Hemato Oncology Testing Market Outlook:

Hemato Oncology Testing Market size was over USD 4.04 billion in 2025 and is poised to exceed USD 14.21 billion by 2035, witnessing over 13.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hemato oncology testing is evaluated at USD 4.53 billion.

The continuous advancements in drug discoveries and testing solutions are expected to augment the hemato oncology testing market growth in the coming years. Several companies are focused on developing customized diagnostic solutions to cater to the rising prevalence of cancer cases, including hemato cancer. Precision medicines and personalized diagnostic technologies are emerging as effective solutions compared to traditional counterparts as they are formulated on one’s specific genetic compositions. For instance, in March 2022, Invitae Corporation launched a personalized cancer-detecting (PCM) platform to diagnose minimal or molecular residual disease (MRD) in patients with solid tumors. This PCM platform detects circulating tumor DNA in blood using a set of personalized assays to get reliable results.

Key Hemato Oncology Testing Market Insights Summary:

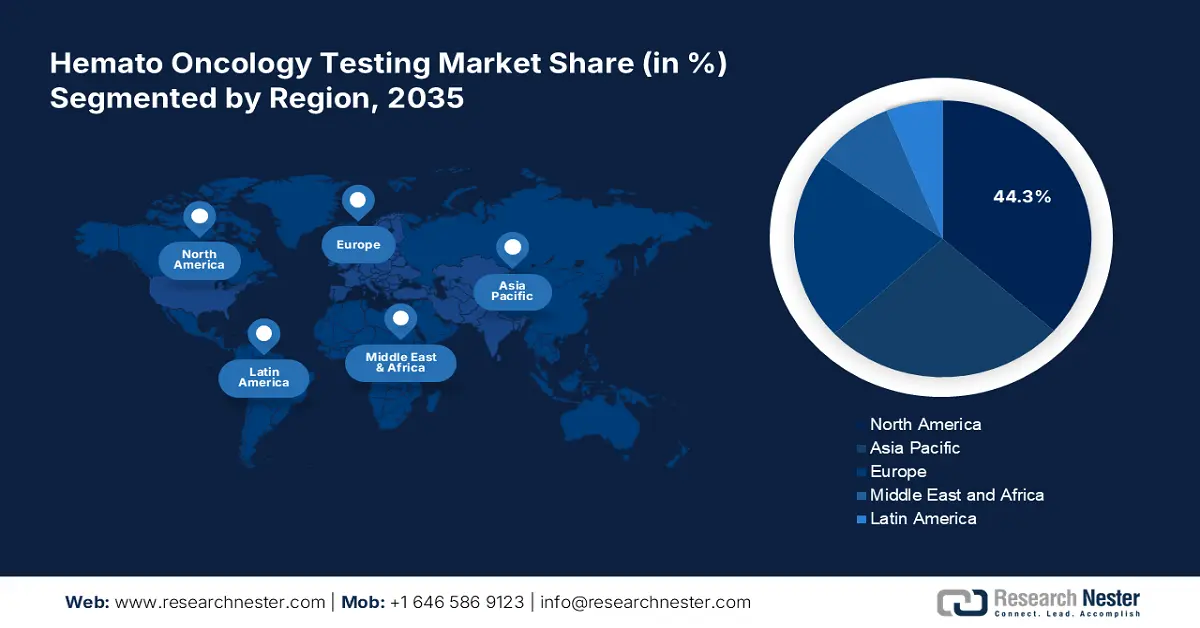

Regional Highlights:

- North America leads the Hemato Oncology Testing Market with a 44.30% share, driven by advanced healthcare facilities and cancer research organizations, positioning it for sustained growth through 2035.

- The Asia Pacific Hemato Oncology Testing Market is projected to undergo rapid growth by 2035, driven by increasing healthcare investments and cancer testing initiatives.

Segment Insights:

- The Lymphoma segment is projected to hold over 52.1% market share by 2035, driven by the high prevalence of Hodgkin and non-Hodgkin lymphoma worldwide.

- The Kits & Reagents segment is forecasted to capture 41.3% market share by 2035, driven by increasing cases of blood cancers and demand for accurate diagnostic solutions.

