Graphene Battery Market Outlook:

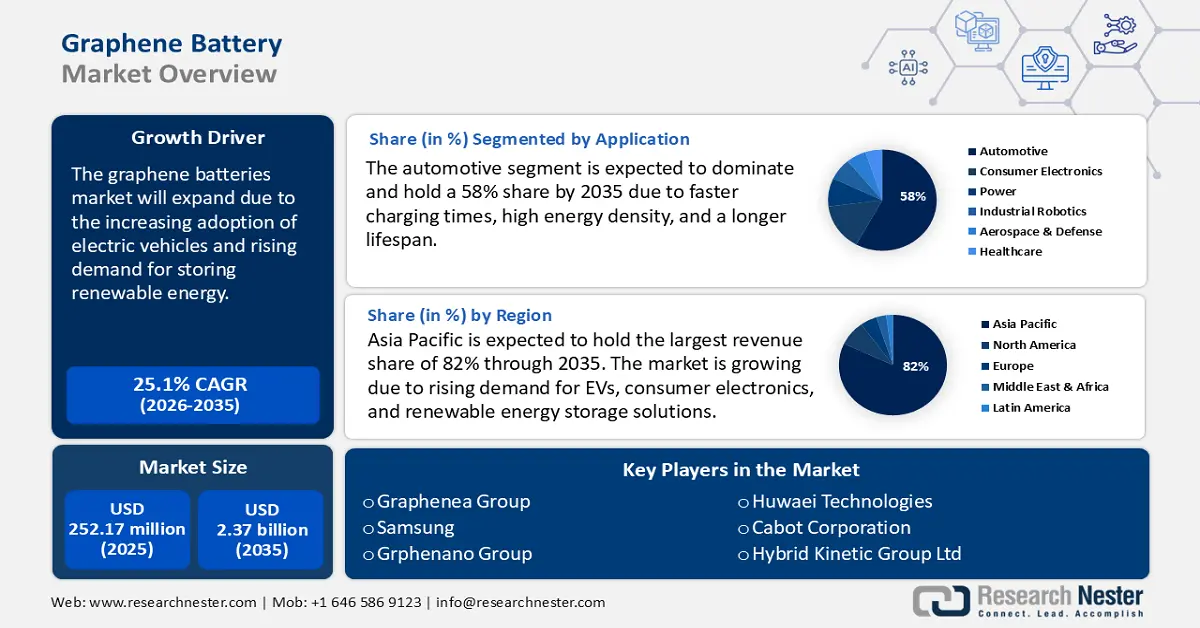

Graphene Battery Market size was valued at USD 252.17 million in 2025 and is expected to reach USD 2.37 billion by 2035, expanding at around 25.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of graphene battery is evaluated at USD 309.14 million.

The demand for graphene battery is growing rapidly and is driven by the increasing adoption of electric vehicles among consumers. Graphene battery can charge up to 10 times faster than traditional lithium-ion batteries. The use of graphene battery in EVs reduces charging times and improves battery performance. According to Global EV Outlook 2024, sales of electric cars reached 14 million in 2023. China recorded the highest sale of EVs, achieving 95% sales, followed by Europe and the U.S. The sale of electric cars in 2023 was 3.5 million higher than in 2022, showcasing a 35% year-on-year increase.

Graphene battery offer better performance over lithium-ion batteries as it is extremely lightweight, which helps to reduce EV weight and increase efficiency. According to the U.S. Department of Energy Report, the use of lightweight materials increases vehicle efficiency. The report further states that a reduction of 10% in overall vehicle weight offers a 6%-8% improvement in fuel economy. Lightweight vehicles with added graphene battery offer faster charging, higher capacity, and longer lifespan compared to traditional lithium-ion batteries, making them ideal for EVs.

Key Graphene Battery Market Insights Summary:

Regional Highlights:

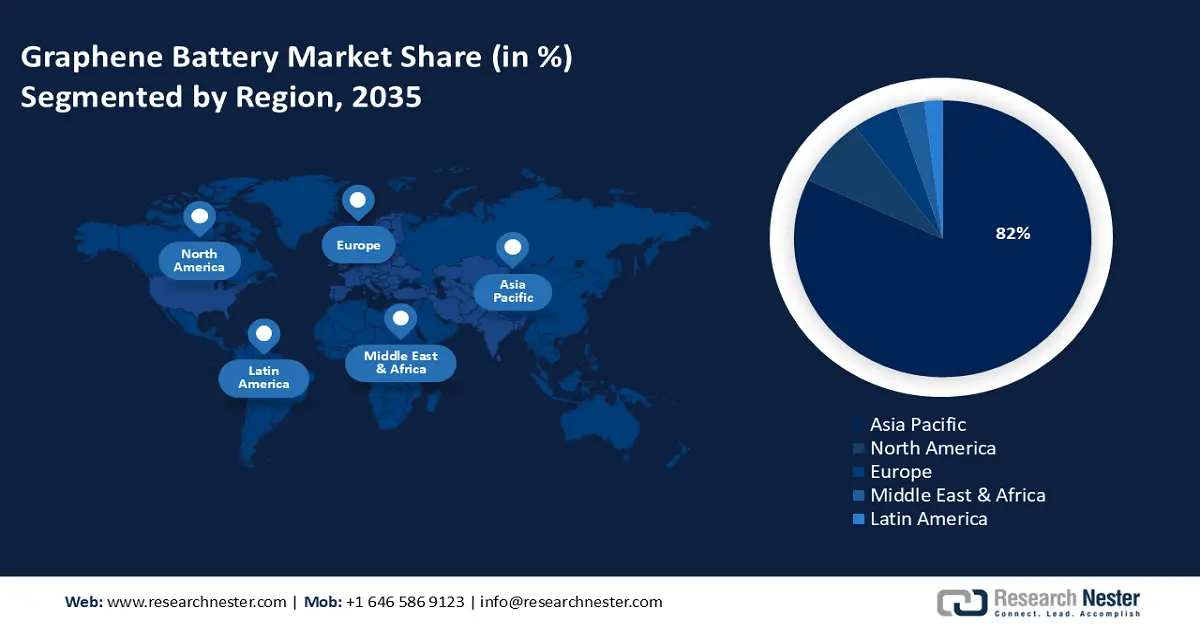

- Asia Pacific dominates the graphene battery market with an 82% share, driven by rising demand for EVs, consumer electronics, and renewable energy storage, positioning it for significant growth through 2035.

- North America's graphene battery market is achieving significant share by 2035, attributed to rising demand for high-performance energy storage in EVs, aerospace, and defense applications.

Segment Insights:

- The Automotive segment is anticipated to capture 58% market share by 2035, driven by the fast charging and high energy density of graphene batteries in electric vehicles.

- The Lithium-ion Graphene Battery segment is anticipated to hold the largest share by 2035, driven by high energy storage and fast charging capabilities.

Key Growth Trends:

- Rising demand for storing renewable energy

- Increasing government support and investments in advanced battery technology

Major Challenges:

- High production costs

- Integration with existing battery technologies

- Key Players: Samsung SDI, Huawei Technologies Co., Ltd, Log 9 Materials Scientific Private Limited, Cabot Corporation, Graphenano Group, Nanotech Energy, XG Sciences, Inc, ZEN Graphene Solutions Ltd., Global Graphene Group.

Global Graphene Battery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 252.17 million

- 2026 Market Size: USD 309.14 million

- Projected Market Size: USD 2.37 billion by 2035

- Growth Forecasts: 25.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (82% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 12 August, 2025

Graphene Battery Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for storing renewable energy: The transition to renewable energy, i.e., solar and wind energy, requires efficient and durable energy storage solutions. Graphene battery have emerged as a promising technology in this context, as they are known to offer high energy density and better charge retention. These capabilities make graphene battery ideal for storage applications. For instance, in January 2025, America Clean Energy Group launched Hybrid-Graphene battery systems of 10 KWH and 15 KWH modules for home and business applications. This advancement in energy storage ensures safety, longevity, and performance.

