- In December 2024, Eagle Electronics raised USD 14 million funding led by the O.H.I.O. Fund and support from Asymmetric Capital Partners. The amount will help set up advanced manufacturing technology and operations in Solon, Ohio, in partnership with CO-AX Technology. This step is an important milestone in bringing high-tech supply chain to the U.S.

- In July 2024, Supplyframe introduced the Electronics Product Carbon Footprint (PCF), a new tool that helps manufacturers quickly check the carbon footprint of over 300 million electronic parts. This first of its kind service helps businesses sustainability rules and make informed decisions about designing and sourcing new products.

Green Electronics Manufacturing Market Outlook:

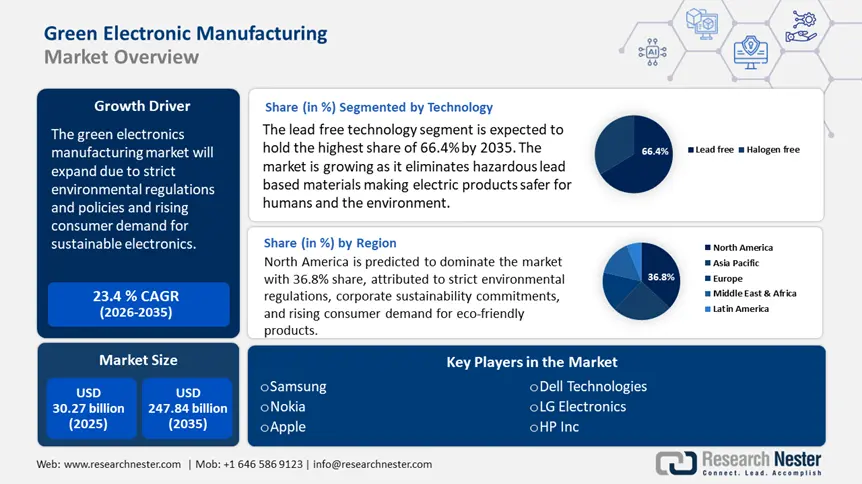

Green Electronics Manufacturing Market size was valued at USD 30.27 billion in 2025 and is likely to cross USD 247.84 billion by 2035, registering more than 23.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of green electronics manufacturing is assessed at USD 36.64 billion.

The rising strict environmental regulations and policies is a key factor expected to fuel global green electronics manufacturing market growth. The enforcement of strict regulations by governments worldwide pushes manufacturers to reduce electronic waste, limit hazardous materials, and promote sustainable production. Policies such as the EU’s Restriction of Hazardous Substances (RoHS), Waste Electrical and Electronic Equipment (WEEE), and Extended Producer Responsibility (EPR) encourage manufacturers toward eco-friendly practices. The EU’s Restriction of Hazardous Substances directive encourages green electronics manufacturing by enforcing strict limits on toxic materials such as lead, mercury, cadmium, and brominated flame retardants. E-waste constitutes one of the fastest-growing solid waste problems in the world. According to the World Health Organization Report 2024, the total e-waste generated in 2022 rose by 82%, reaching 62 million tonnes compared to 2010. These figures suggest the amount of emissions created by e-waste and the necessary steps that should be taken for a greener future.

The top electronic manufacturers are setting carbon-neutral targets. Companies such as Apple, Samsung, and Dell aim to achieve net-zero emissions by 2050. For instance, in September 2023, Apple introduced its first carbon-neutral products, such as specific models of the Apple Watch Series. The low-carbon products include the Apple Watch Series 9, Apple Watch SE, and Apple Watch Ultra 2. These products use 100% clean electricity for manufacturing and incorporate at least 30% recycled or renewable materials by weight. It further ensures that 50% of shipping is conducted without air transportation. These efforts are likely to reduce 75% of product emissions for each model. The commitment towards green manufacturing drives investment in renewable energy-powered factories, sustainable sourcing, and eco-friendly supply chains.

