Heat Transfer Fluids Market Outlook:

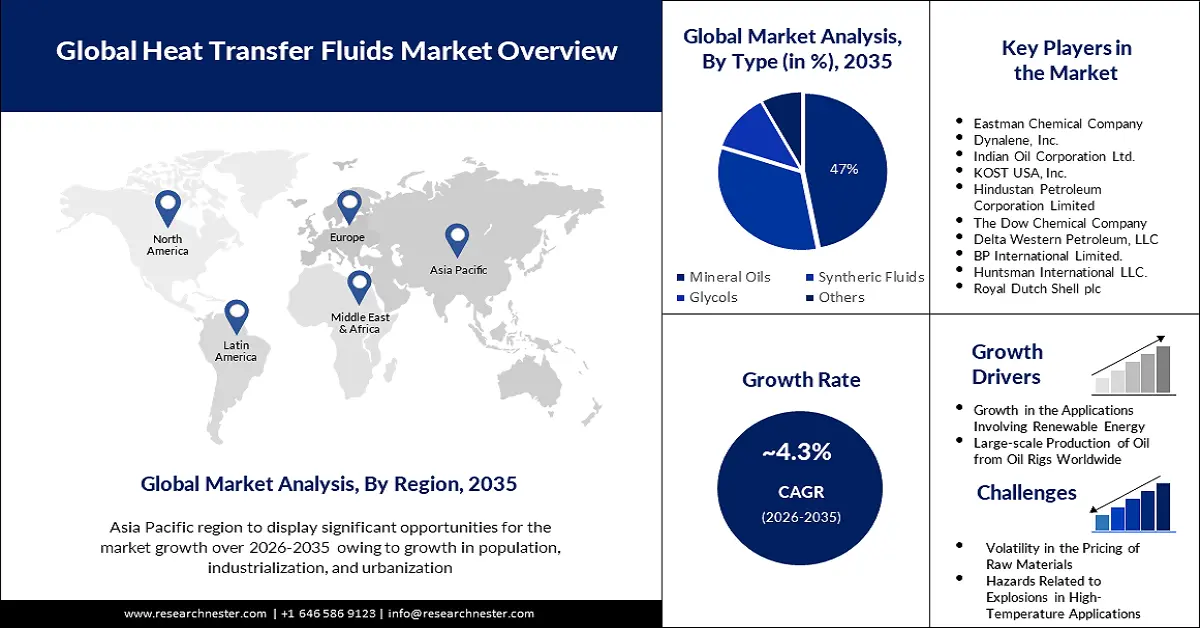

Heat Transfer Fluids Market size was valued at USD 11.79 billion in 2025 and is set to exceed USD 17.96 billion by 2035, expanding at over 4.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of heat transfer fluids is estimated at USD 12.25 billion.

The high demand for clean energy, such as solar power, all over the world is thought to be the major factor driving the growth of the market. Further, the market should also benefit from applications in different industries, including food & beverage, chemical, automotive, renewable energy, pharmaceuticals, oil and gas, and more. According to International Energy Agency (IEA), the power generation from solar photovoltaic (PV) increased by 179 terawatt hours (TWh) between 2020 and 2021. The agency also adds that about 3.6% of the globally generated electricity got generated for Solar PV.

In addition to these factors, the market should also benefit from the rapid and steady growth of urbanization and industrialization in the world. For instance, according to the World Bank, the urban population as a percentage of the world's total population increased steadily from 52% in 2010 to 56% by 2021. Similarly, the total urban population in the world, which stood at 4 billion in 2021, has been projected to grow to 7 billion by 2050. Further, business expansions, acquisitions, and the launch of new innovative products should also create many opportunities for the growth of the market during the forecast period.

Key Heat Transfer Fluids Market Insights Summary:

Regional Highlights:

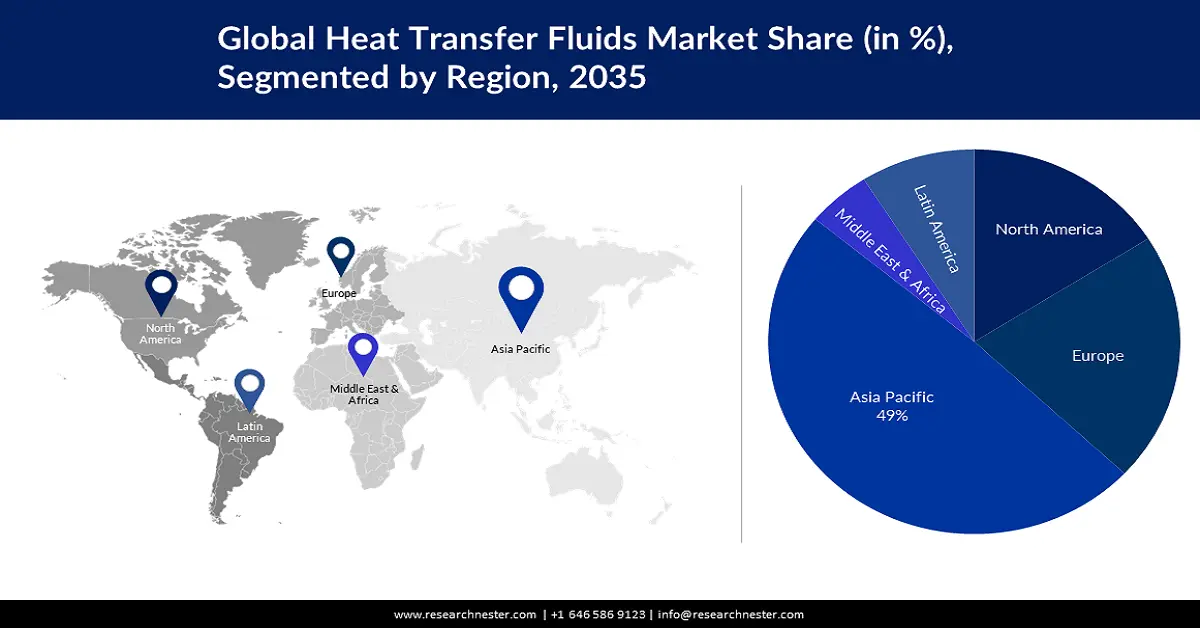

- Asia Pacific heat transfer fluids market will dominate more than 46% share by 2035, driven by rapid industrialization, urbanization, and infrastructure development.

- Europe market will hold the second largest share by 2035, driven by increasing energy demand and infrastructure for solar energy production.

Segment Insights:

- The mineral oils segment in the heat transfer fluids market is anticipated to hold a 47% share by 2035, driven by high demand for mineral oils in various applications across different industries.

- The oil & gas segment in the heat transfer fluids market is anticipated to secure a 24% share by 2035, driven by the inevitable role of heat transfer fluids in all phases of oil production.

Key Growth Trends:

- Tremendous Growth in the Applications Involving Renewable Energy

- Remarkable Growth of the Automotive Sector

Major Challenges:

- Volatility in the Pricing of Raw Materials

- Hazards Related to Explosions in High-Temperature Applications

Key Players: Eastman Chemical Company, Dynalene, Inc., Indian Oil Corporation Ltd., KOST USA, Inc., Hindustan Petroleum Corporation Limited, The Dow Chemical Company, Delta Western Petroleum, LLC, BP International Limited., Huntsman International LLC., Royal Dutch Shell plc.

Global Heat Transfer Fluids Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.79 billion

- 2026 Market Size: USD 12.25 billion

- Projected Market Size: USD 17.96 billion by 2035

- Growth Forecasts: 4.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 11 September, 2025

Heat Transfer Fluids Market Growth Drivers and Challenges:

Growth Drivers

- Tremendous Growth in the Applications Involving Renewable Energy - Heat transfer fluids play a major role in applications where renewable energy is used. For instance, in a solar water heater system, it is the heat transfer fluid that transfers heat through a heat exchanger and solar collector to the heat storage tanks. It is estimated that renewable energy sources accounted for about 29% of the total global electricity generation in 2021.

- Remarkable Growth of the Automotive Sector - The machinery used in the automotive industry requires constant regulation of temperature and pressure. Heat transfer fluids help avoid overheating of machinery and enable these machineries to work efficiently in all temperatures. This also increases the life span of the machinery. Hence, the growth of the automotive sector is expected to result in market growth. It is estimated that the global sales of automobiles did amount to 67 million units by 2021.

- Large-scale Production of Oil from Oil Rigs Worldwide - The drilling of oil from oil wells under high temperatures and pressure often makes use of formate brines, such as potassium formate brine, for heat transfer. Hence the increase in the global production of oil is expected to lead to market growth by 2035. For instance, before the onset of the pandemic, the global oil production volume reached an all-time high of up to 96 million barrels.

- Notable Growth of the Food Processing Sector in Many Parts of the World - Heat transfer is critical in the food processing industry as heating is inevitable not only to ensure product quality but also to develop the correct texture and flavor of food. Further, food processing also employs many thermal processing operations such as baking, canning, and pasteurization. Hence the tremendous growth of the food procession industries in different parts of the world is expected to contribute to the market growth considerably. For instance, as of 2023, the food processing industry in India has generated close to 13% of all employment among Registered Factory sector in the country.

- Wide Demand for Chemicals for Various Applications - Several manufacturing processes of chemicals make use of heat transfer fluids to ensure uniform and precise cooling and heating throughout the process. Chemical manufacturing also includes equipment applications such as reboilers, distillation towers, autoclaves, chemical reactors, jacketed vessels, and more. Hence the large demand for chemicals worldwide is expected to lead to market growth. For instance, it is estimated that Asia Pacific alone sold chemicals worth USD 3 trillion in 2021.

