Hard Disk Market Outlook:

Hard Disk Market size was over USD 64.72 billion in 2025 and is poised to exceed USD 112.66 billion by 2035, witnessing over 5.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hard disk is evaluated at USD 68.04 billion.

The primary growth driver of the hard disk market is the expanding data storage needs fueled by trends in cloud computing, big data analytics, and data-heavy applications such as artificial intelligence (AI) and the Internet of Things (IoT). With increasing demand for large-scale data storage, data centers and cloud providers are investing heavily in hard disks since they offer high storage capacity at a relatively low cost per gigabyte compared to solid-state drives. Companies of all sizes require effective data storage strategies to deal with increasing data. Approximately 79% of small businesses store less than 50TB of data, 78% of medium-sized businesses store less than 100TB, and 63% of enterprises store more than 100TB.

Additionally, solid-state drives (SSDs) are growing in popularity due to their speed and performance advantages. As data centers continue to use hard disks for bulk storage while using SSDs for high-performance jobs, their growth indirectly boosts the hard disk market. This hybrid approach allows data centers to optimize costs using SSDs for frequently accessed data on high-capacity hard disks. SSD adoption increases hard disk demand in data centers, which require cost-effective storage for cold or archive data.

Key Hard Disk Market Market Insights Summary:

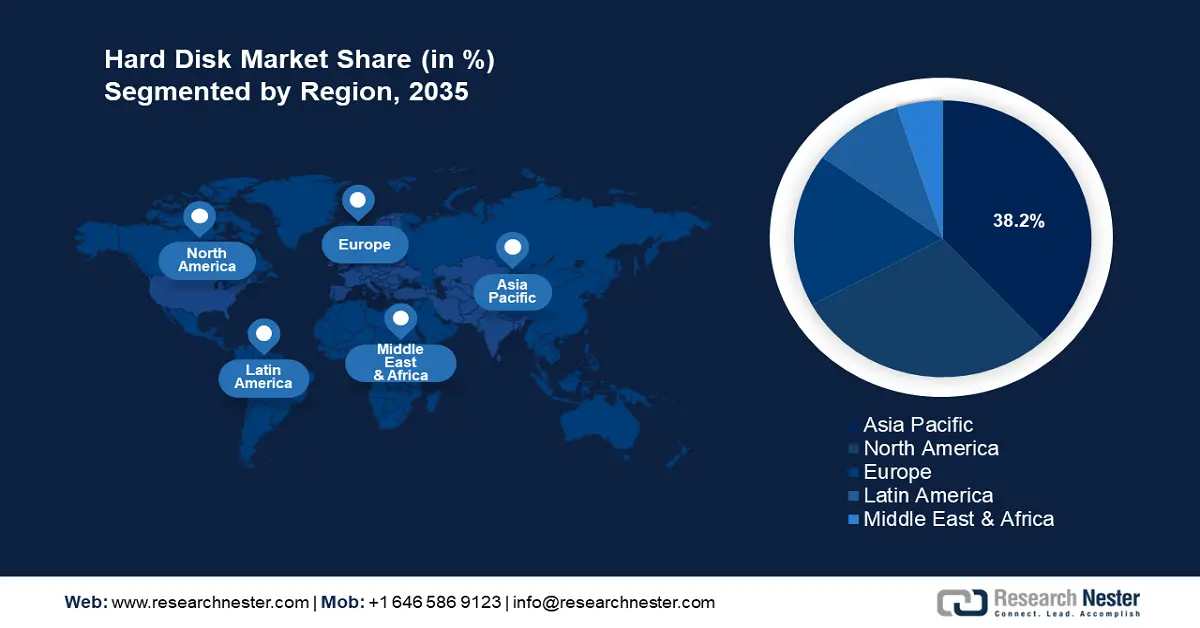

Regional Highlights:

- Asia Pacific dominates the Hard Disk Market with a 38.2% share, fueled by rising demand for data storage solutions, rapid digitalization, and cloud adoption, ensuring robust growth from 2026–2035.

- North America's Hard Disk Market is expected to see steady growth by 2035, fueled by a surge in data-intensive applications and demand for cost-effective large-scale storage.

Segment Insights:

- The Business/Commercial segment is projected to capture over 57.2% market share by 2035, driven by demand for scalable storage from retail, healthcare, and finance industries.

- The Personal Use segment is anticipated to capture a significant share by 2035, propelled by rising digital media consumption and personal data backup needs.

Key Growth Trends:

- Data growth and expansion of data centers

- Emerging markets and digitalization

Major Challenges:

- Increasing competition from solid-state drives (SSDs)

- Energy consumption concerns

- Key Players: Seagate Technology LLC, Transcend Information. Inc., Samsung Electronics, ADATA Technology Co. Ltd., Apple Inc., Quantum Corp., SK Hynix Inc., Intel Corporation.

Global Hard Disk Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 64.72 billion

- 2026 Market Size: USD 68.04 billion

- Projected Market Size: USD 112.66 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, South Korea, Germany

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 14 August, 2025

Hard Disk Market Growth Drivers and Challenges:

Growth Drivers

-

Data growth and expansion of data centers: The volume of data generated globally is growing exponentially due to digital transformation across healthcare, retail, and entertainment sectors. The rise of IoT, 5G, and social media fuel this data explosion, as billions of connected devices create vast amounts of information daily. For instance, there were 16.6 billion linked IoT devices by the end of 2023 (a 15% increase over 2022), and this value climbed 13% to 18.8 billion by the end of 2024. This unprecedented growth in data requires robust storage solutions. Although SSDs are increasingly popular for high-speed applications, hard disks remain essential for high-capacity and cost-effective storage, especially for cold storage or archival purposes, where retrieval speed is less critical.

Data centers support global cloud services, artificial intelligence, big data analytics, and digital transformation initiatives. The demand for reliable, high-capacity storage is increasing with the rapid growth of cloud providers and hyperscale data centers. Hard disks are favored by data centers for bulk storage due to their cost-per-gigabyte advantage over SSDs at high capacities. - Emerging markets and digitalization: Many emerging economies are investing heavily in digital infrastructure as they digitize services in government, healthcare, education, and finance. This transformation is driving demand for data storage solutions to support the data-intensive requirements of these sectors. Hard disks are preferred in these markets due to their cost-effectiveness, making them ideal for large-scale data storage needs where budget constraints may limit the adoption of more expensive storage options.

Moreover, increased internet penetration, mobile connectivity, and the adoption of smart devices in emerging markets are leading to an exponential increase in data generation. With more users online, data volumes are growing rapidly, particularly in social media, e-commerce, streaming, and e-learning, all of which require reliable storage infrastructure. For instance, about 33% of the world's population shops online, representing a 2.7% growth from 2023. - Video surveillance and security: Surveillance systems are increasingly using high-definition and 4K cameras to capture clearer, more detailed footage. This higher-quality video generates larger file sizes, which require substantial storage capacity, making hard disks an ideal solution due to their cost-effectiveness at large capacities. Additionally, as security installations expand from critical infrastructure to residential and retail spaces, storage requirements continue to grow, driving demand for high-capacity hard disks.

Governments around the world are investing in smart city initiatives, which often include extensive surveillance systems for monitoring public spaces, managing traffic, and enhancing urban security. For instance, according to the U.S. Bureau of Labor Statistics, surveillance camera installations in the U.S. increased by 21%, from 70 million in 2018 to roughly 85 million in 2021. These initiatives are especially prevalent in emerging economies and large metropolitan areas, where robust, reliable storage solutions are required. High-capacity hard disks play a critical role in supporting these smart city projects, offering scalable storage solutions that balance performance and cost.

Challenges

-

Increasing competition from solid-state drives (SSDs): SSDs have gained popularity due to their superior speed, energy efficiency, and durability compared to hard disks. This shift is particularly strong in the consumer and enterprise sectors, where speed and performance are highly valued. As SSD prices continue to fall and capacities increase, more consumers and enterprises are adopting SSDs, especially for applications that prioritize performance over capacity, such as laptops, gaming, and high-speed data processing.

-

Energy consumption concerns: Hard disks generally consume more power, which has become a growing concern as data centers look to optimize energy efficiency and reduce operational costs. High power consumption translates to higher cooling and electricity requirements, making hard disks less attractive for companies focused on sustainability. With the increasing pressure on data centers to reduce their carbon footprints, SSDs are often preferred over hard disks for low-power, high-efficiency storage needs.

Hard Disk Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 64.72 billion |

|

Forecast Year Market Size (2035) |

USD 112.66 billion |

|

Regional Scope |

|

Hard Disk Market Segmentation:

Technology [Microwave-Assisted Magnetic Recording (MAMR), Heat-Assisted Magnetic Recording (HAMR), Shingled Magnetic Recording (SMR), and Perpendicular Magnetic Recording (PMR)]

By technology, the perpendicular magnetic recording (PMR) segment in hard disk market is poised to increase its revenue share by 2035. PMR technology, which arranges magnetic bits perpendicularly to the disk platter, allows for higher data density than traditional longitudinal recording. This innovation has enabled hard disk manufacturers to produce drives with greater storage capacities without increasing the physical size of the disk. As data storage demands continue to rise, PMR’s ability to maximize areal density on smaller disks has made it a critical technology, especially for enterprise and data center markets where high-capacity and cost-effective solutions are essential.

PMR-based hard disks have played a vital role in supporting data-intensive applications, such as video surveillance, cloud storage, and big data analytics. The growing demand for storage in these sectors is expected to maintain a steady demand for high-density hard disks leveraging PMR, even as SSDs gain popularity in consumer applications. Additionally, PMR technology is being improved with advancements like shingled magnetic recording (SMR), which overlaps recording tracks to boost density further, and energy-assisted methods (such as HAMR and MAMR), which promise even higher capacities.

