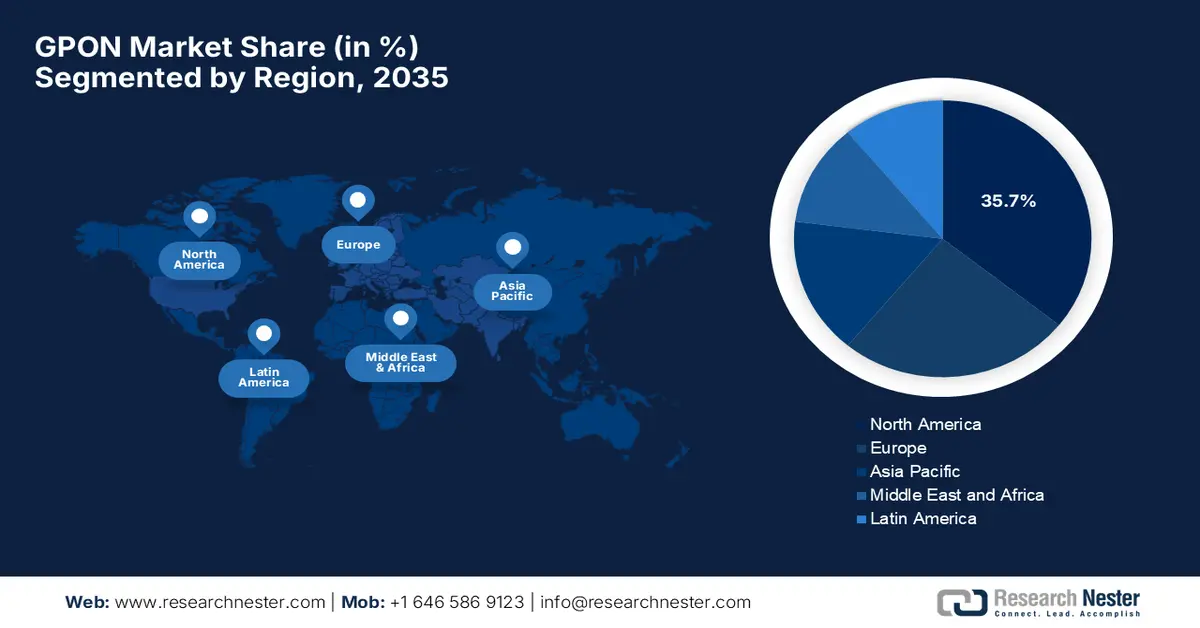

GPON Market - Regional Analysis

North America Market Insights

The GPON market in North America is leading the entire global dynamics, commanding the largest revenue share of 35.7% by the end of 2035. The region continues to expand strongly, driven by large-scale FTTH and fiber‑backhaul deployments coupled with rural broadband initiatives. Most of the ISPs and alternative‑network operators U.S. and Canada are leaning on GPON-based FTTH to meet growing demand for high-speed home broadband. In August 2025, Calix announced the launch of enhanced capabilities for its ASM5001 broadband system by uniting subscriber management, OLT control, and remote line card support in a single platform. In this regard, this solution allows U.S. broadband service providers to simplify network design and scale multi-gig services efficiently. Simultaneously, by consolidating hardware and offering flexible PON architecture options, the firm allows providers to accelerate deployments and improve service reliability.

The U.S. is considered to be the key contributor to growth in the GPON market, wherein the operators complete network upgrades and legacy copper networks are replaced. Simultaneously, this fiber migration is driving new GPON deployments into both urban and rural markets. The rapid pace of home passes and FTTH activations is efficiently boosting demand for passive optical network infrastructure. In November 2025, IonQ announced the acquisition of an optical communications leader, Skyloom Global, to enhance high-speed, secure optical networking infrastructure. Besides, Skyloom’s satellite-to-ground and satellite-to-satellite laser communication terminals will support scalable, high-bandwidth links, accelerating next-generation network deployments. Hence, this move strengthens the company’s capabilities in distributed optical networks, thereby highlighting advancements relevant to high-performance fiber and broadband systems.

Canada has gained enhanced exposure in the GPON market, supported by federal broadband‑coverage goals and funding programs that encourage fiber-based solutions over legacy cable or DSL. In addition, the regulatory and funding environment favors fiber, making the country a stable growth market for GPON suppliers. In February 2024, TELUS announced that it had accelerated its transition from copper to pure fiber by migrating over half a million customers and making 14 regions in BC and AB completely copper-free. This upgrade has reduced over 7,400 tonnes of greenhouse gas emissions, improved energy efficiency by up to 85%, and enhanced network resilience against extreme weather, benefiting the country’s market growth. Furthermore, the company’s sustainable fibre rollout demonstrates the environmental and operational benefits of modernizing broadband infrastructure.

