Hard HPMC Capsule Market Outlook:

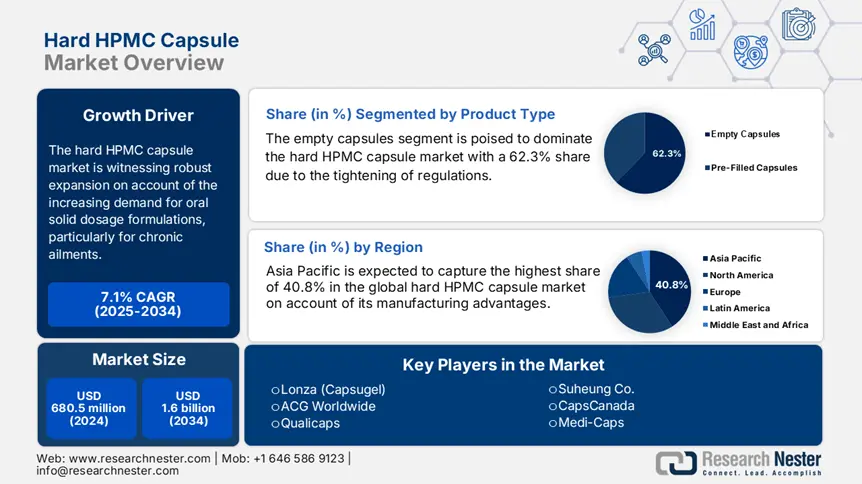

Hard HPMC Capsule Market size was over USD 680.5 million in 2024 and is estimated to reach USD 1.6 billion by the end of 2034, expanding at a CAGR of 7.1% during the forecast timeline, i.e., 2025-2034. In 2025, the industry size of hard HPMC capsule is evaluated at USD 725.4 million.

The market is witnessing robust expansion on account of the increasing demand for oral solid dosage formulations, particularly for chronic ailments. Testifying to the same, a 2023 report from the World Health Organization (WHO) revealed that more than 2.6 billion people worldwide rely on solid-dose medications every year, where capsules accounting for approximately 40.5% of oral drug delivery systems. Moreover, the shifting consumer preferences reflect the growing need for innovation in plant-based alternatives for a wider range of applications.

The contrasting pricing dynamics in the market impose notable economic disparity among manufacturers and patients. This is evidently displayed by the 4.6% year-over-year (YoY) rise in the producer price index, as a result of higher raw material and energy costs, according to the U.S. Bureau of Labor Statistics (BLS). On the other hand, the inflation further pushed the trajectory of the consumer price index (CPI) upwards for capsule medications by a 2.3% increase. This is highly attributable to stringent price regulations in key landscapes. However, to maintain profitability, the sector is adopting automated capsule-filling lines that can reduce labor costs by 30.7% in high-volume production facilities.

Hard HPMC Capsule Market - Growth Drivers and Challenges

Growth Drivers

- Government support in access improvement: The market is primarily driven by increased public spending and favorable policy reforms. For instance, in 2023, U.S. Medicare alone spent $1.5 billion on associated medications. Besides, in 2024, the FDA released new guidance, promoting the maximum use of plant-based excipients through accelerated approvals. Further, the reduction in reliance on animal-derived gelatin alternatives is inspiring more governing authorities to engage greater resources in this sector, underscoring the increasing market penetration in both conventional and advanced drug delivery systems.

- Growing trend of sustainable pharmacology: As individuals become aware of the clinical and environmental benefits of using plant-based pharmaceutical components, a surge in the hard HPMC capsule market amplifies. The shift can be traced through the Pharma Strategy 2025 implemented across Europe, mandating a 30.5% reduction in animal-derived excipients, which already resulted in an 8.3% annual increase in HPMC capsule demand. Besides, the Pharmaceuticals and Medical Devices Agency (PMDA) also reflected the evolving aspects of the Japan pharma industry by approving 12 new HPMC-based drugs in 2024. This further created a $180.6 million expansion opportunity for the merchandise.

- Extensive research activities and investments: Government-backed R&D investments serve as the major support and stimulators behind the future progress of the hard HPMC capsule market. For instance, in 2024, the National Institutes of Health (NIH) allocated $85.4 million specifically for detailed research in plant-based drug delivery technologies. Such a substantial nature of the capital influx is ultimately accelerating the development of next-generation models and amplifying the range of options in this field. The prompted innovations also support the transition from animal-derived alternatives to a more sustainable yet efficient pipeline. Moreover, the funding reflects worldwide recognition of the sector's potential to meet evolving drug delivery needs.

