Heat Shrink Tubing Kit Market Outlook:

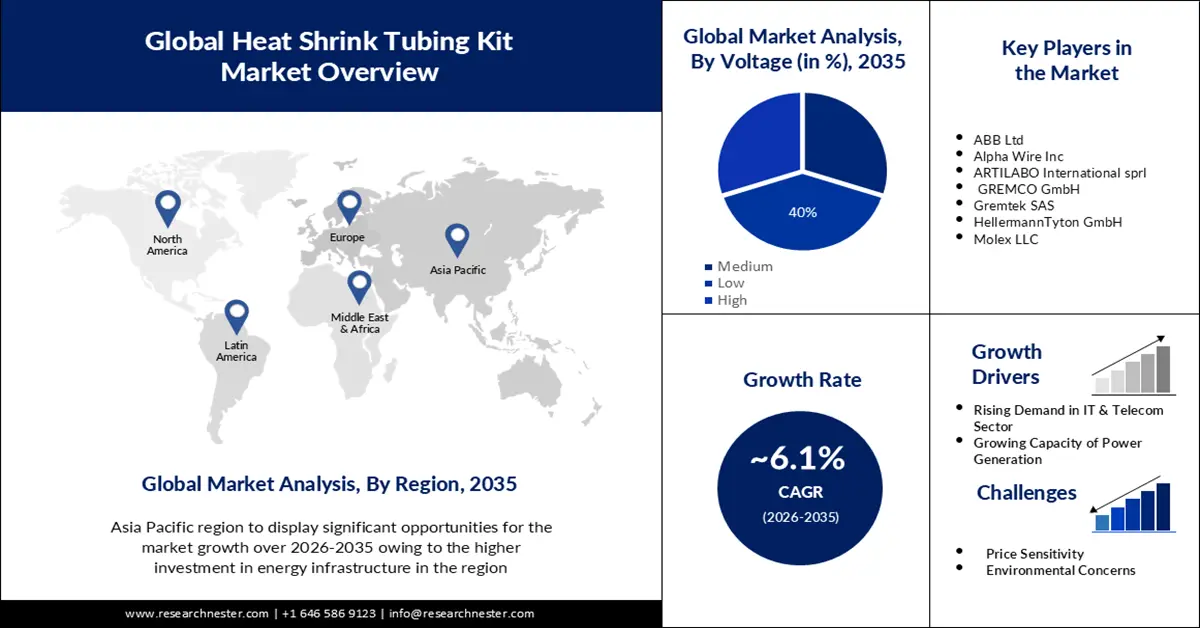

Heat Shrink Tubing Kit Market size was over USD 36.2 billion in 2025 and is poised to exceed USD 65.44 billion by 2035, growing at over 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of heat shrink tubing kit is estimated at USD 38.19 billion.

Transmission and distribution (T&D) of electric power serves as a vital conduit between customers and generating plants. A few things that contribute to the requirement for heat shrink tubes are rising loads, stress brought on by aging equipment, and an increased chance of widespread blackouts. Numerous organizational structures, technologies, types of governmental monitoring, and economic factors make up the transmission and distribution (T&D) industry. Further, lines controlled by investor-owned regulatory utilities (IOUs) handle around 80% of power transactions. Therefore, increasing government support towards the expansion of the T&D system drives the growth of the market in the forecast period. The U.S government’ Infrastructure Investment and Job Act’s offered funds worth USD 2.5 billion for grid modernization

Packaging for sensitive or complex products becomes more intricate in order to safeguard the contents inside. The way that the products are packaged has received a lot of attention lately. Additionally, product packaging comes at a high cost and the weight of the materials used in packing matters. The heat shrink tubing kit market has expanded due to to these features of conventional packaging. Nowadays, heat shrink tubing is the popular option because of its many applications across several verticals, low cost, and ease of availability.

Key Heat Shrink Tubing Kit Market Insights Summary:

Regional Insights:

