Healthcare Fraud Analytics Market Outlook:

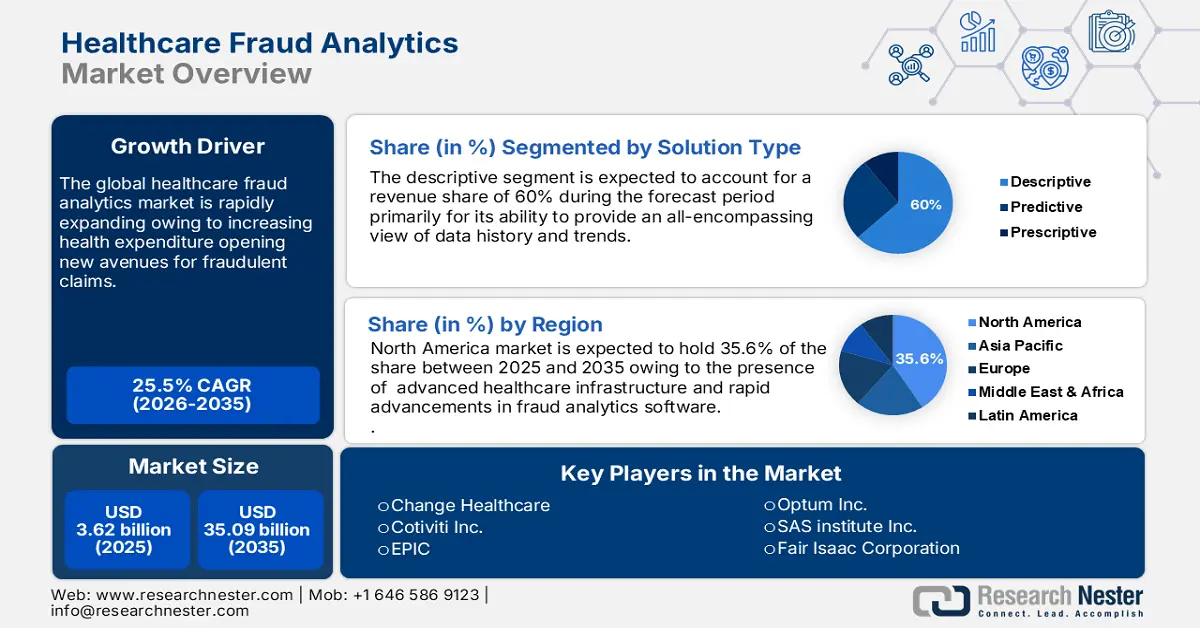

Healthcare Fraud Analytics Market size was valued at USD 3.62 billion in 2025 and is likely to cross USD 35.09 billion by 2035, registering more than 25.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of healthcare fraud analytics is assessed at USD 4.45 billion.

The crucial growth drivers that fuel the growth of the market are budding health expenditures that open avenues for fraudulent claims and thus make it imperative to adopt advanced analytics. Also, a wide acceptance of data analytics and AI in healthcare facilitates detecting and preventing fraudulent claims. Furthermore, regulatory pressures and compliance mandates fuel market growth as healthcare organizations strive to meet the standards. With the rising incidence of healthcare fraud associated with identity theft, billing errors, and the manipulation of a patient's medical records, the need for proactive detection rises and drives growth. Moreover, advances in machine learning and predictive modeling and the shift from pay-and-chase to enable real-time prevention of loss in financial fraud assist the market to be opportunistic.

Another significant reason for the market propels owing the growing demand due to IoT and cloud computing, real-time analytics, and visualization, the need for risk management and compliance solutions is growing, as value-based care and payment integrity. Thus, all these factors come together and form a compelling business case for healthcare fraud analytics and drive investments and innovation in the market. In August 2024, Medibuddy introduced Sherlock, a cutting-edge AI-enabled fraud detection system that allows for the real-time detection of medical reimbursements incorporated with artificial intelligence, machine learning, and data analytics.

