Gynecological Devices Market Outlook:

Gynecological Devices Market size was valued at USD 11.48 billion in 2025 and is likely to cross USD 25.96 billion by 2035, registering more than 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of gynecological devices is assessed at USD 12.36 billion.

In January 2025, the World Health Organization reported that 6–13% of women of reproductive age suffer from polycystic ovarian syndrome, or PCOS. Globally, up to 70% of afflicted women go untreated. The rising prevalence of gynecological disorders such as endometriosis, uterine fibroids, PCOS, and cervical cancer is significantly driving the demand for advanced diagnostics and treatment devices. Early detection is crucial for effective management, leading to increased adoption of high-precision imaging tools, AI-powered diagnostics, and minimally invasive surgical instruments. Rising demand for hysteroscopes, laparoscopes, ultrasound, and robotics propels innovation and gynecological devices market escalation.

Additionally, the shift toward minimally invasive techniques, including laparoscopic and robotic-assisted surgeries, is driving demand for advanced obstetric instruments. AI-driven diagnostics and enhanced hysteroscopy and colposcopy devices enhance accuracy and efficiency in gynecological care. On the other hand, robotic-assisted surgery is gaining traction for its precision, fueling market proliferation by improving treatment effectiveness and accessibility. Thus, these procedures reduce recovery time, minimize complications, and improve patient outcomes, increasing the need for high-precision surgical instruments.

Key Gynecological Devices Market Insights Summary:

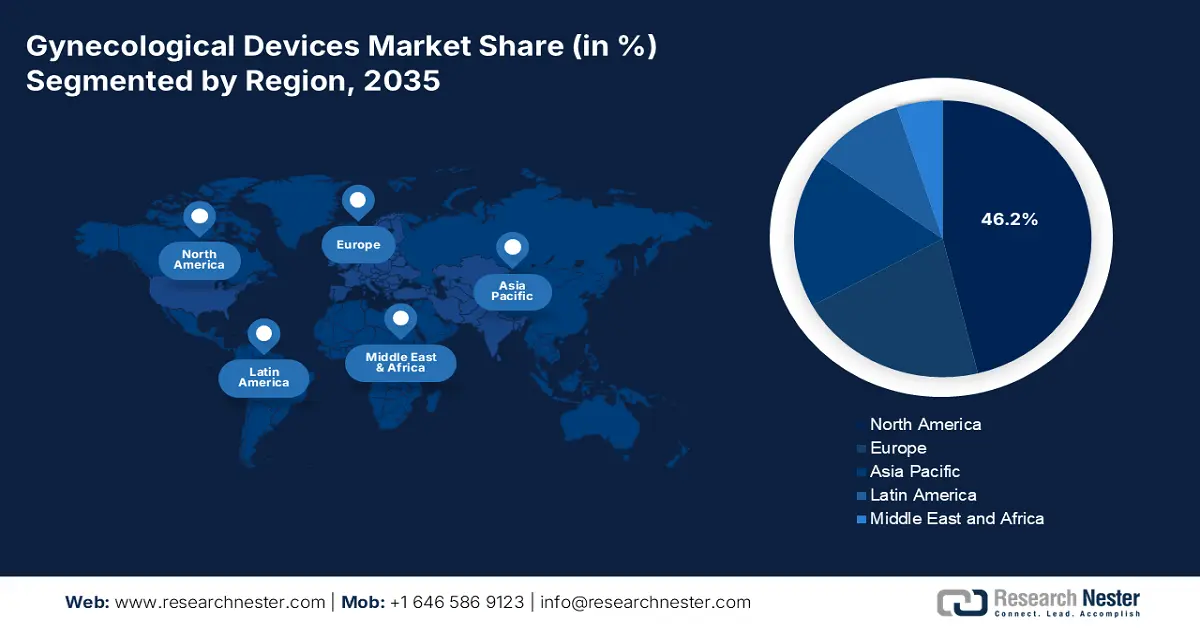

Regional Highlights:

- North America dominates the Gynecological Devices Market with a 46.2% share, supported by advanced healthcare infrastructure and significant investments in women’s health, ensuring strong growth through 2026–2035.

Segment Insights:

- The Hospital & Clinics segment is anticipated to hold the majority of market share by 2035, driven by increasing patient preference for advanced treatments, specialized care, and minimally invasive procedures.

- The surgical devices segment is anticipated to achieve a 58.3% share by 2035, propelled by increasing demand for minimally invasive procedures like laparoscopy and robotic-assisted surgeries.

