Guaifenesin Market Outlook:

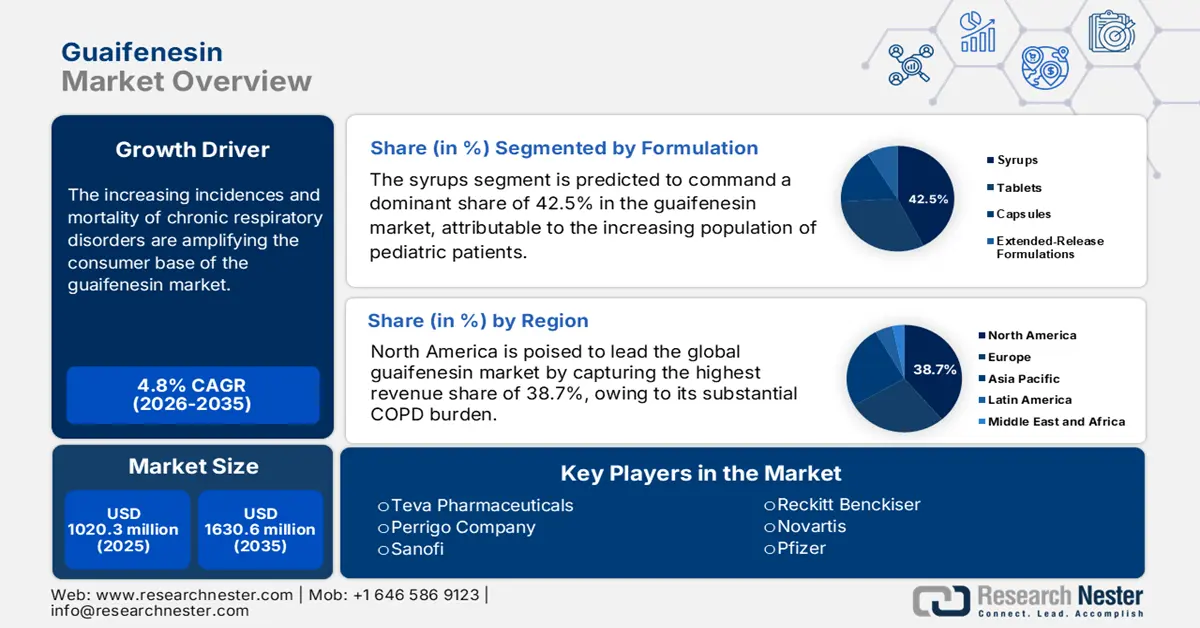

Guaifenesin Market size was over USD 1020.3 million in 2025 and is estimated to reach USD 1630.6 million by the end of 2035, expanding at a CAGR of 4.8% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of guaifenesin is assessed at USD 1069.3 million.

The market is expanding rapidly due to the increasing incidences and mortality of chronic respiratory disorders are amplifying the consumer base. As evidence from the WHO data in June 2025, nearly 81.7 million people are affected and untreated due to chronic respiratory diseases. Another report from the WHO in November 2024 underscored the annual number of chronic obstructive pulmonary disease deaths to surpass 3.5 million globally in 2021. As the medication plays a critical role in both adult and pediatric respiratory care, demand in this sector is growing with the ongoing therapeutic requirements.

Investment in the sector is defined via public research grants and development within established regulatory frameworks. As per the American Lung Association report in October 2024, an amount of USD 22 million is invested in lung health. The research investment supports research in COPD, chronic bronchitis, asthma, and other obstructive lung diseases, which are major indications where guaifenesin is used to manage mucus clearance and productive cough. Furthermore, the U.S. Food and Drug Administration oversees the OTC Monograph system, which governs guaifenesin, and recent reforms have spurred industry investment in manufacturing and deployment of modernized dosage forms.