Key Healthcare Fraud Analytics Market Insights Summary:

Regional Highlights:

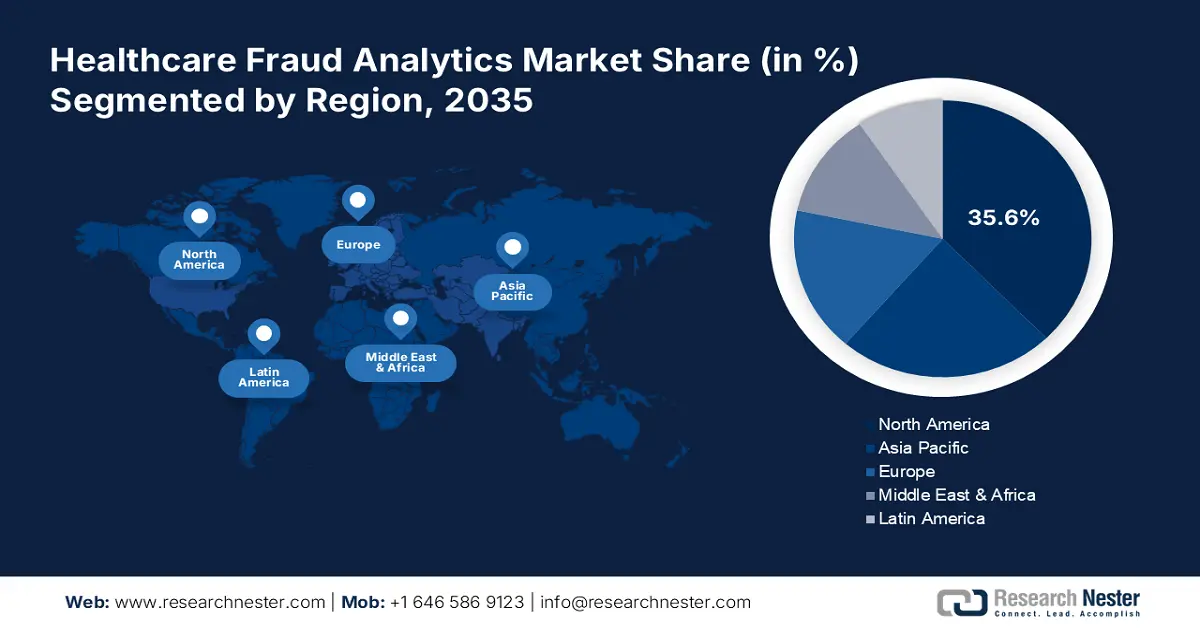

- North America healthcare fraud analytics market will account for 35.60% share by 2035, fueled by advanced healthcare infrastructure and regulatory compliance needs.

Segment Insights:

- The descriptive segment in the healthcare fraud analytics market is projected to achieve significant growth till 2035, driven by its ability to provide comprehensive data trends for fraud detection.

- The on-premises segment in the healthcare fraud analytics market is forecasted to capture a 59.20% share by 2035, fueled by increased reliability and data security concerns.

Key Growth Trends:

- Advancement in data analytics and AI technologies

- Rising incidences of healthcare fraud

Major Challenges:

- Limited resources and budget constraints

- Insufficient skilled personnel and training

Key Players: Cotiviti, Inc., DXC Technology Company, EPIC, ExlService Holdings, Inc., Fair Isaac Corporation, HCL Technologies Limited.

Global Healthcare Fraud Analytics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.62 billion

- 2026 Market Size: USD 4.45 billion

- Projected Market Size: USD 35.09 billion by 2035

- Growth Forecasts: 25.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, United Kingdom, Germany, China, Japan

- Emerging Countries: China, India, Brazil, South Korea, Mexico

Last updated on : 18 September, 2025

Healthcare Fraud Analytics Market Growth Drivers and Challenges:

Growth Drivers

-

Advancement in data analytics and AI technologies: The synergy between data analytics and AI technology has revolutionized the framework of the healthcare fraud analytics market facilitating more enabled real-time fraud detections. Also, continuous innovation results in improved accuracy, enhanced efficiency, and scalability. Advancements in data analytics and AI technologies have streamlined better methods for the detection of fraud and established measures for the prevention of fraudulent activities which has led to significant growth in the market.

As big data processing, machine learning, natural language processing, and cognitive computing are evolving they are indeed proving to enrich the accuracy of detection and efficiency by reducing false positives, thus making it a lucrative market to seek opportunities to render reliable solutions. Moreover, data analytics and AI technologies are proven to be crucial drivers to protect systems' integrity, mitigate financial losses, and continually enhance patient care and comfort. For instance, in September 2023, the Department of Justice (DOJ) and the Department of Health and Human Services (HHS) announced to have significantly expanded and adjusted how they use artificial intelligence (AI) to combat and generate healthcare fraud. -

Rising incidences of healthcare fraud: The rise in healthcare fraud cases is a key growth factor behind the propulsion in the market ranging from claims process manipulation to medical identity theft and data breaches thus, leading to enormous financial losses to healthcare organizations, insurers, and government agencies. This growth in healthcare fraud will therefore be linked to certain elements such as the increasing intricacy of systems of reimbursement, the extensiveness of electronic health records, and technologically savvy hacking methods.

