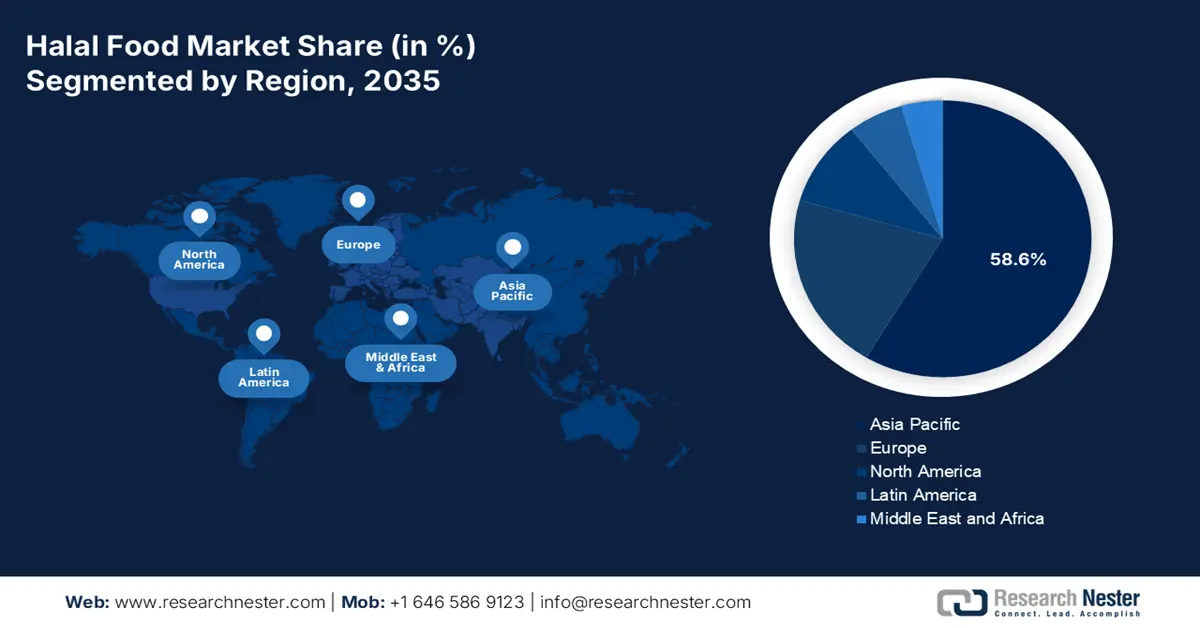

Halal Food Market - Regional Analysis

APAC Market Insights

Asia Pacific is the epicenter of the halal food market and is expected to hold a revenue share of 58.6% by 2035. The market is defined by the immense scale and diverse growth drivers. The demand is mainly due to the growing populations and government-led initiatives that mandate certification and support the sector as a key economic pillar. Countries such as China, Japan, and South Korea are driven by the rising domestic demand from a certain population and the increasing exports of halal products. A regional trend is the incorporation of technology for supply chain integrity, with blockchain pilots for traceability gaining traction. The halal food market is also seeing rapid premiumization with the rising demand for health, functional, organic, and ready-to-eat halal products.

India halal food market is driven by the substantial domestic consumer base. The market is driven by the gradual formalization of the traditionally fragmented sector. A key trend is the expansion of certified products beyond meat into dairy, snacks, and ready-to-eat meals, increasingly available in organized retail. The USDA March 2022 report depicts that the halal trade in India is estimated to be USD 80 billion, which is the total trade in agri-food products. Further, the Export Import data in April 2025 states that India exports meat to more than 100 nations across the globe, among which Malaysia is the key marketer for halal meat products. This export momentum is supported by a network of federally inspected and Halal-certified slaughterhouses. Concurrently, domestic demand is being reshaped by the entry of major food brands launching certified product lines to capture the urban, brand-conscious consumer.

Top Export Destinations for India’s Meat

|

Destination Country |

Total Value (Billion USD) |

Total Value (%) |

|

Vietnam |

15 |

36.5 |

|

Malaysia |

4 |

11.3 |

|

Egypt |

4 |

9.8 |

|

Indonesia |

2 |

5.3 |

|

Iraq |

1 |

4.3 |

|

Saudi Arabia |

1 |

4.3 |

|

Philippines |

1 |

3.3 |

|

United Arab Emirates |

1 |

2.8 |

|

Hong Kong |

1 |

2.7 |

Source: Export Import April 2025

China’s halal food market is strategically oriented towards becoming a global export hub. The market serves the dietary needs of its significant population concentrated in regions such as Ningxia. The market is characterized by strong state involvement in standardization and certification to ensure compliance for international trade. An important trend is the integration of halal production in the large-scale sectors, state modernized agriculture and food processing complexes. The Carnegie Endowment for International Peace data in 2024 reported that in 2021, China was the leading exporter of halal goods and services to the 57 member states, with in trade value of USD 40.4 billion. Moreover, this strategic focus aligns with the broader national food security and economic development goals, which ensure a continued state-backed investment in the sector.

