Healthcare Additive Manufacturing Market Outlook:

Healthcare Additive Manufacturing Market size was over USD 12.35 billion in 2025 and is anticipated to cross USD 76.47 billion by 2035, growing at more than 20% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of healthcare additive manufacturing is assessed at USD 14.57 billion.

The implementation of 3D printing in medical applications has proved to be a cost-effective way of driving the growth of the market. For instance, a review study conducted by Annals of 3D Printed Medicine in May 2024 stated that polyjet (PJ) technology, a combination of stereolithography (SLA) and IJ printing methods, comprises an accuracy rate ranging between 0.49% to 0.61%. However, this technology is expensive ranging from USD 20,000 to USD 120,000. Besides, it comprises printing layers with thicknesses of 16 μm and indifferent colors, along with the ability to yield objects that are either rigid or soft, hence a positive contribution to boosting the market.

Moreover, technological advancement in prosthetics is yet another factor amplifying the development of the market. Based on this, a case study was conducted by NLM in September 2021 to provide a cost-utility analysis concerning the payer’s pricing of the prosthetic care innovation. Prosthetic care with a keep walking implant (KWI) provided an incremental cost-utility ratio (ICUR) of USD 36,890 per QALY, which was USD 76,890 per QALY below the willingness-to-pay threshold, driving the market upliftment. Additionally, this reduced the KWI costs by USD 17,910 while enhancing the utility by 0.485 QALY compared to usual interventions, thus suitable for market upliftment.

Key Healthcare Additive Manufacturing Market Insights Summary:

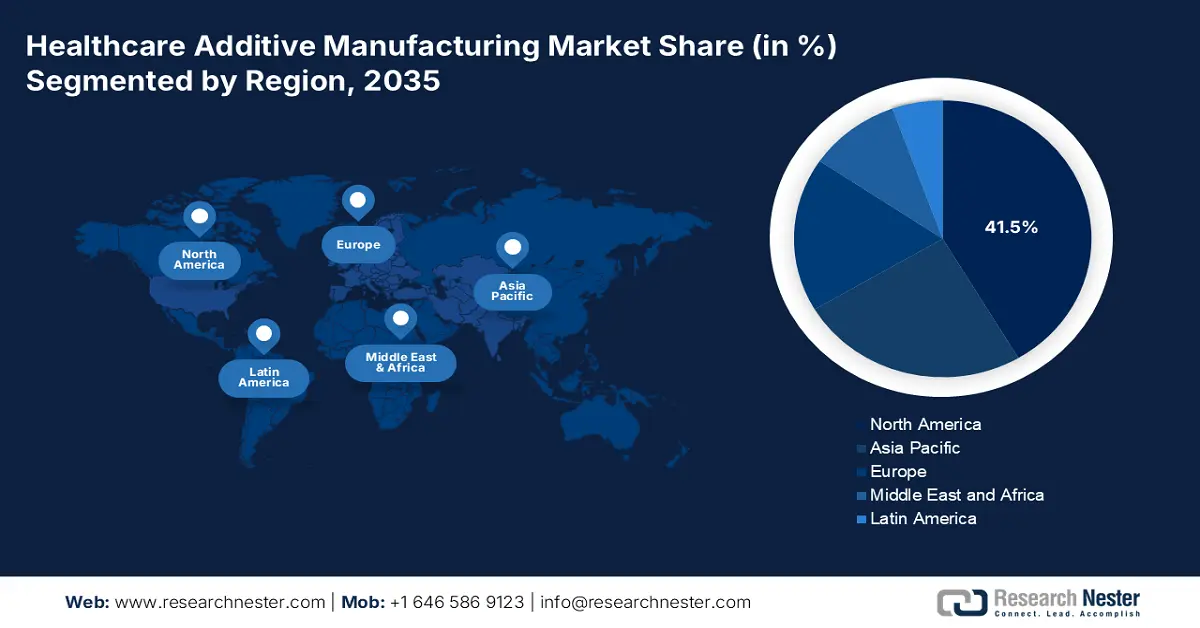

Regional Highlights:

- North America leads the Healthcare Additive Manufacturing Market with a 41.5% share, fueled by increased investments in medical technology and advancements in personalized healthcare, driving growth through 2035.

- The APAC Healthcare Additive Manufacturing Market is expected to experience lucrative growth by 2035, propelled by the adoption of advanced 3D printing technologies and supportive regulatory frameworks.

Segment Insights:

- The Laser Sintering segment is forecasted to hold a 37.8% share by 2035, propelled by material innovation and affordability in healthcare applications.

- The Polymers segment is anticipated to hold a 61.5% share by 2035, driven by their widespread use in 3D printing for medical applications.