Key Growth Trends:

- Rising demand for assisted productive technologies (ART)

- Favorable government policies and healthcare investments

Major Challenges:

- Reimbursement and insurance limitations

- Complications and safety concerns with new devices

- Key Players: Boston Scientific Corporation, Ethicon Inc., Karl Storz Gmbh & Co. KG, Cooper Surgical Inc..

Global Gynecological Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.48 billion

- 2026 Market Size: USD 12.36 billion

- Projected Market Size: USD 25.96 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, Japan, India, South Korea, Singapore

Last updated on : 13 August, 2025

Gynecological Devices Market Growth Drivers and Challenges:

Growth Drivers

-

Rising demand for assisted productive technologies (ART): Rising infertility rates due to lifestyle factors, delayed pregnancies, and health conditions are driving demand for advanced fertility treatments. According to the WHO (April 2023), 17.5% of adults worldwide face infertility, emphasizing the need for accessible reproductive care. This has fueled the adoption of IVF, ovulation monitoring, hormone therapy, and assisted reproductive technologies. Innovations in ultrasound imaging, AI-powered fertility tracking, and minimally invasive procedures are enhancing reproductive health outcomes, and expanding the gynecological devices market globally.

- Favorable government policies and healthcare investments: Governments worldwide are strengthening women’s healthcare by investing in infrastructure, funding research on gynecological diseases, and expanding insurance coverage. These initiatives improve access to early diagnosis and advanced treatments, increasing demand for cutting-edge obstetric tools. Subsidized healthcare programs encourage hospitals to adopt AI-powered diagnostics, minimally invasive surgical tools, and fertility treatment technologies. As public and private investments grow, innovation accelerates, driving the expansion of the gynecological devices market and improving patient outcomes globally.

Challenges

-

Reimbursement and insurance limitations: Inadequate insurance coverage for gynecological procedures and devices limits patient access to advanced treatments, as high out-of-pocket costs discourage many from seeking necessary care. Reimbursement policies vary significantly across countries, creating inconsistencies in market adoption. In regions with limited coverage, hospitals and clinics may hesitate to invest in expensive devices, further slowing innovation. This financial barrier restricts the expansion of cutting-edge technologies, making it challenging for manufacturers to penetrate new markets effectively.

- Complications and safety concerns with new devices: New surgical tools occasionally encounter post-market safety concerns, including recalls due to unexpected complications, malfunctions, or side effects. These incidents can lead to legal challenges, stricter regulatory scrutiny, and increased hesitancy among healthcare providers and patients. Negative publicity further diminishes trust in emerging technologies, slowing adoption rates. Manufacturers must invest in rigorous clinical testing, post-market surveillance, and transparent reporting to maintain confidence and ensure the safety and effectiveness of their products in the market.

Gynecological Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 11.48 billion |

|

Forecast Year Market Size (2035) |

USD 25.96 billion |

|

Regional Scope |

|

Gynecological Devices Market Segmentation:

Product (Surgical Devices, Gynecological Imaging Devices, Portable Tools)

By product, the surgical devices segment is expected to dominate around 58.3% gynecological devices market share by the end of 2035. The segment is growing due to increasing demand for minimally invasive procedures such as laparoscopy and robotic-assisted surgeries, which offer faster recovery and fewer complications. By September 2023, NLM reported that 7733 robotic surgical systems were deployed globally. It further calculated the number of robotic surgeries performed to be more than 10 million. Rising cases of gynecological disorders, including fibroids and endometriosis, stimulate the need for advanced surgical tools. Advancements in hysteroscopic, laparoscopic instruments, imaging, and AI enhance precision, driving market expansion.

End use (Hospital & Clinics, Ambulatory Surgery Centers (ASCs))

Based on end use, the hospital & clinics segment is expected to garner the majority of gynecological devices market share over the forecast period. The segment’s growth is attributed to increasing patient preference for advanced treatments, specialized care, and minimally invasive procedures. Hospitals are adopting cutting-edge technologies such as robotic-assisted surgery, AI-powered diagnostics, and high-precision imaging for better patient outcomes. Government initiatives to improve healthcare infrastructure, expand insurance coverage, and promote preventive screenings further promote growth. Additionally, rising cases of gynecological disorders boost demand for hospital-based treatment and surgery-related equipment.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gynecological Devices Market Regional Analysis:

North America Market Statistics

North America gynecological devices market is predicted to dominate revenue share of over 46.2% by 2035. The region has an advanced healthcare infrastructure, particularly in the U.S. and Canada, facilitating the swift adoption of innovative obstetrics devices in medical facilities. The American Medical Association reported in July 2024 that U.S. health spending rose 4.1% in 2022 to USD 4.5 trillion, or USD 13,493 per person. Significant investments in women’s health and high healthcare expenditure support this trend. Rising cases of endometriosis, fibroids, PCOS, and cervical cancer propel the demand for advanced diagnostics and treatments, with early detection efforts boosting gynecological devices market growth.

