Green Chemicals Market Outlook:

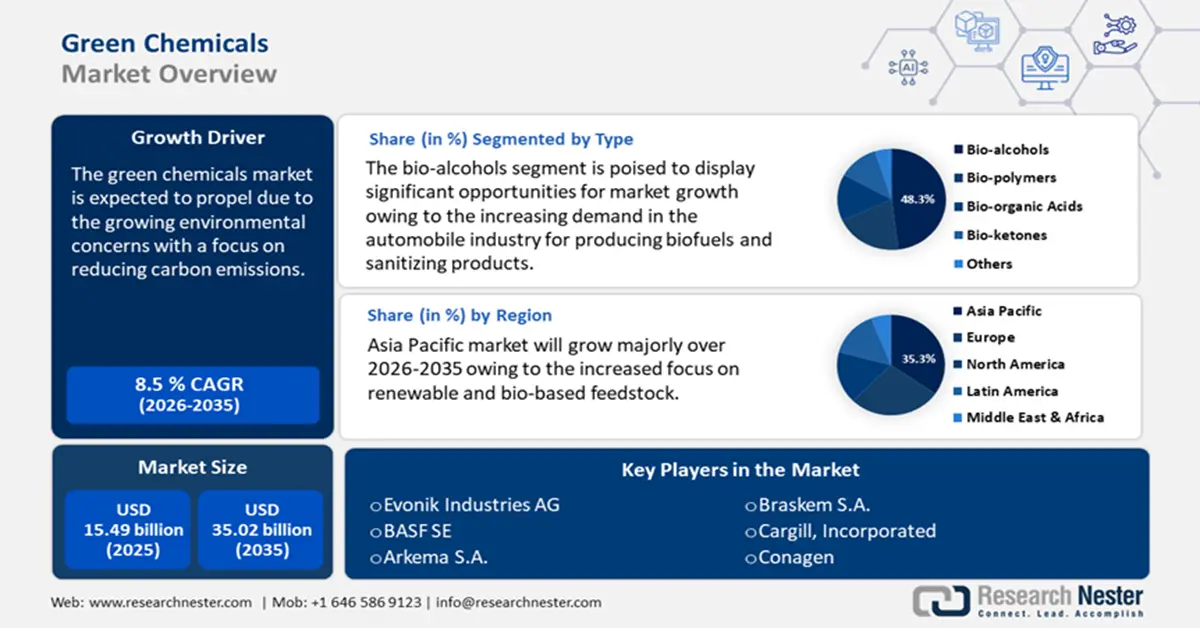

Green Chemicals Market size was valued at USD 15.49 billion in 2025 and is expected to reach USD 35.02 billion by 2035, expanding at around 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of green chemicals is evaluated at USD 16.67 billion.

The global green chemicals market is witnessing tremendous growth as a result of the growing environmental concerns with a focus on reducing carbon emissions. The IEA Bioenergy revealed in 2020 that an estimated 90 million tons of bio-based chemicals and polymers are produced worldwide. Among the most notable examples of bio-based compounds are fermentation products like lysine and ethanol. and fatty acids, sorbitol, glycerol, and citric acid. This has resulted in the adoption of strict laws and policies encouraging green technologies and sustainable development methods. Accordingly, the green chemicals market is being stimulated by customers' growing awareness of the long-term health effects of conventional chemical products.

Furthermore, companies are investing in eco-friendly processes and bio-based raw materials to reduce carbon emissions, minimize waste, and meet stringent environmental regulations. As businesses scale up green chemical production, economies of scale are achieved, leading to cost reductions and making these products more competitive with traditional chemicals. In October 2021, Sekab invested USD 9.34 million to enhance the production of chemicals for industrial applications derived from renewable resources. The investment is undertaken in response to a substantial surge in demand for sustainable alternatives to fossil fuels.

Similarly, SABIC, a worldwide chemical industry leader, announced the introduction of its new certified low-carbon product line. As part of the company's 2050 carbon neutrality objective, this effort will assist our customers and the value chain in achieving their sustainability goals by looking for items with a lower carbon footprint. Consequently, this surge in production is accelerating green chemicals market growth, fostering innovation, and promoting the adoption of green chemicals across various industries, including agriculture, packaging, automotive, and construction.