End user (Personal use, Business/Commercial, and Governmental)

The business/commercial segment is predicted to capture over 57.2% hard disk market share by 2035 with a focus on reliable, scalable storage solutions. The commercial segment is driven by rising storage demands from industries such as retail, media, healthcare, and finance. This segment includes small and medium-sized enterprises (SMEs) and larger corporations that require data storage solutions, such as operational data, backup and disaster recovery, video surveillance, and customer data.

The personal use segment also holds a significant hard disk market share due to the increasing demand for storage in everyday computing. Although enterprise applications dominate the hard disk market, personal use is expected to remain steady due to ongoing consumer demand for cost-effective, high-capacity storage solutions. This demand is driven primarily by the increasing consumption of digital media, such as high-definition video, photos, and large game files, as well as the need for reliable data backups.

Our in-depth analysis of the hard disk market includes the following segments:

|

Type |

|

|

Technology |

|

|

Storage Capacity |

|

|

Substrate |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hard Disk Market Regional Analysis:

APAC Market Forecast

Asia Pacific industry is estimated to account for largest revenue share of 38.2% by 2035, The region is experiencing steady growth due to rising demand for data storage solutions across multiple industries, particularly in major economies like China, India, Japan, and South Korea. This demand is driven by rapid digitalization, the expansion of data centers, and increased adoption of cloud computing and IoT applications. In addition, the region is seeing a surge in the number of data-intensive businesses and IT industries that rely on robust storage solutions to manage growing data volumes.

In China the hard disk market has been heavily impacted by rapid advancements in digital infrastructure and increased demand for data storage across both personal and enterprise sectors. Demand for hard disks in the country remains strong, particularly in the enterprise and data center markets. This trend aligns with the growth in cloud computing, AI, and large-scale data analytics, where traditional hard disks offer high capacity at lower costs compared to SSDs.

The China hard disk market is home to some of the world's largest manufacturers, driving substantial progress and changing the worldwide industry landscape. To preserve a competitive advantage, these organizations use cutting-edge technologies and inventive solutions. For instance, in March 2024, LaCie, Seagate Technology Holdings plc's premium brand, unveiled the new LaCie Rugged Mini SSD portable storage drive, which has a capacity of up to 4TB and is sturdy, quick, and compact.

The hard disk market in India is set for growth driven by a mix of rising demand across consumer electronics, rapid digital transformation, and strategic government policies. Moreover, government initiatives such as Make in India campaign, have promoted local manufacturing and reduced dependency on imports. Policies that import restrictions on laptops and other devices have further stimulated domestic production, indirectly benefiting the hard disk market. In addition, the integration of hard disks into consumer electronics and applications such as surveillance, gaming consoles, and portable storage is fueling the demand.

North America Market Analysis

The hard disk market in North America is experiencing steady growth, driven by a surge in data-intensive applications across both consumer and enterprise sectors. This growth is influenced by high demand in data centers, the increasing adoption of cloud services, and expanding storage needs from sectors such as media, gaming, and surveillance. Hard disks continue to be used widely for large-scale data storage, benefiting from their cost-effectiveness compared to SSDs, particularly for applications that require high-capacity storage at lower costs.

In the U.S. hard disks market still hold a significant place for applications where storage capacity is prioritized over speed such as backups, and network-attached storage (NAS) devices. Gaming consoles and digital media storage also contribute to the hard disk demand within the consumer sector. In addition to commercial demand, government data storage requirements have also supported hard disk usage in the country, as federal and state institutions continue to require secure, high-capacity storage for extensive records and information management.

The U.S. remains one of the largest hard disk market globally, supported by its advanced IT infrastructure and significant investments in data center expansions and digital transformation initiatives. According to the International Data Corporation (IDC), the U.S. accounted for 35.8% of worldwide digital transformation spending in 2023.

Key Hard Disk Market Players:

- Western Digital Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Seagate Technology LLC

- Transcend Information. Inc.

- Samsung Electronics

- ADATA Technology Co. Ltd.

- Apple Inc.

- Quantum Corp.

- SK Hynix Inc.

- Intel Corporation

Leading key players effectively position themselves to serve diverse storage needs, from consumer electronics to large-scale enterprise applications, while managing competition with SSD technology through advancements in hard disk capacity and durability. The key players are focusing on various strategies such as expanding product portfolios, adopting advanced technologies, and targeting specific sectors such as data centers and consumer electronics.

Here are some key players in the hard disk market:

Recent Developments

- In January 2024, Seagate Technology LLC, a global pioneer in mass-data storage infrastructure solutions, introduced the new Seagate IronWolf Pro 24 TB hard drive, which meets the changing data demands of SMB and enterprise network attached storage (NAS) systems.

- In July 2022, Western Digital Corporation launched new 22TB1 HDDs for three key segments: WD Gold HDDs for IT/data center channel customers, WD Red Pro for network attached storage (NAS), and WD Purple Pro for smart video/surveillance.

- Report ID: 6673

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hard Disk Market Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.