Moreover, healthcare organizations are making investments in advanced fraud analytics solutions to detect, prevent, and identify fraudulent activities which further fuels the growth of the healthcare fraud analytics market by including machine learning, artificial intelligence, and predictive modeling to analyze vast amounts of data, identifying patterns or flags on a suspicious transaction, thus making the market expand drastically. -

Growing demand for predictive analytics & risk management: One of the main drivers for the healthcare fraud analytics market is the increasing, ever-growing need for predictive analysis and solutions for risk management. Healthcare organizations are facing more complexities with reimbursements, electronic health records, and very sophisticated fraud schemes, hence the need for proactive, predictive, and advanced methods of fraud detection is rising.

Predictive analysis helps healthcare organizations to identify risk through patients, providers, and claims, while also ensuring that risk management solutions enable the building of strategic mitigation plans, data-driven decisions, and critically analyzed cases thus, the healthcare sector is investing heavily in predictive analytics, and risk management solutions, driving the market through growth and innovation.

Challenges

-

Limited resources and budget constraints: Limited resources and budgetary constraints form a substantial challenge to the provision and effectiveness of healthcare fraud analytics solutions. Healthcare organizations often lack the budgetary provisions necessary to invest in advanced analytical technologies, skilled personnel, and training, crippling their abilities to identify and prevent fraud. Limited investment in technology thus disables the utilization of advanced analytics and machine learning capabilities.

Poor quality data, due to inadequate resource availability fails to ensure data integration, standardization, and governance practices. Additionally, budget constraints cause organizations to get trapped into short-term expense-saving measures at the cost of long-term strategic investments resulting in reduced efficacy and reliability. -

Insufficient skilled personnel and training: The limited availability of skilled personnel and training in the healthcare fraud analytics area poses a significant challenge as it requires specialized knowledge in operating high-tech applications and running complex programs, this gap has become even more exacerbated since fraud schemes and technologies evolve so rapidly thus, continually requiring training and upskilling to stay ahead of the fast-emerging threats. Inadequate analysis and interpretation of data result in missed fraud indicators leading to compromising organizational integrity which further hampers growth.

Healthcare Fraud Analytics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

25.5% |

|

Base Year Market Size (2025) |

USD 3.62 billion |

|

Forecast Year Market Size (2035) |

USD 35.09 billion |

|

Regional Scope |

|

Healthcare Fraud Analytics Market Segmentation:

Solution Type Segment Analysis

Descriptive segment is predicted to dominate over 60% healthcare fraud analytics market share by 2035, primarily for its ability to provide an all-encompassing view of data history and trends, which helps to observe patterns in fraud behavior. Such analysis uses a vast amount of healthcare data, claims, billing records, and patient information to optimize standard operating benchmarks. Growth drivers for descriptive analytics include increased data volumes in healthcare, advanced fraudulent schemes, and the need for healthcare organizations to leverage better compliance and risk management.

In addition, improving technology in data processing and advanced algorithms associated with machine learning helps in making detailed analysis easier and ensures easy identification of anomalies. Descriptive analytics can help healthcare service providers not only detect past cases of fraud but also design predictive models to predict risks in the future, thus making their strategies against fraud more robust and consequently upholding the integrity of healthcare services.

Deployment Mode Segment Analysis

By 2035, on-premises segment is expected to account for around 59.2% healthcare fraud analytics market share due to increased reliability about data security and confidentiality provided by on-premises solutions. Also, organizations tend to favor control over data infrastructure to comply with even the most rigid regulations, such as the Health Insurance Portability and Accountability Act (HIPAA) in the U.S., to guard patient data against unauthorized access. The most conducive argument for on-premises deployment lies in greater ease of customization and integration with existing systems giving healthcare providers control over analytics solutions and tailoring them to unique operational workflows and requirements.

Additionally, on-premises solutions can provide better performance and faster processing since they depend on local servers and resources, which may be very valuable to an organization handling large volumes of data. All these factors collectively make on-premises lead the market in healthcare fraud analytics and promote security, customization, performance, and cost-effectiveness for fraud detection.

