HDPE Conduit Market Outlook:

HDPE Conduit Market size was valued at USD 4.48 billion in 2026 and is likely to cross USD 7.95 billion by 2035, expanding at more than 5.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of HDPE conduit is assessed at USD 4.72 billion.

The HDPE conduit market expansion is driven by infrastructure development and urbanization. Increasing urban population leads to higher demand for electricity, telecommunications, and water management systems. The U.S. electricity demand increased by 1.8% year-to-date as of September 2024 largely due to electrification and industrial reshoring. By 2030, data centers are projected to consume between 11% to 15% of total annual electricity generation, up from 6% to 8% at present. This marks a substantial increase in energy-intensive facilities demand. Governments worldwide are investing in smart city projects, which require efficient underground cable management, a primary use for HDPE conduits.

Expanding electrical grid networks and fiber-optic deployments for broadband connectivity demand durable and flexible conduits. HDPE conduits are widely used for underground power lines and fiber-optic cable protection, especially in high-growth urban areas. Moreover, urbanization increases the need for efficient drainage and water supply systems. HDPE conduits are preferred due to their corrosion resistance, flexibility, and long lifespan in underground piping applications.

Many governments are promoting sustainable and eco-friendly materials in construction, and HDPE conduits are recyclable and energy-efficient. Regulations favoring underground cabling in cities drive demand for HDPE conduits over traditional exposed wiring.

Key HDPE Conduit Market Insights Summary:

Regional Highlights:

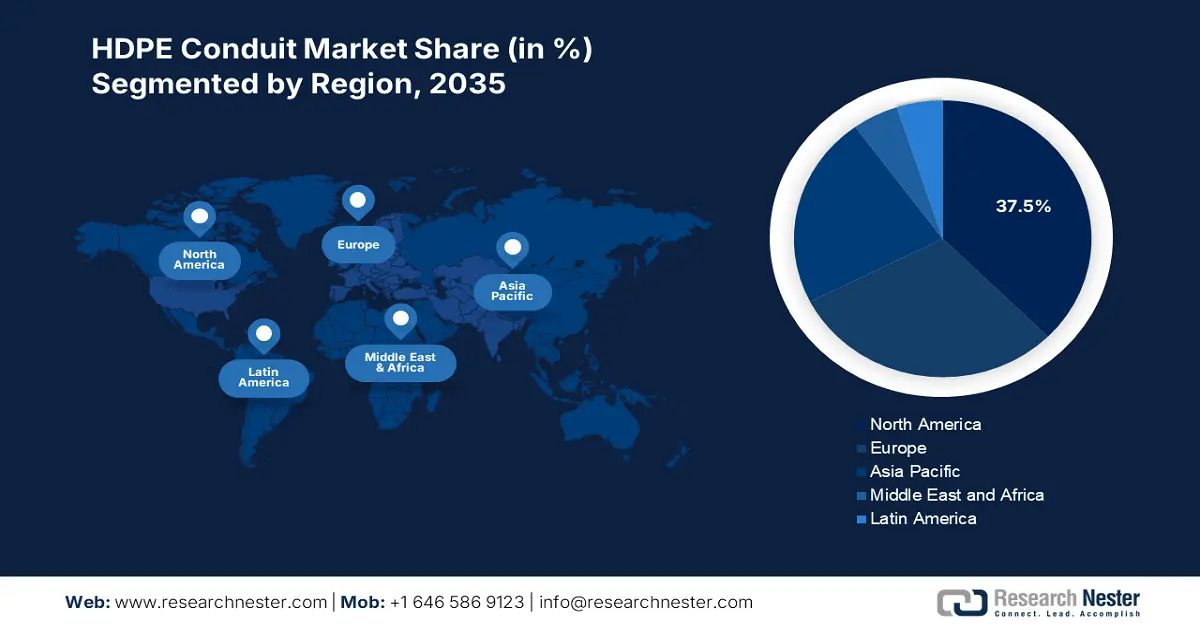

- North America leads the HDPE Conduit Market with a 37.5% share, propelled by telecommunication infrastructure expansion and rapid development of fiber optic networks, ensuring market leadership through 2026–2035.

- Europe's HDPE Conduit Market is expected to achieve a stable CAGR over 2026–2035, driven by ongoing infrastructure projects including expansion of rail networks and energy facilities.

Segment Insights:

- The Telecommunications segment is poised for noteworthy growth through 2035, driven by increasing demand for fiber-optic networks and government-backed broadband infrastructure investments.

- The 2 to 4 inches segment of the HDPE Conduit Market is forecasted to hold over 42.4% share by 2035, driven by demand for conduits ideal for 5G deployment, broadband expansion, and renewable energy applications.