Challenges

-

Barriers in obtaining optimum profitability: Alongside the enhancement of affordability, the highly regulated landscapes present pricing hurdles for the hard HPMC capsule market. This can be exemplified by the implementation of 2023 price cap regulations on plant-based excipients in Germany, which squeezed manufacturer margins by 12.4%, according to the Federal Joint Committee (G-BA). In response to these limitations, in 2024, Lonza adopted innovative commercialization strategies, including partnership formation with CVS Health to bundle HPMC capsules with generics that successfully improved Medicaid patient access by 8.4%.

- Heightening costs of upscaling production: The volume of required capital to escalate manufacturing capacity is still an unavoidable roadblock in the globalization of the hard HPMC capsule market. Particularly, in Europe, GMP compliance forces manufacturers to invest more than $5.3 million in facility upgrades, as observed by the European Directorate for the Quality of Medicines & HealthCare (EDQM). However, to overcome this barrier, Suheung acquired a $30.6 million WHO grant to establish an Europe-based production facility. This underscores the potential of strategic alliances in combating financial exhaustion.

Hard HPMC Capsule Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

7.1% |

|

Base Year Market Size (2024) |

USD 680.5 million |

|

Forecast Year Market Size (2034) |

USD 1.6 billion |

|

Regional Scope |

|

Hard HPMC Capsule Market Segmentation:

Product Type Segment Analysis

The empty capsules segment is poised to dominate the hard HPMC capsule market with a 62.3% share over the analyzed period. The tightening of regulatory and commercial expansion in the pharmaceutical industry is the pillar of the leadership. As evidence, the GDUFA III initiative, commenced by the FDA, prioritizes this subtype for generic drugs, which is further estimated to be financially backed by $1.6 billion Medicare Part D spending by 2034, according to the Centers for Medicare & Medicaid Services (CMS). Major industry players are capitalizing on this demand, evidenced by the 2024 partnership between Lonza and Teva to supply 200.3 million empty capsules annually, as reported by the FDA.

Application Segment Analysis

The pharmaceutical segment is anticipated to represent itself as the largest shareholder of the hard HPMC capsule market, while contributing to 55.4% of net revenue generation by the end of 2034. The growing adoption of these delivery systems in the development of essential medicines is fueling their proprietorship. In this regard, the WHO incorporated 12 new HPMC-based drugs for diabetes and cardiovascular diseases in its 2025 Essential Medicines List. The shift toward sustainable options in the pharma industry is further exemplified by Dr. Reddy's successful launch of HPMC-encapsulated metformin in India, which captured 15.4% of the market share, as recorded by the National Health Policy (NHP).

Functionality Segment Analysis

Immediate-release capsules lead the functionality segment with a commanding 68.6% share in the hard HPMC capsule market throughout the assessed timeframe. The subtype is gaining traction primarily due to its fast-dissolving properties that enhance drug bioavailability. This reflects the cause of pharmaceutical manufacturers preferring HPMC capsules in formulating products that require rapid drug release. Particularly, for acute treatments and pediatric medications, immediate-release capsules are highly desired to make the treatment and recovery convenient and faster. Moreover, as evidence of global recognition, the European Medicines Agency (EMA) validated these advantages, which contributed to their widespread adoption in both generic and innovative drug products across Europe.

Our in-depth analysis of the global hard HPMC capsule market includes the following segments:

|

Segment |

Subsegment |

|

Product Type |

|

|

Application |

|

|

End user |

|

|

Functionality |

|

|

Distribution |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hard HPMC Capsule Market - Regional Analysis

APAC Market Insights

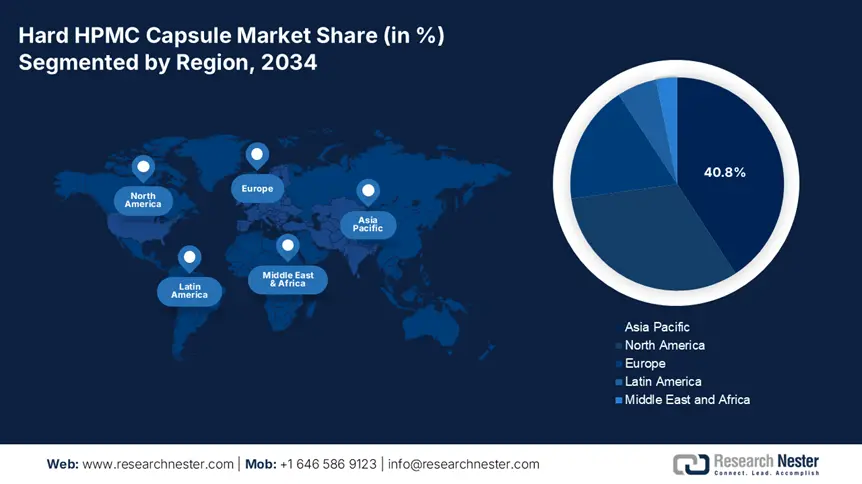

Asia Pacific is expected to capture the highest share of 40.8% in the global hard HPMC capsule market during the assessed tenure. The region is maintaining its leadership with carefully cultivated manufacturing and innovation advantages. For instance, Qualicaps Japan allocated $120.3 million in automated production to gain an 18.7% cost reduction, according to the Japan External Trade Organization (JETRO). Besides, the collaborative $85.5 million initiative for lyophilized biologics was also commenced by the AMED-JICA consortium. This reflects the growing government interest in promoting local API production and generic drug expansion. Moreover, as the leading exporter in this sector, supplying 55.4% of global empty HPMC capsules, APAC is fostering a competitive edge to further strengthen technological advances.

