Healthcare Interoperability Solutions Market Outlook:

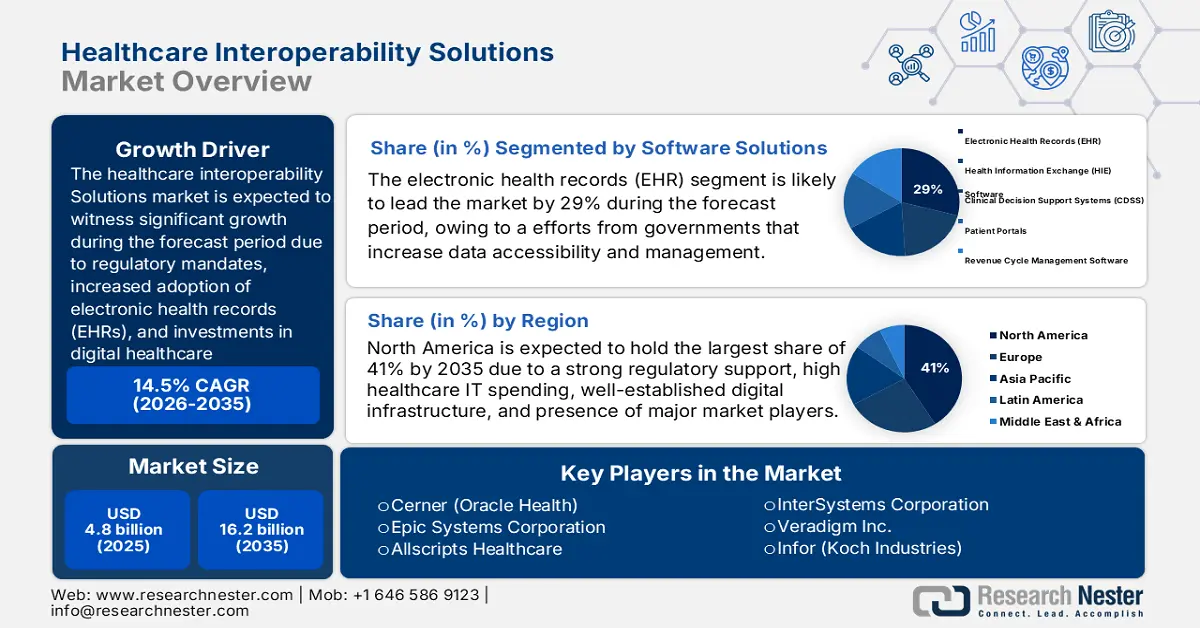

Healthcare Interoperability Solutions Market size is valued at USD 4.8 billion in 2025 and is projected to reach USD 16.2 billion by the end of 2035, rising at a CAGR of 14.5% during the forecast period, i.e., 2026‑2035. In 2026, the industry size of healthcare interoperability solutions is estimated at USD 5.5 billion.

The global market is driven primarily by regulatory mandates, increased adoption of electronic health records (EHRs), and investments in digital healthcare infrastructure. The growing patient population across integrated care settings is driving higher demand for interoperable solutions. According to the U.S. Bureau of Labor Statistics in January 2025, the consumer price index (CPI) for hospital services rose 4.0% in 2024, a reflection of increased usage of healthcare and administrative costs associated with the necessity for sophisticated data processing. In the supply chain, interoperability is increasingly vital as providers work to reduce redundant data capture and testing, and to streamline patient information between primary and specialty care networks.

Moreover, the health IT infrastructure in the market includes responsive software and device systems that support trade activities and manage costs. As per a report by the U.S. Bureau of Labor Statistics, in January 2025, the producer price index (PPI) of pharmaceutical preparations rose 1.7% in 2024 in January 2025, due to steadily increasing input costs for systems based on drug interaction data and e-prescription platforms. This rise in PPI is driven by the growing demand for advanced interoperability tools designed to enhance precision in medication management. Additionally, healthcare providers are investing in integrated platforms to avoid prescription errors and improve patient safety. With more complex drug-related data, the need for a real-time interoperable system is now considered basic from a cost standpoint and clinical outcome perspective.