Key Growth Trends:

- Rising renewable energy projects

- Increasing adoption of power and electrical applications

Major Challenges:

- Supply chain disruptions and logistics challenges

- Limited awareness and slower adoption

- Key Players: TE Connectivity, Conduit Fittings, Anvil International, Cornerstone Building Brands, Plastic Piping Systems, Reliance Worldwide Corporation, Saint-Gobain PAM, Omega Plastics, and AmeriTex Pipe & Items LLC.

Global HDPE Conduit Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.48 billion

- 2026 Market Size: USD 4.72 billion

- Projected Market Size: USD 7.95 billion by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

HDPE Conduit Market Growth Drivers and Challenges:

Growth Drivers

-

Rising renewable energy projects: The shift towards sustainable energy is fueling HDPE conduit demand, driven by infrastructure expansion, durability needs, and cost-effectiveness. Renewable energy projects require extensive electrical cabling for power transmission. HDPE conduit is lightweight, durable, and resistant to chemicals, moisture, and UV rays, making it ideal for protecting underground power cables in harsh environments. Large-scale solar and wind farms use HDPE conduit to shield electrical wiring from extreme weather conditions and mechanical damage.

Further, new power transmission and distribution networks are required as more renewable power plants are developed. HDPE conduits are used for underground and overhead cabling in substations, microgrids, and smart grids connecting renewable energy sources. Many governments are investing in renewable energy and providing incentives for clean energy projects. Regulations often mandate the use of environmentally friendly, recyclable materials, making HDPE an attractive option. According to the International Energy Agency (IEA), in 2024, global energy investment surpassed USD 3 trillion for the first time, with USD 2 trillion allocated to clean energy technologies and infrastructure. - Increasing adoption of power and electrical applications: Growing electricity demand, especially in developing regions, is leading to extensive T&D network expansion, driving demand for HDPE conduit for underground and overhead wiring. High-voltage power lines require strong, impact-resistant conduit solutions, making HDPE an ideal choice. Many urban areas are shifting from overhead power lines to underground electrical networks to improve reliability and reduce power outages caused by extreme weather.

HDPE conduits provide excellent mechanical protection, moisture resistance, and flexibility, making underground installations easier and more efficient. Moreover, the construction boom, including residential, commercial, and industrial projects, is driving demand for HDPE conduits for safe and efficient electrical wiring. Industries like data centers, manufacturing, and automation require reliable conduit systems for electrical and control cabling.

Challenges

-

Supply chain disruptions and logistics challenges: HDPE conduit is primarily made from polyethylene resin, which is derived from petroleum. Any disruptions in the oil and gas industry, such as refinery shutdowns, natural disasters, or geopolitical tensions can limit raw material supply and drive up prices. Fluctuations in polyethylene resin costs make it difficult for manufacturers to maintain stable pricing, impacting profitability and demand. Further, disruptions in global trade routes can also slow down supply chains, causing project delays.

- Limited awareness and slower adoption: Many contractors, engineers, and infrastructure planners are accustomed to using PVC, metal, or fiberglass conduits, making them hesitant to switch to HDPE. Familiarity with older materials leads to resistance against adopting HDPE, even when it offers better long-term benefits. Additionally, in many countries, overhead power lines and traditional conduit systems are still common due to lower initial costs. HDPE conduits are mostly in underground applications, but governments and utility companies may be slow to transition to underground infrastructure.

HDPE Conduit Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 4.48 billion |

|

Forecast Year Market Size (2035) |

USD 7.95 billion |

|

Regional Scope |

|

HDPE Conduit Market Segmentation:

Diameter (Less than 1 inch, 1 to 2 inches, 2 to 4 inches, over 4 inches)

2 to 4 inches segment is projected to dominate HDPE conduit market share of over 42.4% by 2035. The 2 to 4 inches HDPE conduits are ideal for housing fiber optic cables, which are essential for 5G deployment, broadband expansion, and smart city projects. Growing investments in underground telecom infrastructure are boosting demand for these conduit sizes.

These conduit sizes are commonly used in underground electrical distribution for commercial and residential power lines. Grid modernization projects and increasing underground cabling in urban areas are fueling demand. Furthermore, solar and wind power farms require flexible, durable conduits for electrical wiring, making 2 to 4 inches HDPE conduits a preferred choice. These sizes provide the right balance between cable capacity and ease of installation for renewable energy grid connections.

Application (Telecommunications, Power Distribution, Water Supply, Gas Distribution, and Industrial)

Based on the application, the telecommunications segment in HDPE conduit market is likely to hold a noteworthy share by the end of 2035. The market growth is primarily due to the increasing demand for fiber-optic networks, 5G expansion, and broadband connectivity. The global rollout of 5G technology requires extensive underground cabling to connect cell towers and base stations. HDPE conduits provide superior protection for fiber-optic cables, ensuring long-term performance in urban and rural deployments.

