Hand Trucks and Dollies Market Outlook:

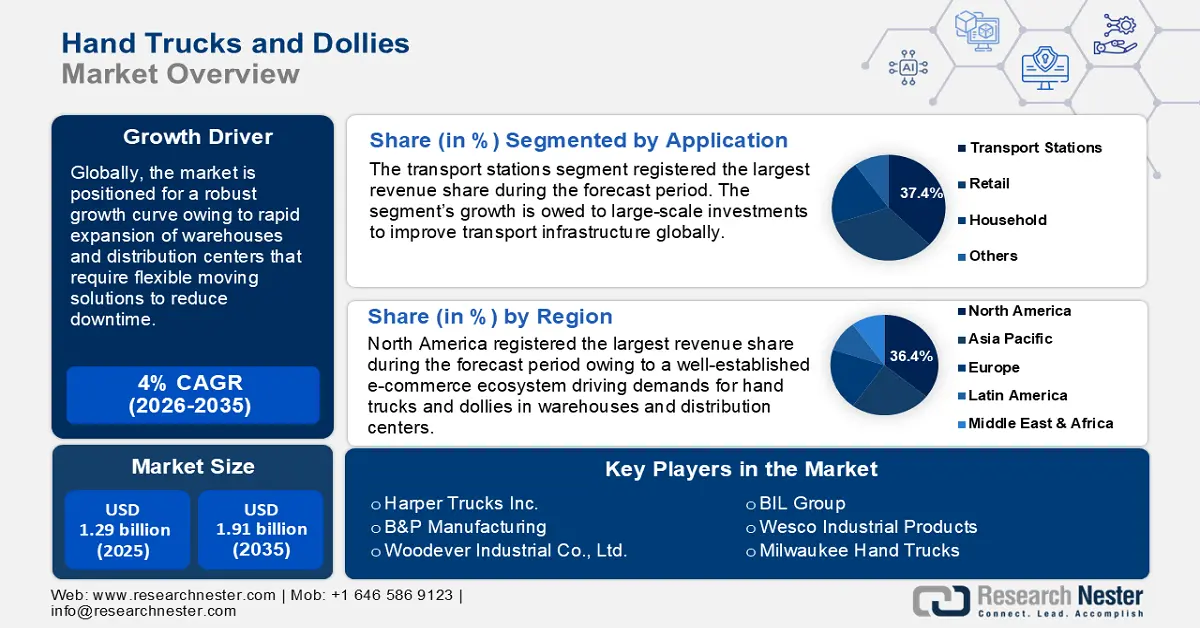

Hand Trucks and Dollies Market size was over USD 1.29 billion in 2025 and is projected to reach USD 1.91 billion by 2035, witnessing around 4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hand trucks and dollies is assessed at USD 1.34 billion.

The growth of the sector is attributed to rising investments in reliable moving equipment for warehouses, construction sites, the hospitality sector, etc. The rapid growth of the e-commerce sector benefits the demand for hand trucks and dollies as online retail requires more precise order fulfillment. For instance, in July 2024, LPP Logistics announced the launch of the second e-commerce warehouse in Romania. The increasing prevalence of e-commerce leads to a surge in order volumes in warehouses necessitating hand trucks and dollies to ensure faster turnaround for customers.

The global hand trucks and dollies market is poised to leverage profitable opportunities in emerging economies such as India, Brazil, Indonesia, etc., owing to the rapid expansion of warehousing facilities. Businesses are investing in large distribution centers that drive demands for efficient moving solutions. For instance, in February 2024, Merck announced the opening of a new distribution center in Brazil investing USD 21.7 million that will have 13000 square meters of space for the life science business sector. Additionally, the global hand trucks and dollies market is positioned to benefit from rising awareness on workplace safety pushing businesses to invest in equipment that can curtail the risk of manual labor. The Occupational Safety and Health Administration of the U.S. has been vocal in efforts to protect the interests of warehouse workers by ensuring access to hand trucks and dollies to minimize strenuous labor.

Advancements in manufacturing materials are poised to assist the growth surge of the global hand trucks and dollies sector. Electric-powered dollies are emerging as alternative solutions to heavy-duty applications, improving operational efficiency. Additionally, advancements in Internet of Things (IoT) sensors are positioned to lead a profit surge in the market as businesses invest in automation, and IoT-integrated hand trucks can track usage benefiting data analysis. As per global trends, manufacturers are increasingly focusing on developing lightweight and robust materials to improve product durability while maintaining ease of use. The hand trucks and dollies market is poised to leverage the favorable trends of advancements and maintain the profitable growth curve by the end of the forecast period.