Challenges

- Volatility in the Pricing of Raw Materials - The fluctuating price of raw materials used in the production of heat transfer fluids is thought to be the major factor that should hinder market growth during the forecast period. The major raw materials involved in the manufacturing of heat transfer fluids include benzene, phenol, and glycol. It was observed that there was an increase of about 26% in the average monthly price for each metric ton of benzene in June 2022 compared to the same period in 2021.

- Hazards Related to Explosions in High-Temperature Applications

- Need to Regularly Carry Out Health Checks of Heat Transfer Fluids and Systems

Heat Transfer Fluids Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.3% |

|

Base Year Market Size (2025) |

USD 11.79 billion |

|

Forecast Year Market Size (2035) |

USD 17.96 billion |

|

Regional Scope |

|

Heat Transfer Fluids Market Segmentation:

By Type Segment Analysis

The global industry is segmented and analyzed for demand and supply by type into mineral oils, synthetic fluids, glycols, and others. Out of the three types, the subsegment of mineral oils is expected to hold the largest market share by 2035. Mineral oils should hold a market share of up to 47% by 2035. The growth of the subsegment can be attributed to the high demand for mineral oils in various applications in different industries, including chemicals, pharmaceuticals, food & beverages, and others. For instance, the demand for white oil-grade mineral oil in the United States (U.S.) alone is expected to surpass 399999 tons in 2025. The low cost of mineral oils and their easy availability from refineries make mineral oil the most popular preference for different applications. Even though synthetic fluids soon follow mineral oils, the cost involved in replacing the mineral oils is much less compared to synthetic fluids. Further, mineral oil is in wide use in several regions of the world, including the Asia Pacific and the Middle East and Africa.

End-use Industry Segment Analysis

The global heat transfer fluids market is also segmented and analyzed for demand and supply by end-use industry into chemical, oil & gas, food & beverage, pharmaceuticals, renewable energy, automotive industry, HVAC and refrigeration, and others. Amongst these end-use industries, the industry of oil & gas is expected to hold the largest market share by the end of the forecast period. It is estimated that the oil & gas industry should hold a market share of 24% by 2035. The inevitable role of heat transfer fluids in all phases of oil production is the major factor driving the demand for these fluids in the oil & gas industry. In offshore oil drilling, the heating and regeneration of glycols make use of liquid-phase heat transfer fluids to separate natural gas and water. There were more than 200 offshore rigs in the world by the end of 2021. Similarly, the number of operational oil rigs on land in the world by the end of 2021 was about 1310.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By End-use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Heat Transfer Fluids Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to account for largest revenue share of 46% by 2035. The regional market growth is expected to be led by China, while India, Japan, and South Korea should also contribute considerably to the development of the market. The rapid developments in industrialization, urbanization, and infrastructure in the region following the tremendous growth of the population are thought to be the major factors increasing the applications for heat transfer fluids. It is estimated that more than 59% of the world's population resides in the Asia Pacific as of current times. Further, about 70% of households in India are expected to be using air conditioning by 2040. This tremendous growth in the use of HVAC in India and many places in the region should also prove beneficial for the market.

Europe Market Insights

The European heat transfer fluids market is expected to be the second-largest market during the forecast period. The energy demand in Europe is estimated to increase remarkably to fulfill the demand of the growing population. The market growth in Europe is expected to be led by Germany and Spain. The developments in different industries in these places should help them hold the major shares in the regional market during the forecast period. Further, the infrastructure for solar energy production in the region is projected to grow remarkably in the coming years. Similarly, a mammoth increase of 49% was observed in solar power generation in the EU in 2022 compared to the previous year.

North American Market Insights

North America market is projected to register significant growth during the forecast period. The region houses a significant number of manufacturers and witness several efforts in research and development for innovative solutions in many applications. Further, the concern over carbon emission and the stringent government regulations to bring the emission rate and volume under control should contribute considerably to the regional market growth. For instance, the United States Environmental Protection Agency estimated that the total greenhouse gas emission in the U.S. in 2021 was equivalent to 5,586 million metric tons of carbon dioxide.

Heat Transfer Fluids Market Players:

- Eastman Chemical Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dynalene, Inc.

- Indian Oil Corporation Ltd.

- KOST USA, Inc.

- Hindustan Petroleum Corporation Limited

- The Dow Chemical Company

- Delta Western Petroleum, LLC

- BP International Limited.

- Huntsman International LLC.

- Royal Dutch Shell plc

Recent Developments

- Eastman Chemical Company announced amending its agreement with Krahn Chemie GmbH for the distribution of its heat transfer fluids (HTF) to expand the company's market in southeastern Europe.

- Royal Dutch Shell plc announced the plans for its subsidiary, Shell Lubricants to launch electric vehicle (EV) battery coolants in India with the country's increase in the consumption of electric vehicles.

- Hindustan Petroleum Corporation Limited announced achieving an increase of 192% in its Profit after Tax (PAT) during the period of April-December 2020 compared to the same period in the previous year.

- Report ID: 4931

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Heat Transfer Fluids Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.