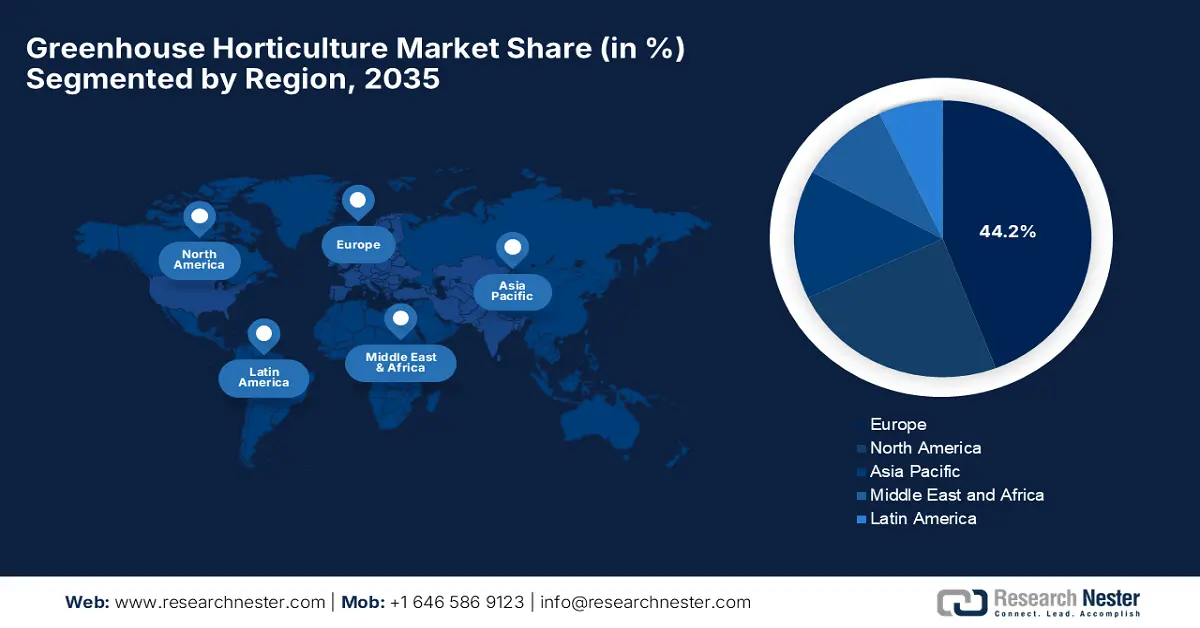

Greenhouse Horticulture Market - Regional Analysis

Europe Market Insights

The Europe greenhouse horticulture market is predicted to dominate the entire global landscape, accounting for around 44.2% of the total revenue share by the end of 2035. The strong emphasis on sustainability, energy efficiency, and high-tech automation is the key factor behind this leadership. Countries such as the Netherlands, Germany, the UK, Spain, and Italy are leading in terms of greenhouse innovations, particularly in terms of hydroponics, vertical farming, as well as LED lighting technologies. In this regard, in November 2024, Hazera announced that it had inaugurated a new 5-hectare high-tech R&D greenhouse in Made, the Netherlands, which is aimed at advancing tomato breeding with a prime focus on disease resistance, high yield, and improved taste. It also mentioned that this facility is repurposed from an existing commercial greenhouse, emphasizing sustainability while accelerating the development of innovative tomato varieties for global markets, hence contributing to overall greenhouse horticulture market growth.

Germany greenhouse horticulture market mostly prioritizes energy-efficient and climate-resilient structures to reduce environmental impact while also maintaining productivity. Growers in the country also benefit from strong government support for sustainable agriculture and renewable energy integration. In October 2025, the German Federal Ministry of Food and Agriculture (BMLEH) reported that it runs the federal program to increase energy efficiency and co₂ reduction in agriculture and horticulture to support the country’s climate goals, aiming to cut annual agricultural emissions by 1.1 million tons of CO₂ by the end of 2030. Funding is provided under national and regional legal frameworks, which include the federal budget code, the climate and transformation fund, and EU regulations on agricultural state aid, thereby ensuring compliance and efficiency. It also mentioned that eligible investments must meet technical and professional standards, and support is distributed annually.

The UK greenhouse horticulture market is growing on account of a strong focus on enhancing local food production and reducing reliance on imports. Simultaneously, government initiatives provide support for energy-efficient greenhouse technology and urban farming projects, which in turn are encouraging more players to make investments in this field. In this regard, in April 2025, Indaver and Rivenhall Greenhouse Limited announced a decarbonisation project at the Rivenhall integrated waste management facility in Essex, to use electricity, heat, and CO₂ from the facility for efficient, year-round greenhouse crop production. The project also includes a carbon capture and usage (CCU) plant, heat exchangers, and a private-wire electricity supply to support LED-lit greenhouses, thereby enhancing yields and sustainability. Such an initiative represents a first-of-its-kind UK model linking low-carbon energy recovery with climate-resilient horticulture, boosting local food security.

