Grid Computing Market Outlook:

Grid Computing Market size was valued at USD 5.7 billion in 2025 and is likely to cross USD 28.59 billion by 2035, expanding at more than 17.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of grid computing is assessed at USD 6.6 billion.

The advent of IoT technology and devices has resulted in the generation of large amounts of data, and there is a need for efficient distributed computing to analyze this data in real time. This need is efficiently addressed by grid computing, which is the dispersion of computing processes that are connected to improve performance and meet the real-time results of the computations. Recent developments highlight the development of the industry. For instance, Oracle, in August 2024 partnered with AT&T, through which the latter incorporates IoT connectivity as well as network APIs in the Oracle Enterprise Communications Platform.

This partnership allows Oracle Cloud customers to run and capture near real-time data from IoT devices across various sectors, including utilities and telehealth industries.

In addition, many companies have been making investments to enhance the computing technologies. In January 2025, Amazon Web Services announced an investment of USD 11 billion in Georgia to develop structures for cloud computing and AI technologies. This initiative by AWS is aimed at strengthening the computational capabilities required to process vast amounts of data generated by IoT devices, facilitating real-time efficient analysis as well as decision-making processes.

Key Grid Computing Market Insights Summary:

Regional Insights:

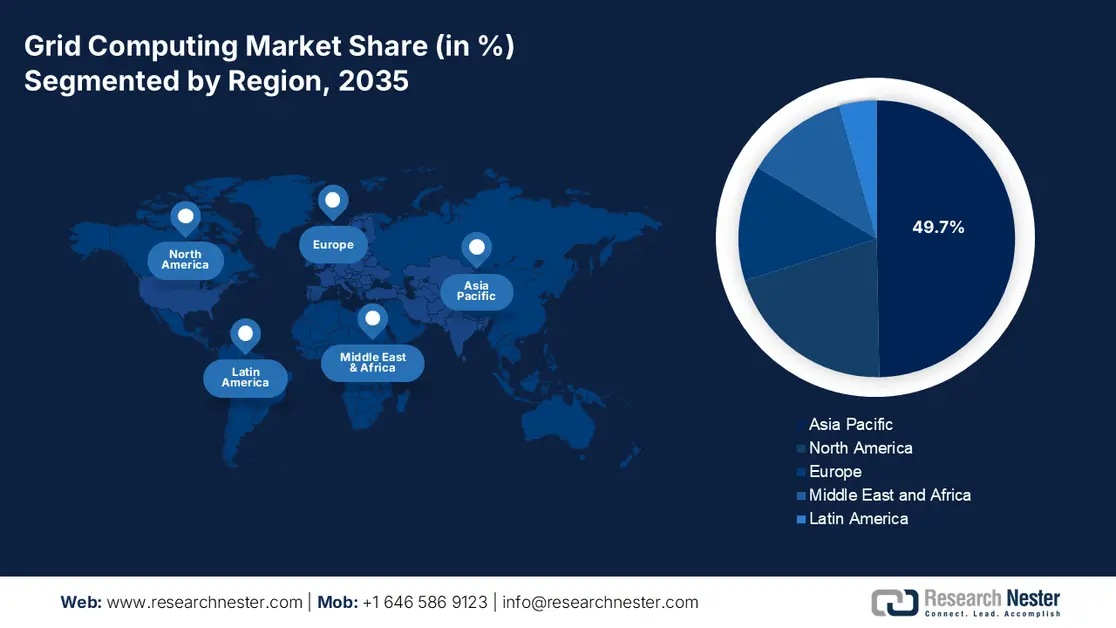

- Over 2026–2035, Asia Pacific is forecast to secure more than 49.7% share of the grid computing market, underpinned by the rapid expansion of cloud computing services.

- North America is anticipated to capture a substantial share by 2035 as the region experiences escalating demand for high-performance computing across key industries.

Segment Insights:

- By 2035, the public cloud segment in the grid computing market is projected to hold over 53.9% share, supported by rising demand for scalable and cost-efficient cloud computing services.

- Across 2026–2035, the small and medium enterprise segment is set to record robust growth as SMEs increasingly leverage grid computing to enhance task efficiency and operational agility.

Key Growth Trends:

- Surge in demand for high computational power

- Advancements in network infrastructure

Major Challenges:

- Dependance on high speed network infrastructure

- Energy consumption

Key Players: Incredibuild, Avepoint, Microsoft, Google, Temenos, Anyscale, Seal Storage Technology, Oracle Corporation, and Kanduo Bus.