The increasing prevalence of gynecological conditions such as endometriosis, uterine fibroids, PCOS, and cervical cancer has escalated the demand for advanced diagnostic and therapeutic devices in the U.S. Early detection and effective treatment are crucial, driving market expansion. Simultaneously, innovations in minimally invasive surgical techniques, including robotic-assisted surgeries and advanced laparoscopic instruments, have enhanced patient outcomes by reducing recovery times and complications. These advancements have reduced recovery times and complications, leading to a higher adoption rate of uterine and pelvic health devices and driving the growth of the gynecological devices market.

Canada has a robust healthcare system and significant investments in female health have facilitated the rapid integration of advanced surgical devices into clinical practice, driving the gynecological devices market expansion. National initiatives and awareness campaigns emphasize the importance of regular gynecological check-ups and early disease detection, leading to increased routine screenings, and thereby boosting the demand for diagnostic devices. These efforts collectively enhance access to and adoption of state-of-the-art gynecological care across the country.

APAC Market Analysis

The APAC gynecological devices market is poised to garner the fastest CAGR over the forecast period. Increased healthcare spending in countries such as China, India, and Japan has bolstered healthcare infrastructure, enabling the adoption of advanced obstetric instruments. Government investments and private sector involvement have improved access to cutting-edge medical technologies. Simultaneously, rapid urbanization and lifestyle changes have led to a rise in lifestyle-related diseases, such as obesity and smoking, which are risk factors for various gynecological disorders. This trend has escalated the need for effective diagnostic and therapeutic devices, driving industry escalation.

The implementation of the 3-child policy in China aims to address declining birth rates and an aging population with more than 47% of women 60 and older as per the Institute of Gender in Geopolitics in March 2024. This policy shift, coupled with changing lifestyle factors and delayed pregnancies, has increased demand for fertility treatments such as IVF and ovulation monitoring devices, thereby expanding the gynecological devices market. Furthermore, the growing elderly female demographic is more susceptible to gynecological conditions such as menopause-related disorders and cancers, leading to heightened demand for diagnostic tools and surgical interventions.

India is experiencing a surge in gynecological disorders such as endometriosis, PCOS, uterine fibroids, and cervical cancer, driving demand for advanced diagnostic tools and minimally invasive treatments. For instance, 1 in 5 young women in India were predicted to have this illness, according to Think Global Health in September 2024. Additionally, rising obesity, sedentary lifestyles, and delayed pregnancies are increasing the prevalence of lifestyle-related gynecological conditions. This has led to higher adoption of hormone therapies, advanced surgical instruments, and diagnostic solutions, fueling the surge of the gynecological devices market across hospitals and specialized clinics.

Key Gynecological Devices Market Players:

- Bayer AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Boston Scientific Corporation

- Ethicon Inc.

- Karl Storz Gmbh & Co. KG

- Cooper Surgical Inc.

- Hologic Inc.

- Medtronic plc

- Gynesonics

- Stryker Corporation

- Richard Wolf GmbH

- MedGyn Product Inc.

Key companies are revolutionizing the gynecological devices market by developing AI-driven diagnostic tools, robotic-assisted surgical systems, and minimally invasive treatment solutions. Advancements in hysteroscopy, colposcopy, and laparoscopic instruments improve precision and patient outcomes. Companies are also integrating smart monitoring systems for fertility tracking and enhancing imaging technologies for early disease detection. For instance, in February 2023, Horoge introduced the NovaSure V5 GEA device to enhance treatment for diverse uterine conditions, expanding innovation in gynecological care. Investments in R&D, personalized medicine, and telehealth solutions further expand access to cutting-edge gynecological care, driving market growth. These players are:

Recent Developments

- In September 2024, Gynesonics launched SMART OS2 software for the Sonata System, an incision-free, uterus-preserving treatment using intrauterine ultrasound and advanced radiofrequency ablation, enhancing minimally invasive fibroid care in the gynecological devices industry.

- In October 2022, Medtronic plc introduced the Hugo robotic-assisted surgery system and gained approvals in Europe, Canada, and Japan, expanding access to minimally invasive gynecological procedures, enhancing precision, and driving global adoption of advanced surgical technologies.

- Report ID: 7234

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gynecological Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.