Key Guaifenesin Market Insights Summary:

Regional Highlights:

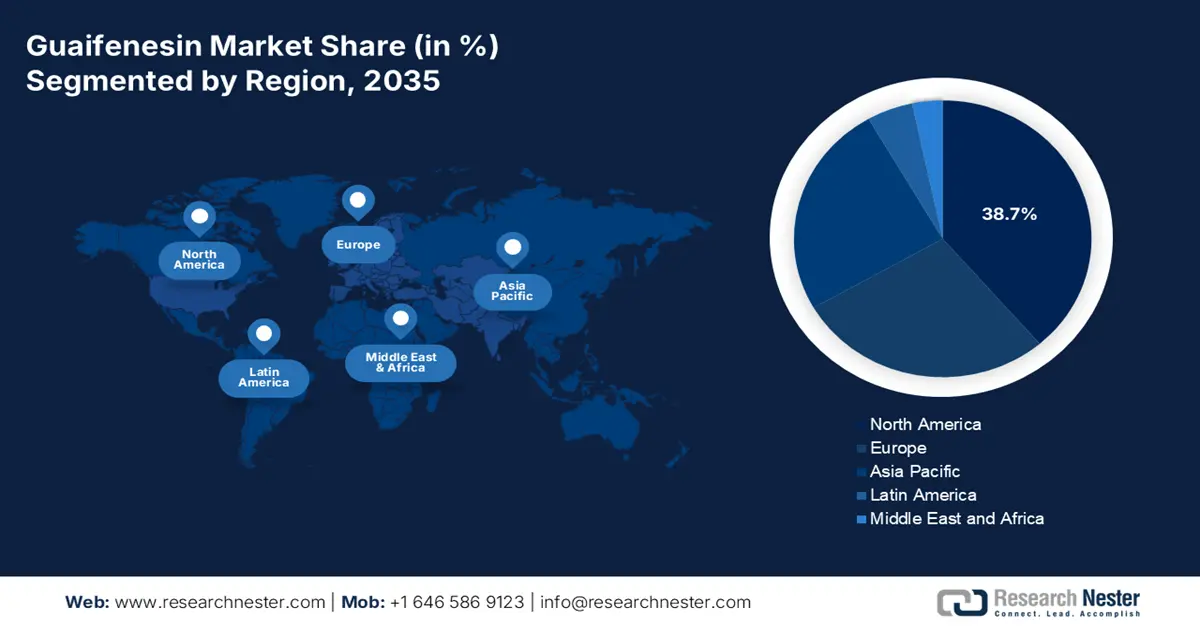

- North America is projected to dominate the guaifenesin market with a 38.7% revenue share during the forecast period, attributed to its high COPD prevalence, expanding consumer base, and strong import activities for finished doses.

- Asia Pacific is expected to record the fastest CAGR of 7.5% from 2026 to 2035, fueled by worsening air quality, healthcare infrastructure growth, and cost-effective generic manufacturing.

Segment Insights:

- The syrups segment is projected to secure a dominant 42.5% share of the guaifenesin market by 2035, propelled by the rising pediatric population and growing preference for convenient, palatable liquid formulations in respiratory treatments.

- The adult respiratory care segment is expected to lead the market by 2035, supported by the escalating global prevalence of COPD and sustained demand for long-term guaifenesin-based therapies.

Key Growth Trends:

- Innovation through R&D investment

- High rising prevalence of respiratory diseases

Major Challenges:

- Financial exhaustion and limitations in reimbursement

- Patent expirations and generic erosion

Key Players: Reckitt, Haleon, Perrigo, Kenvue, Sanofi, Bayer, Teva Pharmaceutical, Viatris (Mylan), Sun Pharmaceutical, Cipla, Dr. Reddy’s Laboratories, Lupin, Aurobindo Pharma, Yuhan Corporation, Mayne Pharma, Takeda, Otsuka Pharmaceutical, Taisho Pharmaceutical, Shionogi, Kowa Company

Global Guaifenesin Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1020.3 million

- 2026 Market Size: USD 1069.3 million

- Projected Market Size: USD 1630.6 million by 2035

- Growth Forecasts: 4.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, United Kingdom, Japan

