Helicopter Skid Landing Gear Market Outlook:

Helicopter Skid Landing Gear Market size was valued at USD 963.2 million in 2025 and is set to exceed USD 1.89 billion by 2035, expanding at over 7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of helicopter skid landing gear is estimated at USD 1.02 billion.

The demand for helicopter skid landing gear has increased significantly owing to the innovations in composite materials combined with lightweight alloys, which improve durability and shock absorption performance while preventing corrosion damage. Using carbon fiber-reinforced polymers and titanium alloys in engineering designs has enabled massive weight reductions alongside systems' structural stability maintenance. According to statistics by Engineering Research Journal, carbon fiber landing gear reduced the overall weight by 54% through tailored layup optimization.

These materials deliver superior toughness and rigidity while weighing drastically, less than conventional metallic components, which leads to reduced helicopter weights, better fuel economy, and larger cargo capability. Airbus Helicopters, for instance, leads industry development through their implementation of advanced composite materials across their helicopter design process. The Airbus Helicopters H160 implements a composite fuselage structure throughout, leading to a lightweight deployment that boosts efficiency. Using this weight reduction strategy improves helicopter performance and lowers fuel costs for operators.

Key Helicopter Skid Landing Gear Market Insights Summary:

Regional Insights:

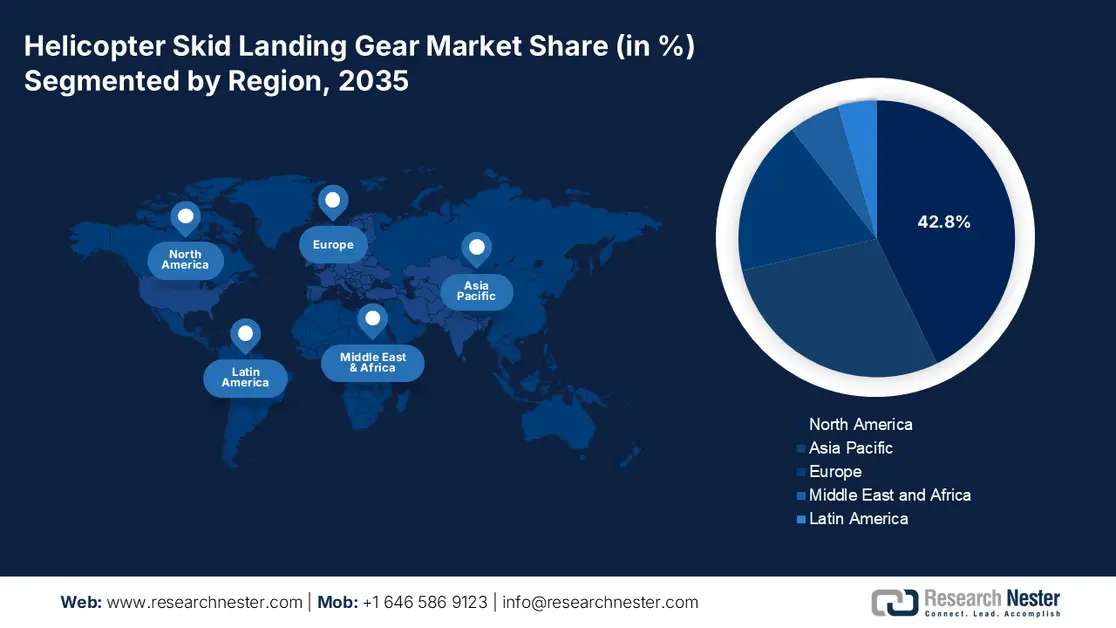

- By 2035, the North America helicopter skid landing gear market is anticipated to secure over 42.8% share, propelled by escalating military utilization and expanding search-and-rescue deployments.

- The Asia Pacific region is projected to expand rapidly during 2026–2035, fueled by increasing cross-sector helicopter operations and the rising adoption of lightweight composite landing gear technology.

Segment Insights:

- The civil helicopters segment is expected to command about 57.1% share by 2035 in the helicopter skid landing gear market, supported by heightened EMS and law-enforcement mission needs that favor the agility and cost efficiency of skid-equipped aircraft.

- The retractable skids segment is set to witness strong revenue CAGR through 2026–2035, underpinned by surging emphasis on aerodynamic improvements and improved fuel economy through reduced drag.

Key Growth Trends:

- Increasing demand for utility helicopters

- Procurement of military and defense

Major Challenges:

- Low load carrying capacity

- Competition from UAM and eVTOL

Key Players: Safran, Robinson Helicopter Company, Rotex Helicopter Services GmbH, Korea Aerospace Industries Ltd, Kazan Helicopters, Kamov, Enstrom Helicopter Corporation, Airbus, Boeing, Daher, UlanUde Aviation Plant, Hindustan Aeronautics Ltd., Leonardo S.p.A., Bell Textron Inc.