Key Hand Trucks and Dollies Market Insights Summary:

Regional Highlights:

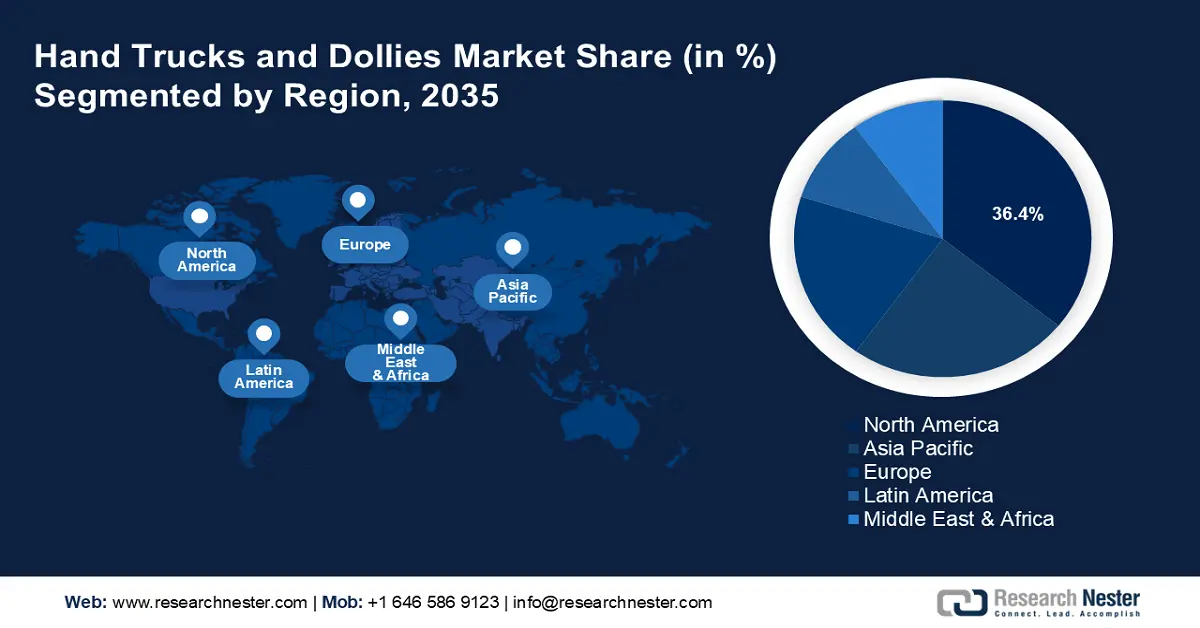

- North America leads the Hand Trucks and Dollies Market with a 36.40% share, driven by robust demand from e-commerce, warehousing, and retail sectors, along with investments in automated distribution centers, ensuring growth through 2035.

- The Asia Pacific Hand Trucks and Dollies Market is projected to experience the fastest growth by 2035, attributed to rapid urbanization, the e-commerce boom, and the rise of cold chain logistics in the pharmaceutical sector.

Segment Insights:

- The Transport Stations segment is projected to hold over 37.4% market share by 2035, fueled by increasing application of hand trucks and dollies in logistics.

Key Growth Trends:

- Rising automation in warehousing and material handling

- Expansion of cold chain logistics & pharmaceutical distribution

Major Challenges:

- Limited advancements in basic models

- Price sensitivity and high competition

- Key Players: Harper Trucks Inc., B&P Manufacturing, BIL Group, Woodever Industrial Co., Ltd., RWM Casters, THOMASNET, Milwaukee Hand Trucks, Wesco Industrial Products, Little Giant Products, Inc..

Global Hand Trucks and Dollies Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.29 billion

- 2026 Market Size: USD 1.34 billion

- Projected Market Size: USD 1.91 billion by 2035

- Growth Forecasts: 4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 14 August, 2025

Hand Trucks and Dollies Market Growth Drivers and Challenges:

Growth Drivers

-

Rising automation in warehousing and material handling: The global hand trucks and dollies sector is driven by integration warehouse automation, fueling demands for hand trucks and dollies that can complement automated systems. For instance, in September 2024, Accio Robots and SCM Champs announced a partnership to revolutionize warehouse automation with SAP integration. Warehouses are adopting hybrid systems where manual hand trucks are used alongside automated sorting systems to improve operational efficiency. Manufacturers are poised to benefit from the emerging trends by developing dollies equipped with tracking technology. Additionally, demands for a seamless transition between manual to automated handling tools necessitate adaptable hand trucks. As smart warehousing continues to gain prominence, the demand for adaptable hand trucks and dollies is positioned for a surge in demand.