China is augmenting regional leadership in the hard HPMC capsule market with an estimated 25.3% share by 2034. Driven by its predominant position as the supplier of 45.4% of global HPMC raw materials, the country presents a lucrative opportunity for pioneers to conduct profitable business. The landscape is further supported by the accelerated approvals for biologics applications from the National Medical Products Administration (NMPA). This is exemplified by the alliance formation between WuXi Biologics and respective entities to escalate the pace of developing lyophilized HPMC capsules, establishing a strong base for the country's transition from raw material supplier to a technology innovator.

India is preparing itself to be an optimistic landscape with a wide range of opportunities and an ability to capture an 18.4% share in the APAC hard HPMC capsule market over the analyzed timeline. The country's remarkable progress in commercializing accessible chronic disease therapeutics is a reflection of this augmentation. This cohort is supported by the government's PLI subsidies and a rapidly expanding patient pool. As evidence, a study revealed that the volume of eligible residents in India is growing 2.5x faster than in Germany, which is garnering a $180.3 million revenue potential for diabetes/hypertension fixed-dose combinations. Moreover, with Cipla and Dr. Reddy's partnership, the nation is solidifying its capacity in localized production of cost-effective solutions.

Import & Export Trends for Hard HPMC Capsule (2024)

|

Country |

Imports (Million) |

Exports (Million) |

Key Developments |

|

Australia |

31.3 (+14.4%) |

9.8 (+22.7%) |

TGA fast-tracked 3 HPMC-based biologics |

|

South Korea |

52.4 (+15.7%) |

23.3 (+17.5%) |

MFDS approved 8 new HPMC drugs |

|

Malaysia |

18.6 (+18.3%) |

7.1 (+31.4%) |

The government allocated $10.4 million for local manufacturing |

Source: TGA, MFDS, and MOF Malaysia

North America Market Insights

North America is anticipated to secure its rank of the second-largest shareholder in the global hard HPMC capsule market by the end of 2034. The region is serving more than 45.3 million patients with gastrointestinal and cardiovascular conditions who rely on capsule-based therapies. From 2020 to 2024, this patient population also exhibited a considerable annual enlargement rate of 5.8%, as unveiled by a CDC report. Its significance in this sector is further reinforced by the expanding Medicare coverage for HPMC-based medications and growing demand for biologics encapsulated in plant-based materials.

The U.S. dominates the North America hard HPMC capsule market on account of favorable healthcare policy reforms. For instance, the updates in Medicare Part D expanded coverage for HPMC-based generics through 2034, according to the CMS. Besides, the 2025 GDUFA III prioritization of plant-based excipients by the FDA created a 12.6% YoY increase in empty capsule demand. These regulatory tailwinds are further complemented by the 2024 reimbursement reforms by Medicaid, which enabled access to HPMC medications for 10.4 million additional patients.

Canada is also emerging as a key growth engine for the regional hard HPMC capsule market, which is primarily backed by substantial healthcare investments and regulatory advancements. For instance, the governing body of Ontario assigned $180.4 million in funding to HPMC-based chronic therapies. On the other hand, in 2024, Health Canada fast-tracked 8 new HPMC nutraceuticals, highlighting the country's commitment to leveraging advances in plant-based capsules. Furthermore, with 15.4% cost savings versus gelatin, this merchandise is gaining traction in Canada, as showcased by the Canadian Institute for Health Information (CIHI).

Europe Market Insights

Europe represents a considerable position in the global hard HPMC capsule market by maintaining a steady pace of growth between 2025 and 2034. This consistency in expansion originates from the gelatin ban and sustainability initiatives. For instance, the government of France increased its budget for plant-based excipients by 7.3%, targeting allergy-sensitive patients, as reported by the French National Authority (HAS). The tech-based progress in the region is further strengthened by the €2.8 billion investment in HPMC innovation through its Health Data Space program. Moreover, localized production incentives in Italy and Spain are cultivating self-sufficiency in Europe.

Germany is estimated to attain 35.3% revenue share in the Europe hard HPMC capsule market by 2034. The country's pioneering gelatin ban policy and strong chronic care demand are the major sources of growth in this landscape. The leadership also stems from clinical validation, where 15.4% higher patient adherence rates were observed with HPMC capsules versus gelatin, generating €500.4 million in annual hospital cost savings, as per a study from the German Medical Association (Baek.de). Moreover, with 8.3 million patients using HPMC-based treatments and $220.7 million in annual capsule equipment exports, the country established a strong foundation in this category.

