Head and Neck Cancer Therapeutics Market Outlook:

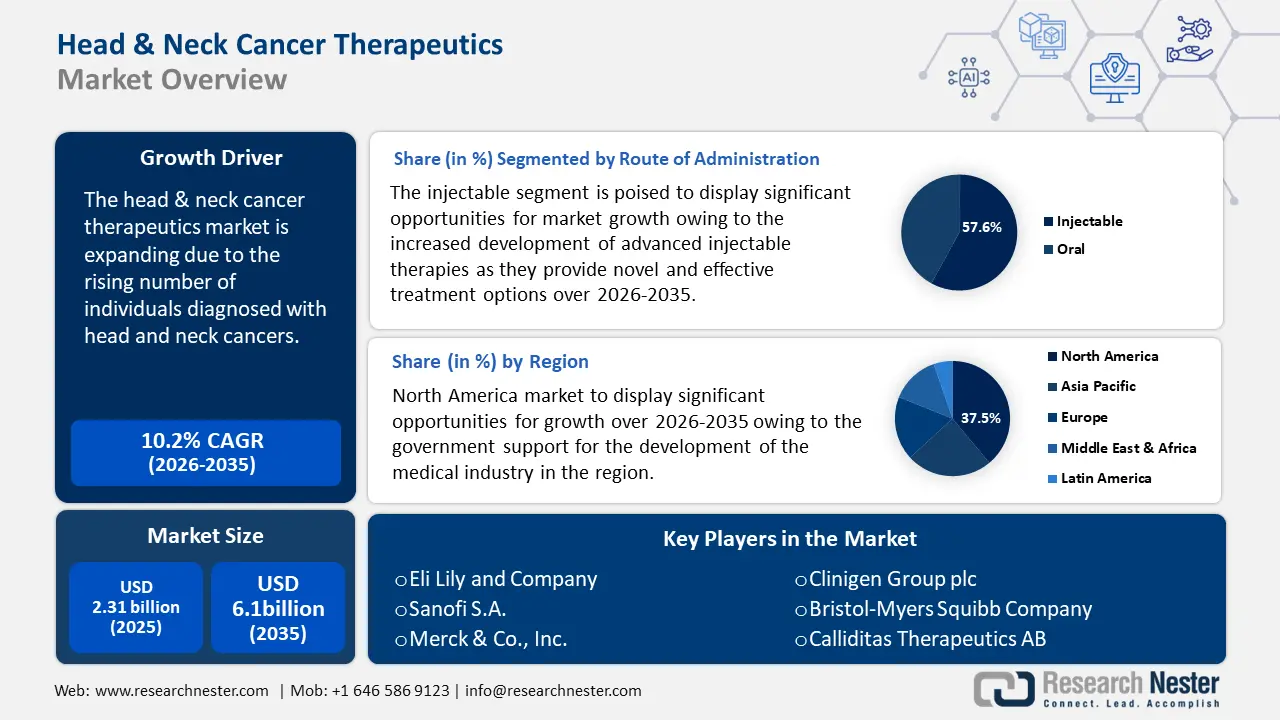

Head and Neck Cancer Therapeutics Market size was valued at USD 2.31 billion in 2025 and is expected to reach USD 6.1 billion by 2035, expanding at around 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of head and neck cancer therapeutics is evaluated at USD 2.52 billion.

The head and neck cancer therapeutics market is witnessing rapid growth due to the rising number of individuals diagnosed with head and neck cancers due to increased consumption of alcohol and tobacco. According to the Oral Cancer Foundation, 80% of overall oral cancer is attributed to smoking, while a 2020 study by the European Society for Medical Oncology stated that with roughly 6% of all cancer diagnoses and 1%-2% of all cancer-related deaths, head and neck cancer is the sixth most prevalent malignancy in the world. The most pervasive head and neck cancers worldwide are those of the oral cavity and larynx (age-adjusted standardized incidence rates of 3.9 and 2.3 per 100,000, respectively). This increase has created a substantial demand for innovative cancer treatments worldwide.

Presently, advancements are being made after years of stagnancy in HNSCC therapeutics and treatment methods. Researchers have been striving to identify distinctive forms of ferroptosis cell death triggered by erastin, a molecule capable of hindering cystine uptake through the xCT or cystine/glutamate antiporter system. This consequently impedes the cell's antioxidant defense mechanism, thereby, eliminating potential cancer cells that inhibit HNSCC chemo-radiotherapy processes. A recent study conducted by TissueGnostics investigated xCT activity, encoded by SLC7A11, and patient survival rates to outline its efficacy in treating HNSCC patients and achieved localization of tumor cells using TissueFAXS platform and HistoQuest single-cell analysis software. Several new viable treatment solutions are being developed to cater to the expanding patient base and deliver care at competitive costs.