Key Green Chemicals Market Insights Summary:

Regional Highlights:

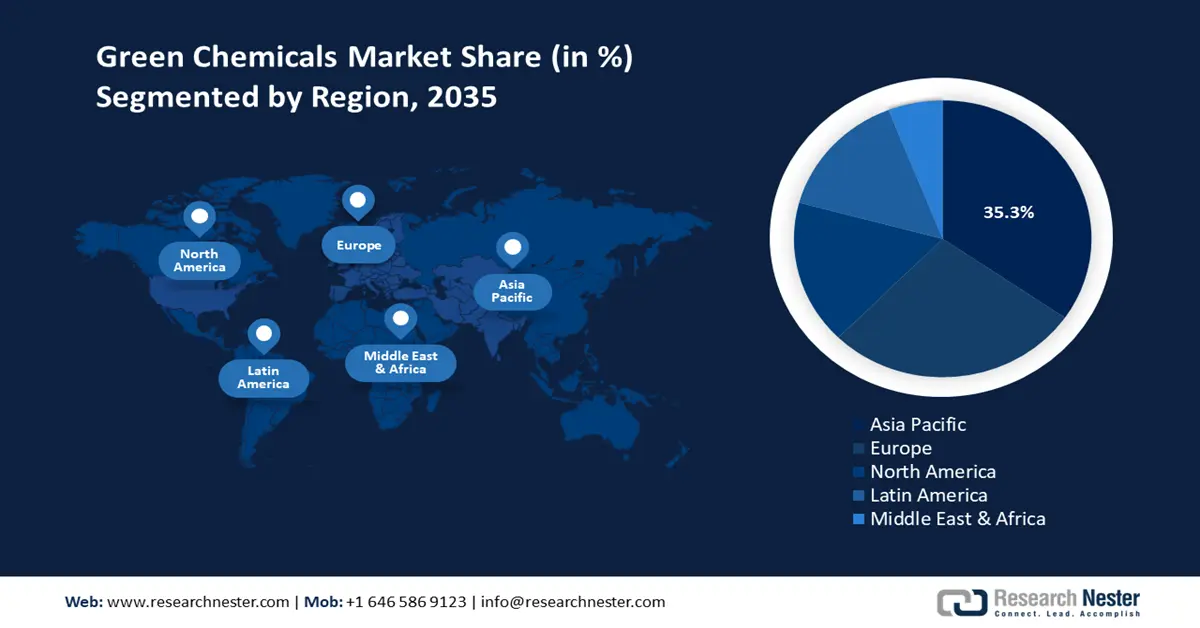

- Asia Pacific dominates the Green Chemicals Market with a 35.3% share, driven by government initiatives and growing environmental sustainability awareness, driving growth through 2026–2035.

Segment Insights:

- The Bio-alcohols segment is anticipated to capture a 48.30% share by 2035, driven by rising demand for bio-based alternatives in fuel, cosmetics, and sanitizing applications.

Key Growth Trends:

- Innovations in the production of bio-based chemicals

- Expansion of carbon capture and utilization for green chemical production

Major Challenges:

- High production costs

- Technological limitations and regulatory hurdles

- Key Players: Evonik Industries AG, BASF SE, Arkema S.A., Braskem S.A., Cargill, Incorporated, Conagen, GF Biochemicals, Vertec BioSolvents, Inc., Global Green Chemicals Public Company Limited, Avantium N.V..

Global Green Chemicals Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.49 billion

- 2026 Market Size: USD 16.67 billion

- Projected Market Size: USD 35.02 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Green Chemicals Market Growth Drivers and Challenges:

Growth Drivers

- Innovations in the production of bio-based chemicals: Chemicals play a vital role in the global economy, driving many aspects of our technological civilization. However, the chemicals industry significantly contributes to climate change, accounting for over 5% of annual global greenhouse gas (GHG) emissions. This is largely due to the resource-intensive processes involved and the reliance on petrochemicals as feedstock. In response to these challenges, synthetic biology emerges as a promising solution by advancing bio-based chemical synthesis through genetic manipulation of microorganisms and enzymes.

As this technology has matured, several companies, including Codexis, Arzeda, and CinderBio, have begun to integrate synthetic biology into their manufacturing processes.

Rather than fully engaging in the bio-manufacturing of specialty or commodity chemicals, these businesses have focused on developing enzymes that enhance biomanufacturing efficiency. Although the implementation of synthetic biology in industrial chemicals is still in its early stages, it is already poised to drive significant technological advancements and capture an increasing share of the green chemicals market. - Expansion of carbon capture and utilization for green chemical production: As the world's population has grown and fossil fuel usage has increased, so too have greenhouse gas emissions, especially those of CO2, methane (CH4), and nitrous oxide (N2O). Carbon capture and utilization (CCU), a supplementary strategy to CCS, has surfaced, providing the advantages of both emission reduction and the conversion of CO2 into products with added value. The CCU avoids some of the energy and financial costs related to storage by combining CO2 capture and conversion to create fuels, chemicals, polymers, and other materials.