Key Green Electronics Manufacturing Market Insights Summary:

Regional Highlights:

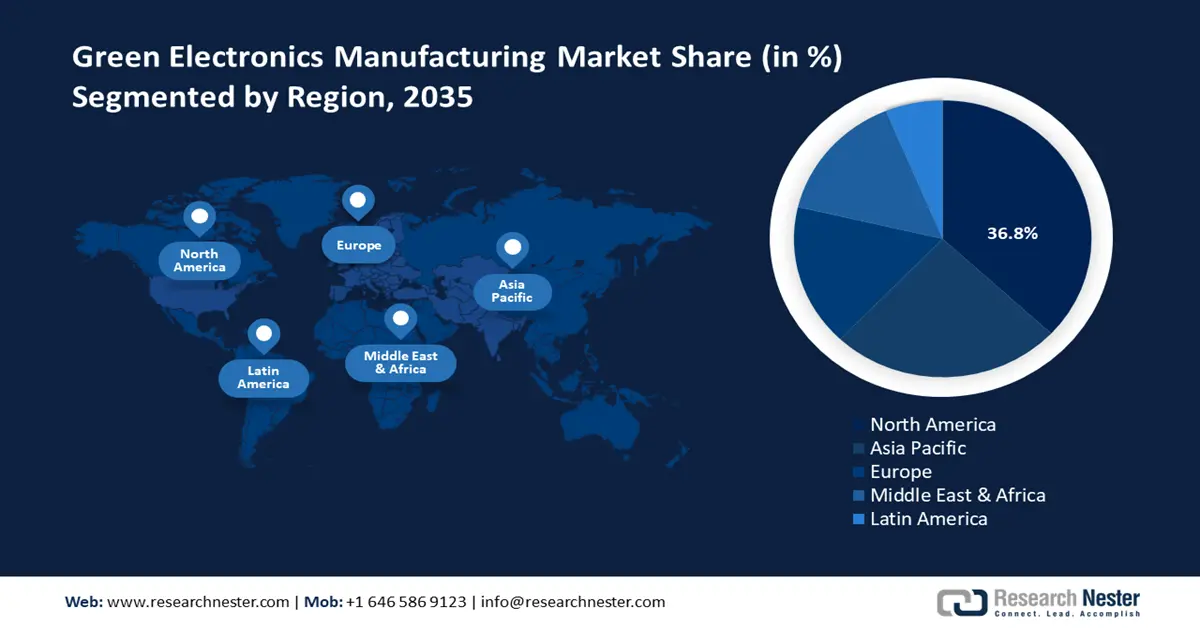

- North America holds a 36.8% share in the Green Electronics Manufacturing Market, driven by strict environmental regulations and rising consumer demand for eco-products, reinforcing its leadership through sustainable practices by 2035.

- The Asia Pacific Green Electronics Manufacturing Market is projected for the fastest growth over 2026–2035, fueled by government sustainability targets, technological advancements, and renewable energy integration.

Segment Insights:

- Lead-free Technology segment is anticipated to hold a 66.94% share by 2035, propelled by stringent regulations and adoption of sustainable materials.

Key Growth Trends:

- Advancements in green manufacturing technology

- Circular economy and E-waste recycling initiatives

Major Challenges:

- High production costs

- Complex recycling and E-waste management

- Key Players: Apple Inc., Samsung Electronics Co., Ltd., Dell Technologies Inc., LG Electronics Inc., HP Inc..

Global Green Electronics Manufacturing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 30.27 billion

- 2026 Market Size: USD 36.64 billion

- Projected Market Size: USD 247.84 billion by 2035

- Growth Forecasts: 23.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, Japan, South Korea, Taiwan, India

Last updated on : 12 August, 2025

Green Electronics Manufacturing Market Growth Drivers and Challenges:

Growth Drivers

- Advancements in green manufacturing technology: The development of innovative ideas in green technology, including biodegradable circuit boards, makes sustainable electronics more feasible. The development of recyclable batteries and energy-efficient semiconductors also promotes green electronics. For instance, in December 2024, researchers at the Technical University of Dresden developed fully biodegradable printed circuit boards using natural leaves as substrates. This approach aims to reduce electronic waste by creating PCBs that decompose naturally and reduce environmental impact. The development of these leaf-based circuit boards represents efforts toward a sustainable future.

- Circular economy and E-waste recycling initiatives: In recent times, companies are shifting towards closed-loop production models. In this model, materials from old devices are recovered, recycled, and reused in new products. For instance, Dell has implemented a closed-loop recycling system where materials recovered from old devices are reintegrated into the production of new products. This approach reduces reliance on sourcing raw materials, minimizes waste, and lowers carbon footprints. With growing global concerns over e-waste, circular economy strategies are becoming a prominent driver for sustainability in the green electronics industry.

Challenges

- High production costs: The presence of eco-friendly materials such as biodegradable plastics, recyclable metals, and low-energy semiconductors cost more than conventional alternatives. Therefore, investment in green manufacturing infrastructure such as energy-efficient machinery and renewable energy sources require significant capital. These high costs may limit green electronics manufacturing market expansion.

- Complex recycling and E-waste management: Electronic waste is difficult to process due to the complex composition of electronic components. The recycling of these components requires specialized methods. Moreover, lack of proper infrastructure for effective e-waste collection, segregation, and recycling act as a hindrance for the development of green electronics manufacturing. The informal recycling sector in developing countries often handle e-waste unsafely, which leads to environmental pollution.

Green Electronics Manufacturing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

23.4% |

|

Base Year Market Size (2025) |

USD 30.27 billion |

|

Forecast Year Market Size (2035) |

USD 247.84 billion |

|

Regional Scope |

|

Green Electronics Manufacturing Market Segmentation:

Technology (Lead free and Halogen free)

Lead-free technology segment is set to capture green electronics manufacturing market share of around 66.4% by the end of 2035 as lead-free technology is widely used across several sectors to eliminate hazardous lead materials. An additional factor fueling the segment's growth is the stringent regulations implemented by institutions to boost the sustainability of supply chains. Moreover, the convergence of trends in circular economy initiatives aligns with the adoption of lead-free technology. Manufacturers are using alternatives such as tin silver copper (SAC) alloys, which maintain reliability while reducing environmental impact. Lead-free technology also enhances product recyclability and reduces toxic waste in landfills. As sustainability demands grow, the adoption of lead-free materials is a big factor contributing to the future of green electronics.

Industry (Consumer Electronics, Automotive, Heavy Industrial Manufacturing, Aerospace & Defense, Healthcare, IT & Telecom)

The consumer electronics segment in green electronics manufacturing market is expected to register rapid growth during the forecast period as consumer electronics companies are adopting sustainable practices to meet environmental regulations and consumer demand. Leading brands are integrating energy-efficient designs, recyclable materials, and eco-friendly packaging to reduce their carbon footprint. Further innovations such as biodegradable circuit boards, lead-free soldering, and low-power semiconductors transform product sustainability.

E-waste recycling initiatives and circular economy models ensure responsible disposal and material recovery. For instance, Samsung’s Galaxy S24 Ultra features nine components made with at least 10% recycled plastics sourced from discarded fishing nets, water barrels, and PET bottles. Similarly, the Galaxy Tab S9 Ultra includes 15 components utilizing recycled plastics and the Galaxy Watch Ultra incorporates two components made with 20% recycled plastics. These initiatives reflect how leading consumer electronic companies integrate sustainable practices into their manufacturing processes.

Our in-depth analysis of the global green electronics manufacturing market includes the following segments:

|

Technology |

|

|

Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Green Electronics Manufacturing Market Regional Analysis:

North America Market Analysis

North America green electronics manufacturing market is projected to account for revenue share of around 36.8% by 2035, attributed to strict environmental regulations, corporate sustainability commitments, and rising consumer demand for eco-friendly products. The U.S. and Canada are the leading countries to have e-waste recycling initiatives and adopt renewable energy-powered manufacturing. Top electronics players such as Apple, Dell, and HP are investing in closed-loop production and sustainable materials. Further, government policies such as the U.S. Inflation Reduction Act support the transition to green electronics. The former Act is a landmark legislation aimed at reducing inflation, lowering energy costs and boosting clean energy investments.

The U.S. green electronics manufacturing market is growing due to strong federal policies, corporate sustainability goals, and investments in eco-friendly technology. Federal policies such as the Inflation Reduction Act and Extended Producer Responsibility (EPR) laws provide funds, tax credits, and regulatory support for sustainable electronics manufacturing. In addition, increasing consumer demand for energy-efficient and recyclable electronics is pushing companies to adopt sustainable practices. Advancements in AI-driven energy optimization and sustainable semiconductor manufacturing are accelerating industry growth. With rising awareness of e-waste and carbon footprints, the U.S. market is poised for innovation and expansion in sustainable electronics.