Key Head and Neck Cancer Therapeutics Market Insights Summary:

Regional Highlights:

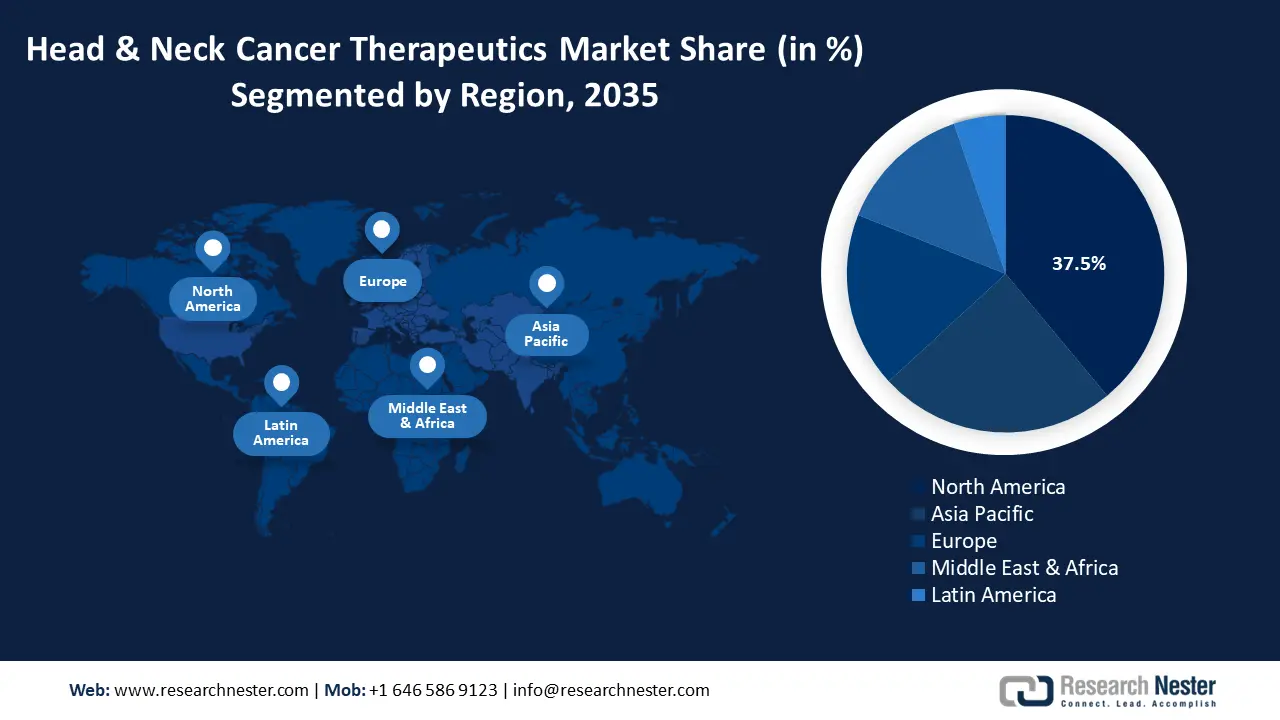

- North America’s 37.5% share in the head and neck cancer therapeutics market is driven by government support, ensuring dominance through 2026–2035.

- Asia Pacific’s head and neck cancer therapeutics market anticipates huge growth by 2035, fueled by growing use of immunotherapeutic medications.

Segment Insights:

- Immunotherapy segment is expected to lead the Head and Neck Cancer Therapeutics Market with a 51.8% share by 2035, propelled by advancements in treatments like KEYTRUDA trials.

- The Injectable segment is forecasted to secure over 57.6% market share by 2035, propelled by the precision and effectiveness of IV therapies.

Key Growth Trends:

- Technological advancements in cancer diagnostics

- Burgeoning incidences of human papillomavirus (HPV)

Major Challenges:

- Severe medication effects

- Higher treatment costs

- Key Players: Eli Lily and Company, Sanofi S.A., Merck & Co., Inc., Clinigen Group plc, Bristol-Myers Squibb Company, Calliditas Therapeutics AB, Naveris, Inc., AstraZeneca plc, Hoffman-La Roche Ltd., Coherus BioSciences.