Global Grid Computing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.7 billion

- 2026 Market Size: USD 6.6 billion

- Projected Market Size: USD 28.59 billion by 2035

- Growth Forecasts: 17.5%

Key Regional Dynamics:

- Largest Region: Asia Pacific (49.7% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Australia, Brazil

Last updated on : 2 December, 2025

Grid Computing Market - Growth Drivers and Challenges

Growth Drivers

- Surge in demand for high computational power: Many businesses and organizations including healthcare, finance, aerospace industries, and engineering require large-scale computations for tasks including simulation, research, and data analysis, among others. These needs are best addressed through grid computing since this is designed to seamlessly distribute the workload over a collection of connected systems, thus improving processing capacity without having to invest in additional specialized infrastructure. Collaboration between companies is a significant factor that is fostering the grid computing market. Infosys, in February 2023, partnered with GE Digital to boost grid transformation for the utilities sector.

- The collaboration aims to deliver innovative solutions to achieve higher grid resilience and effectiveness through the integration of energy information, network analysis, and AI. Similarly, Tata Power signed a strategic partnership in March 2023, to tap the potential of the Indian power distribution grid through digitalization. This collaboration is underway for the new secondary substations and advancement in metering technology regarded the new requirements for enhanced computational designs for future power systems.

- Advancements in network infrastructure: The continual progress in network infrastructure has also accelerated the grid computing industry. This has made the high-speed internet and reliable communication networks more accessible for infrastructure, which in turn leads to smoother operations in businesses. One notable development in this domain includes the FABRIC project by the National Science Foundation (NSF) which, in October 2023, announced a significant enhancement in network infrastructure by achieving data transmission speeds of 1.2 Tbps. This achievement is expected to bring academic research infrastructures closer to competing with internet-scale platforms, thereby accelerating the capabilities of grid computing systems.

Challenges

- Dependance on high-speed network infrastructure: Efficient grid computing requires strong and fast networks to support all the communication channels between the distributed systems. Where the internet connection is poor or where advanced communication technologies are not readily available, the deployment of grid computing becomes difficult. These grids cannot support slow or unstable networks due to latency, data flow restrictions, and reduced computational processing making it impossible to deploy advanced grids. Solving this challenge demands large investments in broadband infrastructure and other next-generation networks to provide equal access and high-quality connectivity worldwide.

- Energy consumption: Grid computing uses extensive, centralized infrastructures that require large amounts of electrical energy to run and cool communication devices. This tends to raise operational expenses together with some social issues like higher carbon footprint. This is a robust threat for organizations that consider sustainability as a central issue. The problem with energy consumption is more acute when considered across resource-intensive uses, such as scientific simulation and machine learning. The general proposition to address this challenge is to incorporate energy-efficient hardware, matched resource allocation, and renewable suppliers in the case of grid computing.

Grid Computing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

17.5% |

|

Base Year Market Size (2025) |

USD 5.7 billion |

|

Forecast Year Market Size (2035) |

USD 28.59 billion |

|

Regional Scope |

|

Grid Computing Market Segmentation:

Deployment Type Segment Analysis

Based on the deployment type, the public cloud segment is projected to hold grid computing market share of over 53.9% by the end of 2035, owing to the rising demand for cloud computing services by businesses as they seek affordable and scalable solutions. The rise of distributed cloud solutions has accelerated the compliance as well as the performance of public cloud services. Public cloud services are allocated by distributed cloud to various physical locations, to optimize compliance and performance. This approach is beneficial for businesses that involve specific geographical requirements. These solutions are anticipated to grow significantly, to resemble hybrid cloud solutions in private settings, offering easier compliance with regulations and more reliable networks. The Akamai App Platform, introduced by Akamai in November 2024, is a ready-to-run solution that simplifies the deployment, management, as well as scaling of highly distributed applications. This platform makes applications run better in the public cloud while allowing users to grow their computing needs.

Organization Size Segment Analysis

By organization size, the small and medium enterprise segment in grid computing market is expected to register rapid revenue growth during the assessment period. Small and medium enterprises use grid computing to make tasks run better and grow more flexible. Small businesses gain access to distributed computing services which let them accomplish complex work without significant upfront infrastructure investments. This strategy helps organizations expand their infrastructure budget efficiently based on business development.

The grid computing market growth also benefits from grid computing solutions that fit small enterprise needs. Companies have been developing products to meet the unique requirements of small and medium businesses and offer them affordable and adaptable services. For instance, Huwai released the HECS X instance in April 2024 to help small and medium businesses through flexible cloud computing. This technology platform includes 100+ variable parameters so businesses can pick specific hardware combinations tailored to their exact situation.

Our in-depth analysis of the global grid computing market includes the following segments:

|

Deployment Type |

|

|

Organization Size |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Grid Computing Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific grid computing market is predicted to account for revenue share of more than 49.7% by the end of 2035. The rapid expansion of cloud computing services has contributed to the development of robust infrastructure for grid computing applications. This expansion also facilitates the integration of grid computing solutions, enhancing more resourceful solutions that are scalable as well as cost-effective. The enhanced use of renewable energy also calls for sophisticated approaches to manage the distribution grid which in turn expands the use of grid computing technologies even further. The industry is also experiencing strategic partnerships and technological advancements. The partnership between Landis+Gyr and Sense in December 2024, unveiled an integrated intelligent grid edge solution for Asia Pacific markets with a preliminary emphasis on real-time management of energy.

