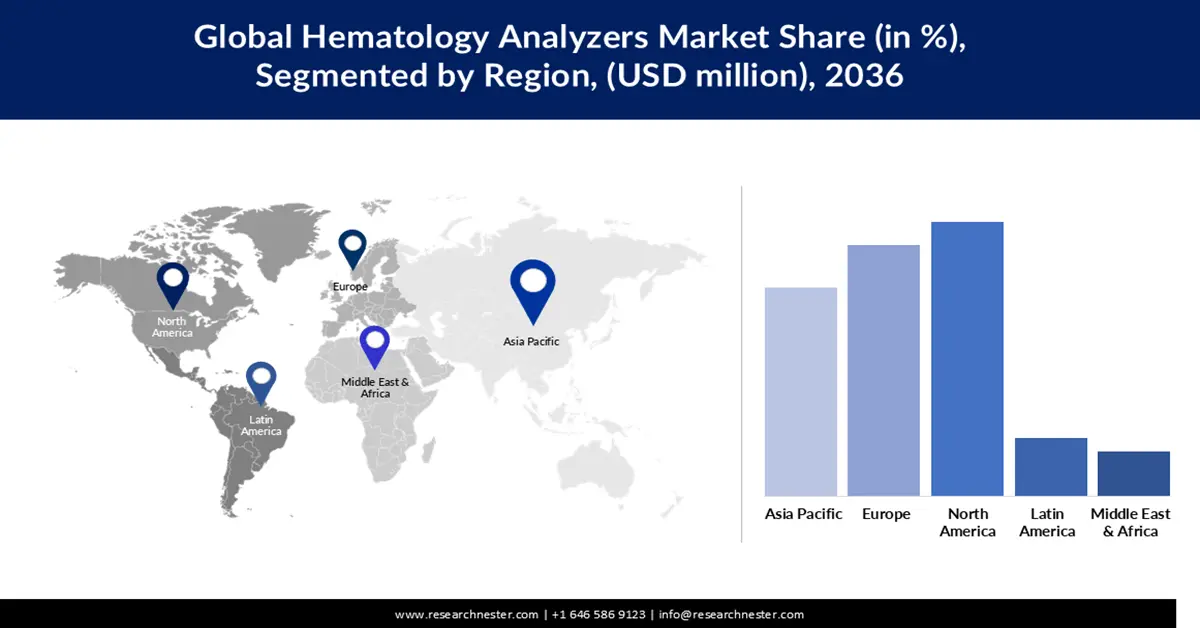

Regional Highlights:

- The North America hematology analyzers market is expected to capture a significant revenue share between 2026 and 2036, stemming from the rising prevalence of hematological and chronic diseases.

- The Europe market is anticipated to secure a remarkable revenue share by 2036, facilitated by regulatory guidelines that encourage advancements in the treatment of hematological and chronic disorders.

Segment Insights:

- The 3-part differential hematology analyzer segment is projected to acquire a notable market share by 2036 in the hematology analyzers market, propelled by its cost-effectiveness and compatibility with smaller healthcare settings.

- The complete blood count (CBC) segment is anticipated to hold a significant share by 2036, underpinned by the rising prevalence of chronic diseases.

Key Growth Trends:

- An aging population globally

- The trend of early disease detection and prevention

Major Challenges:

- Lack of a skilled workforce

- Disruptions in the supply chain

Key Players: Abbott Laboratories (U.S.), Sysmex Corporation (Japan), Beckman Coulter (U.S.), Siemens Healthineers (Germany), Danaher Corporation (U.S.), F. Hoffmann-La Roche Ltd. (Switzerland), Bio-Rad Laboratories (U.S.), HORIBA Ltd. (Japan), Mindray Medical International Limited (China), Nihon Kohden Corporation (Japan), Boule Diagnostics AB (Sweden), Ortho Clinical Diagnostics (U.S.), Diatron MI PLC (Hungary), Thermo Fisher Scientific Inc. (U.S.), Agilent Technologies Inc. (U.S.).

Global Hematology Analyzers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8 billion

- 2026 Market Size: USD 8.6 billion

- Projected Market Size: USD 16.1 billion by 2036

- Growth Forecasts: 7.2% CAGR (2026-2036)

Key Regional Dynamics:

- Largest Region: North America

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Singapore

Last updated on : 5 November, 2025

Hematology Analyzers Market - Growth Drivers and Challenges

Growth Drivers

- An aging population globally: An aging population increases the likelihood of a growing prevalence of hematological and chronic disorders. As disclosed by the National Council on Aging in July 2025, around 93% of adults aged over 65 and older suffer from at least 1 chronic illness, while 79% have two or more. In February 2025, the World Health Organization estimated that by 2030, around 1.4 billion people are expected to be aged 65 and over, from 1.1 billion in 2023. Based on all these facts, it can be assumed that the demand for hematology analyzers in different healthcare settings can increase sharply over the next few years.