Global Head and Neck Cancer Therapeutics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.31 billion

- 2026 Market Size: USD 2.52 billion

- Projected Market Size: USD 6.1 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, Japan, India, South Korea, Singapore

Last updated on : 14 August, 2025

Head and Neck Cancer Therapeutics Market Growth Drivers and Challenges:

Growth Drivers

-

Technological advancements in cancer diagnostics: There have been significant technological developments in the diagnosis-screening process and an increase in research to create novel cancer treatments. For instance, nanotechnology facilitates the isolation and analysis of circulating tumor cells (CTCs) and extracellular vesicles (EVs) from bodily fluids. This non-invasive approach can detect cancer at earlier stages and monitor treatment responses. According to a 2022 published report on Gold nanomaterials for oral cancer diagnosis and therapy, adding Gold nanoparticles (AuNPs) to oral squamous cell carcinoma (OSCC) or normal human serum demonstrated 80.7% sensitivity, 84.1% specificity, and an overall accuracy rate of 81.1% for OSSC diagnosis.

Most people with head and neck cancer (HNC) are diagnosed at an advanced stage and usually have a poor prognosis because of the disease’s propensity to spread swiftly into nearby tissues and produce distant metastases. In order to diagnose the illness early, researchers are working to develop new screening techniques. - Burgeoning incidences of human papillomavirus (HPV): HPV, specifically HPV type 16, significantly increases the risk of oropharyngeal cancers, particularly those impacting the tonsils and the base of the tongue. The growing prevalence of HPV-related infections has been associated with an increase in these specific types of cancers. Also, head and neck cancers that are HPV-positive typically strike younger people who may not have established risk factors such as alcohol or tobacco use.

Consequently, there is an increasing need for efficient treatments to reduce symptoms and enhance patients' quality of life as HPV incidence rises globally. The World Health Organization stated that the global prevalence of HPV was 31%, while the prevalence of high-risk HPV was 21% in 2022. The most common HPV genotype was HPV-16 (5%) and then HPV-6 (4%). Young individuals had a high prevalence of HPV, which peaked between the ages of 25 and 29 and then stabilized or slightly declined. - Development of new drugs: An increase in R&D efforts related to discovering new therapeutic targets and interdisciplinary treatment modalities will raise the survival rate of patients with head and neck cancers. In December 2023, Exelixis, Inc. announced the start of STELLAR-305, a phase 2/3 pivotal trial comparing zanzalintinib with pembrolizumab to pembrolizumab alone in patients with untreated PD-L1-positive recurrent or metastatic squamous cell carcinoma of the head and neck (SCCHN).

Challenges

-

Severe medication effects: Chemotherapy medications are intended to kill rapidly proliferating cells. However, since they cannot distinguish between malignant and healthy cells, their use can have unexpected adverse effects. Chemotherapy side effects that are most frequently reported include fatigue, neuropathy, loss of appetite, and hearing loss. To decrease the negative effects of head and neck cancer medications, a physician may, nevertheless, change the dosage, consider other medications, or suggest support services.

-

Higher treatment costs: If identified early, head and neck cancer is highly curable, often with a single modality of treatment. Advanced head and neck cancer is typically treated with a combination of surgery, radiation, and chemotherapy, which raises the expense of treatment impeding the head and neck cancer therapeutics market from growing.

Head and Neck Cancer Therapeutics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 2.31 billion |

|

Forecast Year Market Size (2035) |

USD 6.1 billion |

|

Regional Scope |

|

Head and Neck Cancer Therapeutics Market Segmentation:

Therapy Type (Chemotherapy, Immunotherapy, Targeted Therapy)

Immunotherapy segment is projected to dominate head and neck cancer therapeutics market share of around 51.8% by the end of 2035. The segment growth can be attributed to the growing development of new therapeutics. For instance, in July 2024, a clinical-stage biotechnology company, Immutep Limited, announced positive outcomes from Cohort B of the TACTI-003 (KEYNOTE-PNC-34) Phase IIb trial, which assessed eftilagimod alfa in conjunction with MSD's anti-PD-1 therapy, KEYTRUDA (pembrolizumab), as the first-line treatment for patients with recurrent or metastatic head and neck squamous cell carcinoma who exhibit negative PD-L1 expression. For patients with advanced or recurrent head and neck malignancies, immunotherapy is seen to be a viable treatment option. By using the body's immune system to identify and combat cancer cells, this method provides an alternative to conventional treatments like radiation, chemotherapy, and surgery.