Apart from conventional applications like carbonation and improved oil recovery (EOR) in the food and beverage sector, CCU makes it possible to produce cutting-edge molecules such as methane, formic acid, and methanol that have a variety of industrial uses. According to the International Energy Agency (IEA), the announced storage capacity experienced a remarkable increase of 70% in 2023, while the announced capture capacity is projected to grow by 35% by 2030. As a result, the estimated annual storage capacity for CO2 will reach approximately 615 million tons (Mt), and the total amount of CO2 that could potentially be absorbed by 2030 is expected to be around 435 Mt.

Researchers are focusing on carbon capture and utilization (CCU) to produce green chemicals, serving as a key driver for the green chemicals market. This focus is meeting both regulatory requirements and consumer demand for sustainable solutions, positioning green chemicals as essential components of a low-carbon future. For instance, in July 2024, Researchers from the University of Chicago, Northern Illinois University, Valparaiso University, and Argonne National Laboratory demonstrated the creation of a family of catalysts that effectively transform CO2 into ethanol, acetic acid, or formic acid. Many commercial products contain these compounds, among the most produced in the U.S.

Challenges

- High production costs: The availability of agricultural and animal products, such as vegetable oils, sugars, and animal fats, is a major determinant of the capacity to generate green commodities. Conversely, the dwindling agricultural output caused by the gradual loss of arable land poses a serious obstacle to the generation of green chemicals. The declining amount of arable land is also a result of increasing urbanization, population growth, and industrialization. Therefore, it is anticipated that the availability of raw materials required to produce green chemicals will be impacted by the shrinking of arable land, which is hindering the green chemicals market's growth.

- Technological limitations and regulatory hurdles: Despite advancements in the field, many green chemical production methods remain nascent and require substantial investment in research and development. Scaling these processes for mass production often presents significant challenges. Additionally, green chemicals frequently encounter complex regulatory requirements, particularly concerning safety, environmental impact, and performance standards. Regional discrepancies in these regulations may result in delays associated with product development and green chemicals market introduction.

Green Chemicals Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 15.49 billion |

|

Forecast Year Market Size (2035) |

USD 35.02 billion |

|

Regional Scope |

|

Green Chemicals Market Segmentation:

Type (Bio-alcohols, Bio-polymers, Bio-organic Acids, Bio-ketones)

Bio-alcohols segment is projected to dominate green chemicals market share of around 48.3% by the end of 2035. In the market for green chemicals, bio-alcohols—such as ethanol, methanol, and butanol made from bio-based feedstock—have become more popular. They are sought-after substitutes due to their environmentally benign qualities and versatility across a variety of industries, including fuel manufacturing and cosmetics. Due to their disinfecting qualities, bio-alcohols are a trend that requires ongoing study to increase production efficiency and broaden applications, especially in the automobile industry for biofuels and sanitizing products.

Also, as industries seek greener solutions, the expansion of ethanol production is strengthening the bio-alcohols segment, making it a key component of the growing greens chemicals sector. With rising demand for bio-based alternatives to fossil fuels, ethanol is increasingly being used in biofuels, solvents, and bioplastics, boosting its role in sustainable chemical production.

Application (Industrial & Chemical, Food & Beverages, Pharmaceuticals, Packaging, Construction, Automotive)

The industrial & chemicals segment in green chemicals market is poised to garner a significant share during the assessed period. Growing urbanization and industrialization, rising global energy consumption, increased chemical transparency throughout the supply chain, and restrictions on the manufacture and use of hazardous materials are all factors contributing to the segment's rise. Eco-friendly chemicals are being adopted by manufacturers to lessen their environmental impact and adhere to strict requirements. A growing understanding of how chemical activities affect the environment is what is causing this transition towards green methods.

Our in-depth analysis of the global green chemicals market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Green Chemicals Market Regional Analysis:

APAC Market Statistics

Asia Pacific green chemicals market is set to account for revenue share of more than 35.3% by the end of 2035. The market for green chemicals is expanding rapidly in the Asia Pacific due to government initiatives to encourage cleaner alternatives and growing environmental sustainability awareness. One of the main trends is the increased focus on renewable and bio-based feedstock, which supports the region's efforts to lower carbon emissions. The growing middle class is also demonstrating a desire for environmentally friendly products, which is driving demand for green chemicals across a range of sectors, including manufacturing and agriculture.

The green chemicals market is growing in China owing to the increasing environmental regulations, rising consumer awareness, and government initiatives promoting sustainable development. The Chinese government is focused on helping enterprises produce chemicals that meet green regulations and are more environmentally friendly. This comprises coating materials for transportation equipment, biodegradable materials, and materials in batteries. As the country seeks to reduce pollution and carbon emissions, industries are shifting toward eco-friendly alternatives in sectors such as agriculture, manufacturing, and energy. Additionally, advancements in green technologies and innovations in bioplastics, biofuels, and biodegradable products are driving green chemicals market demand.