Key Growth Trends:

- Rising cases of blood cancer

- Introduction of advanced technologies

Major Challenges:

- Limited access to advanced healthcare settings

- Complex and lengthy product approval process

- Key Players: F. Hoffmann-La Roche AG, Abbott Laboratories, ARUP Laboratories, Bio-Rad Laboratories Inc., Danaher Corporation, Entrogen Inc., and Illumina, Inc.

Global Hemato Oncology Testing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.04 billion

- 2026 Market Size: USD 4.53 billion

- Projected Market Size: USD 14.21 billion by 2035

- Growth Forecasts: 13.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 14 August, 2025

Hemato Oncology Testing Market Growth Drivers and Challenges:

Growth Drivers

-

Rising cases of blood cancer: The increasing cases of cancer and blood-related disorders are substantially contributing to the demand for advanced hemato oncology testing kits and technologies. For instance, according to the Leukemia & Lymphoma Society of Canada analysis, every 3 minutes an individual in the U.S. is diagnosed with myeloma, leukemia, or lymphoma. Furthermore, the World Cancer Research Fund International revealed that in 2022, around 4,87,294 new leukemia cancer cases and 1,87,952 new multiple myeloma cases were detected worldwide, respectively. Such high prevalence of blood cancer accelerates the need for advanced and reliable hemato oncology testing solutions.

-

Introduction of advanced technologies: The integration of digital technologies such as artificial intelligence (AI), machine learning (ML), deep learning, and big data analytics is emerging as a game changer in hematologic cancer screening. The AI and ML algorithms effectively manage large datasets of parameters and easily analyze the interactions between several attributes, making it easy to find a reliable result. The AI-supported evaluation systems identify cancerous cells with high accuracy and speed, minimizing human errors. In September 2024, Harvard Medical School revealed that their scientists have developed an AI platform, which is capable of performing the diagnosis of various types of cancer.

Challenges

-

Limited access to advanced healthcare settings: Inadequate healthcare infrastructure can significantly hamper the adoption of advanced hemato oncology testing solutions. Many underdeveloped and developing economies lack specialized laboratories which limits the performance of advanced testing. Modern diagnosis often requires the availability of high-tech or compatible equipment and instruments, which may not be available in smaller or budget-constrained healthcare settings. This gap may limit the sales of advanced hemato oncology testing products.

-

Complex and lengthy product approval process: Strict regulations and lengthy product approval procedures often delay the entry of innovative testing technologies. Countries across the world have varying regulatory frameworks for diagnostic test solutions, which increases the approval times. Heamto oncology testing manufacturers face huge profit losses because of these complex and lengthy approval processes.

Hemato Oncology Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.4% |

|

Base Year Market Size (2025) |

USD 4.04 billion |

|

Forecast Year Market Size (2035) |

USD 14.21 billion |

|

Regional Scope |

|

Hemato Oncology Testing Market Segmentation:

Product & Service (Instruments, Kits & Reagents, Software & Services)

In hemato oncology testing market, kits & reagents segment is projected to hold revenue share of more than 41.3% by 2035. For instance, in 2021, F. Hoffmann-La Roche AG announced the launch of the AVENIO tumor tissue comprehensive genomic profiling (CGP) kit. This is an expansion of the company in the personalized cancer research segment for better care and effective clinical decision-making. Furthermore, the increasing cases of blood cancers augment the need for accurate diagnostic solutions including, kits and reagents. In addition, the ongoing research in hemato oncology including clinical trials and studies and rising demand for testing kits and reagents in both academic and commercial labs are expected to boost segment growth during the forecast period.

Cancer Type (Leukemia, Lymphoma)

By 2035, lymphoma segment is anticipated to dominate hemato oncology testing market share of over 52.1% owing to high prevalence of Hodgkin lymphoma and non-Hodgkin lymphoma worldwide. The World Cancer Research Fund International estimated that in 2022, around 82,469 new Hodgkin lymphoma cases were detected worldwide. Also, the American Cancer Society anticipates that about 80,620 Americans are expected to be diagnosed with non-Hodgkin lymphoma in 2024. Understanding the importance of hemato oncology cancer care, many public and private research organizations are initiating diagnostic and awareness programs. For instance, the 15th of September each year is celebrated as World Lymphoma Awareness Day.