Key Growth Trends:

- Evolution of additive manufacturing (AM)

- Growing demands for unmet needs

Major Challenges:

- High expenditure

- Poor maintenance and limited material availability

- Key Players: GE Additive, 3D Systems Inc., EnvisionTEC GmbH, RegenHU, Allevi Inc..

Global Healthcare Additive Manufacturing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.35 billion

- 2026 Market Size: USD 14.57 billion

- Projected Market Size: USD 76.47 billion by 2035

- Growth Forecasts: 20% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, Japan, India, South Korea, Brazil

Last updated on : 13 August, 2025

Healthcare Additive Manufacturing Market Growth Drivers and Challenges:

Growth Drivers

- Evolution of additive manufacturing (AM): It is a progressive digital manufacturing procedure that directly generates a physical model of composite structures and geometries from CAD models by adding layer-wise materials. According to a study by NLM in February 2024, AM in product invention can diminish lead times by almost 90% and manufacturing costs by 70%. Therefore, its implementation in the medical field, for instance, caters to the control of drug dosage and enhancement in the bone growth process with improved combinations of materials and techniques that ensure compatibility, which in turn is amplifying the healthcare additive manufacturing market.

AM Contribution in Medical Areas

|

Application |

Contribution (%) |

|

Prototypes |

66% |

|

Anatomical models |

47% |

|

Surgical planning |

35% |

|

Patient-matched devices |

26% |

|

Biofabrication |

16% |

|

Serialized devices |

12% |

|

Dental |

23% |

Source: NLM 2024

- Growing demands for unmet needs: Practical supervisory assignation with technology developers can quicken the translation of research into therapeutic solutions that address unfulfilled medical demands. As per a study conducted by Heliyon in October 2024, commingled PET (polyethylene terephthalate) yarn is a sustainable and affordable composite material that is useful for manufacturing patient-specific sockets (PSS). The vertical ground reaction force discovered a stance phase of 60% and a swing phase of 40% along with 40% to 50 % of body weight, thus suitable for medical demands and a positive impact on the healthcare additive manufacturing market growth.

Challenges

- High expenditure: The demand for specialized raw materials based on which additive machines function is a huge constraint for the development of the market. Besides, the primary cost of setting up an in-house additive manufacturing operation can be high owing to the need to capitalize on the precise equipment and materials and ensure staff training for handling the operational processes of machines. As a result, small-scale businesses and start-ups experience barriers as well as organizations with an already-established traditional manufacturing operation.

- Poor maintenance and limited material availability: Challenges of surface quality, lengthy manufacturing periods, and dimensional accuracy restrain the escalation of the market. Besides, there are software limitations such as design capabilities and data interoperability since printability tests, CAD modeling, simulation analysis, and structural optimization are all required for discrete software platforms. Also, slow production processes, manual post-processing, and inconsistencies in material characteristics are major technological hurdles limiting the exposure of additive manufacturing in the medical sector, as stated by the Journal of Manufacturing Processes in December 2023.

Healthcare Additive Manufacturing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

20% |

|

Base Year Market Size (2025) |

USD 12.35 billion |

|

Forecast Year Market Size (2035) |

USD 76.47 billion |

|

Regional Scope |

|

Healthcare Additive Manufacturing Market Segmentation:

Material (Polymers, Metals & Alloys, Biological Cells)

Based on material type, the polymers segment is predicted to hold healthcare additive manufacturing market share of more than 61.5% by 2035, based on the design type. According to a study conducted by Polymer Testing in March 2024, polymers such as polycaprolactone, polylactic acid, and polyethylene terephthalate are mainly utilized in the manufacturing process, especially for fused deposition modeling, selective laser sintering, and stereolithography. For instance, 3 wt% of carbon nanofibre-polyamide-12 enhances the storage modulus of devices, hence suitable for market upliftment.

Technology (Laser Sintering, Stereolithography, Deposition Modeling, Electron Beam Melting, Jetting Technology, Laminated Object Manufacturing)

In healthcare additive manufacturing market, laser sintering segment is expected to hold revenue share of more than 37.8% by 2035. It is a process wherein powdered material is heated to near-melting temperatures, producing particles to bond together to form a solid structure. In this regard, Sinterit declared its partnership with Forward AM, a BASF brand, in February 2024 to conjointly advance the compact SLS segment and industrial applications. This ensured the development of the latest materials tailored for its use in laser sintering technology, to make 3D powder materials affordably accessible from small-scale entry-level to big-scale industrial use, hence an optimistic growth for the market.