Europe Market Insights

Europe is expected to be the fastest growing halal food market and is expected to grow at a CAGR of 5.3% during the forecast period 2026 to 2035. The market is primarily driven by the rising consumer base and the mainstreaming of halal as a quality and ethical assurance. Demographic changes with the young and growing population that adheres to halal dietary laws and increasing concern about animal welfare and food safety are the primary drivers of the market growth. Regulatory harmonization remains be challenge, but the private certification bodies have established a strong framework. The market is also seeing a growth in e-commerce platforms that are dedicated to halal products, therefore improving accessibility. As per the European Commission data, the food safety and sustainability, consumer demand for transparent and ethically sourced food products is a key priority, which is boosting the halal market.

The UK is projected to hold the largest revenue share in Europe by 2035, and is driven by its well-established, diverse consumer base and a robust private certification ecosystem. The Office for National Statistics continues to report on population growth in line with Halal dietary adherence, highlighting a stable demand. As per the UK Parliament data in June 2025, nearly 1.035 billion animals were processed in English and Welsh slaughterhouses in 2024, and a part of 214.6 million animals (20.7%) were slaughtered to produce halal meat. This data highlights the segment's deep integration into the national food supply chain. the market is further evolving beyond the raw meat with a strong growth in the value-added products categories, such as ready-to-eat meals and certified snacks that are increasingly distributed via mainstream retail channels.

Germany will maintain a leading market share in the halal food market in Europe, which is fueled by having the largest consumer population opting for halal products. The growth is primarily propelled by the retail sector’s strategic inclusion of certified private label products and the expansion of halal options within the food service industry, including the fast food and delivery services. According to the USDA data in November 2022 on Germany: Halal and Kosher Food Market in the Making depicts that the country has more than 83 million of the world’s wealthiest consumers and is by far the biggest market in the EU. The country's strong regulatory environment for food labeling and safety, enforced by authorities like the Federal Office of Consumer Protection and Food Safety (BVL), provides a trusted foundation that benefits the Halal segment.

North America Market Insights

The North America is experiencing a rapid growth in the halal food market, which is fueled by the combination of demographic shifts and its alignment with the prevailing consumer trends. The certification is highly recognized by a broad consumer base as a marker of ethical production, animal welfare, and strong food safety protocols. These perceptions drive the demand beyond the traditional retail channels into mainstream supermarkets and food service, where product diversification into ready-to-eat, premium, and organic categories is surging. The market expansion is further promoted by the significant investments in the supply chain logistics and third-party certification bodies that ensure product integrity, positioning halal as a significant value-added segment within the broader food industry in North America.

The demand for the halal food in the U.S. is supported by certain demographic expansion, increased institutional procurement, and strengthened federal oversight of food imports. The USDA’s Production, Supply, and Distribution data depicts that there is a sustained reliance on imported poultry and beef from compliant suppliers, mainly for value-added foodservice segments. The FDA 2024 data highlights that the food safety budget of USD 7.2 billion is allocated, a part of which is to reinforce national inspection systems, benefitting halal certified meat processors and imported product flows by enhancing the residue monitoring, traceability, and facility compliance. The U.S. Census Bureau population data shows that a continued growth of certain communities increases the household purchasing of certified meat, packaged foods, and bakery products. Federal school meal programs and correctional facility procurement increasingly incorporate halal options in certain areas. The Department of Commerce trade data shows rising imports of prepared foods, providing growth opportunities for certified exporters meeting U.S. labeling requirements.

Growth in Canada’s halal food market is driven by immigration trends, expanded certification capacity, and federal investment in food safety systems. Statistics Canada reports sustained immigration inflows from South Asia, MENA, and Southeast Asia, surging the demand for certified poultry, beef, frozen foods, and confectionery. The halal and the CFIA Beef Watch report in April 2024 indicate that the halal beef production follows Islamic slaughter requirements, while the CFIA applies strict animal welfare rules under the Safe Food for Canadians Regulations. This ensures the animals are not suspended until unconscious. Canada regulates halal labeling mandates verified certification and also audits via Preventive Control Plans to prevent fraud and maintain compliance with halal and welfare standards. As the consumer base surges, the market is estimated to be nearly USD 1 billion; the certification agencies play a vital role in supporting the producers and expanding the market.