Key Healthcare Interoperability Solutions Market Insights Summary:

Regional Highlights:

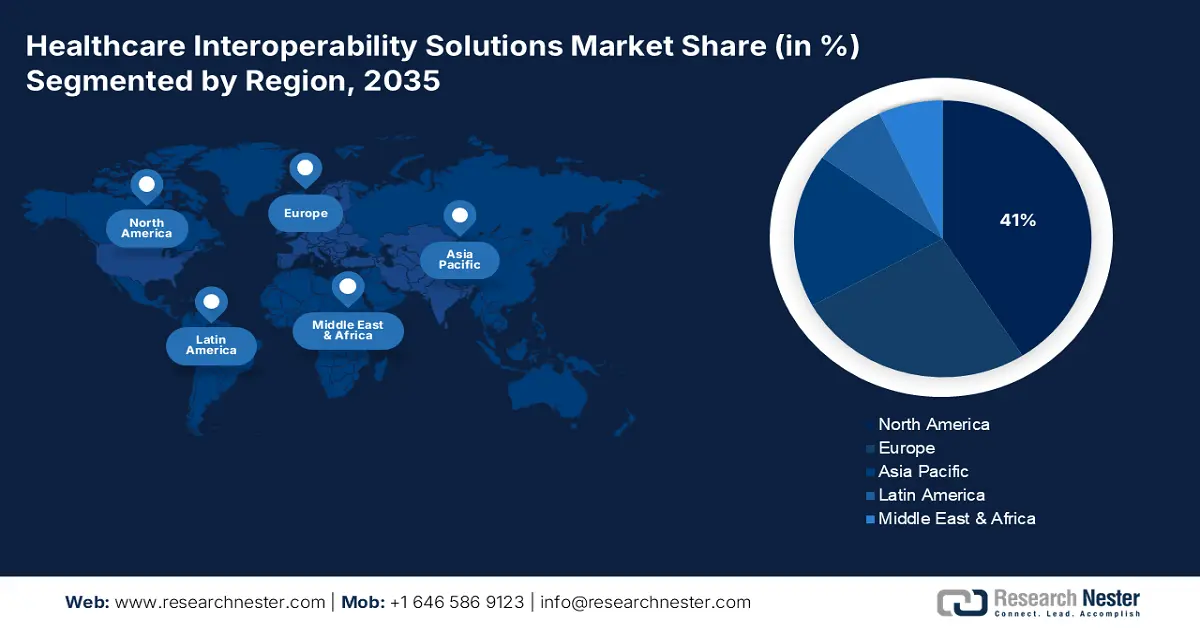

- The Healthcare Interoperability Solutions Market in North America is projected to secure a 41% share by 2035, supported by robust regulatory frameworks, significant healthcare IT investments, and the presence of leading industry participants.

- The Asia Pacific region is anticipated to witness the fastest expansion from 2026–2035, attributed to rapid healthcare digitization and growing governmental support for health IT infrastructure.

Segment Insights:

- The electronic health records (EHR) sub-segment within the software solutions segment of the Healthcare Interoperability Solutions Market is anticipated to capture a 29% share by 2035, driven by governmental initiatives enhancing data accessibility and management.

- The system integration services sub-segment is expected to command the largest share during 2026–2035, propelled by the escalating need to integrate diverse healthcare IT systems and streamline clinical workflows across care environments.

Key Growth Trends:

- Rising medical care costs for healthcare interoperability solutions

- Sustained Investment in Medical Equipment Imports

Major Challenges:

- Data security and privacy concerns

- Lack of standardization across systems

Key Players: Cerner (Oracle Health), Epic Systems Corporation, Allscripts Healthcare, InterSystems Corporation, Veradigm Inc., Infor (Koch Industries), Orion Health Group, NXGN Management, LLC, OSP Labs, Jitterbit, iNTERFACEWARE Inc., ViSolve, Inc., Koninklijke Philips N.V., Change Healthcare, NextGen Healthcare.

Global Healthcare Interoperability Solutions Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.8 billion

- 2026 Market Size: USD 5.5 billion

- Projected Market Size: USD 16.2 billion by 2035

- Growth Forecasts: 14.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, France

- Emerging Countries: India, China, South Korea, Australia, Singapore

Last updated on : 24 September, 2025

Healthcare Interoperability Solutions Market - Growth Drivers and Challenges

Growth Drivers

- Rising medical care costs for healthcare interoperability solutions: Higher costs of medical care are the major growth driver for the market, highlighting the demand for effective data exchange in a bid to manage costs as well as coordination of care. According to the U. S. Bureau of Labor Statistics in January 2025, medical care was 2.8% more expensive in 2024, up from a 0.5% increase in 2023. Hospital and related services rose 4.0%, physicians' services increased 2.6%, and prescription drugs went up 1.1%, while nonprescription drugs fell 0.3%, reflecting shifting cost pressures in the healthcare arena.