Global Helicopter Skid Landing Gear Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 963.2 million

- 2026 Market Size: USD 1.02 billion

- Projected Market Size: USD 1.89 billion by 2035

- Growth Forecasts: 7%

Key Regional Dynamics:

- Largest Region: North America (42.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, Canada

- Emerging Countries: India, Brazil, Australia, South Korea, United Arab Emirates

Last updated on : 2 December, 2025

Helicopter Skid Landing Gear Market - Growth Drivers and Challenges

Growth Drivers

-

Increasing demand for utility helicopters: The helicopter skid landing gear market accounts for substantial growth, owing to the rising requirements of light and utility helicopters across several sectors including emergency medical services, law enforcement, military reconnaissance platforms, and tours. The lightweight helicopters rely on skid-type landing gear, due to its reduced weight, cost-effectiveness, and simplicity.

Significant changes have taken place in the utility sector in recent years. For instance, in January 2025, Hindustan Aeronautics Limited (HAL) and the Indian Armed Forces collaborated to launch the Light Utility Helicopter to replace aging aircraft fleets. The LUH demonstrates a skid-based landing gear system that fulfills the industry's demand for lightweight versatile configurations. The experiences continuous expansion as the industry leaders forge strategic partnerships to drive performance improvement and helicopter versatility advancement through technological breakthroughs. -

Procurement of military and defense: The defense sector is experiencing major changes owing to the forces that are increasingly buying helicopters that use skid landing gear for light attack and training operations. Defense forces validate these helicopters, as these offer agility while being affordable and suitable for multiple operational environments, including border security, search and rescue, and troop transport. Major defense sectors are expanding their fleets, and implementing advancements in their operations. In October 2024, The Nigerian Air Force acquired 24 Italian-made attack jets and 10 Trekker helicopters from Leonardo S.p.A. as part of its fleet expansion. The country’s military operations are expected to enhance capabilities through helicopters that depend on skid landing gear systems.

Challenges

-

Low load carrying capacity: The lightweight helicopters use skid landing gear, owing to its basic design and compact nature. Due to its insufficient payload handling capability, the design limits application in heavy-lift and transport helicopters. Heavy aircraft wheeled landing gears provide shock absorption and taxiing ability that fulfill demands of cargo transport and military operations, alongside offshore operations equipped with regular ground movement with heavy payloads.

-

Competition from UAM and eVTOL: Rapid advancements in Urban Air Mobility (UAM) together with electric vertical take-off and landing (eVTOL) aircraft show signs of reducing skid-equipped helicopter demand, attributed to eVTOL manufacturers' focus on wheeled and retractable landing gear systems for better performance in urban areas. Companies have been making significant investments in next-gen aircraft designed for air taxi operations while diverting resources from traditional helicopters that use skid landing systems.

Helicopter Skid Landing Gear Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7% |

|

Base Year Market Size (2025) |

USD 963.2 million |

|

Forecast Year Market Size (2035) |

USD 1.89 billion |

|

Regional Scope |

|

Helicopter Skid Landing Gear Market Segmentation:

Application Segment Analysis

Civil helicopters segment is expected to dominate around 57.1% helicopter skid landing gear market share by the end of 2035, due to the rising need for EMS services along with law enforcement operations. Skid landing gear helicopters remain the preferred choice in these operations, owing to their affordability and spatial flexibility that match the operational requirements. Skid landing gear stands out due to its basic design, which fits best in cases requiring urgent responses, creating better mission-run performance.

The tourist industry has led to amplified helicopter use in aerial tours and private charter flights. Skid-equipped helicopters provide the best solution for these sectors, due to their maintenance affordability and diverse terrain landing capability, which makes them among the standout choices. This helicopter skid landing gear market demand has prompted manufacturers to launch new models that combine upgraded passenger comfort functionality with panoramic windshield features. Recent improvements to skid landing gear systems concentrate on aerodynamic optimization and aesthetic enhancements that target the luxury tourism market.

Type Segment Analysis

The retractable skids segment in helicopter skid landing gear market is expected to register robust revenue CAGR during the forecast period as these skids improve performance and fuel efficiency through decreased aerodynamic drag. Thus, the increasing focus on better fuel economy and lower environmental emissions is expected to increase the adoption of retractable skids. Moreover, the growing demand for helicopter services across several sectors, a high focus on enhancing aerodynamic efficiency, and rising investments in developing advanced retractable skids are predicted to support segment growth going ahead.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

Type |

|

|

Material |

|

|

Weight Class |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Helicopter Skid Landing Gear Market - Regional Analysis

North America Market Insights

North America helicopter skid landing gear market is set to hold revenue share of over 42.8% by the end of 2035. The growth is attributed to the increase in the use of helicopters in military applications as well as search and rescue operations. Rising commercial helicopter adoption within aerial tourism along with EMS operations, and oil and gas extraction activities also drive the regional market's expansion. EMS services in the region are making extensive use of helicopters featuring skid systems for quick patient retrieval throughout remote areas that remain inaccessible to standard emergency transport vehicles.