- The trend of early disease detection and prevention: Healthcare organizations are increasingly adopting predictive modelling to enable early detection and prevention of diseases, such as cancer, heart disorders, and Alzheimer’s. Growing deaths due to the occurrence of noncommunicable diseases drive the need for the adoption of measures for early diseases and prevention in different healthcare settings. As projected by the World Health Organization in February 2025, around 30 to 50% of cancers can currently be cured by avoiding risk factors and applying available evidence-based prevention tactics. Hematology analyzers are supposed to play a crucial role in strengthening early detection and prevention of diseases by allowing for rapid analysis of blood samples with utmost accuracy.

- Improvement of healthcare infrastructure: Leaders of different health systems globally are striving for efficiencies, productivity, and enhancement of patient engagement. Governments in developing economies are also active in massive investments for the development of healthcare infrastructure. As revealed by the India Brand Equity Foundation in May 2025, the union budget for the development, enhancement, and maintenance of the healthcare system of the country was USD 11.5 billion in 2025. The efforts to develop healthcare infrastructure can accelerate the adoption of hematology analyzers in different healthcare settings, including hospitals. In addition, access to adequate funding is also there to expand the diagnostic capabilities of the medical devices through investment in research and development.

Challenges

- Lack of a skilled workforce: The engagement of a technologically skilled workforce is required for the efficient operation of modern-day hematology analyzers. A report released in November 2023 revealed that hiring suitable employees became challenging for 77% of employers in the high-demand sector, where the engagement of tech-savvy people is integral. The World Health Organization has also estimated a lack of 11 million health workers by 2030. The shortage of the mentioned types of workers in the healthcare sector can hinder the adoption of the advanced hematology analyzers.

- Disruptions in the supply chain: A wide range of geopolitical landscapes, including poor political relations between countries, natural disasters, and others, can create operational hurdles and a shortage of raw materials, such as control units, power sources, and sample trays that are required for the manufacturing of the hematology analyzers. This can cause delays in the completion of the production of hematology analyzers. The operations of the medical device also rely on certain regents, including sodium chloride, purified water, buffers, sodium sulfate, and others. In March 2024, the United Nations reported that around 50% of the global population, which accounts for approximately 4 billion suffer issues with a shortage of water for at least a month of the year. The shortage of reagents can lead hematology analyzers to go into standby mode in different healthcare settings.

Hematology Analyzers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2036 |

|

CAGR |

7.2% |

|

Base Year Market Size (2025) |

USD 8 billion |

|

Forecast Year Market Size (2036) |

USD 16.1 billion |

|

Regional Scope |

|

Hematology Analyzers Market Segmentation:

Product Type Segment Analysis

The 3-part differential hematology analyzer segment is anticipated to acquire a remarkable market share by 2036, attributed to its growing popularity in terms of cost-effectiveness and compatibility with smaller healthcare settings. The simple design of the medical device makes the costs lower compared to a range of other types of hematology analyzers. The low price, compact size, simple design, and capability to perform rapid testing attract smaller clinics and laboratories to adopt the 3-part differential hematology analyzers significantly. Numerous key players are also engaged in the development of 3-part differential hematology analyzers, influencing the dominance of the segment. For example, in April 2022, Sysmex Europe launched XQ-320, an automated 3-part differential hematology analyzer. In a small bench space, the device can be used using a small sample volume. Sysmex Corporation also expanded the production of the automated medical machine in India in response to the Make in India policy.

Application Segment Analysis

The complete blood count (CBC) segment is estimated to hold a significant market share during the projection timeline, due to the growing prevalence of chronic diseases. This can fuel the adoption of the hematology analyzers to perform the CBC test so that blood cells, platelets, hemoglobin, and white blood cells amounts and sizes can be measured effectively.