Route of Administration (Injectable, Oral)

In head and neck cancer therapeutics market, injectable segment is expected to capture revenue share of over 57.6% by 2035. The segment growth can be attributed to the increased development of advanced injectable therapies as they provide novel and effective treatment options. IV injectables are used to provide several popular immunotherapy medications for head and neck cancer, including pembrolizumab (Keytruda) and nivolumab (Opdivo).

Furthermore, precise control over dosage and administration is made possible by injectables, which is crucial for maximizing effectiveness and limiting side effects in cancer treatment. Because of the proximity of critical structures including the airway and nerves, precision is important in head and neck tumors, where cautious management is necessary. This increases the adoption rate of injectables.

Our in-depth analysis of the global head and neck cancer therapeutics market includes the following segments:

|

Therapy Type |

|

|

Route of Administration |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Head and Neck Cancer Therapeutics Market Regional Analysis:

North America Market Statistics

North America industry is estimated to dominate majority revenue share of 37.5% by 2035. The market is growing due to government support for the development of the medical industry, favorable reimbursement policies, and increased awareness of diseases, increased R&D, and easy access to advanced healthcare facilities.

The head and neck cancer therapeutics market is expanding in the U.S. due to the high incidence of the disease, active research and development, quick adoption of novel treatments, and a strong healthcare system. Furthermore, the patient base needing specialized therapies has expanded due to the increasing frequency of oropharyngeal malignancies, one of the most common head and neck cancers, which is linked to HPV. The U.S. Cancer Statistics estimates that between 2017 and 2021, there were 47,984 new HPV-related malignancies recorded in the country, with 26,280 cases affecting females and 21,704 cases affecting males.

The Government of Canada provides funding for medical research, especially cancer research, fostering innovation in head and neck cancer therapy and displaying opportunities for novel medications and treatment approaches. For instance, the Canadian Institutes of Health Research CIHR invested more than USD 1 billion on cancer research between 2016 and 2021.

APAC Market Analysis

Asia Pacific will encounter huge growth for the head and neck cancer therapeutics market during the forecast period. The market growth is anticipated to be fueled by the aging population and the growing usage of immunotherapeutic medications such as Nivolumab (Opdivo) and Pembrolizumab (Keytruda) for treating different forms of HNC. According to the United Nations Population Fund, the number of individuals in the region who are 60 or older will more than double to 1.3 billion by 2050.

China is one of the largest pharmaceutical markets globally. A robust healthcare system, a highly skilled labor force, and a robust and changing consumer health market are just a few factors contributing significantly to the nation's head and neck cancer therapeutics industry growth.

The need for cutting-edge cancer therapies is fueled by India's rise as a major destination for medical tourism, where patients come for reasonably priced and excellent cancer treatment. According to the Ministry of Tourism, from 5,244 in 2016 to 8,537 in 2019, the number of patients from outside rose, and the medical tourism industry reached USD 6 billion in 2019.

Key Head and Neck Cancer Therapeutics Market Players:

- Eli Lily and Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sanofi S.A.

- Merck & Co., Inc.

- Clinigen Group plc

- Bristol-Myers Squibb Company

- Calliditas Therapeutics AB

- Naveris, Inc.

- AstraZeneca plc

- Hoffman-La Roche Ltd.

- Coherus BioSciences

Key players in the head and neck cancer therapeutics market have implemented significant tactics, including new product development, mergers and acquisitions, and strategic alliances with government authorities. Innovative medications and treatment approaches are being introduced by manufacturers to improve patients' quality of life. The provision of regulatory support has facilitated the development of a substantial medication pipeline by businesses, hence augmenting the likelihood of obtaining superior treatment compared to the existing methods in this domain. Here are some prominent players in the market:

Recent Developments

- In May 2024, Calliditas Therapeutics AB reported results from a proof-of-concept Phase 2 trial of setanaxib, its lead NOX enzyme inhibitor, in combination with pembrolizumab in patients with squamous cell carcinoma of the head and neck (SCCHN). The study found statistically significant increases in progression-free survival (PFS) and overall survival (OS), and statistically significant alterations in tumor biology that were consistent with setanaxib's mode of action.

- In April 2024, Naveris, Inc., the market leader in precision oncology diagnostics for viral-induced cancers, announced the start of a Phase II clinical trial in HPV-driven head and neck cancer with minimum residual disease (MRD+). Memorial Sloan Kettering Cancer Center (MSKCC), a world-renowned cancer treatment and research institution, will lead the study.

- Report ID: 6540

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.