North America Market Insights

The North America greenhouse horticulture market is exponentially growing owing to the presence of advanced controlled environment agriculture systems and technology-driven farming practices. The region also benefits from strong government support for sustainable agriculture initiatives and incentives for energy-efficient greenhouse construction. In this regard, BrightFarms, in December 2024, announced the inauguration of its first Texas greenhouse in Lorena by covering 1.5 million square feet and featuring advanced climate-control technology for year-round leafy green production. The facility is considered to be a part of BrightFarms’ rapid expansion across the U.S., creating over 250 local jobs and supporting sustainable, hydroponic farming methods that use less land and water than traditional agriculture. Further, it is backed by Cox Farms, the project reinforces investment in scalable, energy-efficient indoor farming, reducing transportation emissions.

In the U.S., the greenhouse horticulture market is expanding, fueled by the integration of AI, robotics, and IoT-enabled monitoring systems to improve both efficiency and sustainability. The country’s government programs and state-level initiatives also support workforce training and the adoption of green technologies, promoting resilience in food supply chains. In August 2025, AeroFarms reported that it had refinanced its debt and raised equity to support ongoing operations at its Danville, Virginia, vertical farm and fund pre-construction activities for a second farm. The company is a leading U.S. supplier of microgreens, uses patented aeroponics, robotics, AI, and 100% renewable energy to grow crops year-round with 90% less water and 230× less land when compared to traditional farming. This is supported by investors including Grosvenor Food & AgTech and Siguler Guff. This financing enables AeroFarms to expand sustainably, allowing it to maintain its leadership in climate-resilient, high-efficiency indoor agriculture.

Canada greenhouse horticulture market is maintaining a strong position in the regional dynamics owing to the resource-efficient production, the country’s harsh climate, and short growing seasons. Federal and provincial programs in the country deliberately encourage innovation in horticultural practices, which include crop diversification and integrated pest management. In December 2025, Agriculture and Agri-Food Canada and the Government of Alberta announced that they had launched the USD 10‑million growing greenhouses program to support expansion and innovation in Alberta’s greenhouse and vertical farming sector. The program funds new construction, energy-efficient systems, advanced lighting, automation, and robotics to enable year-round production of domestically grown fruits and vegetables, reducing import reliance and strengthening food security.

APAC Market Insights

The Asia Pacific greenhouse horticulture market is maintaining a strong position, facilitated by the increasing population, urbanization, and rising disposable incomes. Countries in the region are opting for modern greenhouse technologies to enhance productivity and reduce environmental impact. In this regard, in April 2025, DENSO Corporation and DELPHY Groep BV reported that they signed a memorandum of understanding to develop data-driven smart horticulture that optimizes greenhouse cultivation utilizing IoT, sensors, and digital twin technology. In addition, this collaboration aims to automate crop data collection, improve cultivation planning through DELPHY’s QMS software, and simulate plant growth for stable, sustainable production. Furthermore, by combining DENSO’s sensing and environmental control expertise with DELPHY’s cultivation knowledge, this initiative is all set to advance precision, efficient, and climate-resilient horticulture by the end of 2030.

China greenhouse horticulture market is leveraging both traditional and modern greenhouse structures to meet the high domestic demand for vegetables, fruits, and flowers. The market is primarily driven by government initiatives that are focused on food security, sustainability, and technological modernization. In January 2024, Kingpeng International Hi-Tech Corporation announced the completion of the first planting zone of its 26-hectare intelligent agriculture industrial park in Henan, China, which is a project integrating smart greenhouse production, technology, ecology, and agri-tourism. In addition to an investment of about RMB 400 million (USD 55-56 million), the park uses modern greenhouse systems and digital management to drive agricultural upgrading, improve productivity, and support farmer employment, enhancing sustainability and regional economic development.

India greenhouse horticulture market is efficiently progressing due to increasing consumer demand for high-quality fruits and vegetables, along with government programs that are proactively promoting protected cultivation. The country’s market also benefits from technological collaborations for drip irrigation, fertigation, and climate control systems. In this regard, Farmers Welfare in August 2025 highlighted horticulture as the central pillar of agricultural growth by emphasizing diversification into high-value crops to boost farmer incomes and sustainability. It is also supported by schemes such as the Mission for Integrated Development of Horticulture (MIDH), and the sector efficiently promotes protected cultivation, which includes greenhouses and polyhouses, modern technologies, and post-harvest infrastructure. In addition, horticulture production rose to 367.72 million tonnes in 2024-25. The initiative underlines strong policy backing and market potential for greenhouse horticulture in the country.

India Horticulture Production & Productivity Trends: Official Government Data

|

Indicator |

Earlier Period |

Latest Period |

Growth |

|

Total horticulture production |

280.70 million tonnes (2013-14) |

367.72 million tonnes (2024-25) |

31% |

|

Fruit production |

86.6 million tonnes (2014-15) |

112.97 million tonnes (2023-24) |

30% |

|

Vegetable production |

169.47 million tonnes (2014-15) |

207.2 million tonnes (2023-24) |

22% |

|

Fruit productivity |

14.17 t/ha |

15.80 t/ha |

Improved |

|

Vegetable productivity |

17.76 t/ha |

18.40 t/ha |

Improved |

|

Government support |

MIDH, NHB, HMNEH |

Protected cultivation, including greenhouses |

Active & ongoing |

Source: Farmer’s Welfare, Government of India