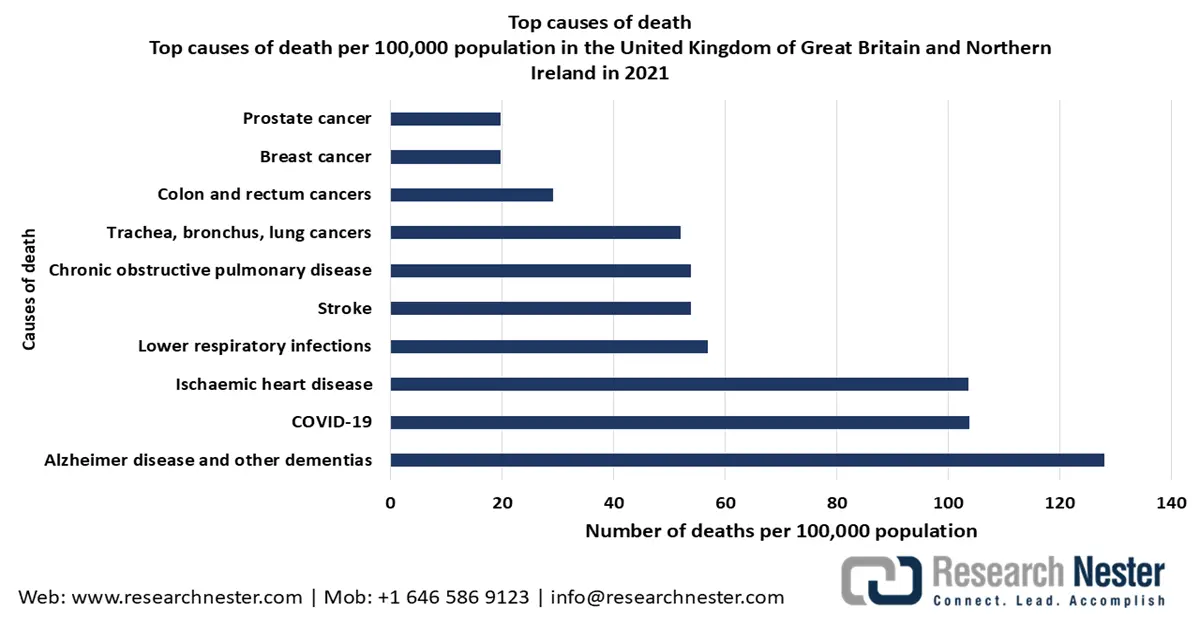

Rising deaths caused by different chronic diseases are driving the need for early disease detection and prevention. A report by the World Health Organization, published in August 2024, states that ischemic heart diseases, stroke, chronic obstructive pulmonary disease, lower respiratory infection, lung cancer, bronchus, trachea, alzheimer's disease, dementia, diabetes mellitus, kidney diseases, and tuberculosis were among the 7 of the 10 leading causes of death in 2021. The growing need for early disease detection and prevention is expected to boost the consumption of hematology analyzers to make CBC testing automated, influencing the dominance of the segment in the upcoming financial years.

Statistics on Deaths Caused by Chronic Diseases from 2020 to 2021

|

Causes |

Death counts in 2021/percentage increases in 2021 since 2000 |

|

Ischaemic heart disease |

9.1 million |

|

Stroke |

10% |

|

Obstructive pulmonary disease |

5% |

|

Lower respiratory infections |

2.5 million |

|

Trachea, bronchus, and lung cancers |

1.9 million |

|

Alzheimer’s disease and other forms of dementia |

1.8 million |

|

Diabetes |

95% |

|

Kidney diseases |

95% |

Source: WHO

Automation Level Segment Analysis

The fully automated hematology analyzers segment is projected to account for an extensive market share by the end of 2036, owing to the growing popularity of the advanced medical devices in enhancing diagnostic capabilities in different healthcare settings. The use of cytometry and electrical impedance technology enabled fully automated hematology analyzers not only to help in increasing accuracy in cell counting and analysis but also to obtain quicker outcomes, owing to the high-throughput capabilities. The market accessibility of fully automated hematology analyzers is also growing with the consistency of key players in the development of automated medical devices. For instance, in April 2024, HORIBA Medical launched HELO 2.0, a fully automated and high-throughput hematology analyzer approved by CE-IVDR.

Our in-depth analysis of the market includes the following segments:

|

Segments |

Subsegments |

|

Product Type |

|

|

Modality |

|

|

Application |

|

|

Automation level |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hematology Analyzers Market - Regional Analysis

North America Market Insights

North America market is expected to acquire a significant revenue share between 2026 and 2036, owing to the rising prevalence of hematological and chronic diseases. According to the study by the National Library of Medicine, published in July 2025, high-income North America had recorded the highest age-standardized death rate of 2.8% per 100,000 people in 2021, caused by hematological malignancies. This indicates a strong demand for hematology analyzers to measure high-throughput blood count and generate data regarding cell population while carrying out monitoring and diagnosis of diseases repeatedly. Organizations operating within the region are also involved in driving AI-related innovations in hematology analyzers, which can lead to continuous advancement of the medical device.