Also, the Information Technology and Innovation Foundation (ITIF) reported that with more than 40% of the worldwide market, primarily in basic chemicals, China leads the world in sales of chemicals. With growing pressure from both domestic and international markets to adopt sustainable solutions, China is positioning itself as a key player in the global green chemistry industry. This large-scale shift towards green chemicals is reshaping supply chains, boosting investment in sustainable research and development, and positioning China as a leader in the global transition to environmentally responsible chemical production.

The table below shows the global value-added output in chemicals by the leading producers and the rest of the world in 2020:

|

Country |

Value-added Output (USD billion) |

|

China |

334 |

|

USA |

210 |

|

Japan |

64 |

|

Germany |

57 |

|

India |

38 |

|

Korea |

36 |

|

France |

26 |

|

Saudi Arabia |

24 |

|

Brazil |

20 |

|

Italy |

17 |

|

Rest of the World |

320 |

Source: ITIF

Furthermore, in India, the increasing demand for eco-friendly products, supportive government initiatives to promote green chemistry, and the availability of diverse and abundant feedstock for green chemical production are some of the major factors escalating the market growth in the nation. Also, advancements in biotechnology and green chemistry are enabling the production of bio-based chemicals, further boosting the green chemicals market growth. Additionally, with a supportive government and a good regulatory environment, India has profitable business prospects in the green chemicals sector. Joint ventures, strategic alliances, and knowledge transfers can help foreign investors take advantage of the nation's rising need for green chemicals. Additionally, the country is funding the construction of specialized chemical parks and clusters as well as other infrastructure to assist the expansion of the chemical industry.

International investors now have the chance to set up production plants and research institutes for the development of green chemicals. In October 2024, AM Green announced its decision to invest in its inaugural green ammonia project at an existing facility located in Kakinada, Andhra Pradesh. This project aims to produce one million tons of green ammonia, utilizing 1.3 GW of advanced pressured alkaline electrolyzers. The commencement of production at this facility is anticipated in the second half of 2026. The project will involve the delivery of the electrolyzers in two phases of 640 MW each, facilitating the generation of green hydrogen that will subsequently be converted into green ammonia.

Europe Market Analysis

The Europe green chemicals market is expected to grow at a significant rate during the projected period. Due to growing environmental consciousness and the demand for cleaner substitutes for conventional chemicals, the green chemicals market is leading the way in a revolutionary transition towards sustainability and environmental friendliness. The need for bio-based and ecologically friendly chemical solutions is rising as a result of industries being forced to embrace greener practices by increasingly conscious customers. Biofuels, biodegradable polymers, and non-toxic solvents are just a few of the many items in this industry that are intended to reduce environmental damage while satisfying a variety of consumer demands.

Also, the European Chemical Industry Council (CEFIC) revealed that the chemical industry is ideally situated in the center of European manufacturing to help realize a climate-neutral society, and it aims to achieve climate neutrality by 2050. To achieve this goal, the industry asks the European Commission to collaborate on a roadmap for the EU chemical industry that lays out the prerequisites for the effective implementation of cutting-edge technologies.

Moreover, the Government of the UK is focusing on achieving net-zero carbon emissions by 2050, which has prompted industries to adopt eco-friendly alternatives to traditional chemicals. Advances in green chemistry, which focus on using renewable raw materials and reducing hazardous substances, have made sustainable products more accessible and cost-effective. Additionally, businesses are increasingly recognizing the benefits of green chemicals in reducing their environmental impact and enhancing their brand reputation.

Key Green Chemicals Market Players:

- Evonik Industries AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- Arkema S.A.

- Braskem S.A.

- Cargill, Incorporated

- Conagen

- GF Biochemicals

- Vertec BioSolvents, Inc.

- Global Green Chemicals Public Company Limited

- Avantium N.V.

To increase their green chemicals market share, businesses are employing a range of tactics, including partnerships, mergers and acquisitions, product/service launches, market forecasting, strategic alliances, and regional expansion. The industry's competitive environment is thoroughly analyzed in the green chemicals market research and growth study, together with details about important firms such as:

Recent Developments

- In January 2025, Evonik inked a term sheet with the Dutch business VoltH2 to expand green hydrogen generation at the Delfzijl Chemical Park. According to the deal, VoltH2 will build a 50-MW electrolyzer near Evonik's hydrogen peroxide (H2O2) plant. Evonik will thereafter receive a large amount of its hydrogen requirements from the electrolyzer, which will begin operations by the end of 2027. The facility will be the first green hydrogen water electrolysis plant on an industrial scale in the northern Netherlands.

- In October 2024, BASF and AM Green B.V. signed a memorandum of understanding (MoU) to collaboratively explore and develop commercial prospects for low-carbon chemicals manufactured entirely with renewable energy, as well as the relevant value chains in India.

- Report ID: 7270

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Green Chemicals Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.