Healthcare Packaging Market Outlook:

Healthcare Packaging Market size was valued at USD 167.04 billion in 2025 and is expected to reach USD 285.33 billion by 2035, registering around 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of healthcare packaging is evaluated at USD 175.31 billion.

The growth of the market can be attributed to the expanding pharmaceutical industries, growing online sales of healthcare products and pharmaceuticals, and rising spending on medications. It was observed that approximately USD 1.5 trillion was spent globally on pharmaceuticals in 2021, and this sum is estimated to rise sharply in the years to come. Additionally, there are developing medication and pharmaceutical dependencies as well as advancements in laboratory technologies which frequently require the export and import of various healthcare chemicals and equipment across the world. Hence, all these factors are anticipated to boost the market growth during the forecast period.

In addition to this, the increasing penetration of online shopping trends, including online pharmacy shopping, is estimated to boost the need for healthcare packaging over the ensuing years. Online pharmacy orders are frequently transported from one location to another, necessitating suitable and robust packaging to guarantee that the quality of the medications or medical supplies is not compromised. It was noted that in 2021, around 3 million people in India used online pharmacy applications to order medicines. Furthermore, the growing awareness among the people regarding social distancing owing to the pandemic havoc and the rising number of people living in assisted living care facility centers who are generally more dependent on doorstep services are anticipated to propel the healthcare packaging market growth over the forecast period.

Key Healthcare Packaging Market Insights Summary:

Regional Highlights:

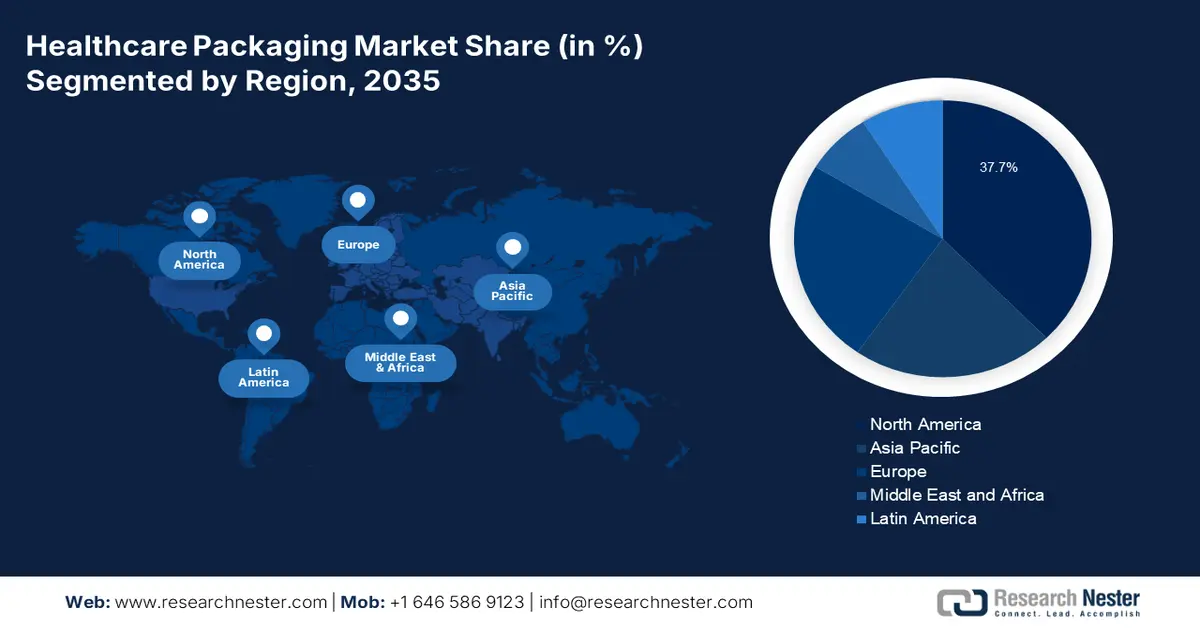

- North America healthcare packaging market will hold over 37.7% share by 2035, driven by pharma growth and aging population’s need for medications.

Segment Insights:

- The polyethylene segment in the healthcare packaging market is anticipated to hold the largest share by 2035, driven by its chemical resistance and lightweight properties in healthcare packaging.

- The oral segment in the healthcare packaging market market will capture notable revenue share, fueled by ease of administration and cost-effectiveness of oral drug delivery over the forecast period 2026-2035.

Key Growth Trends:

- Growing Pharmaceutical Industry Across the Globe

- Rising Inclination of the Global Population Toward Early Diagnosis

Major Challenges:

- Low adoption of standard quality packaging

- Requirement for higher set-up cost

Key Players: Toray Plastics (America), Inc, Amcor Limited, Dunmore Corporation, Gerresheimer AG, CCL Industries Inc., DS Smith Plc, Winpak Ltd., Huhtamäki Oyj, Berry Global, Inc, Sealed Ai.

Global Healthcare Packaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 167.04 billion

- 2026 Market Size: USD 175.31 billion

- Projected Market Size: USD 285.33 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, Russia

Last updated on : 10 September, 2025

Healthcare Packaging Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Pharmaceutical Industry Across the Globe – In 2021, the worldwide pharmaceutical industry was estimated to generate approximately 1 trillion in revenue. The pharmaceutical industry includes research and development, distribution, quality control, and the use of pharmaceuticals and medical devices. Owing to the growing need for medical supplies and medications, the healthcare packaging market is expected to develop over the projected timeframe.

