Hardware-in-the-Loop Market Outlook:

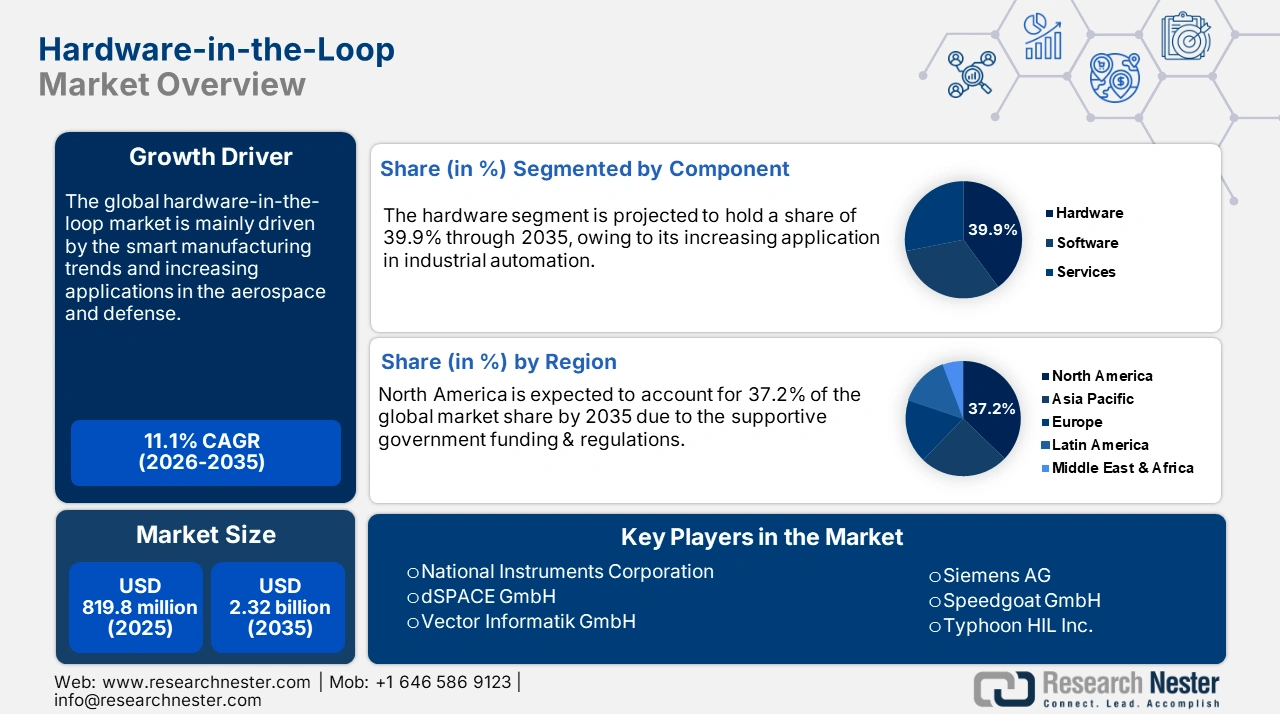

Hardware-in-the-Loop Market size was USD 819.8 million in 2025 and is estimated to reach USD 2.32 billion by the end of 2035, expanding at a CAGR of 11.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of hardware-in-the-loop is assessed at USD 910 million by 2026.

The hardware-in-the-loop (HIL) production is focused on the supply chain of high-precision electronics, software platforms, digital equipment, and embedded solutions. The steady supply of these systems reflects a positive influence on the trade of hardware-in-the-loop components. The majority of raw materials imported by Western manufacturers, particularly from the U.S., are from Asia Pacific countries such as Japan, Taiwan, and South Korea. The analysis by OEC states that in 2024, the U.S. imported semiconductor devices worth USD 22.6 billion, ranking them as the country’s 20th most imported product out of 1,227 categories. The leading countries of these imports were Vietnam (USD 5.64 billion), Thailand (USD 3.5 billion), Malaysia (USD 3.26 billion), India (USD 1.62 billion), and Cambodia (USD 1.35 billion).

The report by the U.S. Geological Survey (USGS) also suggests that China is the largest producer and exporter of global rare earth exports. This underscores that the trade of raw materials vital for the production of hardware-in-the-loop components is dominated by the Asia Pacific. Furthermore, the public investments in the HIL-aligned technologies in the energy sector are set to gain traction in the coming years. Thus, the public funding moves are estimated to play a vital role in accelerating the adoption of hardware-in-the-loop solutions.