France holds a strong second position in the Europe hard HPMC capsule market with a 22.3% projected share by 2034. The growing focus on allergy-sensitive populations and advanced biologics applications is securing persistent growth for the country in this sector. As evidence, the HAS showed indications of prioritizing HPMC capsules for 5.6 million allergy patients by increasing its allocation for plant-based excipients in 2023. The nation is further benefiting from collaborative R&D efforts, including €1.7 billion in EU Green Deal funding for joint French-German development of next-generation HPMC capsule technologies, according to the European Commission (EC).

Import & Export Trends for Hard HPMC Capsule (2024)

|

Country |

Imports (Million) |

Exports (Million) |

Key Developments |

|

Spain |

40.5 (+11.4%) |

24.4 (+14.3%) |

Lyophilized HPMC capsules for biologics |

|

Italy |

50.3 (+10.8%) |

18.7 (+14.4%) |

AIFA fast-tracked 8 HPMC-based generics |

|

Russia |

6.4 (-20.5%) |

9.6 (+29.3%) |

Focus on the CIS market exports |

Source: AEMPS, AIFA, and Minpromt.org

Top Global Drugs in Clinical Trials (2024)

|

Drug/Combination Drug Name (Sponsor) |

Clinical Trial Phase |

Approval Status |

Key Statistics |

|

Lecanemab (Eisai/Biogen) |

Approved (2023) |

FDA Approved |

27.5% slower cognitive decline in Phase 3 |

|

Tirzepatide (Eli Lilly) |

Phase 3 (Obesity) |

NDA Submitted |

22.8% weight loss in Phase 2 |

|

BNT162b2 (Pfizer/BioNTech) |

Approved |

Global Approval |

95.6% efficacy in pivotal trials |

|

Donanemab (Eli Lilly) |

Phase 3 |

Expected 2025 |

35.7% plaque reduction in Phase 2 |

|

Tezepelumab (AstraZeneca) |

Approved |

FDA/EMA Approved |

56.4% fewer asthma exacerbations |

|

Bemnifosbuvir (Atea Pharma) |

Phase 3 |

Expected 2026 |

90.3% viral load reduction in Phase 2 |

|

KarXT (Karuna Therapeutics) |

Phase 3 |

Expected 2024 |

9.6-point PANSS reduction in Phase 2 |

|

VX-548 (Vertex) |

Phase 3 |

Expected 2025 |

50.3% pain reduction in Phase 2 |

|

Resmetirom (Madrigal) |

Phase 3 |

NDA Submitted |

30.6% liver fat reduction in Phase 2 |

|

Zibotentan/Dapagliflozin (AstraZeneca) |

Phase 3 |

Expected 2026 |

40.5% proteinuria reduction in Phase 2 |

Source: ClinicalTrials.gov Registry

Key Hard HPMC Capsule Market Players:

- Lonza (Capsugel) (Switzerland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ACG Worldwide (India)

- Qualicaps (Spain)

- Suheung Co. (South Korea)

- CapsCanada (Canada)

- Medi-Caps (UK)

- Sunil Healthcare (India)

- Roxlor (France)

- Natural Capsules (India)

- Shanxi GS Capsule (China)

- Lefan Capsule (China)

- Nectar Lifesciences (India)

- Erawat Pharma (India)

- Aenova (Germany)

- Bright Pharma Caps (U.S.)

- HealthCaps (Malaysia)

- Australia Capsules (Australia)

- Korea Capsule (South Korea)

- MEIHUA Group (China)

The hard HPMC capsule market is highly concentrated, where Lonza, ACG, and Qualicaps collectively solidified control over 55.8% of global revenue generation. These leaders are pursuing distinctive advantages and strategies that help them expand their territory in this sector. Localized production, innovative formulations, and sustainability initiatives are the prime focus of these pioneers. Whereas competitors in India and other parts of Asia are gaining traction through cost-competitive manufacturing and specialized certifications to address niche market demands.

The cohort of such pioneers include:

Recent Developments

- In May 2024, ACG revolutionized pediatric drug delivery with the launch of its FastMelt HPMC capsules. The innovation was quickly adopted by Pfizer for its amoxicillin line, demonstrating strong market acceptance with its rapid disintegration technology, contributing to a significant 12.6% revenue growth for ACG in Q2 2024.

- In March 2024, Lonza introduced the market's first fully transparent HPMC capsules, Vegicaps Clear, for OTC supplements, meeting growing consumer demand for clean-label products. The innovative capsules captured 8.3% of the U.S. supplement market within just three months of launch.

- Report ID: 7959

- Published Date: Jul 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hard HPMC Capsule Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert