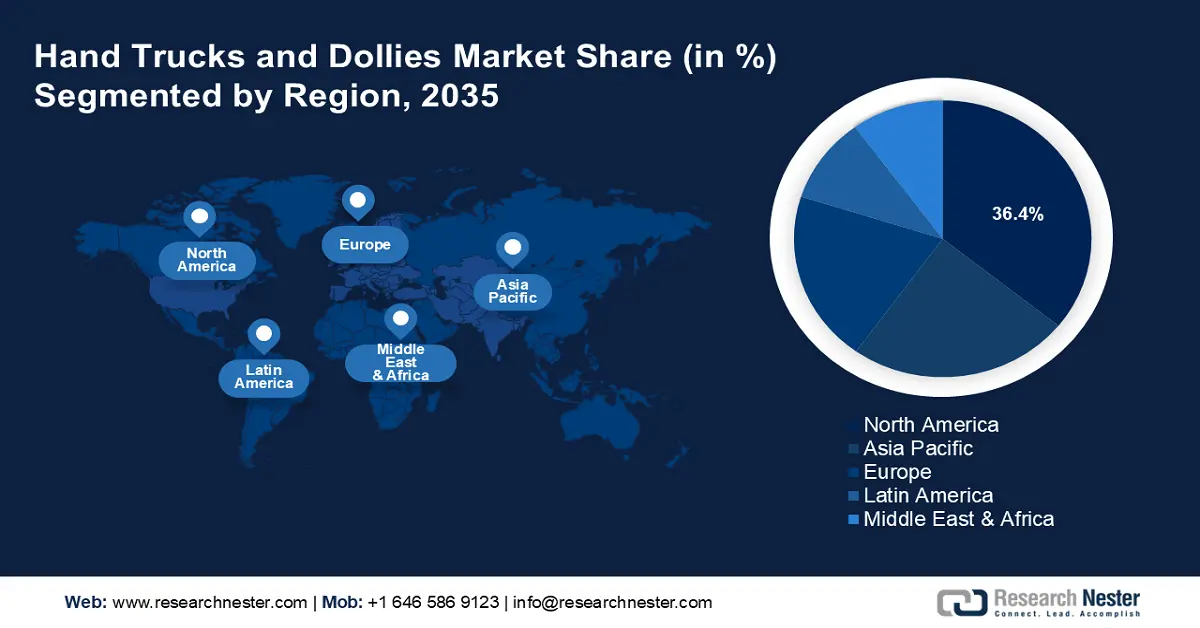

Hand Trucks and Dollies Market Regional Analysis:

North India Market Forecast

North America hand trucks and dollies market is poised to account for revenue share of more than 36.4% by the end of 2035. The regional market’s growth is owed to robust demand from e-commerce, warehousing, and retail. The region benefits from well-established e-commerce and retail sectors driving demands for efficient material handling. Due to the high volume of online shopping in the region, companies are investing in last-mile delivery solutions fueling demands for durable dollies and hand trucks that can withstand frequent use. Additionally, the hand trucks and dollies market leverages the rising push for worker safety in warehouses in the region by supplying moving equipment that can reduce labor strain. Major retailers are investing in automated distribution centers that are positioned to fuel further demands for hand trucks and dollies. For instance, in July 2024, Walmart announced the opening of five automated distribution centers across the U.S.

The U.S. is poised to register the largest revenue share in the hand trucks and dollies sector. The hand trucks and dollies market’s growth is attributed to the rapid growth of urban warehousing and micro-fulfilment centers. For instance, in February 2024, Grainger announced plans to build a new distribution center near Houston to provide additional capacity to the company. Additionally, home improvement and construction sectors are driving demands for heavy-duty dollies to handle bulk materials. Rising worker safety concerns are prompting businesses to seek ergonomic moving solution that reduces strain on workers and increasing regulatory pressure to improve worker conditions is poised to fuel the market’s growth.

Canada is projected to increase its revenue share in the hand trucks and dollies sector by the end of the forecast period. The hand trucks and dollies market’s growth in Canada is attributed to rising demands for hand trucks and dollies from the e-commerce sector. Additionally, the boom of retail expansion in major cities such as Toronto and Vancouver drives demands for compact and easy-to-maneuver hand trucks. With investments in smart warehousing, hand trucks that can seamlessly interact with new technology are poised to create a steady demand benefiting the sector’s growth. For instance, in May 2024, Brokk announced the opening of a distribution center in Hamilton, Ontario.

APAC Market Analysis

The Asia Pacific hand trucks and dollies market is poised to register the fastest revenue growth during the forecast period. The market’s growth is attributed to rapid urbanization and e-commerce boom in the region. The revenue growth is led by China, India, Japan, and South Korea. With the region being the hub of multiple supply chains and manufacturing hubs, companies are investing in durable moving solutions to support high-volume material handling operations. Additionally, the growth of cold chain logistics in the pharmaceutical sector is poised to drive demands for hand trucks and dollies. For instance, in July 2024, West Pharmaceuticals announced the expansion of capabilities in Asia and expanded warehouse facility expansion in South Korea.

China registered the largest revenue share in the hand trucks and dollies market. The market’s growth is attributed to the country’s massive e-commerce sector. Logistics and fulfillment centers in China are fueling the adoption of advanced material handling equipment, assisting the market’s growth curve. The country is investing in large-scale construction and urbanization projects that are poised to drive demands for compact hand trucks that can easily navigate confined spaces. For instance, in October 2023, GEODIS and Sephora announced the opening of a distribution center in Shanghai with cutting-edge storage technologies.

India is projected to increase its revenue share in the hand trucks and dollies sector by the end of the forecast period. The regional hand trucks and dollies market is boosted by the rapid expansion of manufacturing, logistics, and retail sectors. Post COVID-19, the e-commerce sector has experienced a considerable profit surge boosting demands for hand trucks and dollies in expanding warehouses. Additionally, the country faces logistical challenges in narrow delivery lanes and uneven surfaces, prompting demands for moving solutions models that can be navigated in tight spaces, In March 2024, TVS SCS announced the expansion of its warehouse footprint in India by adding new multi-client warehouse space in Hosur, Tamilnadu. The hand trucks and dollies market in the country is positioned to leverage the favorable trends and maintain its growth.