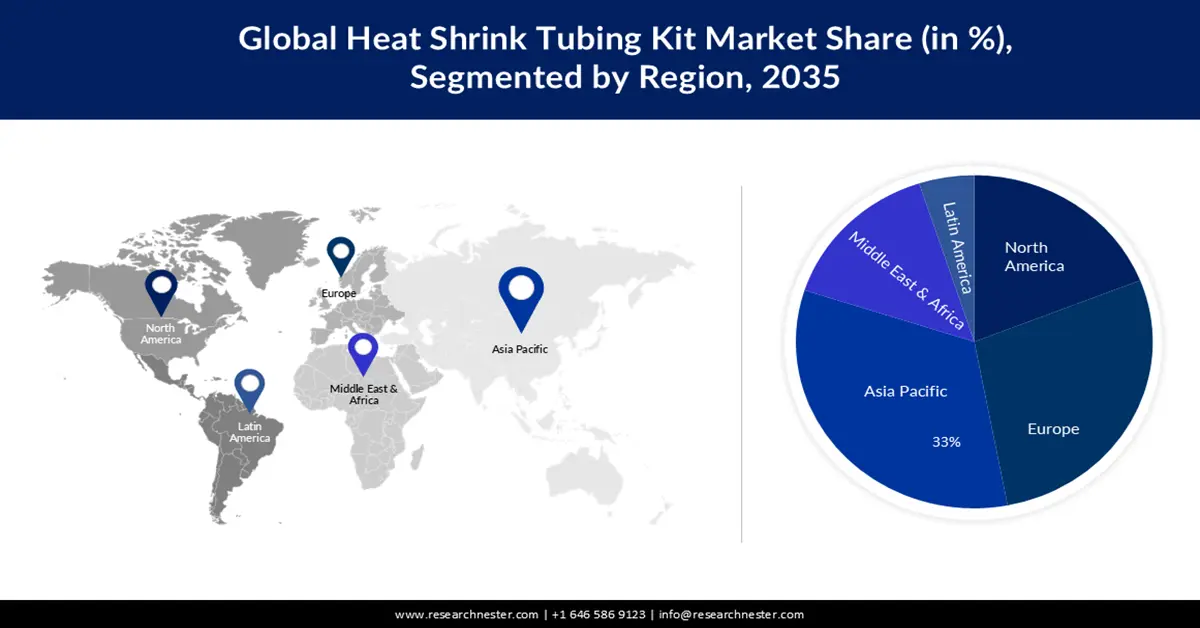

- Across 2025–2035, the Asia Pacific region in the heat shrink tubing kit market is anticipated to capture a 33% share, fostered by expanding electrification and large-scale energy infrastructure investments.

- By 2035, the Europe region is projected to experience notable growth, underpinned by ongoing infrastructure development and technological advancements in heat-shrink tubing solutions.

Segment Insights:

- By 2035, the low voltage segment in the heat shrink tubing kit market is projected to command a 40% share, sustained by escalating utilization of heat-shrinkable tubes across insulation, sealing, and consumer electronics applications.

- Over 2026–2035, the polyolefin segment is anticipated to secure a 25% revenue share, supported by its superior flame-resistant and flexible material properties.

Key Growth Trends:

- Increasing Capacity for Power Generation

- Increasing Demand in IT & Telecom Sector in the Upcoming Years

Major Challenges:

- Price Sensitivity

- Lack of Awareness about the Heat Shrink Tubing Kit Benefits

Key Players: ABB Ltd, Alpha Wire Inc, ARTILABO International sprl, GREMCO GmbH, Gremtek SAS, HellermannTyton GmbH, Molex LLC, TE Connectivity, Nexans SA.

Global Heat Shrink Tubing Kit Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 36.2 billion

- 2026 Market Size: USD 38.19 billion

- Projected Market Size: USD 65.44 billion by 2035

- Growth Forecasts: 6.1%

Key Regional Dynamics:

- Largest Region: Asia Pacific (33% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: USA, China, Germany, Japan, South Korea

- Emerging Countries: India, Vietnam, Indonesia, Mexico, Brazil

Last updated on : 26 November, 2025

Heat Shrink Tubing Kit Market - Growth Drivers and Challenges

Growth Drivers

-

Increasing Capacity for Power Generation - Heat shrink tubing is produced in two steps. Standard extrusion is the initial phase, and then the tubing is subjected to a secondary procedure that allows it to shrink when heated. The details of this secondary procedure are kept private, but it involves using force and heat to increase the tubing's diameter. The tube is brought down to room temperature while it is still inflated. The tubing will contract to its initial size if it is stiff. Increasing transmission capacity at a reasonable cost can be achieved by upgrading the power lines and substations along current corridors. Reconducting existing lines can boost transmission capacity by utilizing materials like composite conductors, which have a higher current-carrying capacity.

-

Increasing Demand in IT & Telecom Sector in the Upcoming Years - Heat shrink tubes will be used to unprecedented levels in the electrical, IT, and telecom sectors in the upcoming years. Significant advancements in this field are being made with an eye on improving data center and telecommunication security. Heat shrink tubing can be used to dress cable assemblies, providing telecom and IT experts with more alternatives for managing and routing intricate wire networks. The industry will continue to be driven by an increase in the need for insulation and sealing to safeguard the wires in telecommunication connectors. Furthermore, the increasing adoption of technologies such as IoT & cloud computing in the IT & telecom sector is expected to drive market growth as well. By 2030, approximately 29 billion Internet of Things devices are expected to be on the market worldwide, compared with 15.3 billion in 2020.