- Expansion of cold chain logistics & pharmaceutical distribution: The growth of cold chain logistics in the pharmaceutical and food industries is poised to drive the growth of the hard trucks and dollies sector. Cold chain logistics are driving demand for durable hand trucks that are corrosion-resistant. Pharmaceutical and food industries require moving equipment solutions that can perform in low temperatures and do not require frequent sanitization. Hand trucks manufactured with special coatings are ideal to cater to the growing demands. For instance, in February 2021, the supermarket chain Asda launched trolley handles and in-store surfaces with antimicrobial coatings. The global hand trucks and dollies market is poised to leverage burgeoning demands for hand trucks designed for pharmaceutical and cold storage food sectors and maintain its growth curve.

- Growing infrastructure & construction activities in emerging markets: The rapid growth in infrastructure development projects and construction activities in emerging economies is a significant driver of the global hand trucks and dollies sector. Countries such as India, Brazil, and Indonesia are investing in large-scale construction projects, leading to a surge in demand for durable material handling and moving equipment. With construction sites demanding rugged hand trucks that can navigate large loads and rough terrains, manufacturers can leverage the opportunities by providing rugged models that can withstand heavy-duty usage in the construction sector.

Additionally, the DIY and home improvement boom in developed markets drives demand for multipurpose hand trucks that can transport bulky items such as furniture, appliances, construction materials, etc. For instance, in August 2024, Clark launched a new electric pallet truck series on the hand market with four new models for pedestrian operation.

Challenges

-

Limited advancements in basic models: A large percentage of basic models of hand trucks and dollies have not experienced advancements owing to limited investments. Hand trucks can also be perceived as simple tools that do not necessitate complex engineering, causing manufacturers to not invest in product advancements. This can cause hand trucks and dollies market challenges by creating minimum differentiation in standard models, making it challenging for businesses to establish a competitive edge in the hand trucks and dollies sector.

- Price sensitivity and high competition: The global hand trucks and dollies market can face challenges owing to a saturated market with local and international manufacturers. As multiple manufacturers offer similar products, pricing becomes a critical factor to differentiate products in emerging markets. This can cause customers to value cost over quality leading to the market being flooded with cheap and low-quality products that can drive down prices for all the players involved. The price sensitivity can force premium manufacturers to compromise on quality to reduce prices to remain competitive in the hand trucks and dollies market.

Hand Trucks and Dollies Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4% |

|

Base Year Market Size (2025) |

USD 1.29 billion |

|

Forecast Year Market Size (2035) |

USD 1.91 billion |

|

Regional Scope |

|

Hand Trucks and Dollies Market Segmentation:

Application (Transport Stations, Retail, and Household)

By application, the transport stations segment is estimated to account for more than 37.4% hand trucks and dollies market share by the end of 2035. The segment’s growth is attributed to the increasing application of hand trucks and dollies in logistics where transport stations are crucial. Airports are experiencing increasing footfalls and remain at the forefront of demands to manage luggage. For instance, in July 2020, GMR Hyderabad Air Cargo launched a multi-ULD cool dolly for an unbroken cold chain for time and temperature-sensitive shipments. The segment is positioned to maintain its revenue share in the global hand trucks and dollies market owing to the expansion of transport infrastructure globally fueling investments on transport stations to adopt moving solutions that can withstand heavy-duty usage.

The retail segment of the hand trucks and dollies sector is poised to increase its revenue share by the end of the forecast period. The segment’s growth is attributed to rising demands for hand trucks and dollies in retail stores with high footfalls such as supermarkets, department stores, convenience stores, etc. A key driver of the segment is the frequent need to restock retail fueling for hand trucks with lightweight frames and high load capacities. Additionally, the surge in e-commerce boosts demand for hand trucks in retail fulfillment centers and is crucial in last-mile delivery.

Type (Hand trucks and Dollies, Non-Foldable Hand Trucks, Foldable Hand Trucks)

By type, the hand trucks and dollies segment is poised to register a profitable share in the hand trucks and dollies market. The segment has cemented its position in addressing diverse handling needs across various sectors, increasing its adoption and boosting revenue growth. Dollies often cater to the horizontal movement of large items owing to their flat platforms and hand trucks cater to the vertical lifting of stacked boxes. Advancements in equipment are poised to increase the versatility of hand trucks and dollies benefiting adoption across diverse applications. As urban logistics and retail sectors register steady growth globally, the segment is poised to leverage a steady demand for movement solutions by the end of the forecast period.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

Type |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hand Trucks and Dollies Market Regional Analysis:

North India Market Forecast

North America hand trucks and dollies market is poised to account for revenue share of more than 36.4% by the end of 2035. The regional market’s growth is owed to robust demand from e-commerce, warehousing, and retail. The region benefits from well-established e-commerce and retail sectors driving demands for efficient material handling. Due to the high volume of online shopping in the region, companies are investing in last-mile delivery solutions fueling demands for durable dollies and hand trucks that can withstand frequent use. Additionally, the hand trucks and dollies market leverages the rising push for worker safety in warehouses in the region by supplying moving equipment that can reduce labor strain. Major retailers are investing in automated distribution centers that are positioned to fuel further demands for hand trucks and dollies. For instance, in July 2024, Walmart announced the opening of five automated distribution centers across the U.S.

