Headset Market Outlook:

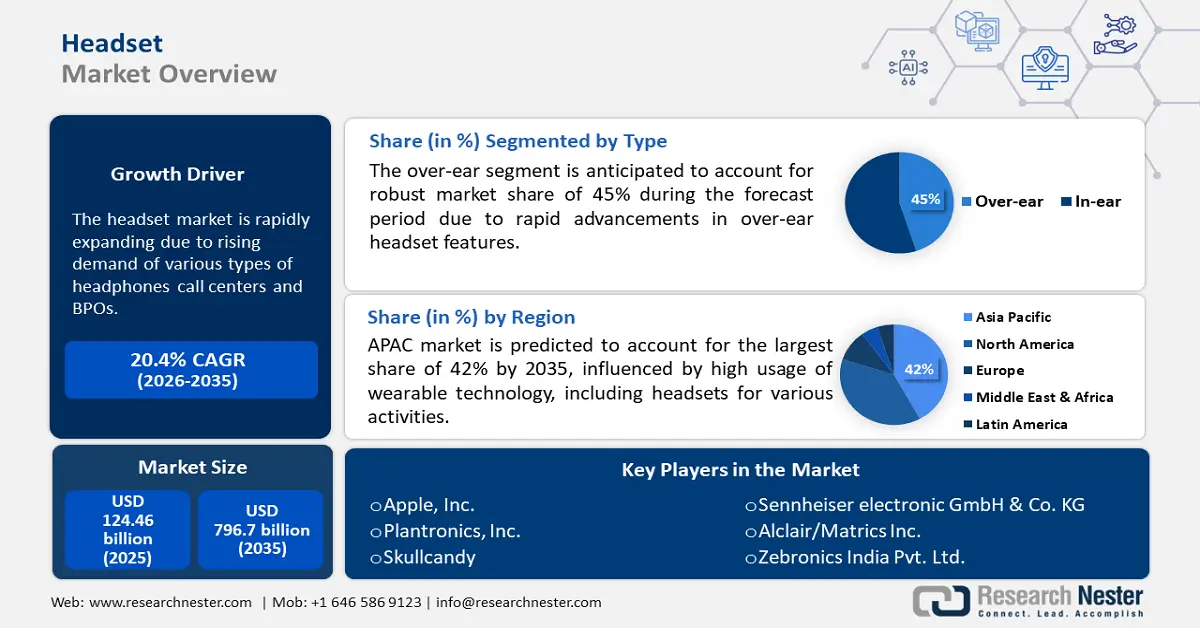

Headset Market size was over USD 124.46 billion in 2025 and is anticipated to cross USD 796.7 billion by 2035, growing at more than 20.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of headset is assessed at USD 147.31 billion.

The growth of the global market is attributed to the rapidly expanding call center and BPO sector. Headsets equipped with noise-cancellation features are used in business process outsourcing and call centers to enhance employee productivity by improving the call sound quality. Noise cancellation technologies effectively reduce background noise, allowing employees to focus on their work. For instance, in September 2023, Sennheiser electronics GmbH & Co. KG announced the launch of ACCENTUM wireless headphones with a serenity of hybrid active noise technology. It can quickly charge for up to 5 more hours of listening in just 10 minutes.

Key Headset Market Insights Summary:

Regional Highlights:

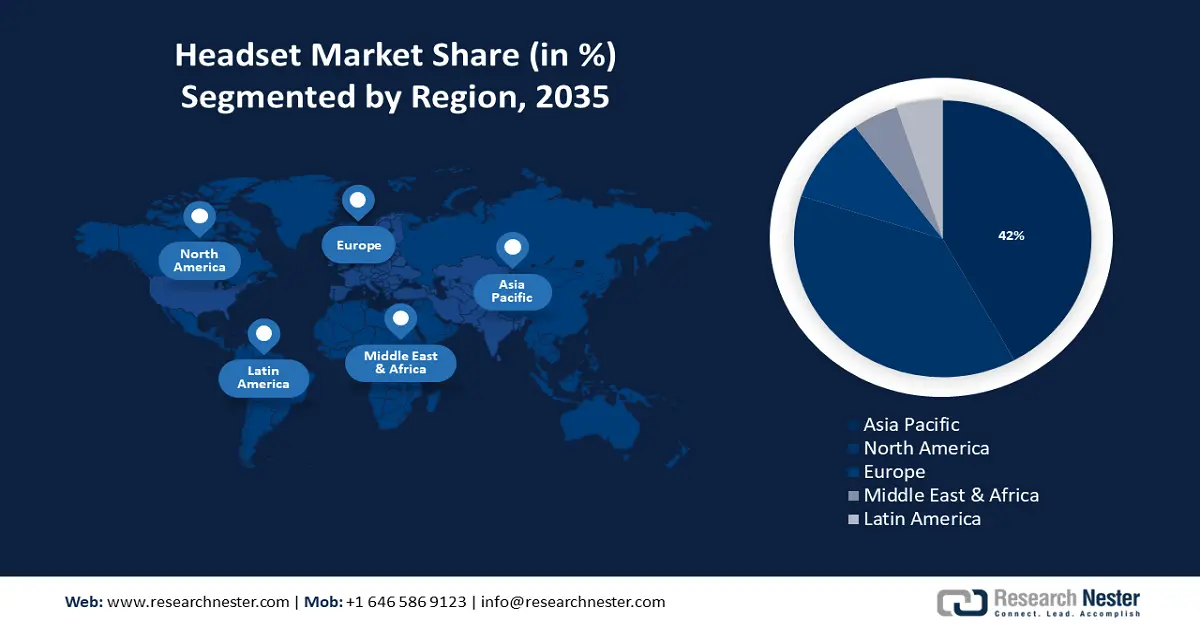

- The Asia Pacific headset market will dominate around 42% share by 2035, driven by the surging adoption of wearable technology in the region.

- The North America market will achieve substantial share by 2035, driven by the increasing presence of established firms and adoption of innovative tech.

Segment Insights:

- The personal segment in the headset market is expected to secure a 75% share by 2035, influenced by growing consumer preference for advanced audio headsets used in leisure, sports, and gaming.

- The wireless segment in the headset market is expected to grow significantly by 2035, driven by the development of wireless technologies such as Bluetooth and augmented reality.

Key Growth Trends:

- Rising popularity of online games

- Growing fitness industry

Major Challenges:

- Increasing number of counterfeit items

- Supply chain disruptions

Key Players: Motorola, ULTIMATE EARS, Apple, Inc., Plantronics, Inc., Skullcandy, Sennheiser electronic GmbH & Co. KG, Matrics Inc., Zebronics India Pvt. Ltd., Bose Corporation.

Global Headset Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 124.46 billion

- 2026 Market Size: USD 147.31 billion

- Projected Market Size: USD 796.7 billion by 2035

- Growth Forecasts: 20.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 17 September, 2025

Headset Market Growth Drivers and Challenges:

Growth Drivers

- Rising popularity of online games - The combination of cutting-edge technology and immersive experiences is changing the gaming environment for players, industry professionals, and audiences. There is been a rapid increase in the availability of advanced headsets, mobile phones, computers, and gaming consoles, catering to therising number of games and gamers worldwide. Companies are developing and launching special noise-clearance headsets for gamers that block external noises. For instance, in January 2023, JBL released the JBL Quantum 360X/P and JBL Quantum 910X/P. These novel headphones are especially designed for Xbox and PlayStation consoles to offer excellent sound quality and seamless communication for gamers.

- Growing fitness industry - Sports or workout headsets are specifically designed to cater to the needs of people engaged in physical activities. Sports enthusiasts and athletes opt for hassle-free wireless headsets to focus without distractions. In January 2024, Sony India introduced a new model of wireless sports headphones, Flot Run WI-OE610 that focused on the runner’s form, for a stable experience without compromising the sound quality. It offers important features to athletes, such as a light-weight design, and flexible neckband, so that the headphone does not slip while running.

Challenges

- Increasing number of counterfeit items - Consumers frequently get captivated and purchase counterfeit goods that provide comparable characteristics such as shape, size, and color at a significantly reduced cost. The demand for branded products is negatively impacted by the availability of inexpensive imitation products. In addition, the lack of knowledge among people to distinguish between authentic and inexpensive counterfeit goods in less developed and emerging economies is expected to restrain market growth in the coming years.

- Supply chain disruptions - Issues in the supply chain such as earthquakes and regional conflicts cause delays in the manufacturing and distribution processes, resulting in limited availability of headsets in the market. Furthermore, these disruptions have impacted the procurement process of raw materials used in headset such as aluminum, plastics, ceramic, and other metal alloys, leading to escalated manufacturing expenses and probable price surges for customers.

Headset Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

20.4% |

|

Base Year Market Size (2025) |

USD 124.46 billion |

|

Forecast Year Market Size (2035) |

USD 796.7 billion |

|

Regional Scope |

|

Headset Market Segmentation:

Type Segment Analysis

Over-ear segment is anticipated to dominate over 45% headset market share by 2035. The segment growth can be attributed to the continuous advancements in the over-ear headset features such as compact, portable, and active noise cancellation. Over-ear headsets are portable, possess a longer battery life for enhanced audio, and are increasingly used among consumers to enhance their overall experience. In August 2023, JBL announced the launch of JBL LIVE 770NC and 670NC headphones in a comfortable over-ear headband style. These headsets deliver sound with true adaptive noise canceling, and smart ambient technology, and offer sophisticated customization.