With the increasing demand for high-speed internet and data services, telecom companies are investing in fiber-to-the-home (FTTH), fiber-to-the-building (FTTB), and fiber-to-the-curb (FTTC) networks. HDPE conduits are ideal for underground fiber optic cable installations due to their flexibility, durability, and resistance to environmental factors. Investments in FTTB are on the rise, driven by increasing demand for high-speed internet and advancements in telecommunications technology. New federal and state funding initiatives, such as Texas’ USD 700 million BOOT program, are facilitating investments in fiber infrastructure, particularly in rural areas.

Our in-depth analysis of the global HDPE conduit market includes the following segments:

|

Application |

|

|

Diameter |

|

|

Material Grade |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

HDPE Conduit Market Regional Analysis:

North America Market Forecast

North America in HDPE conduit market is likely to capture over 37.5% revenue share by 2035. The market growth in the region is due to the telecommunication infrastructure expansion. The rapid development of fiber optic networks, driven by the demand for high-speed internet and 5G connectivity, requires durable conduits. HDPE conduits are preferred for their flexibility, strength, and resistance to environmental factors.

Investments in renewable energy in the U.S. have seen remarkable growth. According to the American Council on Renewable Energy (ACORE) in 2023, investments reached more than USD 105 billion, marking the highest annual investment in U.S. clean energy history. Further, in Q3 of 2024, a record USD 71 billion was invested in clean energy and transportation, reflecting a 12% year-over-year increase.

Further, the World Resources Institute reports that solar power installations continue to surge, with an estimated 39.6 gigawatts (GW) added in 2024, surpassing previous records. Total installed solar capacity now stands at about 220 GW, contributing over 7% of the nation’s electricity. Clean energy, federal tax credits, and innovative U.S. businesses are driving a new manufacturing boom in the country.

According to the American Clean Power Association (ACP), more than 105,000 new manufacturing jobs and 186 clean energy production plants have been announced throughout the energy tax credit period. Over 94 new primary renewable energy industrial projects have been commissioned, totaling over USD 73 billion in realized investment.

In Canada, the telecommunications sector has seen substantial growth and investment, significantly impacting the economy and connectivity across the nation. Canada boosts 99.7% mobile wireless network coverage, including 98.5% coverage in rural areas, and 93.5% high-speed internet coverage, with efforts ongoing to enhance service availability and speed, especially in underserved regions.

Europe Market Analysis

Europe is expected to experience a stable CAGR during the forecast period. The ongoing infrastructure projects across Europe, including the expansion of rail networks and energy facilities, have increased the demand for durable conduit solutions. HDPE conduits are preferred in these applications due to their flexibility and resistance to corrosion, making them suitable for protecting electrical and communication cables in diverse environments.

Germany’s strong focus on energy efficiency and sustainable building practices has fueled the demand for high-quality conduit systems that meet stringent standards and regulations. HDPE conduits, known for their durability and environmental benefits, align with these national priorities, leading to increased adoption in various infrastructure projects. The country’s commitment to sustainability includes strict energy efficiency codes, with a focus on reducing carbon emissions in the construction sector. The country aims to achieve climate neutrality by 2045, promoting the use of sustainable materials and technologies.

Key HDPE Conduit Market Players:

- IPEX

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Te Connectivity

- Conduit Fittings

- Anvil International

- Cornerstone Building Brands

- Plastic Piping Systems

- Reliance Worldwide Corporation

- Saint-Gobain PAM

- Omega Plastics

- AmeriTex Pipe & Items LLC

- Carlon

- Uponor

- Pipelife

- Osmose Utilities Services

- Georg Fischer

- NIBCO

Key players are investing in research and development to produce high-quality, durable, and flexible HDPE conduits that meet the evolving needs of industries such as telecommunications and power utilities. Leading firms are expanding their HDPE conduit market presence through acquisitions and collaborations. Moreover, there is a growing emphasis on environmental responsibility, with manufacturers incorporating recycled materials into their products and developing conduits that are resistant to environmental stressors. This approach not only meets regulatory standards but also appeals to environmentally conscious consumers.

Here are some leading players in the HDPE conduit market:

Recent Developments

- In October 2024, KPS, a division of OPW Retail Fueling and Dover, announced the introduction of its innovative conductive 3" (110/90mm) double wall piping system made of High-Density Polyethylene (HDPE). The system, which was developed in response to customer demand, is designed for medium to high-flow applications on fueling forecourts, data centers, backup, and primary generators, including fill lines and other fuel and vapor lines that need to fulfill the strictest specifications.

- In April 2024, AmeriTex Pipe & Items LLC, a Sequin, Texas-based company, is building a new facility in Conroe, Texas to extrude corrugated pipe from virgin high-density polyethylene and polypropylene to satisfy the state's demand for infrastructural products.

- Report ID: 7367

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

HDPE Conduit Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.