The U.S. is poised to register the largest revenue share in the hand trucks and dollies sector. The hand trucks and dollies market’s growth is attributed to the rapid growth of urban warehousing and micro-fulfilment centers. For instance, in February 2024, Grainger announced plans to build a new distribution center near Houston to provide additional capacity to the company. Additionally, home improvement and construction sectors are driving demands for heavy-duty dollies to handle bulk materials. Rising worker safety concerns are prompting businesses to seek ergonomic moving solution that reduces strain on workers and increasing regulatory pressure to improve worker conditions is poised to fuel the market’s growth.

Canada is projected to increase its revenue share in the hand trucks and dollies sector by the end of the forecast period. The hand trucks and dollies market’s growth in Canada is attributed to rising demands for hand trucks and dollies from the e-commerce sector. Additionally, the boom of retail expansion in major cities such as Toronto and Vancouver drives demands for compact and easy-to-maneuver hand trucks. With investments in smart warehousing, hand trucks that can seamlessly interact with new technology are poised to create a steady demand benefiting the sector’s growth. For instance, in May 2024, Brokk announced the opening of a distribution center in Hamilton, Ontario.

APAC Market Analysis

The Asia Pacific hand trucks and dollies market is poised to register the fastest revenue growth during the forecast period. The market’s growth is attributed to rapid urbanization and e-commerce boom in the region. The revenue growth is led by China, India, Japan, and South Korea. With the region being the hub of multiple supply chains and manufacturing hubs, companies are investing in durable moving solutions to support high-volume material handling operations. Additionally, the growth of cold chain logistics in the pharmaceutical sector is poised to drive demands for hand trucks and dollies. For instance, in July 2024, West Pharmaceuticals announced the expansion of capabilities in Asia and expanded warehouse facility expansion in South Korea.

China registered the largest revenue share in the hand trucks and dollies market. The market’s growth is attributed to the country’s massive e-commerce sector. Logistics and fulfillment centers in China are fueling the adoption of advanced material handling equipment, assisting the market’s growth curve. The country is investing in large-scale construction and urbanization projects that are poised to drive demands for compact hand trucks that can easily navigate confined spaces. For instance, in October 2023, GEODIS and Sephora announced the opening of a distribution center in Shanghai with cutting-edge storage technologies.

India is projected to increase its revenue share in the hand trucks and dollies sector by the end of the forecast period. The regional hand trucks and dollies market is boosted by the rapid expansion of manufacturing, logistics, and retail sectors. Post COVID-19, the e-commerce sector has experienced a considerable profit surge boosting demands for hand trucks and dollies in expanding warehouses. Additionally, the country faces logistical challenges in narrow delivery lanes and uneven surfaces, prompting demands for moving solutions models that can be navigated in tight spaces, In March 2024, TVS SCS announced the expansion of its warehouse footprint in India by adding new multi-client warehouse space in Hosur, Tamilnadu. The hand trucks and dollies market in the country is positioned to leverage the favorable trends and maintain its growth.

Key Hand Trucks and Dollies Market Players:

- Harper Trucks Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- B&P Manufacturing

- BIL Group

- Woodever Industrial Co., Ltd.

- RWM Casters

- THOMASNET

- Milwaukee Hand Trucks

- Wesco Industrial Products

- Little Giant Products, Inc.

The global hand trucks and dollies market is poised to register profitable growth during the forecast period. Key players in the market are investing in offering advanced hand trucks and dollies that can be integrated with smart systems, and are robust and flexible to increase applications.

Here are some key players in the market:

Recent Developments

- In October 2024, Siemens announced that it will sell airport logistics business to Vanderlande. The transaction is poised to amount for USD 326 million. The transaction is expected to close in the course of calendar year 2025.

- In July 2024, InventHelp inventor developed improved hand truck/dolly. The original design was submitted to the National sales office of InventHelp. It is currently available for licensing or sale to manufacturers or marketers.

- Report ID: 6694

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hand Trucks and Dollies Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.