- Increasing government support and investments in advanced battery technology: Governments are investing in advanced battery technologies to support clean energy and electric mobility goals. The increasing support through grants, subsidies, and research initiatives further fuel graphene battery market growth. For instance, in October 2024, the European Investment Bank (EIB) provided a USD 20.96 trillion loan to the Italian start-up BeDimensional. This funding aims to expand the company’s production of graphene and ultra-thin crystals that enhance lithium-ion battery storage capabilities. Further, with the help of this investment, BeDimensional plans to increase its production capacity from 3 tonnes annually to more than 30 tonnes by 2028, bolstering the supply chain for advanced battery materials.

Challenges

- High production costs: The cost of graphene production remains high due to complex and energy-intensive production methods, including chemical vapor deposition (VPR). This process requires specialized equipment, controlled environments, and high energy input, leading to higher costs per gram of graphene. Also, the emergence of alternatives such as solid state, lithium Sulphur, and sodium ion batteries stand as competitor in adopting graphene battery.

- Integration with existing battery technologies: While graphene can enhance lithium-ion and solid-state batteries, integrating it into current battery supply chains requires extensive research and development. Thus, compatibility with existing manufacturing infrastructure is a concern for the growth of the graphene battery market.

Graphene Battery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

25.1% |

|

Base Year Market Size (2025) |

USD 252.17 million |

|

Forecast Year Market Size (2035) |

USD 2.37 billion |

|

Regional Scope |

|

Graphene Battery Market Segmentation:

Application (Automotive, Consumer Electronics, Power, Industrial Robotics, Aerospace & Defense, Healthcare)

Automotive segment is projected to dominate graphene battery market share of over 58% by 2035. Graphene battery play a critical role in revolutionizing the automotive industry due to faster charging times, high energy density, and a longer lifespan compared to traditional lithium-ion batteries. In electric vehicles, graphene battery enable ultra-fast charging that reduces charging times to minutes instead of hours. Graphene-based supercapacitors help to store and deliver power instantly, which in turn improves fuel efficiency in conventional and hybrid cars. Moreover, due to better heat dissipation capability, graphene battery reduce overheating risks, making them safer and more durable in automobiles.

Type (Lithium-ion Graphene Battery, Graphene Supercapacitor, Lithium Sulphur Graphene Battery)

The lithium-ion graphene battery segment is anticipated to hold the largest graphene battery market share through 2035. Lithium-ion graphene battery are gaining popularity in the market due to their high energy storage and fast charging capabilities. These batteries offer a longer lifespan, better thermal stability, and improved efficiency, making them ideal for EVs and electronics. These batteries combine lithium-ion technology with graphene to enhance performance. For instance, in November 2024, researchers at Caltech and JPL developed a method to coat lithium-ion battery cathodes with graphene, which enhanced battery life and performance. Further, companies such as Tesla, Panasonic, and Samsung are investing in graphene-enhanced lithium-ion technology for next-generation applications.

Our in-depth analysis of the global graphene battery market includes the following segments:

|

Application |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Graphene Battery Market Regional Analysis:

Asia Pacific Market Analysis

Asia Pacific graphene battery market is set to hold revenue share of more than 82% by 2035, due to rising demand for EVs, consumer electronics, and renewable energy storage. Countries such as China, Japan, India, and South Korea are leading in R&D and large-scale production of graphene battery. Further, government investments boost battery innovation and manufacturing capacity. Major battery manufacturers in the Asia Pacific are integrating graphene to enhance battery efficiency, lifespan, and charging speed. With ongoing technological advancements, Asia Pacific is set to dominate the global market in the coming years.

The graphene battery market in China is expanding due to rapid advancements in electric vehicles, renewable energy storage and consumer electronics. The government is heavily investing in battery research and development, supporting large-scale production and commercialization of graphene-based energy storage solutions. With the world’s largest EV market, China sees graphene battery as a way to improve charging speed, battery lifespan, and energy efficiency. Leading manufacturers in China such as CATL, BYD, and GAC Group are actively developing graphene battery technology to stay ahead in the global battery race.