- Emerging Countries: India, South Korea, Brazil, Malaysia, Indonesia

Last updated on : 20 October, 2025

Guaifenesin Market - Growth Drivers and Challenges

Growth Drivers

- Innovation through R&D investment: The market is benefitted from continuous participation and funding in extensive research, development, and deployment. For instance, in support of such clinical studies, the National Institute of Health allocated significant capita to improve pediatric bioavailability. Besides, in April 2025, AATec Medical secures EUR 4 million to advance clinical development, including guaifenesin combination therapies. These R&D investments are surging the formulation advancements and expanding therapeutic applications and hence creating new opportunities in this sector through innovation.

- High rising prevalence of respiratory diseases: The rising patient pool requiring guaifenesin is expanding rapidly due to the high occurrence of global respiratory conditions. For example, NLM study in December 2023 depicts that there are 300 to 400 million people living with COPD globally. This growing disease burden mainly driven by the elderly population due to sever air pollution and smoking creates a sustained demand for the expectorants ensuring a consistent market growth.

- Untapped potential of unmet demand: Unmet requirements in emerging economies offers a lucrative scope of investment for the guaifenesin market. As evidence, till 2024, the Ministry of Health, Labour and Welfare observed the absence of resources for eligible residents in Japan due to high prescription costs. on the other hand, the Brazilian Ministry of Health reported that the lack of coverage from public insurers in Brazil left eligible patients untreated in 2023. These access gaps underscore the expansion potential for this sector through the introduction of affordable generic alternatives.

Prevalence of Flu and Respiratory Disease

|

Region |

Prevalence |

|

North America |

40 million |

|

Europe |

3 million to 5 million |

|

Asia |

3 million to 5 million |

|

Chile |

23.72 per 100,000 |

Sources: CDC November 2024, WHO February 2025, WHO July 2025, NLM February 2025

Challenges

- Financial exhaustion and limitations in reimbursement: The Federal Joint Committee of Germany has released the Act on the Reorganization of the Pharmaceutical Market, urges for price cuts on combination products. Despite having a positive effect on affordability, such government control on pricing often makes it harder for manufacturers to curate their desired profit margin from the guaifenesin market. Besides, U.S. Medicaid covered prescriptions. These restrictive policies are limiting adoption of prescribed formulations, and hence hindering revenue generation in this sector.

- Patent expirations and generic erosion: The revenue challenges from patent expirations are discouraging new entrants from getting involved in long-term trading affairs in the guaifenesin market. This can be exemplified by the brand-name sales loss by Teva within just six months following its 2023 patent cliff, as unveiled by the U.S. Securities and Exchange Commission (SEC). This failure of branded products in delivering optimum performance highlights the intense competitive pressure from generic alternatives available in this field. However, innovator companies need to accelerate product lifecycle strategies and amplify differentiation efforts to avoid such downfall.

Guaifenesin Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 1020.3 million |

|

Forecast Year Market Size (2035) |

USD 1630.6 million |

|

Regional Scope |

|

Guaifenesin Market Segmentation:

Formulation Segment Analysis

Based on formulations, the syrups segment is predicted to command a dominant share of 42.5% in the guaifenesin market over the assessed period. Primarily, the leadership is attributable to the increasing population of pediatric patients and the requirement for a convenient drug administration method. This is also reflected through the substantial clinical need, with the NLM study in January 2025 reporting the infants hospitalized due to bronchitis cases in the U.S. alone to be more than 3.6 million. Moreover, as the liquid form of dosing brings flexibility and palatability, syrups became the most preferred delivery system for both children and geriatric candidates seeking respiratory treatments, sustaining its position in the sector.

Application Segment Analysis

Application of products from the guaifenesin market in adult respiratory care is anticipated to dominate the global landscape with a considerable revenue share by the end of 2035. The amplifying worldwide burden of COPD is the pillar of this segment's proprietorship. This can be evidenced by 2025 findings from the CDC, indicating over 854,000 adult patients visit hospitals to treat respiratory related disease. The chronic nature of COPD and related respiratory conditions ensures sustained, long-term utilization of guaifenesin products among adult candidates, which subsequently empowers its grip on the revenue generation from this sector. These epidemiological factors are also proven to shape product development and commercialization strategies across the industry.