Our in-depth analysis of the market includes the following segments:

|

Product & Service |

|

|

Cancer Type |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hemato Oncology Testing Market Regional Analysis:

North America Market Forecast

North America industry is predicted to dominate majority revenue share of 44.3% by 2035, share owing to the presence of advanced healthcare facilities and cancer research organizations. The increasing population rate of the senior population, growing awareness of advanced treatment and diagnostic options, and rising prevalence of blood cancer are collectively contributing to the hemato oncology testing market growth.

The U.S. market is estimated to increase at a robust CAGR till 2035 owing to rising healthcare expenditure, continuous introduction of advanced diagnostic technologies, and presence of leading manufacturing companies. The U.S. is also witnessing a high prevalence of blood-related disorders including cancer, contributing to the high demand for hemato oncology testing technologies. For instance, according to the Leukemia & Lymphoma Society of Canada, combined a total of 1,87,740 U.S. individuals are expected to be diagnosed with lymphoma, leukemia, or myeloma in 2024.

In Canada, the rising prevalence of hemato cancer and the presence of advanced cancer research and treatment organizations and healthcare facilities are boosting the demand for innovative hemato oncology testing solutions. The Leukemia & Lymphoma Society of Canada, Canadian Cancer Society, and Ontario Institute of Cancer Research are some of the top research organizations in the country.

Asia Pacific Market Statistics

The Asia Pacific market is expected to register a rapid CAGR the projected period owing to the increasing investments in healthcare infrastructure development, growing government initiatives for cancer testing and care, and the rising entrance of international pharma firms in the region. The sedentary lifestyles and poor eating habits are increasing the risk of cancer among youngsters and adults, while the growing senior citizen population rates who are more susceptible to chronic disorders such as blood cancer is fuelling the demand for advanced hemato oncology testing solutions in the region.

In India, supportive government initiatives related to healthcare infrastructure development, and cancer care and awareness programs are positively influencing the hemato oncology testing market growth. For instance, the government under its Rashtriya Arogya Nidhi initiative offers financial assistance to patients with low income or those who are below the poverty line for the treatment of life-threatening diseases including, cancer. Such initiatives are increasing the demand for advanced hemato oncology testing solutions in the country.

China has a large older population that easily gets affected by several chronic disorders such as cardiovascular issues, lung diseases, and cancer. This has a direct influence on the sales of diagnostic technologies including hemato oncology testing solutions. According to a report by Frontiers, in China around 1,05,667 cases of leukemia were detected in 2021.

Key Hemato Oncology Testing Market Players:

- F. Hoffmann-La Roche AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abbott Laboratories

- ARUP Laboratories

- Bio-Rad Laboratories Inc.

- Danaher Corporation

- Entrogen Inc.

- Illumina, Inc.

- Invivoscribe, Inc.

- Invitae Corporation

- Qiagen N.V.

- Thermo Fisher Scientific, Inc.

- Vela Diagnostics

- Horiba Medical

The key players in the hemato oncology testing market are employing several organic and inorganic tactics to earn high profits and increase their market reach. Leading companies are collaborating with other players and research organizations to develop innovative hemato oncology testing technologies. Such strategic partnerships are also aiding them to improve their product offerings. Furthermore, market players are entering into mergers & acquisitions and regional expansion strategies to reach a wider audience base.

Some of the key players include:

Recent Developments

- In September 2024, F. Hoffmann-La Roche AG announced the expansion of its digital diagnostic offerings. Its digital pathology environment was integrated with over 20 new advanced AI algorithms from 8 new collaborators. This move is expected to boost the company’s AI-enabled cancer diagnostics division.

- In April 2024, Horiba Medical announced the launch of its next-gen fully automated modular hematology solution. This CE-IVDR-approved solution offers flexible and high-quality analytical performance.

- In November 2023, Roswell Park Comprehensive Cancer Center announced the development of innovative, high-speed blood cancer tests. The PanHeme test is based on next-gen gene sequencing technology that effectively detects hemato oncology such as leukemia, lymphoma, and myeloma.

- Report ID: 6632

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hemato Oncology Testing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.