Application Segment Analysis

Insurance claims review segment in the healthcare fraud analytics market is anticipated to grow at massive CAGR till 2035 driven by some compelling reasons in maintaining the integrity of healthcare financing. The volume of insurance claims processed necessitates the development of an effective review mechanism to identify and mitigate fraudulent activities. As the cost of health care continues to escalate, the increased emphasis is ensuring claims are properly vetted to avoid losses from fraudulent billing practices. Regulatory pressures and compliance need also fuel insurance companies to institute comprehensive claims review programs to ensure standards and avoid possible penalties.

Furthermore, advanced analytics tools have enhanced the accuracy and sophistication of claims assessment. Moreover, incorporating machine learning and AI in the processes of reviewing claims informs the identification of fraud indicators through patterns and anomalies to improve detection for patient safety and quality. Thus, the insurance claims review segment is expected to propel while ensuring compliance and enhancing overall operational efficiency.

Our in-depth analysis of the market includes the following segments:

|

Solution Type |

|

|

End user |

|

|

Deployment Mode |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Healthcare Fraud Analytics Market Regional Analysis:

North America Market Insights

North America industry is set to hold largest revenue share of 35.6% by 2035, owing to its advanced healthcare infrastructure, which includes a vast provider network, health insurance companies, and regulatory authorities. Such a huge infrastructure requires effective tools to detect and prevent fraud so that avoidable financial losses are not incurred as a result of fraudulent activities. Healthcare institutions are implementing advanced analytics solutions to meet regulatory compliance in the form of HIPAA, ACA, and other related laws. Moreover, since fraud schemes are on the rise, healthcare organizations require more innovative forms of analytics tools that exploit artificial intelligence and machine learning to better enhance detection capabilities.

Investments within North America, both in the public and private sectors in technology and data analytics have created a space where effective fraud analytics solutions can flourish. Also, the growing awareness of the financial as well as reputational impacts by various groups of stakeholders on the different dimensions of healthcare fraud has led to a proactive approach to embrace holistic fraud analytics strategies. Thus, North America is at the apex of the healthcare fraud analytics market.

In the U.S., the health care fraud unit within the criminal division’s fraud section had been created where a dedicated data analytics team monitors billing trends, identifies aberrant providers, and helps our prosecutors spot emerging schemes and stop them.

Asia Pacific Market Insights

The Asia Pacific is growing at a healthy pace in the healthcare fraud analytics market, influenced by a couple of significant factors attributable to witnessing an enormous increase in healthcare expenses that is being driven by rising populations, urbanization, and an ever-growing middle class. This crucial incurred expenditure has subsequently catalyzed growth in healthcare services and insurance coverage, thus increasing demand for efficient mechanisms to detect and prevent fraud. Also, the increased awareness by government and private organizations on healthcare fraud and its implications has facilitated an increased investment in analytics solutions to combat fraudulent activities.

Moreover, recent regulatory frameworks implemented on healthcare transparency and accountability have further increased the pressure of demand on sophisticated tools for fraud analytics. Advances in digital health technologies, such as telemedicine and electronic health records, also started to generate immense data that must be used on advanced analytics to identify fraud risks and mitigation in general. Additionally, the fast adoption of artificial intelligence and machine learning technologies in the region further boosts the capabilities of fraud detection systems to higher efficiency and effectiveness.

In July 2023, A penalty amount of USD 1.14 million was recovered while 210 hospitals were de-impanelled based on information of fraud obtained through artificial intelligence and machine learning-based anti-fraud initiatives.

Healthcare Fraud Analytics Market Players:

- IBM Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Change Healthcare

- Conduent Incorporated

- Cotiviti, Inc.

- DXC Technology Company

- EPIC

- ExlService Holdings, Inc.

- Fair Isaac Corporation

- HCL Technologies Limited

- LexisNexis Risk Solutions.

- Optum Inc.

- Qlarant Commercial Solutions, Inc.

- SAS Institute Inc.

- WIPRO LIMITED

The healthcare fraud analytics market covers a diversified range of market players striving to develop innovative solutions for combating the number of frauds in the industry. Owing to distinctive capabilities and expertise companies are serving as a forefront in enhancing efforts toward fraud detection and measures for prevention. Key market players leveraging cutting-edge technologies are:

Recent Developments

- In June 2024, the client of Cotiviti found over USD 1 million in false claims, which FWA verified and processed to Cotiviti's special investigations unit (SIU) for further data analysis.

- In November 2023, Cotiviti shared innovative approaches to preventing fraud, waste, and abuse at the 2023 NHCAA Annual Training Conference.

- Report ID: 6500

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Healthcare Fraud Analytics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.