- Sustained Investment in Medical Equipment Imports: Consistent high import volumes of medical equipment reflect steady investment in healthcare infrastructure, which underlies the development of interoperability solutions in the market. The U.S. Census Bureau, in August 2025, indicated USD 35,725 million worth of medical equipment was imported into the U.S. in the year 2024, and in 2025, USD 39,975 million worth of medical equipment was imported. This steady increase has shown that there has been a consistent demand for healthcare devices that is vital to the operation of healthcare in the market. The continued increase is favorable for the expansion of interoperability solutions for integrating advanced healthcare technologies into clinical workflows.

- Increasing adoption of digital health technologies: The rapid adoption of digital health technologies by healthcare providers is fueling demand for interoperability solutions in the market. With the use of electronic health records (EHR), telehealth, and remote monitoring by hospitals and clinics, the need for smooth data flow across platforms becomes essential. This focus on integrated care improves coordination, reduces errors, and boosts patient outcomes, driving demand for interoperability solutions.

Global Countries and Most Recent Healthcare Expenditure (% of GDP) (2022/23)

Healthcare Expenditure (% of GDP) (2022/23)

|

Country |

Region |

Most Recent Year |

Healthcare Expenditure (% of GDP) |

|

U.S. |

North America |

2022 |

16.5 |

|

Germany |

Europe |

2023 |

11.8 |

|

Brazil |

Latin America & Caribbean |

2022 |

9.1 |

|

South Africa |

Sub-Saharan Africa |

2022 |

8.7 |

|

India |

South Asia |

2022 |

3.3 |

|

China |

East Asia & Pacific |

2022 |

5.3 |

|

Saudi Arabia |

Middle East & North Africa |

2022 |

4.6 |

|

Australia |

Oceania |

2022 |

9.9 |

|

Russia |

Europe & Central Asia |

2022 |

6.9 |

|

Canada |

North America |

2023 |

11.2 |

Source: World Bank, 2025

Challenges

- Data security and privacy concerns: According to an IEEE survey, the volume of healthcare data exchanged through interoperable systems is increasing in the market. As data volume grows, security and privacy risks also rise. Protecting sensitive patient information from cyber threats and unauthorized access remains a major challenge. Additionally, healthcare regulations, such as the Health Insurance Portability and Accountability Act (HIPAA), add complexity to data management and system design. Strong encryption, secure authentication, and continuous monitoring must be ensured in any interoperable solution. These challenges are slowing the adoption of interoperability solutions, especially among smaller healthcare providers.

- Lack of standardization across systems: The lack of uniform standards across different platforms and vendors creates many interoperability issues in healthcare. From data formats to communication protocols and integration methods, there are many incompatibilities. Each technology brings a different challenge that blocks smooth data flow, causing inefficiencies and higher implementation costs. This problem is even bigger as healthcare institutions have varying levels of IT sophistication. Without common standards, it will be impossible to achieve scalable interoperability solutions across regions and local systems. This can only be solved through industry-wide coordinated efforts supported by regulators.

Healthcare Interoperability Solutions Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14.5% |

|

Base Year Market Size (2025) |

USD 4.8 billion |

|

Forecast Year Market Size (2035) |

USD 16.2 billion |

|

Regional Scope |

|

Healthcare Interoperability Solutions Market Segmentation:

Software Solutions Segment Analysis

The electronic health records (EHR) sub-segment within the software solutions segment is expected to hold the highest market share of 29% within the forecast period due to efforts from governments that increase data accessibility and management. As per a report by OECD in September 2023, in 18 out of 27 countries, such as Japan, Denmark, and the Netherlands, national governments build databases from electronic health records, ensuring uniform data gathering. This extensive governmental involvement enhances data interoperability and security, which in turn supports the adoption of EHR systems and expands the market growth.

