Green Solvents Market Outlook:

Green Solvents Market size was over USD 5.81 Billion in 2025 and is poised to exceed USD 11.54 Billion by 2035, growing at over 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of green solvents is estimated at USD 6.18 Billion.

The growth of the market can be attributed to their being biodegradable in nature, followed by the surging use of eco-friendly paints and coatings. As green solvents emit less volatile organic compounds (VOC) owing to which the major population these days prefers to use such solvents as of the rise in pollution. Such advantages are estimated to be the primary growth factor for the green solvents market in the forecast period. For instance, a recent estimate showed that emissions of VOCs decreased from 12,930 in 2018 to 11,880 tons in 2021 in the United States. In addition to this, the growing use of green solvents in various end-use industries such as automotive, pharmaceutical, industrial & domestic cleaners is another major factor that is estimated to propel the market growth over the projected time frame.

In addition to these, factors that are believed to fuel the market growth of green solvents include the rising trend of sustainability, along with increasing awareness in people for reducing carbon footprints. Since, traditional solvents highly impact the environment by creating air pollution and diseases such as lung infection, nausea, headache, and skin irritation. Therefore, the high level of air pollution and rising concern for environmental protection is anticipated to foster the demand for green solvents. The World Health Organization stated that in 2019, 99% of the world’s population was living in places where the WHO air quality guidelines levels were not met. Additionally, the growing promotion for adopting green products by various regulatory bodies is also predicted to present the potential for market expansion over the projected period.

Key Green Solvents Market Insights Summary:

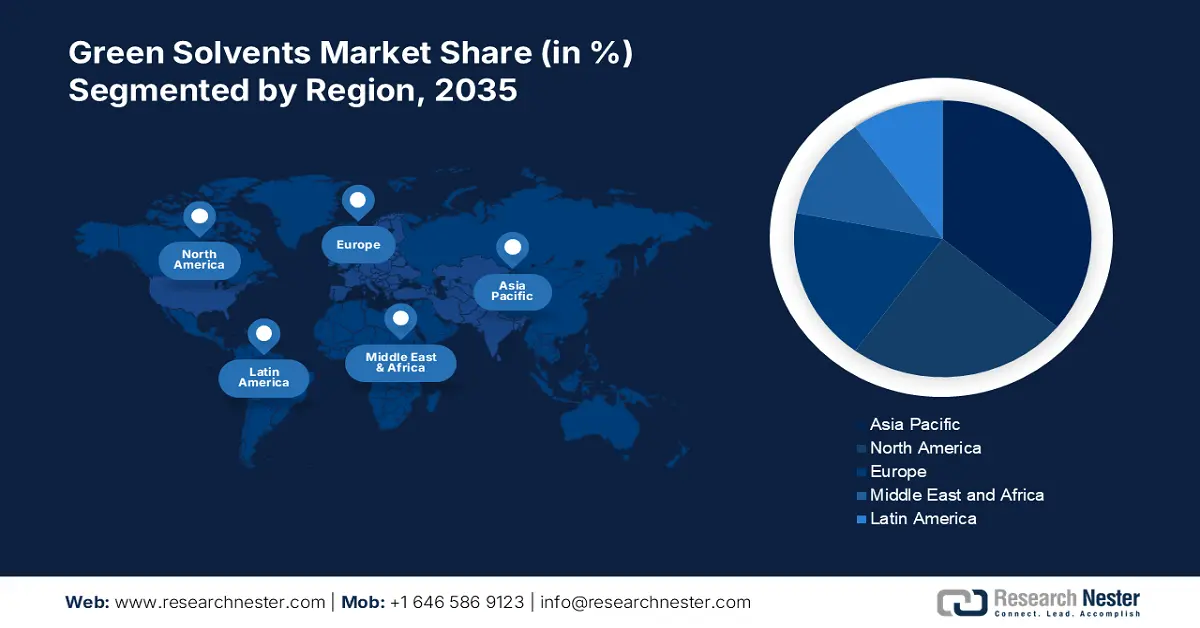

Regional Highlights:

- Asia Pacific’s green solvents market holds the largest share by 2035, fueled by rising pharmaceutical spending in countries like Japan and Korea, and initiatives to reduce air pollution and promote eco-friendly products.

- North America market will achieve lucrative growth during the forecast timeline, driven by rising concern for environmental safety, increased use of green solvents in the paint industry, and government regulations on traditional solvents.

Segment Insights:

- The paints & coatings (application) segment in the green solvents market is projected to capture the highest market share by 2035, driven by the growing construction industry and demand for renewable solvent solutions.

- The d-limonene segment in the green solvents market shows massive CAGR, driven by the rising use of d-limonene in cleaning products and as a fragrance, forecast year 2035.

Key Growth Trends:

- Rapid Urbanization and Industrialization

- Increased Demand for Consumer Goods

Major Challenges:

- High Cost of Production of Green Solvents

- Fluctuation in Raw Material Prices

Key Players: Archer Daniels Midland Company, Braskem SA, BASF SE, Huntsman International LLC, The Dow Chemical Company, Cargill, Incorporated, Gevo, Inc., Vertec BioSolvents Inc., Akzo Nobel N.V., LyondellBasell Industries N.V,.

Global Green Solvents Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.81 Billion

- 2026 Market Size: USD 6.18 Billion

- Projected Market Size: USD 11.54 Billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 9 September, 2025

Green Solvents Market - Growth Drivers and Challenges

Growth Drivers

-

Rapid Urbanization and Industrialization – Rapid urbanization has resulted in high demand for construction, food & beverages, automobiles, and other things. This increased demand is further expected to rise the adoption rate of green solvents for their varied use. As per data from the United Nations Organization, the worldwide ratio of the population living in urban settlements accounted to be around 55% in 2018. This number is further anticipated to increase to 68% by 2050.

-

Worldwide Expansion in the Automobile Sector - As per the data by the International Organization of Motor Vehicle Manufacturers (OICA), the global sales of all vehicles rose from 78,774,320 units in 2020 to 82,684,788 units in 2021.

-

Increase in Demand for Paints and Coatings- For instance, in 2020, the consumption of architectural paint in the U.S. amounted to be around 860 million gallons.

-

Increased Demand for Consumer Goods –In 2022, India’s fast-moving consumer goods (FMCG) sector was calculated to be India’s fourth-largest sector with household and personal care accounting for 50% of FMCG sales in India.

-

An Upsurge in the Pharmaceutical Industry - For instance, as of November 2021, the pharmaceutical industry in the United States was worth over USD 2.8 trillion.

Challenges

- High Cost of Production of Green Solvents – The production cost of green solvents is comparatively higher than that of conventional paints as of their complex production process. Hence, this factor is anticipated to hinder the market growth over the forecast period.

- Fluctuation in Raw Material Prices

- Complex Production Process of Green Solvents

Green Solvents Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 5.81 Billion |

|

Forecast Year Market Size (2035) |

USD 11.54 Billion |

|

Regional Scope |

|

Green Solvents Market Segmentation:

Application Segment Analysis

The global green solvents market is segmented and analyzed for demand and supply by application into industrial & domestic cleaners, paints & coatings, adhesives & sealants, pharmaceuticals, cosmetics, and others. Out of these segments, the paints & coatings segment is anticipated to garner the highest revenue over the projected time frame. The growth of the segment can be attributed to the worldwide growth in the construction industry where demand for renewable solvent solutions has been increasing. For instance, the worldwide revenue collected by the construction industry was almost USD 2 trillion in 2019. Further, the increased housing construction, backed by the growing population are further factors that are estimated to propel the growth of the segment.

Type Segment Analysis

The global green solvents market is also segmented and analyzed for demand and supply by type into alcohols, glycols, diols, lactate esters, D-limonene, methyl soyate, and others. Amongst these segments, the lactate esters segment is expected to garner a significant share. The growth of this segment can be attributed to the increasing demand and consumption of lactate asters from the various end-use industries, followed by the rising use of lactate aster as they are recyclable, biodegradable, non-corrosive, and so on. On the other hand, the D-limonene segment is projected to witness a massive CAGR during the forecast period, owing to the rising use of D-limonene as a fragrance ingredient in several sectors such as food & beverages, along with its rising use in the production of cleaning goods. In addition to this, the significantly rising use of lactate asters as a thickening agent in several kind of creams, and lotions in functional cosmetics and personal care products is also a major factor that is projected to push the segment growth further throughout the forecast period.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Green Solvents Market Regional Analysis:

APAC Market Insights

The Asia Pacific green solvents market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035. The growth of the market can be attributed majorly to the significant rise in pharmaceutical spending in Asia-Pacific countries such as Japan and Korea, which is anticipated to boost the market growth of green solvents throughout the region during the projected timeframe. According to the Organization for Economic Cooperation and Development (OECD), pharmaceutical spending in Japan was 2.27% of the GDP in 2019, while it was 1.63% of the GDP in Korea in 2021. In addition to this, the increasing initiatives to reduce air pollution and the surge in the use of eco-friendly products are also anticipated to boost the market growth during the forecast period in the APAC region. Moreover, rapid urbanization is propelling the huge use of architectural coatings to coat buildings is also a significant factor that is anticipated to boost the growth of the green solvents market throughout the forecast period in the region.

North American Market Insights

Furthermore, the North American green solvents market is also estimated to display lucrative market growth by the end of 2035. The growth of the market can be attributed to the rising concern regarding environmental safety among people and end-use sectors which is fueling up the deployment of eco-friendly products. For instance, approximately 3 quarters of Americans say they are conscious about the environment. More than 80% admit they attempt to live in ways that help safeguard the environment. In addition to this, the rising use of green solvents in the paint and coatings industry, along with the stringent rules by the government regarding the use of traditional solvents are some further factors that are anticipated to accelerate the market growth further throughout the projected time frame in the region.

Green Solvents Market Players:

- Archer Daniels Midland Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Braskem SA

- BASF SE

- Huntsman International LLC

- The Dow Chemical Company

- Cargill, Incorporated

- Gevo, Inc.

- Vertec BioSolvents Inc.

- Akzo Nobel N.V.

- LyondellBasell Industries N.V.

Recent Developments

-

Archer Daniels Midland Company has decided to acquire Florida Chemical Company (FCC), a division of Flotek Industries that manufactures citrus-based flavors and fragrances.

-

Braskem S.A. has launched its first partially renewable solvent – HE-706, made from sugarcane ethanol and with raw materials such as bio-based carbon.

- Report ID: 4327

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Green Solvents Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.