Connectivity Segment Analysis

By the end of 2035, wireless segment is projected to dominate around 55% headset market share. Rising investments in the development of innovative technologies such as Bluetooth, WI-FI, augmented reality, artificial intelligence, and others are the major factors boosting the segment’s growth. . In July 2024, Edifier International introduces the STAX SPIRIT S5 Wireless Planar Magnetic Headphones to provide a superior audio experience to the customers. The STAX SPIRIT S5 is a portable device with Bluetooth V5.4 technology and embedded with a 2μm thin film and 2nd gen EqualMass wiring technologies.

Application Segment Analysis

In headset market, personal segment is set to account for around 75% revenue share by 2035, owing to the increasing popularity of headsets among consumers for leisure, listening to music, sports, fitness, and gaming. There has been a growing inclination towards highly advanced headset devices for better audio quality in personal devices such as laptops, mobiles, and computers. In April 2024, Marshall introduced the Major V on-ear headphones, offering over 100+ hours of wireless playtime and improved comfort and battery longevity. These headphones are equipped with a customizable button that provides instant access to features such as Spotify control, EQ adjustment, and voice assistant activation.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Connectivity |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Headset Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is likely to account for largest revenue share of 42% by 2035, due to the surging adoption of wearable technology. In this region, wireless headsets with wearable technology are increasingly used for multiple activities such as watching movies, making phone calls, gaming, attending video conferences, and others.

The market in China is characterized by a dynamic landscape that is shaped by a wide range of factors, such as technology improvements, pricing strategies, regulatory environment, and customer preferences. China's headset industry is characterized by intense competition between prominent players and local businesses. Brands such as boAt, and Shenzben Dongxue Technology Co., Ltd. have successfully launched wireless headsets with a range of advanced capabilities while maintaining competitive pricing.

The market in India is projected to experience significant growth by 2035, fueled by the rising demand for wireless and noise-canceling devices among gamers. These devices act as an essential accessory for gamers to enhance their gaming experience. The expansion of the India e-commerce sector has also exerted a substantial influence on the market. Prominent brands such as Sony, boAt, and Apple Inc. have been selling their headphones and audio gadgets through e-commerce platform.

The headset industry in Japan is distinguished by the presence of companies that offer superior quality, and technologically sophisticated products to cater to the customer's needs. Japanese companies are focusing on producing high-quality products using various advanced technologies.

North America Market Insights

By the end of 2035, North America headset market is predicted to account ffor substantial share, owing to the increasing presence of established firms and the growing adoption of innovative technological items.

The need for virtual reality (VR) and augmented reality (AR) technology has led to the growing acceptance of headsets in the U.S. market, particularly in the gaming, healthcare, and education sectors. The dominance of key players such as Apple and Beats, notably in wireless headphone sales, and the expanding use of VR and MR technologies in numerous industries further boost the market growth in the country. In February 2024, Apple unveiled plans to release the Vision Pro Mixed-Reality Headset. Vision Pro is an innovative spatial computer that revolutionizes the way individuals work, communicate, connect, reminisce, and experience entertainment.

The rise of the smart technology in Canada has contributed to the expansion of market., This growth is further fueled by need for headsets with various advanced features.

Headset Market Players:

- Motorola

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ULTIMATE EARS

- Apple, Inc.

- Plantronics, Inc.

- Skullcandy

- Sennheiser electronic GmbH & Co. KG

- Matrics Inc.

- Zebronics India Pvt. Ltd.

- Bose Corporation

The headset market is characterized by the presence of several influential players who have a substantial impact on the industry's dynamics and innovation. These firms are renowned for their cutting-edge technologies in goods and products, strong brand image, and extensive distribution networks, which greatly influence the competitive dynamics of the headset industry. In addition, industry players across the globe are undertaking strategies such as mergers and acquisitions, joint ventures, license agreements, and product launches to expand their global reach and enhance their product portfolio.

Recent Developments

- In May, 2024, Zebronics, introduced a wireless headphone named ZEB-AEON. This headphone offers an impressive 110 hours of backup time and can be fully charged in just 10 minutes. The Zeb-Aeon, is equipped with Active Noise Cancellation (ANC) and Environmental Noise Cancellation (ENC) technology in its microphone, ensuring clear audio quality for calls and gaming.

- In September 2023, Bose unveiled the latest iteration of its renowned QuietComfort series: the QuietComfort Ultra Headphones, QuietComfort Ultra Earbuds, and the QuietComfort Headphones. These devices continue to uphold the distinguished characteristics including exceptional noise cancellation, superior audio quality, and unparalleled comfort and stability.

- Report ID: 6290

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Headset Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.