Our in-depth analysis of the global market includes the following segments

|

Material |

|

|

Technology |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Healthcare Additive Manufacturing Market Regional Analysis:

North America Market Analysis

North America in healthcare additive manufacturing market is likely to hold more than 41.5% revenue share by 2035. The increase in awareness and advances in medical services has resulted in ensuring investments, which is expected the drive the market growth. For instance, in December 2024, Axial3D notified the achievement of a new investment round totaling USD 18.2 million. The purpose of this was to scale global medical-based technology development and transmute patient-specific care with support from investors. In addition, there will be constant technology application enlargement and its impact on innovations that will make advances in personalized healthcare.

The U.S. market is gaining traction due to the launch of the latest medical devices approved by various administrative bodies, and making contributions in developing nations to promote health. As per the June 2023 U.S. FDA report, there has been approval of more than 100 devices with the use of additive manufacturing technologies globally in association with regulatory science research. Besides, in September 2024, Think Global Health Organization reported the provision of U.S. recycled prosthetic limbs to assist an amputee from Sri Lanka at an estimated cost of USD 1,600. Therefore, regional contributions toward promoting a healthy lifestyle are expected the uplift the market growth.

The market in Canada is witnessing significant growth owing to the presence of hand-vascularized composite allotransplantation (VCA) and myoelectric prostheses that are efficient for hand amputations. As per the review study conducted by JPRAS Open in June 2022, a simulation model was utilized to signify savings of both devices, accounting for USD 10.04 billion and USD 12.17 billion for all regional patients sustaining hand amputation with a 30-year life expectation. Besides, the expense of myoelectric prostheses was low in comparison to unilateral and bilateral upper limb amputations that is, USD 4.45 billion and USD 1.86 billion, thus bolstering the market growth.

APAC Market Statistics

The healthcare additive manufacturing market in APAC is the fastest-growing region and is poised to witness lucrative growth during the forecast timeline. As per a cross-national study conducted by the International Journal of Pharmaceutical Investigation in July 2024, in Singapore, the Health Sciences Authority (HSA) supervises the guidelines for 3D-printed devices within the prevailing governing structure designed for medical devices. The country has a huge potential for additive manufacturing technology implementation based on localization, democratization, and advancement of the production of 3D technology for market upliftment.

The healthcare additive manufacturing market in India is expecting substantial growth since it plays a pivotal role in bringing about Industrial Revolution 4.0 to make the country a leading manufacturing hub. To obtain this, the Ministry of Electronics and Information Technology (MeitY) articulated the National Strategy on Additive Manufacturing, as stated in the IBEF Organization March 2022 report. This aims to upsurge India’s share in global additive manufacturing to 5% along with an additional US 1 billion to the country’s GDP in upcoming years. Owing to this, there will be simplified supply chains, employment opportunities, sustainable development, gross value growth, and redesigning ease, hence bolstering the market.

The market in China is gaining exposure owing to the deployment of medical products and machines. As per a comprehensive review conducted by Additive Manufacturing Frontiers in December 2024, the electron beam powder bed fusion (EB-PBF) has gained exposure in the country, to provide manufacturing devices with dimensions ranging between 100 mm to 2 m. For instance, the use of EB-PBF is beneficial to yield high-Si-content steels and co-relate microstructural characteristics, process parameters, and magnetic performance. It also facilitates machine learning for real-time process optimization, thus enhancing market growth.

Key Healthcare Additive Manufacturing Market Players:

- GE Additive

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- 3D Systems Inc.

- EnvisionTEC GmbH

- RegenHU

- Allevi Inc.

- EOS GmbH (Electro Optical Systems)

- Materialise N.V.

- Nanoscribe GmbH

- GPI Prototype and Manufacturing Services LLC.

- Stratasys

- Axial3D

Companies dominating the healthcare additive manufacturing market are gaining rapid exposure due to cutting-edge technologies that are catering to fundamental modifications to tackle issues for the production of the latest drugs and customize medical devices for patients and health providers. For instance, in January 2025, Phase3D reported its strategic partnership with Taiyo Nippon Sanso Corporation to enhance its innovative Fringe Inspection product suite in the Japan market. This ensures the inclusion of Japan researchers and manufacturers’ straight entree to Phase3D’s industry-leading additive manufacturing quality control solutions, strengthening their production capabilities and accuracy, thus amplifying the market growth.

Recent Developments

- In September 2024, Stratasys declared the availability of the Origin® Two DLP printer in tandem with its post-processing system, the Origin Cure. This addressed the growing demand among manufacturers for injection-molding quality for short production operations, delivering a level of surface finish, accuracy, and repeatability formerly inaccessible with additive manufacturing.

- In July 2023, Axial3D notified the FDA approval for an AI-driven, automated, and cloud-based segmentation platform, Axial3D INSIGHT, for orthopedic trauma, maxillofacial, and cardiovascular applications with the use of additive manufacturing systems.

- Report ID: 7207

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.