Services Segment Analysis

The services segment's system integration services sub-segment is projected to hold the largest market share over the forecast period, owing to growing demand for integrating heterogeneous healthcare IT systems, enabling data exchange, and streamlining clinical workflows between several providers and care environments. Rising healthcare ecosystem complexity and rising digital health tech usage are fueling demand for competent integration services offering seamless interoperability and reducing operational inefficiencies.

Hardware Segment Analysis

The medical devices sub-segment in the hardware segment is expected to hold the highest market share over the forecast period. As per a report by IBPF in July 2025, India and Russia are eyeing Rs. 260,880 crore (USD 30 billion) of bilateral trade by 2025, which reflects the growing importance of cross-border trade in medical devices and other healthcare technologies. This increasing trade relationship supports higher availability and innovation within medical devices, propelling market growth and enabling interoperability among healthcare systems.

Our in-depth analysis of the global healthcare interoperability solutions market includes the following segments:

|

Segment |

Subsegments |

|

Software Solutions |

|

|

Services |

|

|

Hardware |

|

|

Network Infrastructure |

|

|

Data Analytics |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Healthcare Interoperability Solutions Market - Regional Analysis

North America Market Insights

The healthcare interoperability solutions market in North America is expected to hold the highest growth rate, 41% market share, during the forecast period, supported by strong regulatory support, high healthcare IT spending, well-established digital infrastructure, and the presence of major market players. As per a report by CMS, December 2023, hospital care services spending increased by 2.2% in 2022 to USD 1.4 trillion, yet at a slower rate compared to last year. Physician and clinical services spending increased by 2.7% to USD 884.9 billion in 2022. This growth of healthcare spending is increasing the demand for efficient solutions to improve care coordination and reduce administrative spending.

The healthcare interoperability solutions market in the U.S. is expected to grow due to government activities such as the 21st Century Cures Act, greater demand for EHR integration, robust investment in health tech startups, and emphasis on value-based care. As per a report by CMS, December 2023, spending on health care in the U.S. accelerated by 4.1% to USD 4.5 trillion during 2022, outpacing the 3.2% increase the previous year, yet much lower than the 10.6% growth last year. This increase in spending reflects added demand for systems that are interoperable and can drive efficiency, prevent duplication of services, and lower data-driven decision-making across care settings.

The healthcare interoperability solutions market in Canada is expected to grow due to national digital health plans, increased need for error-free data sharing, rising chronic disease burden, and proliferation of telehealth services. Government programs such as Canada Health Infoway are promoting the use of interoperable electronic health records and patient portals between provinces. With an aging population and increasing prevalence of chronic illnesses, care providers are being put in the position of coordinating care more effectively across settings. The growth in virtual care and telehealth capabilities through the pandemic and into its aftermath also put increased pressure on having real-time integrated data exchange.

Asia Pacific Market Insights

The healthcare interoperability solutions market in the Asia Pacific is expected to hold the fastest-growing market within the forecast period due to rapid healthcare digitization, government support for health IT infrastructure, increasing medical tourism, and growing investments by global health tech companies. Distributed across the remotest regions of the country, a model of medical care is now in place EHR or electronic health records that maintain patient data from any location, along with interoperable frameworks. Many patients with chronic conditions need integrated, patient-centered care, which is driving the use of systems with interoperable solutions.

The healthcare interoperability solutions market in China is expected to grow due to various government reforms aimed at a large increase in hospital networks, the incorporation of AI in healthcare, and a strong emphasis on health data standards. According to a report by the World Bank, 2025 suggests that, as per the World Health Organization, the current health expenditure was 5.3% of the GDP in 2022, showing an upward trend during the past ten years, while the country kept on strengthening its healthcare system. Also, the growing middle class raises awareness of healthcare.

The healthcare interoperability solutions market in India is expected to grow due to the Aayushman Bharat Digital Mission rollout, escalating EHR adoption, more investments into private healthcare, and demand for patient-centric care systems. As per a report by IBPF in July 2025, investment inflows in sectors such as hospitals & diagnostic centers and medical & surgical appliances stood at Rs. 1,01,687 crore (USD 11.82 billion) and Rs. 33,638 crore (USD 3.9 billion), respectively, over the last 5 years, which were crucial to enhancing and modernizing healthcare infrastructure across the nation. In addition, increasing penetration of smartphones and internet connectivity is enabling even broader adoption of digital health platforms.