The U.S. helicopter skid landing gear market is witnessing significant growth, owing to the growing civil aviation industry along with charter services. The helicopters support various commercial operations together with private-sector transport and corporate services. Operations conducted in distant areas such as private estates and offshore sites succeed best with splined landing gear systems.

Companies in the country are making advancements in their aircraft, which is also accelerating the helicopter skid landing gear market growth. For instance, in November 2024, the commercial helicopter services of Lockheed Martin's Sikorsky division increased the inspection intervals of S-92 helicopters. With this advancement, the operators will be able to safely keep the aircraft in service longer between inspections. Agricultural helicopter adoption in the country also continues to grow steadily, while also expanding for the purposes of crop protection and inspection. Helicopters operating with skid landing gear systems prove particularly valuable for agricultural operations as this gear allows aircraft to safely land in the irregular terrains found in rural regions.

The helicopter skid landing gear market in Canada is growing due to the rugged and vast areas in the country. The local government has increased its investment in wildlife monitoring services as well as forest preservation programs. Skid landing gear helicopters enable scientists to conduct wildlife surveys by enabling safe landings across forested and marshy landscapes during conservation operations.

Asia Pacific Market Insights

The Asia Pacific helicopter skid landing gear market is expected to witness a rapid expansion between 2026 and 2035 as diverse sectors demonstrate increasing demand for helicopter-based operations. Despite challenging conditions and restricted infrastructure, these helicopters maintain their superiority through their broad operating capacity between tight areas and uneven land features. The growth of the APAC helicopter skid landing gear market is also attributed to the requirement of organizations for efficient technology, cost efficacy, and system durability. The region benefits from composite materials that deliver lightweight functionality, durability, and corrosion resistance. The use of advanced materials across landing gears continues to advance performance capabilities and decrease maintenance expenses, thereby supporting military and commercial helicopter operations.

The China helicopter skid landing gear market is expected to propel due to the rising military budget allocations. China invests heavily in defense programs that drive helicopter purchases of tactical and light aircraft designs with skid-type landing gear systems. These helicopters have multiple roles such as border protection, reconnaissance, and emergency rescue missions. The military finds skid landing gear systems compelling due to their basic construction and their superior performance on rugged surfaces. Tourism helicopters have been experiencing higher demand within the country as travelers in China increasingly depend on helicopter tours to access remote areas. Moreover, manufacturers are introducing new models that integrate convenience for passengers while ensuring operational efficiency through actions that fuel market expansion.

The helicopter skid landing gear market in India is expanding as the local government is been making investments in broadening and updating the country's civil aviation systems. One such example is the Ude Desh ka Aam Naagrik (UDAN) Scheme works to connect regional areas by air through its efforts which triggers a growing demand for helicopters in these helicopter skid landing gear markets. The initiative has resulted in rising helicopter operations in remote geographical locations, including hilly areas, as the skid landing gear demonstrates essential functionality in these conditions.

Helicopter Skid Landing Gear Market Players:

- Safran

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Robinson Helicopter Company

- Rotex Helicopter Services GmbH

- Korea Aerospace Industries Ltd

- Kazan Helicopters

- Kamov

- Enstrom Helicopter Corporation

- Airbus

- Boeing

- Daher

- UlanUde Aviation Plant

- Hindustan Aeronautics Ltd.

- Leonardo S.p.A.

- Bell Textron Inc.

The competitive landscape of the helicopter skid landing gear market is rapidly evolving, attributed to the integration of advanced technologies in energy management systems by key players. They are focused on developing new technologies and products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global helicopter skid landing gear market:

Recent Developments

- In August 2023, All Airbus Helicopters Model EC120B, EC130B4, and EC130T2 helicopters received a safety directive from the Federal Aviation Administration. The directive sets specific guidelines to address landing gear safety issues for expanded aircraft operational safety.

- In January 2023, Leonardo delivered the AW169M helicopter with novel skid undercarriage capability. This fleet comprises 24 units spread across six models with landing gear fixed in position and 18 units enabled with skid undercarriage functions for military and civilian aviation tasks.

- Report ID: 7088

- Published Date: Dec 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Helicopter Skid Landing Gear Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.