The U.S. hematology analyzers market is expected to witness significant expansion throughout the forecast period, attributed to the rising prevalence of blood disorders, expected to accelerate the consumption of the medical device exponentially. Continuous initiatives by the government to develop the healthcare infrastructure also influence the adoption of a greater number of hematology analyzers in different healthcare settings, including laboratories and hospitals, in the upcoming business years. The Centers for Medicare & Medicaid Services in June 2025 reported that around 32% of the total health spending was sponsored by the federal government in 2023. These facts indicate that bearing the costs of adopting and operating hematology analyzers cannot be challenging for small-scale laboratories and healthcare organizations since they have access to adequate financial support from the government.

The hematology analyzers market in Canada is set to experience a robust CAGR from 2026 to 2036, owing to the aging population, influence an increase in the prevalence of hematological and chronic diseases in the near future. As updated by Statistics Canada in September 2025, around 19.5% of the overall population of the country was aged 65 and over as of July 2025. In addition, the median age in the country increased to 40.6 years in July 2025 from 40.3 years in July 2024. This indicates the likelihood of an accelerated consumption of hematology analyzers in the treatment of chronic diseases in the years to come. People in Canada have also started to prefer early disease detection and prevention, boosting the demand for hematology analyzers.

Europe Market Insights

Europe market is poised to acquire a remarkable revenue share between 2026 and 2036, owing to the regulatory guidelines that encourage advancements in the treatment of hematological and chronic disorders. For instance, in March 2023, the European Union enacted the Regulation (EU) 2023/607. The law extended the transitional period for a range of medical devices used to perform in vitro diagnostics. Therefore, the suppliers of hematology analyzers within the region have more time to alter the traditional medical devices with new sets in different healthcare settings. The growing prevalence of blood disorders is also estimated to boost the demand for hematology analyzers. Strategic events are also organized within the region to promote the advancements of the medical device. For instance, the 2nd European Hematology and Blood Disorder Congress is going to take place in November 2025, where the stakeholders of the industry can get the opportunity to exchange knowledge, which can help to drive innovation in hematology analyzers.

Germany is set to become the fastest-growing hematology analyzers market in Europe during the study period, due to the robust healthcare ecosystem of the country. A report by the International Trade Administration, published in August 2025, reveals that, as the third largest medical technology market, the value of Germany was USD 44 billion in 2025. The healthcare market of the country generated a year-on-year economic output worth USD 838 billion. Adhering to all these facts, one can adapt to the scenario that healthcare organizations have an adequate financial situation to adopt advanced diagnostic technologies like hematology analyzers and increase their market accessibility. Around 24.9% of the population of the country was aged 65 and older in 2023. This indicates the probability of a strong prevalence of hematological and chronic disorders, which can fuel the demand for hematology analyzers.

The UK hematology analyzers market is projected to hold an extensive revenue share during the stipulated timeframe, on account of the growing prevalence of chronic diseases, leading to drastic amounts of deaths. This is influencing the demand for advanced medical devices like hematology analyzers to detect and prevent diseases at their early stages of development. As reported by the Health Foundation in July 2023, around 9.1 million of the population in England are estimated to live with major illnesses by 2040. An aging population within the country is driving a surge in the prevalence of hematological disorders, such as leukemia and anemia, which can boost the use of the medical device in performing blood tests regularly in the upcoming years. As disclosed by Leukaemia UK, approximately 3,100 individuals are diagnosed with Acute Myeloid Leukemia each year, and 42% of the cases are among patients aged 75 and over.

Source: WHO

Asia Pacific Market Insights

The Asia Pacific hematology analyzers market is projected to account for a significant revenue share by the end of 2036, as a consequence of the rising government investments across different countries for the development of healthcare infrastructure. This indicates the likelihood of a high adoption of advanced and automated medical devices, including hematology analyzers. The demand for medical devices is also expected to surge with the growing prevalence of chronic and infectious diseases. According to the Asian Development Bank in June 2025, people of over 20 nations of the region are vulnerable to a 20% risk of dying prematurely because of chronic diseases.