APAC Market Insights

Asia Pacific in the GPON market is growing at an extensive pace over the forecasted years since there has been a massive urbanization, large populations, and government broadband infrastructure initiatives across countries such as China and India drive very high FTTH adoption. In February 2023, Nokia announced that it had expanded the manufacturing of GPON optical line terminals at its Chennai factory in response to the heightened demand for high-speed broadband. Besides, the move supports both fiber-to-the-home deployments and 5G transport networks, helping operators manage surging data traffic. Moreover, its participation in India’s production-linked incentive scheme further strengthens the company’s capacity to meet regional and international requirements. Hence, this expansion allows the region to advance next-generation PON solutions and enhance fiber connectivity across diverse markets.

China is augmenting its leadership in the GPON market on account of a huge base of fiber-optic broadband subscribers. The country’s continued infrastructure investments and high FTTH adoption rates are sustaining strong demand for both GPON OLT/ONU hardware and passive fiber components. In June 2025, China Mobile and ZTE together announced the launch of a 50G PON-based fixed mobile convergence residential community in Jiangsu to deliver ultra-fast symmetric 50-gigabit services. Also, this deployment supports advanced applications such as cloud gaming, smart homes, and Fiber to the Room, thereby demonstrating the commercialization of 50G PON technology. Furthermore, with the integration of 5G small cells and high-speed broadband, the community offers strong connectivity indoors and outdoors, hence denoting a positive GPON market opportunity.

The government-backed rural and urban broadband programs are accelerating fiber installations, increasing demand in the GPON market as the preferred access technology in India. Since there has been an expansion of population centers simultaneously the internet penetration is also deepening, wherein many fiber broadband subscribers are being connected through GPON networks. For instance, in April 2022, HFCL announced that it had completed broadband connectivity for all 1,789 gram panchayats in Jharkhand through a GPON network, laying 7,765 km of optical fiber cable, making it the first state in the country to achieve full connectivity under the state-led BharatNet program. The company also reported that it will operate and maintain the network for eight years to ensure continuous, high-quality broadband services. Furthermore, the company has also expanded GPON deployments in Punjab and is supplying fiber optic cables in Maharashtra, Telangana, and Chhattisgarh under BharatNet, strengthening rural digital infrastructure.

Europe Market Insights

Europe has acquired the most prominent position in the global GPON market, which is coordinated by national as well as increasing fiber coverage, and is achieving gigabit connectivity for households and businesses. Operators across the region continue upgrading older networks toward fiber-based GPON or next-gen PON infrastructure. In October 2023, DZS announced that it had partnered with Orange to deploy its velocity fiber access portfolio across Europe, which was followed by a successful pilot in Orange Polska, supporting GPON, XGS-PON, and point-to-point technologies. Thus, this deployment enhances Orange’s FTTH network by providing multi-gigabit services, flexible system options, and future-ready upgrades to 50/100 Gbps capacity. Furthermore, this collaboration strengthens network automation and multi-vendor interoperability, advancing the region’s next-generation broadband infrastructure.

Germany has gained a prominent position in the regional GPON market, in which a significant portion of broadband expansion is focused on fiber deployment, driven by federal broadband funding programs and increasing demand for high-speed broadband among both urban and suburban households. In September 2024, EIP reported that the European Investment Bank provided a €350 million (USD 411 million) loan under the EU’s Invest EU programme to Deutsche Glasfaser to expand fibre-optic broadband access to around 460,000 rural homes and businesses in Germany. It also mentioned that the project will deliver high-speed fibre connections (up to 10 Gbps) to underserved and rural areas, addressing the digital‑infrastructure gap inherently creates demand for passive and active optical‑network components, hence making it suitable for overall market growth.

The government programs, such as Project Gigabit, are catalyzing nationwide fiber deployment, propelling continued growth in the U.K. GPON market. The country is witnessing an increased demand for high-speed connectivity, due to which GPON-based FTTH deployments are also expanding, creating sustained opportunities for both network operators and equipment suppliers. In October 2024, Adtran and Netomnia announced that they had entered into a partnership to launch the country’s first-ever 50G PON services, providing high-capacity broadband to meet growing residential and enterprise demands. Besides, the technology integrates with existing GPON and XGS-PON networks, enabling non-disruptive upgrades. Furthermore, backed by over £1.3 billion (≈ US$1.6 billion) in funding, Netomnia aims to serve 3 million premises by the end of 2025 and scale 50G PON.