-

Rising Inclination of the Global Population Toward Early Diagnosis – Early diagnosis is a crucial public health approach in all settings as it improves outcomes by giving care at the earliest feasible time. Hence, the market is estimated to grow on the back of the rising number of laboratories and imaging centers across the globe, backed by the increasing purchase of test equipment and medicinal drugs. The market for diagnostic imaging devices was predicted to reach USD 45 billion in 2022.

- Expanding Packaging Industries – Growing packaging industries around the world, which provide pharmacy manufacturers with a variety of cutting-edge packaging solutions, are anticipated to propel healthcare packaging market expansion. It was found that in the United States, the packaging market was estimated to be worth USD 184 billion in 2021 and is projected to grow to USD 218 billion by 2027.

- Growing Demand for Modern Medical Equipment– Modern medical equipment has made it possible to diagnose illnesses or diseases at an early stage, and the increasing production and sales of these medical devices from one area of the world to another are predicted to boost market growth as packaging is crucial during shipping. For instance, in 2022, the revenue generated by orthopedic devices was anticipated to be around USD 45 billion.

- Increasing Spending on Medicines – The market is expected to increase as a result of the rising sales of over-the-counter medications and medicines sold through online channels, where vendors guarantee to deliver medications to customers' doorsteps in reliable, high-quality packaging. It was noted that, globally around 1.5 trillion USD was spent on medicine in 2021.

Challenges

-

Low adoption of standard quality packaging - Government agencies often impose very strict regulations for healthcare packaging. Therefore, the low adoption of standard packaging requirements in low- and middle-income countries and poor public awareness of the need for uniform, durable pharmaceutical packaging is predicted to be the main hindrance to the healthcare packaging market growth.

-

Requirement for higher set-up cost

- More packaging weight results in more expensive transportation

Healthcare Packaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 167.04 billion |

|

Forecast Year Market Size (2035) |

USD 285.33 billion |

|

Regional Scope |

|

Healthcare Packaging Market Segmentation:

Material Type Segment Analysis

The global healthcare packaging market is segmented and analyzed for demand and supply by material type into glass, polyethylene, metal, plastic, paper & paperboard, and others. Out of these, the polyethylene segment is predicted to attain the largest market share over the projected time period. Polyethylene is one of the modern era's toughest polymer varieties. It is inexpensive and very chemical resistant too; this indicates that it can withstand various environmental risks. These qualities make polyethylene packaging superior to other packaging materials in most circles, including healthcare packaging. Furthermore, the rising demand for polyethylene across the globe is predicted to drive segment growth during the forecast period. For instance, in 2019, the total demand for polyethylene was estimated to be around 50 million tons. In addition to this, polyethylene packaging is more compact and lightweight than alternatives, resulting in reduced weights for vehicles and airlines and hence, lower shipping costs. Thus, this factor is also anticipated to support segment expansion throughout the forecast period.

Administration Mode Segment Analysis

The global healthcare packaging market is also segmented and analyzed for demand and supply by administration mode into dermal, inhalable, oral, injectable, and others. Among these, the oral segment is predicted to hold a notable market share over the forecast period. Owing to benefits including ease of oral drug administration, patient preference, cost-effectiveness, and simplicity of producing oral dosage forms on a wide scale, the oral route of administration is the most popular method of drug administration. Additionally, oral medication does not reach the bloodstream directly and dissolves properly through different channels, making it more adaptive for the body, and decreasing the chances of a reaction or allergy. Hence, the inclination towards oral medication is increasing, which in turn is expected to support the segment’s expansion. Moreover, the rising sales and manufacturing of oral drugs across the world is predicted to drive the segment growth over the ensuing years. It was noted that orally administered pharmaceutical medicines make up around 85% of the top-selling medications, which are currently worth about USD 35.1 billion worldwide.

Our in-depth analysis of the global healthcare packaging market includes the following segments:

|

By Product |

|

|

By Material Type |

|

|

By Administration Mode |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Healthcare Packaging Market Regional Analysis:

North American Market Insights

North America region is anticipated to hold over 37.7% market share by 2035, driven by pharma growth and aging population’s need for medications. For instance, around 65 percent of American adults, or more than 130 million people, consume prescription medicines, also age-related diseases and chronic illnesses are associated with higher utilization.

Additionally, the rising investment by the key healthcare packaging market players in the region considering the boom in the demand for medicines and the increasing prevalence of chronic diseases in the USA and Canada are anticipated to propel the market growth in the region. For instance, recently on December 2022, one of the leading healthcare packaging company has declared to open a production facility in the USA. From three production facilities in Europe, Nelipak currently provides its market-leading assortment of healthcare flexible packaging products to clients all over the world. In order to meet the rising demand in the Americas region, Nelipak will replicate its current capabilities by opening a new flagship production site in America.

Healthcare Packaging Market Players:

- Toray Plastics (America), Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amcor Limited

- Dunmore Corporation

- Gerresheimer AG

- CCL Industries Inc.

- DS Smith Plc

- Winpak Ltd.

- Huhtamäki Oyj

- Berry Global, Inc

- Sealed Ai

Recent Developments

-

Toray Plastics (America), Inc. unveils its new product, Torayfan OPP label film portfolio and Toray Label Film (TLF) at the Labelexpo Americas 2022. These label films consist of new label material such as TLFC clear film in 48, TLFM matte film in a 59 gauge, moisture resistance, and an excellent ink adhesive, suitable for various packaging.

-

Amcor Limited to release sustainable packaging solutions for pharmaceuticals. The company is focused on expanding its pharma packaging portfolio by launching more sustainable High Shield laminates.

- Report ID: 4633

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Healthcare Packaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.