Ground Fault Sensor Market Outlook:

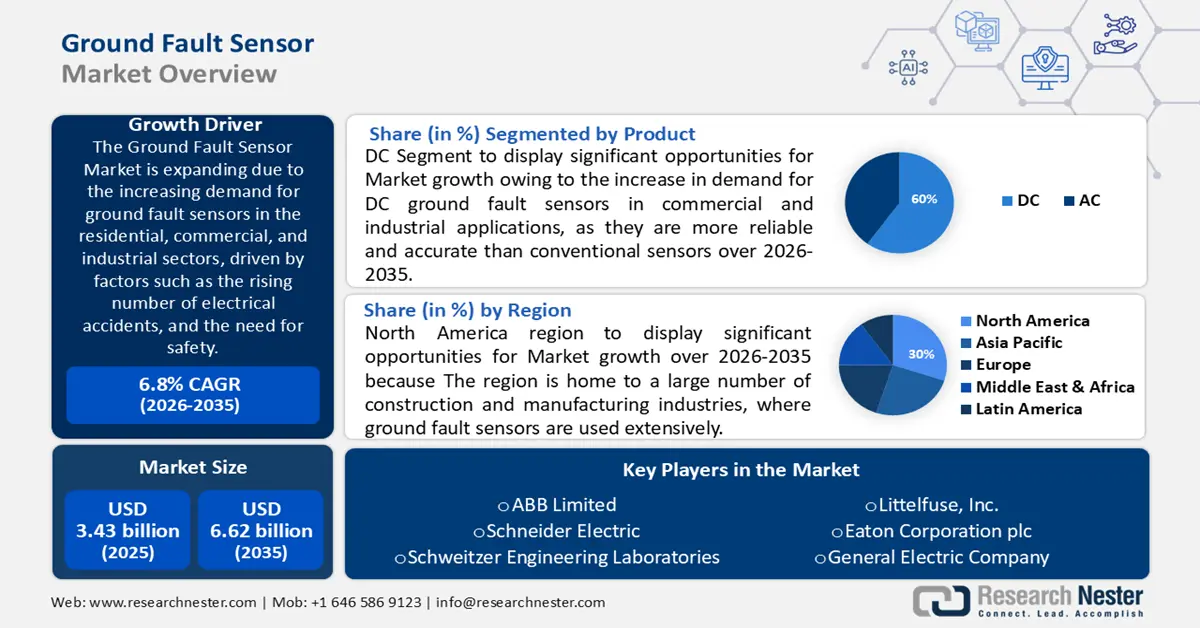

Ground Fault Sensor Market size was valued at USD 3.43 billion in 2025 and is likely to cross USD 6.62 billion by 2035, registering more than 6.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ground fault sensor is assessed at USD 3.64 billion.

This is mainly due to the increasing demand for ground fault sensors in the residential, commercial, and industrial sectors, driven by factors such as the rising number of electrical accidents, and the need for safety.

The International Labor Organization (ILO) reports that there are over 16 million work-related accidents globally each year and that occupational accidents claim the lives of over one million individuals. A further around 3600-4,000 people are electrocuted at the workplace every year. These incidents have emphasized the importance of reliable ground fault sensors for identifying and preventing electrical accidents.

Technological advancements in ground fault sensors have resulted in improved accuracy, ensuring more precise detection and measurement of ground faults. For instance, an important factor in the development of contemporary society is the manufacturing sector. As the forerunner of smart factories, Industry 4.0 possesses access to a multitude of cutting-edge technologies, including big data analytics, artificial intelligence, advanced robotics, 3D printing, and cloud computing. All these advanced technologies require ground fault sensors to work efficiently.

Recently, EV technology has advanced to bidirectional charging systems using ground fault current sensors. Technological advancements have also led to the incorporation of enhanced safety features in ground fault sensors, providing additional protection against electrical hazards.

Key Ground Fault Sensor Market Insights Summary:

Regional Highlights:

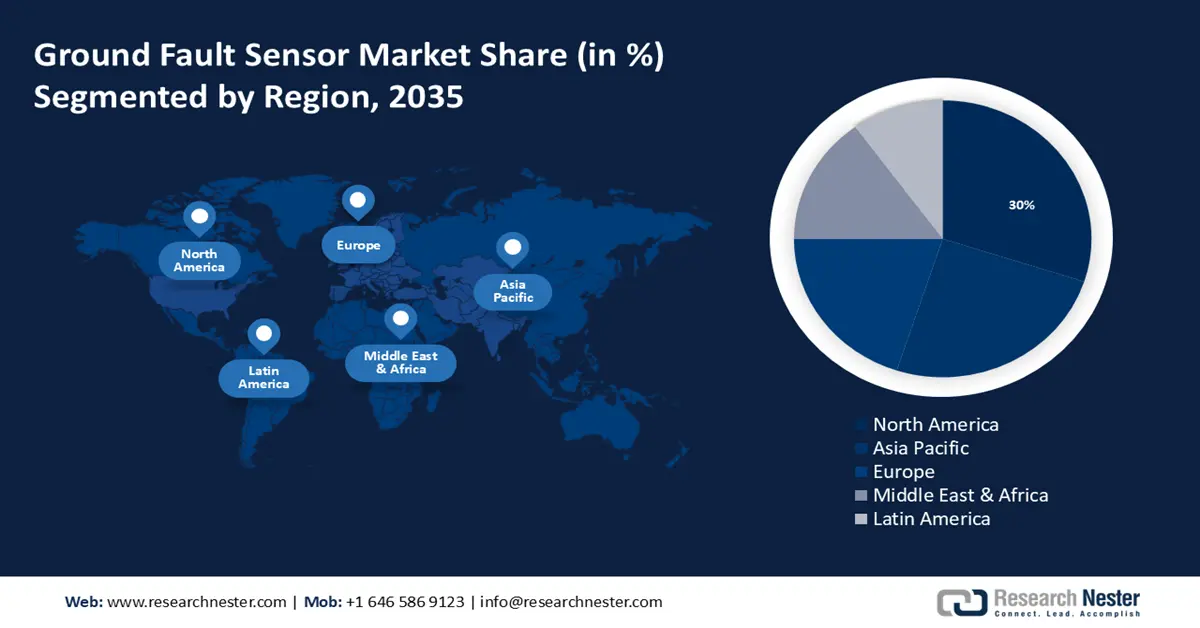

- By 2035, North America in the ground fault sensor market is projected to secure around 30% revenue share, supported by the extensive use of ground fault sensors across construction and manufacturing industries.

- By the end of 2035, Asia Pacific is anticipated to command nearly 25% revenue share, fueled by the rising number of grid-connected renewable power plants.

Segment Insights:

- By 2035, the DC segment in the ground fault sensor market is expected to hold over 60% share, propelled by the increase in demand for DC ground fault sensors in commercial and industrial applications.

- Across 2026–2035, the power segment is estimated to account for nearly 40% revenue share by 2035, underpinned by the increased adoption of renewable energy sources.

Key Growth Trends:

- Increasing demand from the construction industry

- Rise in industrial automation

Major Challenges:

- Complications related to the ground fault operating systems

- High entry barriers due to the need for advanced technology and expertise in the field.

Key Players: ABB Limited, Schneider Electric, Schweitzer Engineering Laboratories, Littelfuse, Inc., Eaton Corporation plc, General Electric Company, NK Technologies, Rockwell Automation, Siemens AG, Steven Engineering.

Global Ground Fault Sensor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.43 billion

- 2026 Market Size: USD 3.64 billion

- Projected Market Size: USD 6.62 billion by 2035

- Growth Forecasts: 6.8%

Last updated on : 27 November, 2025

Ground Fault Sensor Market - Growth Drivers and Challenges

Growth Drivers

-

Increasing demand from the construction industry - The building sector can save a lot of money by implementing sustainable practices including using renewable energy sources and energy-efficient building materials. The most often stated motivation for technology investment was increased productivity (62%) followed by cost reduction and increased competitiveness (both 38%) and enabling quicker construction timeframes (36%).

One cannot stress how important it is to use this technology to increase efficiency. IoT devices and smart sensors provide construction organizations with real-time data on critical variables like temperature, pressure, and humidity, enabling them to make well-informed decisions quickly. Instantaneous and continuous condition monitoring has the potential to drastically cut downtime, increase productivity, and ultimately lower project costs. -

Rise in industrial automation - Robots are indeed replacing humans in industrial manufacturing, as it looks. Over 380,000 industrial robots are currently in use in industries all over the world, having more than tripled in annual installations between 2010 and 2019. Singapore, South Korea, and Japan are at the top of the list with the most robots per 10,000 manufacturing workers, followed by Sweden and Denmark. While the U.S. and Europe are lagging, they are implementing automation at a quick pace.

The smart manufacturing industries use ground fault sensors to incorporate their smart devices and robotics into work. This makes the ground fault sensors increase massively by the end of 2035. -

Need for reliable ground fault protection - When a conductor at a voltage different from the earth reference comes into touch with another conductive material that is linked to the ground, a ground fault happens. This can result in undervoltages, unwanted single-line-to-ground fault currents, and transient or persistent overvoltages, depending on the type of grounding system implemented.

These errors can injure people, damage systems, or even spread to more serious errors if they are not separated. Therefore, every industry worldwide requires trustworthy ground fault protection to stop these huge mishaps.

Challenges

-

Complications related to the ground fault operating systems - According to statistics, more than 80% of all defects on overhead line power distribution systems are ground faults. Therefore, one of the most crucial tasks for protection engineers is the identification and isolation of ground faults. When a ground fault has a high fault impedance, which translates to a minimal fault current, it can be harder to detect.

High-impedance fault (HIF) conditions are generally brought on by downed electrical lines when the ground surface contains weakly conductive materials such as dry sand, deep snow, or asphalt. Furthermore, distribution system ground faults frequently occur close to human activity, increasing the likelihood that they will result in property and life loss. Although this can pose a threat to the global ground fault sensor market expansion, still the demand will increase because of the rising safety concerns. -

Economic uncertainties and fluctuations in the global market impacting investment decisions and ground fault sensor market growth.

-

High entry barriers due to the need for advanced technology and expertise in the field.

Ground Fault Sensor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 3.43 billion |

|

Forecast Year Market Size (2035) |

USD 6.62 billion |

|

Regional Scope |

|

Ground Fault Sensor Market Segmentation:

Product Segment Analysis

In ground fault sensor market, DC segment is poised to dominate over 60% share by 2035. The segment growth can be attributed to the increase in demand for DC ground fault sensors in commercial and industrial applications, as they are more reliable and accurate than conventional sensors. Furthermore, the low line resistance and high DC link capacitance of DC microgrid lead to a significant rise in current. It could result in an unwanted resource disconnection during fault conditions, rendering the system unreliable. To investigate and overcome the aforementioned obstacles, an accurate and quick operating protection plan is required.

The rise in demand for DC loads in commercial, industrial, and residential settings has led to a predominant occurrence of renewable energy sources (RES) in today's power systems. Power electronic converters in the DC microgrid can readily interface with sources, loads, and energy storage devices like batteries and supercapacitors.

Application Segment Analysis

In ground fault sensor market, power segment is estimated to account for around 40% revenue share by 2035. The segment growth can be owing to the increased adoption of renewable energy sources, such as solar and wind, which require power applications to monitor and protect equipment from ground faults.

PV array ground faults are typically caused by errors committed during installation or by the mechanical, electrical, or chemical deterioration of photovoltaic (PV) components. The position and impedance of a defect define its type, and depending on these two characteristics, the fault's influence on array operations can vary greatly in severity.

In contrast to resistance-grounded or solidly grounded systems, ungrounded systems require a distinct approach to ground fault monitoring solutions. The ideal practice for unground systems is to continuously check the insulation system's "strength" to ground, even when the system is in use.

Our in-depth analysis of the global ground fault sensor market includes the following segments:

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ground Fault Sensor Market - Regional Analysis

North America Market Insights

North America industry is likely to account for largest revenue share of 30% by 2035. The region is the domicile of a large number of construction and manufacturing industries, where ground fault sensors are used extensively. Again, the region also has a powerful existence of regulatory bodies that set rigorous safety standards for electrical installations, which further drives the demand for ground fault sensors.

For instance, In the United States, the National Electrical Code, or NFPA 70, specifies safe wiring and equipment installation procedures for electrical wiring and equipment. These safety standards require the implementation of ground fault sensors to detect electrical faults in the ground and alert the user of any potential hazards.

APAC Market Insights

By the end of 2035, Asia Pacific region in ground fault sensor market is anticipated to dominate around 25% revenue share. The market’s expansion can be propelled majorly by the increasing demand for renewable energy sources, the growing need for reliable power systems, and the rising number of grid-connected renewable power plants.

For instance, to increase its renewable energy capacity to almost 4 terawatts by 2030—more than three times its 2022 total—China plans to construct more than 200 of these bases. To identify and interrupt ground faults, solar inverters need to be equipped with a ground fault detection and interruption (GFDI) device.

Ground Fault Sensor Market Players:

- ABB Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Schneider Electric

- Schweitzer Engineering Laboratories

- Littelfuse, Inc.

- Eaton Corporation plc

- General Electric Company

- NK Technologies

- Rockwell Automation

- Siemens AG

- Steven Engineering

Recent Developments

- ABB Limited has introduced a program to replace aging protection devices with new multi-function devices. The program is the i-bus KNX, with which aging can be ring-fenced, and offers a future-proof solution for switchgear that is part of a rapidly expanding electrical grid.

- Littelfuse, Inc., —a global manufacturer of leading technologies in circuit protection, power control, and sensing—expanded its SB5000 Industrial Shock Block Series with two new high-capacity GDT Transient Voltage Surge Suppressor (TVSS) devices to protect industrial systems against harmful transient overvoltages.

- Report ID: 5598

- Published Date: Nov 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ground Fault Sensor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.