Challenges

-

Price Sensitivity – Heat shrink tubing kits are a relatively low cost product and this might make it difficult for manufacturers and distributors to differentiate themselves from competitors on price alone. This can lead to price wars which can erode profit margins. Therefore, it is predicted to hamper the heat shrink tubing kit market growth in the upcoming period.

-

Lack of Awareness about the Heat Shrink Tubing Kit Benefits is Set to Pose a Limitation on the Market Growth in the Upcoming Timeframe.

- Environmental Concerns Associated with Heat Shrink Tubing are Poised to Restrict the Market Expansion in the Forecast Period.

Heat Shrink Tubing Kit Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 36.2 billion |

|

Forecast Year Market Size (2035) |

USD 65.44 billion |

|

Regional Scope |

|

Heat Shrink Tubing Kit Market Segmentation:

Voltage Segment Analysis

In terms of voltage, the low voltage segment in the heat shrink tubing kit market is set to hold the largest revenue share of 40% during the projected period. An essential element for electricity distribution within a voltage range of 1 +1.1 kV is heat shrink tubes, which are used in low-voltage cables. Demand for these heat-shrinkable tubes is anticipated to increase in the market, as more and more of them are being used by insulation and seal cables. Heat shrink tubes are used in consumer electronics as well for several applications such as wire protection, cable bundling and connector insulation. Therefore, increasing demand for consumer electronics is also expected to drive the segment growth in the predicted period. By 2028, globally 9014 million pieces are going to be produced by the consumer electronics sector.

Material Segment Analysis

In terms of material, the polyolefin segment in the heat shrink tubing kit market is set to hold a significant revenue share of 25% during the time period. In this sector, the polyolefins segment has higher revenue and thus is a large part of the market. The polyolefin material has excellent chemical, physical, and electrical properties that make it highly resistant to flames and abrasions as well as extremely flexible. Cross Cross-linking polyphenylene fin is used in aerospace and defense industries due to its flame retardant or inflammable properties, which are likely to increase demand on the market.

Our in-depth analysis of the global heat shrink tubing kit market includes the following segments:

|

Voltage |

|

|

Material |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Heat Shrink Tubing Kit Market - Regional Analysis

APAC Market Insights

The heat shrink tubing kit market in the Asia Pacific region is set to account for the largest revenue share of 33% during the time period between 2025 –2035. Better access to energy throughout the region especially in China, India, Australia, and certain developing countries in Southeast Asia is expected to boost the growth of the market in the region Nearly 97 % of households in India are currently connected to the electricity grid, according to IRES 2020. As 96.7 % of Indian households now have access to the grid and another 0.33% are dependent on off-grid electricity sources, India has been making a remarkable effort towards electrification. Furthermore, significant expenditures are being planned for the construction of energy infrastructure in order to maintain rapid industrialization and keep up with the rapidly expanding economy. Over the course of the forecast period, favorable government assistance in the form of these investments is anticipated to boost national heat shrink tubing spending and fuel the expansion of the Asia-Pacific heat shrink tubing market. Because it has major participants in the biggest consumer market with the highest GDP, China is the dominant country in the Asia-Pacific area.

European Market Insights

The heat shrink tubing kit market in the Europe region is expected to grow significantly during the forecast period. Europe is continuously investing in infrastructure development and construction projects comprising roads, railways, and power grids. Heat shrink tubing plays a crucial role in protecting and insulating electrical cables, wires, and components in these applications, ensuring their long-term reliability and safety. Furthermore, continuous advancements in heat shrink tubing technology, such as the development of self-fusing or self-adhering tubing are enhancing the performance and application range of these products, further driving the expansion of the heat shrink tubing kit market in this region during the estimated period.

Heat Shrink Tubing Kit Market Players:

- 3M Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ABB Ltd

- Alpha Wire Inc

- ARTILABO International sprl

- GREMCO GmbH

- Gremtek SAS

- HellermannTyton GmbH

- Molex LLC

- TE Connectivity

- Nexans SA

Recent Developments

- TE Connectivity introduced new EV Single Wall (EVSW) tubing specifically designed for high voltage applications and the safe isolation and protection of conductive components and cables. This product is a single-layer tube focused on electrical insulation and protection of high-voltage components in electric vehicles. This will help the company diversify its product portfolio and address the unique challenges of EV applications.

- Molex released the Miniaturization Report, showcasing expert insight and innovation in product design technology and cutting-edge connectivity. This miniaturization has allowed the company to improve the effectiveness and safety of its products. This development has expanded the company's product range and positively impacted the growth of the global shrink tubing market.

- Report ID: 5446

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Heat Shrink Tubing Kit Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.