The China grid computing market is growing rapidly as a result of investments in smart grids. One of the major drivers behind the advancement of these facilities is the overall growth in the country’s smart grid systems. These advancements include the integration of advanced metering infrastructure as well as supervisory control and data acquisition systems, to strengthen the reliability as well as efficiency of the power sector. The continual advancements in China’s high-performance computing industry foster the grid computing ecosystem. The country has made significant growth in quantum sensors and semiconductor chip manufacturing, which is anticipated to propel the grid computing market growth. These developments are accompanied by strategic collaborations and product releases. For instance, Marvell Technology in April 2023, unveiled the industry’s first 3nm data infrastructure silicon, marking a major milestone in data processing capabilities.

The grid computing market in India is witnessing significant growth, due to the country’s strategic initiatives to accelerate its digital infrastructure. Digital India initiative, since being rolled out in 2015 is a campaign that seeks to push the country towards being a digitally empowered society and inclusive knowledge economy. This has led to investments in outer data centers and cloud computing services, giving a strong base of grid computing applications.

Besides the governmental efforts, the private sector is also driving the grid computing industry in the country. For instance, in December 2022, InstaSafe partnered with ZNet Technologies to extend InstaSafe’s product portfolio in India. Moreover, the government is focused on launching various schemes and making investments to strengthen the position of grid computing. For instance, the government launched a scheme in 2022 with an investment of USD 38 billion to support the power distribution companies update their systems. This project works to upgrade the energy networks and bring grid computing technology into the grid computing power system.

North America Market Insights

The North America grid computing market is expected to account for a significant revenue share between 2026 and 2035. The growth in the need for high-performance computing (HPC), across industries such as healthcare, financial, and engineering is a major factor fueling the grid computing market growth in North America. HPC involves demanding grid computing solutions for activities like performance modeling and simulation, data analysis, and real-time processing. Due to the recent increase in uses of applications such as AI and machine learning, which require vast computational capabilities, Grid computing is vital in addressing requirements for those purposes. Another major source of growth is the increasing demand for big data and data analytics including complex data analytics.

Distributed computing systems have become essential as they allow businesses to gather large quantities of data to handle complex tasks. Through grid computing, there is an efficient way of partitioning the processing loads, where an organization can deal with big data with the efficiency it requires. The grid computing market in the U.S. is highly dependent on the use of cloud computing services. When organizations transmute their operations to the cloud, the need for computing capacity becomes explosive. In grid computing, the different processing tasks are distributed into one or more servers providing improved performance and reliability.

The advancement of next-generation computing paradigms including quantum computing, and other sophisticated AI algorithms is straining the requirement for grid computing solutions. They are computationally intensive, and grid computing utilities can use distributed systems to offer this capacity. In February 2020, the smart energy company Gridbeyond expanded its operations in the U.S. grid computing market, establishing an office in Houston, Texas. This expansion plans to establish a strong foothold for the company in the U.S. energy sector and use grid computing technologies for energy management solutions.

The grid computing market in Canada is significantly growing attributed to the strategic initiatives by the government to strengthen the technological infrastructure in the country. As part of Canada's push to lead quantum technology worldwide, the government introduced the National Quantum Strategy in 2022. This strategy is expected to emphasize advancing quantum research, developing a skilled workforce as well as fostering innovation.

Government investments in quantum technology support the development of advanced grid computing applications to manage complex quantum calculations. The establishment of the AI Compute Access Fund in December 2024 with an investment of up to USD 300 million is expected to make the companies and innovators in the country use AI computing resources. The program is expected to strengthen three essential sectors - life sciences, energy, and advanced manufacturing through grid computing infrastructure to process data effectively. The fund gives these industries direct access to powerful computing tools which helps them advance and grow more efficiently.

Grid Computing Market Players:

- Incredibuild

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Avepoint

- Microsoft

- Temenos

- Anyscale

- Seal Storage Technology

- Oracle Corporation

- Kanduo Bus

- WebRadar

- Sun Microsystems

- IBM Corporation

The competitive landscape of the grid computing market is rapidly evolving, attributed to the integration of advanced technologies in grid computing by key players, and their focus on developing new technologies and products catering to the stringent regulatory norms and consumer demand. The key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global grid computing market:

Recent Developments

- In June 2024, Dell joined forces with Cerebras to create AI infrastructure solutions for generative AI applications. The duo is expected to offer AI systems and supercomputers, white-glove large language model training, as well as machine learning expert services.

- In May 2021, IBM announced innovations in hybrid cloud and AI capabilities, aimed at boosting digital transformation. These advancements highlight the company’s role in helping clients, as well as partners, build strategic ecosystems that accelerate better business outcomes.

- Report ID: 7050

- Published Date: Dec 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Grid Computing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.