The green electronics manufacturing market in Canada is rising as industries shift toward low-carbon production and resource-efficient technologies. Government support to adopt clean energy and stricter e-waste regulations are encouraging manufacturers to integrate sustainable materials and circular economy models. For instance, the government in Canada has proposed amendments to control the export, import, and transit of electronic waste. These amendments aim to ensure that e-waste is managed in an environmentally sound manner, preventing harm to the environment as well as human health. Companies are exploring biodegradable components, energy-efficient designs to reduce environmental impact. With increasing consumer preference for eco-friendly products, Canada is building a more sustainable and competitive electronics industry.

Asia Pacific Market Analysis

Asia Pacific green electronics manufacturing market is expected to be the fastest growing economy through 2035. The market is steadily expanding, owing to government sustainability targets, technological advancements, and a strong push towards renewable energy integration. China, Japan, and South Korea are investing in eco-friendly semiconductor production, energy-efficient factories, and advanced e-waste recycling systems. Top companies in the Asia Pacific are adopting green supply chain practices, biodegradable components, and AI-powered efficiency solutions to reduce environmental impact.

The expansion of green electronics manufacturing in China can be attributed to government policies promoting carbon neutrality, heavy investments in renewable energy, and advancements in eco-friendly materials. China is heavily investing towards cleaner future with the carbon neutrality goals and policies encouraging adoption of ecofriendly materials and production processes. The World Economic Forum Report 2025 states that China plays a key role in transitioning towards a green future. It further predicts investments of nearly USD 40 trillion in ESG strategies worldwide. China leads in sustainable semiconductor production, with major firms integrating low-energy chip manufacturing and closed-loop recycling systems. In November 2024, STMicroelectronics announced a partnership with Huo Hong to produce microcontroller chips in China by the end of 2025. This collaboration aims to enhance local manufacturing capabilities aligning with China’s focus on sustainable semiconductor production.

The green electronics manufacturing market in India is fueled by government initiatives including the Production Linked Incentive (PLI) scheme. The adoption of renewable energy and focus on e-waste management are also key drivers for growth. Companies are investing in sustainable supply chains, energy-efficient manufacturing, and recyclable materials to align with India’s net zero goals. The rise of domestic semiconductor production and eco-friendly smartphone assembly is enabling green electronics manufacturing market growth. For instance, in July 2024, the Indian government proposed a PLI scheme targeting e-waste recycling also known as urban mining to recover critical minerals essential for electronics manufacturing. The initiative established a sustainable and self-reliant recycling ecosystem, reducing environmental impact and supports circular economy. Additionally, with increasing consumer demand for sustainable electronics and strict environmental regulations, India is emerging as a key player in green manufacturing.

Key Green Electronics Manufacturing Market Players:

- Samsung Electronics Co., Ltd

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nokia

- Apple Inc.

- Dell Technologies Inc.

- LG Electronics Inc.

- HP Inc.

- General Electric Company

- Siemens AG

The leading companies in the green electronics manufacturing market include Apple, Samsung, and Dell. These companies invest in renewable energy, recyclable materials, and carbon neutral production. HP and Panasonic are also driving sustainability through energy-efficient designs and eco-friendly packaging. These companies are adopting circular economy models to reduce e-waste and set new industry standards. Here are some leading players in the green electronics manufacturing market:

Recent Developments

- In December 2024, Eagle Electronics raised USD 14 million funding led by the O.H.I.O. Fund and support from Asymmetric Capital Partners. The amount will help set up advanced manufacturing technology and operations in Solon, Ohio, in partnership with CO-AX Technology. This step is an important milestone in bringing high-tech supply chain to the U.S.

- In July 2024, Supplyframe introduced the Electronics Product Carbon Footprint (PCF), a new tool that helps manufacturers quickly check the carbon footprint of over 300 million electronic parts. This first of its kind service helps businesses sustainability rules and make informed decisions about designing and sourcing new products.

- Report ID: 7296

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.