China can emerge as a steadily expanding hematology analyzers market at an extensive CAGR during the forecast timeline, owing to lucrative investment opportunities. Potential investors interested in the production of hematology analyzers can get adequate financial support from the government. As reported by the International Trade Administration in September 2025, China emerged as the second-largest healthcare market globally in 2024. The market value surpassed USD 1 trillion and is expected to reach USD 1.5 trillion in 2029. Around 60% of health expenses are initiated by the government under the Healthy China 2030 initiative. This is expected to drive further expansion of the sector, which increases the chances of an accelerated adoption of hematology analyzers in clinical settings.

The hematology analyzers market in India is likely to witness exponential growth, owing to the susceptibility of a large pool of the population to blood disorders. This is also a significant factor driving the need for blood across the country. A study, published by the Observer Research Foundation (ORF) in October 2025, states that the parliament was informed regarding an annual blood requirement of a projected 14.6 million units by the government. During the financial year 2024-2025, 14,601,147 units of blood were consumed, an increase 15% from 12,695,363 units in 2023. As a result, the demand for hematology analyzers can rise dramatically to perform blood cell analysis.

Key Hematology Analyzers Market Players:

- Abbott Laboratories (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sysmex Corporation (Japan)

- Beckman Coulter (U.S.)

- Siemens Healthineers (Germany)

- Danaher Corporation (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Bio-Rad Laboratories (U.S.)

- HORIBA Ltd. (Japan)

- Mindray Medical International Limited (China)

- Nihon Kohden Corporation (Japan)

- Boule Diagnostics AB (Sweden)

- Ortho Clinical Diagnostics (U.S.)

- Diatron MI PLC (Hungary)

- Thermo Fisher Scientific Inc. (U.S.)

- Agilent Technologies Inc. (U.S.)

- Abbott Laboratories is a leading global healthcare company specializing in diagnostics, medical devices, and pharmaceuticals. In hematology, Abbott provides advanced analyzers and reagents that enable accurate and rapid blood testing, supporting clinical decision-making in hospitals and laboratories worldwide.

- Sysmex Corporation is a major Japanese provider of hematology analyzers and diagnostic solutions. The company focuses on innovative automation, digital integration, and high-throughput blood testing, making it a key player in clinical laboratories and healthcare institutions globally.

- Beckman Coulter develops and manufactures a wide range of hematology analyzers, reagents, and workflow solutions. Its technologies are known for precision, efficiency, and scalability, serving hospitals, laboratories, and research institutions internationally.

- Siemens Healthineers is a leading global medical technology company offering hematology analyzers, laboratory automation, and digital diagnostics. Its solutions emphasize accuracy, workflow optimization, and integration with hospital information systems.

- Danaher Corporation operates through its Life Sciences segment, providing hematology analyzers, reagents, and diagnostic platforms. The company focuses on innovation, reliability, and comprehensive laboratory solutions that enhance diagnostic efficiency worldwide.

Below is the list of the key players operating in the global hematology analyzers market:

The hematology analyzers market globally is highly competitive, which is expected to intensify over time. The dominance of large multinational manufacturers and supplies of the medical device and the association of a large pool of regional players, are intensifying the industry competition. Small players in the market compete with the larger businesses in ways that the industry remains moderately fragmented. In other words, large players cannot acquire the majority of the revenue shares in the presence of small competitors, mainly due to price competition from the small players. The market is becoming moderately fragmented. Research and development is the common area of focus of all the key competitors associated with the global hematology analyzer industry.

Recent Developments

- In May 2025, Lifotronic initiated the official announcement of the new eCL8600 ECLIA Analyzer at the product launch event of the 26th IFCC-EFLM European Congress of Clinical Chemistry and Laboratory Medicine (EUROMEDLAB 2025). The hematology analyzer is equipped with 30 reagents and 80 sample positions, delivering a processing speed of 200 tests per hour while enabling high-throughput sample processing at the same time.

- In December 2024, Zoetis Inc. unveiled its plan to launch Vetscan OptiCell at the Veterinary Meeting & Expo (VMX). Vetscan OptiCell is a screenless point-of-care hematology analyzer built upon a cartridge and AI, and allows for to gain of accurate insights from CBC testing in minutes.

- In June 2024, HORIBA expanded its portfolio of award-winning hematology equipment with the launch of products that are Yumizen H550E (autoloader), Yumizen H500E OT (open tube), and H500E CT (closed tube). The technologies are capable of delivering combined testing for CBC/DIFF with Erythrocyte Sedimentation Rate (ESR) from the entire blood in a minute of time.

- Report ID: 3295

- Published Date: Nov 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hematology Analyzers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.