Distribution Channel Segment Analysis

In terms of distribution channel, the retail pharmacies segment is expected to hold the largest share in the guaifenesin distribution throughout the analyzed timeframe. Its pivotal role in serving as the primary access point for consumers seeking OTC respiratory medications is making these distributors the first priority for global leaders in this field. This channel's emphasis is also portrayed by the widespread availability and convenience of purchasing OTC products, where consumers can directly procure the same from neighborhood pharmacies without prescriptions. Moreover, the strong retail presence of these pharmaceutical entities ensures easy patient access, even to branded expectorant formulations, making it the most popular distribution method around the world.

Our in-depth analysis of the guaifenesin market includes the following segments:

| Segment | Subsegment |

|

Formulation |

|

|

Application |

|

|

Distribution Channel |

|

|

Drug Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Guaifenesin Market - Regional Analysis

North America Market Insights

North America is poised to lead the global guaifenesin market by capturing the highest revenue share of 38.7% during the discussed tenure. Its substantial COPD burden, where more than 11.1 million adults are living with it in the U.S. in 2023 alone, is creating a substantial demand across the region, as reported by the American Lung Association report in September 2025. The enlarging population of citizens in North America, reflecting the presence of a strong consumer base. Furthermore, the region's dominance can be testified by its significant import activity for finished doses, as per the U.S. Census Bureau.

The U.S. dominates the regional guaifenesin market on account of its significant COPD burden and extensive financial backing system. Further the rising cases of influenza and pneumonia in the country is the major growth driver. Based on the CDC report in July 2025, the deaths registered due to influenza and pneumonia is 13.5 in 100,000 population. The country is led by OTC sales dominance, as the trend of self-medication is growing stronger. Besides, the pediatric syrups segment is showing robust YoY growth, according to the FDA findings. Moreover, the NIH funding for respiratory R&D and Medicaid coverage for prescriptions are collectively reinforcing the nation's trajectory and accessibility.

Cummulative Influenza Hospitalization Rates by Age

|

Age Group |

Hospitalization (per 100,000) |

|

0–4 years |

104.7 |

|

5–17 years |

40.4 |

|

18–49 years |

50.7 |

|

50–64 years |

150.1 |

|

65 years and older |

407.6 |

Source: CDC September 2025

The Canada's guaifenesin market in defined by the strong provincial healthcare commitments. The U.S. Department of Health and Human Services report in June 2025 states that USD 963 million is allocated for immunization and respiratory diseases for the fiscal year 2026. Health Canada’s oversight through the Natural and Non-prescription Health Products Directorate ensures all OTC guaifenesin products meet strict safety standards. Moreover, the rural access expansion through the updated telehealth policies in Alberta is ensuring sustainability of the adoption rate in this sector.

Influenza Detections in Canada in 2025

|

Age |

Percentage |

|

0-4years |

89.5 |

|

5-19 |

90.7 |

|

20-44 |

90.5 |

|

45-64 |

98.5 |

|

65+ |

92.3 |

Sources: Government of Canada October 2025

APAC Market Insights

Asia Pacific is the fastest growing region and is expected to grow at a CAGR of 7.5% in the global guaifenesin market during the timeline between 2026 and 2035. The worsening air pollution, healthcare infrastructure expansion, and cost-optimized generics manufacturing are the major driving factors behind the region's accelerated progress in this category. In support of the penetration of affordable solutions, South Korea deregulated OTC usage, which resulted in a sales boost, as recorded by the Ministry of Food and Drug Safety. On the other hand, healthcare reforms in Malaysia have been remarkably impactful in enhancing patient access by expanding coverage of COPD candidates, as per the Ministry of Health.