Europe Market Insights

The healthcare interoperability solutions market in Europe is expected to grow steadily within the forecast period due to the stringent laws on data protection, worldwide eHealth initiatives, patient data exchange across borders, and increased demand for integrated healthcare systems. As per a report by Eurostat November 2024, in the countries of Europe, Germany, with 12.6%, France, with 11.9%, and Austria, with 11.2%, were the countries with the highest current healthcare expenditure relative to GDP in 2022. This is a strong financial commitment. The same attenuates towards the adoption of the latest interoperability tech to improve healthcare delivery. Simultaneously, some more effort is being put in by the Europe member states in order to come up with common standards, thus fast-tracking the integration of healthcare data across the region.

The healthcare interoperability solutions market in the UK is expected to grow due to the NHS's digital transformation strategy, post-Brexit health IT investments, increasing focus on AI-driven health solutions, and more public-private partnerships in health tech. Interoperable platforms that support advanced analytics and personalized care are in demand due to the growing focus on AI-driven health solutions. The increasing public-private partnership in health tech is further setting the agenda for developing and later deploying top-class health technologies. The partnerships address the challenges of data security, integration, and scalability.

The healthcare interoperability solutions market in Germany is expected to grow due to the introduction of the Digital Healthcare Act, the rise of demand for interoperable EHRs, the med-tech being a robust sector, and investments in digital health innovations. As per a report by Eurostat in November 2024, Germany stood first while registering the ever-higher current expenditure on healthcare among the Europe-based countries, standing at €489 billion in 2022. Amid IT infrastructure overhauls at hospitals and clinics, hotels are increasingly realizing the need to implement system integration so that patient information can flow uninterruptedly. Further, the government also supports digital transformation via dedicated funding programs on the delivery mechanism for healthcare services and health outcomes.

Current Healthcare Expenditure in Countries of Europe (2022)

|

Country |

€ million |

€ per inhabitant |

PPS per inhabitant |

% of GDP |

|

Germany |

488,677 |

5,832 |

5,317 |

12.6 |

|

France |

313,574 |

4,607 |

4,302 |

11.9 |

|

Austria |

49,897 |

5,518 |

4,751 |

11.2 |

|

Belgium |

59,626 |

5,105 |

4,339 |

10.8 |

|

Portugal |

25,370 |

2,437 |

2,823 |

10.5 |

|

Netherlands |

96,820 |

5,470 |

4,531 |

10.1 |

|

Spain |

131,114 |

2,745 |

2,814 |

9.7 |

|

Italy |

175,719 |

2,978 |

2,945 |

9.0 |

Source: Eurostat, November 2024

Key Healthcare Interoperability Solutions Market Players:

- Cerner (Oracle Health)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Epic Systems Corporation

- Allscripts Healthcare

- InterSystems Corporation

- Veradigm Inc.

- Infor (Koch Industries)

- Orion Health Group

- NXGN Management, LLC

- OSP Labs

- Jitterbit

- iNTERFACEWARE Inc.

- ViSolve, Inc.

- Koninklijke Philips N.V.

- Change Healthcare

- NextGen Healthcare

The market is highly competitive as U.S. and global market players are focusing on cloud-based platforms, AI-driven analytics, and the application of standard data protocols. The key strategic moves include mergers by acquiring providers in partnerships or otherwise, to increase capability and market penetration. The Japan-based manufacturers, however, have been firm with their specialized offerings for diagnostic imaging and health IT integration. There is continuous improvement in innovation and regulatory compliance to meet the growing requirements for healthcare data exchange worldwide, thus suitable for boosting the market internationally.

Here is a list of key players operating in the global market:

Recent Developments

- In February 2025, Edifecs Inc., a global health information technology solutions provider, has announced the Healthcare Interoperability Cloud, which allows players to strategically work on interoperability and address compliance, including CMS-9115-F and CMS-0057-F, and also non-compliance use cases.

- In February 2025, Cotiviti acquired Edifecs to boost healthcare interoperability, improving payer-to-provider connectivity and value-based care. Emad Rizk leads the combined companies in creating advanced, collaborative data solutions to enhance efficiency, transparency, and patient outcomes.

- Report ID: 5260

- Published Date: Sep 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Healthcare Interoperability Solutions Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.