The graphene battery market’s growth in India can be attributed to the country’s push for electric mobility and affordable, efficient energy storage solutions. Additionally, the market for graphene battery is rising as the local government is highly promoting local battery manufacturing. It encourages local manufacturing through initiatives such as the Production Linked Incentive schemes to reduce reliance on imports. The graphene battery market is rapidly evolving as India-based companies such as Exide Industries and Amara Raja Batteries, along with global players, are investing in graphene-based energy storage solutions to support the sustainable energy goals of India. Recently, in January 2025, Exide Industries invested nearly USD 17.2 million in its subsidiary brand, Exide Energy Solutions to support the construction of a new lithium battery plant in Bangalore. This investment aligns with India’s focus on local battery manufacturing and the adoption of advanced energy storage technologies.

North America Market Analysis

North America is anticipated to garner a significant graphene battery market share from 2026 to 2035. The market growth is driven by rising demand for high-performance energy storage in EVs, aerospace, and defense applications. Graphene battery offer faster charging and longer lifespan, making them ideal for the growing electric vehicle and renewable energy sectors in North America. The local startups and research institutions in the region are actively developing scalable graphene production methods to lower costs. Giants such as Tesla, Nanotech Energy, and General Motors are exploring graphene-enhanced batteries to improve performance and efficiency.

The graphene battery market in the U.S. is growing due to rising demand for faster charging, efficiency energy storage in EVs and aerospace. Further, government initiatives are funding next-generation battery research to reduce dependence on traditional lithium-ion technology. For instance, in September 2024, the U.S. Department of Energy allocated USD 3 billion for Battery Materials Processing Grants. This program aims to ensure a working domestic battery materials processing industry, supporting the development and commercialization of advanced battery technologies, including those utilizing graphene. Further, companies are focusing on scalable graphene production to make these batteries more practicable.

The graphene battery market in Canada is experiencing steady growth due to investments in clean energy storage and sustainable transportation. The country’s push for EV adoption and renewable energy integration is driving demand for high-performance batteries. Furthermore, government funding and university research are accelerating graphene-based battery innovations. Companies in Canada are exploring local graphene production to reduce costs and support domestic manufacturing. Additionally, in November 2024, Volt Carbon Technologies and its subsidiary, Solid UltraBattery were awarded funding from the Downsview Aerospace Innovation and Research (DAIR) Green Fund. This investment accelerates the development of graphene-based battery technologies for aerospace applications, highlighting Canada’s commitment to advancing clean energy solutions.

Key Graphene Battery Market Players:

- Graphenea Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Samsung SDI

- Huawei Technologies Co., Ltd.

- Log 9 Materials Scientific Private Limited

- Cabot Corporation

- Graphenano Group

- Nanotech Energy

- XG Sciences, Inc.

- ZEN Graphene Solutions Ltd.

- Graphene NanoChem

- Vorbeck Materials Corp.

- Hybrid Kinetic Group Ltd.

- Targray Group

The competitive landscape of the graphene battery market is rapidly evolving, attributed to the integration of advanced technologies in the industry by key players. They are focused on developing new technologies and products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies, such as mergers and acquisitions, joint ventures, partnerships, and novel product launches, to enhance their product base and strengthen their market position. Here are some key players operating in the global graphene battery market:

Recent Developments

- In November 2024, Graphene Manufacturing Group Ltd. introduced SUPER G, a special graphene mixture that improves lithium-ion batteries. This new product can change the future of energy storage by making batteries more efficient, powerful and long-lasting.

- In July 2024, Nanotech Energy teamed up with ST Advanced Precision Co., Ltd to improve its battery production. This partnership focuses on increasing production to meet rising global demand. This partnership will also involve the design and construction of a gigawatt-hour scale battery factory, poised to set new industry standards in energy storage capacity and efficiency.

- Report ID: 7316

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Graphene Battery Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.