China commands dominance over the APAC guaifenesin market by holding the largest share in the region. The regional leadership is backed by the enlarging patient pool, where severe air pollution affected more than 2 million deaths in the country, as per the 2025 WHO report. This environmental factor further created unprecedented demand for respiratory treatments, with the NMPA reporting consistent growth in both prescription and OTC formulations. Till now, pollution crisis in China continues to shape its pharmaceutical landscape, making it the largest consumer base of the region.

India is expanding gradually in the guaifenesin market. As per the IBEF data in April 2025, India is the third leading drug industry and the country exports 78.94% of drugs and pharmaceutical products. The landscape is now transforming and mitigating roadblocks with healthcare digitalization and modernization. As evidence, the blockchain tracking technology, introduced by Dr. Reddy, reduced the prevalence of counterfeit drugs in India. Besides, Reckitt Benckiser adopted e-commerce platforms to amplify its significance in the country, which further earned an online sales boost for the company.

Europe Market Insights

The Europe guaifenesin market is poised to augment consistently and attain the second-largest revenue share by the end of 2035. The region's strong position in this category is highly supported by the increasing respiratory disease prevalence and government healthcare investments. On the other hand, Italy and Spain are maintaining a gradual growth rate through remarkable OTC expansions and rising COPD cases, according to the Italian Medicines Agency (AIFA). reflecting balanced growth across the region. These factors combine to create a stable, policy-driven environment for this sector in Europe.

Germany dominates the Europe guaifenesin market and is backed by its enlarging consumer base. Testifying to the same, the NLM study in June 2025 has stated that 2.6 million COPD patients were treated with 77% precision. The country's progress in the development and deployment of innovative models, such as formulations that are compatible with nebulizers for severe COPD, reflects its sophisticated R&D infrastructure. Moreover, environmental factors and smoking prevalence continue to sustain demand in this sector, making Germany the most valuable landscape in the region.

The UK holds the largest share in the Europe guaifenesin market, which is primarily attributable to the massive government spending. As evidence, the Health Foundtion Report in June 2025 depicts that the total healthcare budget is projected to increase by 3.1% across the nation. On the other hand, the NHS Long Term Plan has intensified focus on community-based care for respiratory illnesses, aiming to reduce hospital admissions, which increases the usage of effective expectorants like guaifenesin. These factors collectively maintain the country's existence as the second-largest source of revenue generation in the region, which is characterized by strong public support and growing access to non-prescription options.

Key Guaifenesin Market Players:

- Reckitt

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Haleon

- Perrigo

- Kenvue

- Sanofi

- Bayer

- Teva Pharmaceutical

- Viatris (Mylan)

- Sun Pharmaceutical

- Cipla

- Dr. Reddy’s Laboratories

- Lupin

- Aurobindo Pharma

- Yuhan Corporation

- Mayne Pharma

- Takeda

- Otsuka Pharmaceutical

- Taisho Pharmaceutical

- Shionogi

- Kowa Company

The guaifenesin market features a fragmented competitive environment, where Perrigo and Reckitt maintain their leadership through OTC brand dominance. On the other hand, Pfizer and Novartis are more focused on high-margin prescription formulations, while Sun Pharma and Cipla share via their abilities in cost-effective production. Moreover, strategies to sustain a profitable business in this category include global scale commercialization, product innovation, vertical integration for API security, and partnership formation with authorized entities. Such a diverse approach reflects the sector's liability under the segmentation across branded, generic, OTC, and prescription segments.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In February 2025, Granules India Limited has announced the acquisition with Senn Chemicals AG and enhanced the vertical integration, manufacturing footprint, and European market access, which indirectly benefits its guaifenesin production and distribution strategy

- In August 2023, Marksans received the USFDA approval for Guaifenesin ER Tablets (OTC). These tablets aid to loosen phlegm and thin bronchial secretions to rid the bronchial passageways of bothersome mucus and make coughs productive.

- Report ID: 7948

- Published Date: Oct 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Guaifenesin Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.