Gold Plating Chemicals Market Outlook:

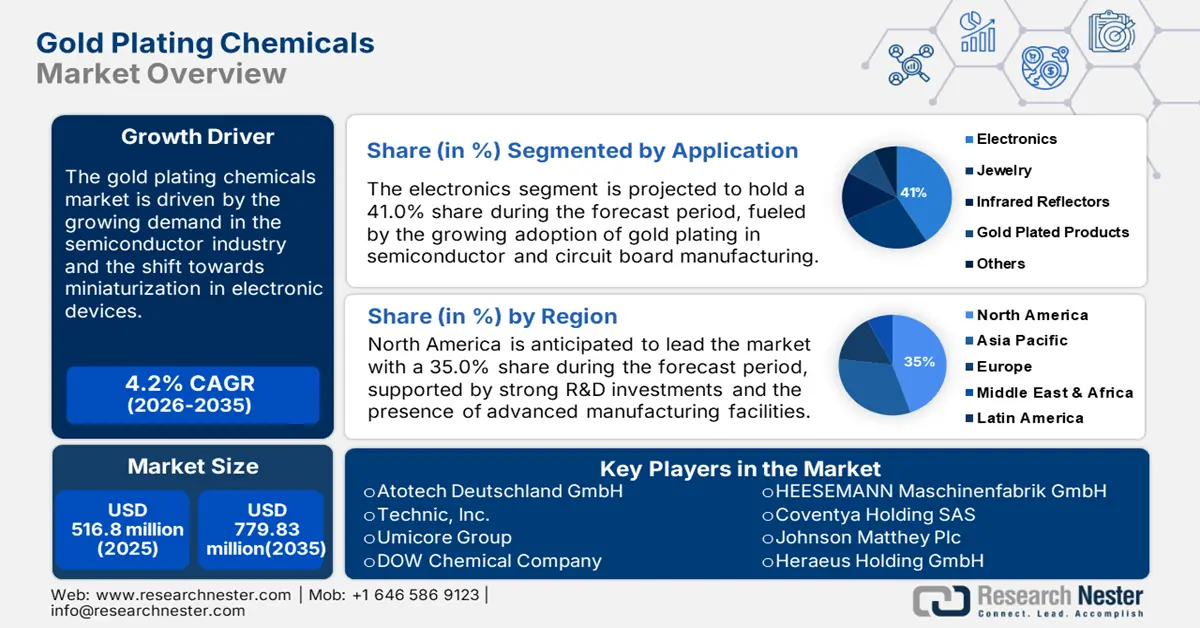

Gold Plating Chemicals Market size was over USD 516.8 million in 2025 and is poised to exceed USD 779.83 million by 2035, witnessing over 4.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of gold plating chemicals is estimated at USD 536.34 million.

The gold plating chemicals market is anticipated to rise due to the hike in demand from various end-use industries, such as electronics, jewelry, and aerospace, among others. Versatility and superior conductivity have made gold an integral part of present-day electronics, which foster market growth. Moreover, continuous advancements in plating technologies and growing interest in sustaining resources would further open new vistas of opportunities for market players. This is further accelerated by the introduction of more intelligent devices and 5G technology.

The companies in the market are heavily involved in various research and development-related activities to introduce improved product offerings. Also, governments around the world are playing a crucial part in shaping the gold plating chemicals market. According to a 2024 report by the Environmental Protection Agency (EPA), new standards regarding the maximum allowable limits of harmful substances emitted due to industrial processes will induce the market toward sustainability. This is anticipated to drive more innovations in the field.

Key Gold Plating Chemicals Market Insights Summary:

Regional Highlights:

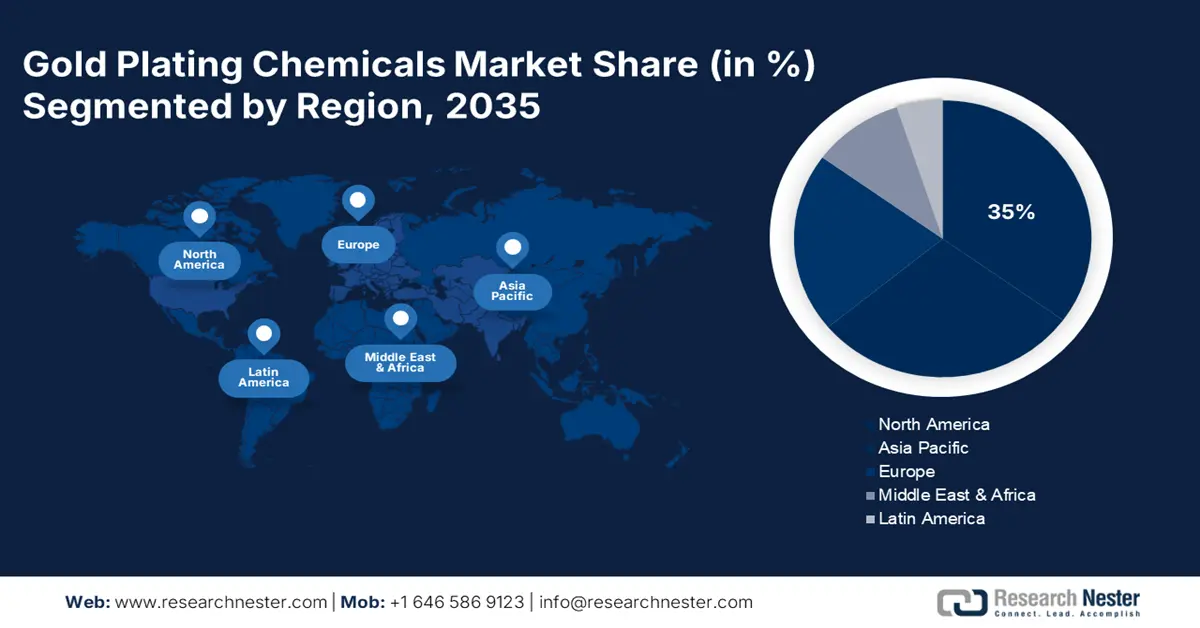

- North America’s gold plating chemicals market is anticipated to capture 35% share by 2035, driven by advanced competencies in manufacturing and an intensely innovative culture propelling market growth.

- Asia Pacific market will grow rapidly at a CAGR during 2026-2035, driven by robust industrialization, increased demand from the electronics market, and continuous investment in high-tech industries.

Segment Insights:

- The electronics segment in the gold plating chemicals market is projected to achieve significant growth till 2035, driven by increasing demand for high-performance electronic devices and high-purity solutions.

- The potassium gold cyanide segment in the gold plating chemicals market is anticipated to hold a 37% share, driven by its wide applications in electronics and jewelry industries due to high purity by 2035.

Key Growth Trends:

- Demand from the electronics industry

- Sustainable innovations

Major Challenges:

- Stringent environmental regulations

- Recovery costs and efficiency

Key Players: Electroplating Engineers of Japan, Ltd. (EEJA), Atotech Deutschland GmbH, Technic, Inc., Umicore Group, Japan Pure Chemical Co., Ltd., DOW Chemical Company, Tanaka Holdings Co., Ltd., HEESEMANN Maschinenfabrik GmbH, Coventya Holding SAS, Johnson Matthey Plc.

Global Gold Plating Chemicals Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 516.8 million

- 2026 Market Size: USD 536.34 million

- Projected Market Size: USD 779.83 million by 2035

- Growth Forecasts: 4.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 18 September, 2025

Gold Plating Chemicals Market Growth Drivers and Challenges:

Growth Drivers

-

Demand from the electronics industry: With the rise in consumer electronics, including smartphones and wearables, good-quality gold plating chemicals will be needed to maintain better connectivity and performance. The World Gold Council estimates that 80% of the gold used in technology solutions goes into the electronics sector. This acts as a major growth factor for the gold plating chemicals market. The arrival of IoT devices is also proving to be one of the factors for this surge.

-

Sustainable innovations: Innovations promoting sustainability are gaining prominence in the market. For example, in November 2023, ACS Publication research discussed gold recovery through photocatalysis from wastewater generated at the end of the gold-plating process using cyanide-based solutions. This has introduced the use of nanocomposites of TiO2/WO3 for gold recovery as an economic and eco-friendly way of recovering gold, thus improving sustainable measures in industries and contributing to growing demand.

- Expanding applications of gold plating chemicals into the automotive sector: Gold plating gaining traction in electric vehicles to improve their efficiency and reliability. For example, in 2021, Umicore announced a USD 1.66 billion investment to expand its production capacity for cathode materials. This is attributed to the overall shift in the transportation means toward sustainable solutions.

Challenges

-

Stringent environmental regulations: Severe environmental regulations on the use of hazardous chemicals pose a hindrance to the gold plating chemicals market growth. In March 2023, experts were found inventing a means of removing cyanide particles from gold cyanide residues, showing the plight of the industry about conformation with regulations. However, such innovations increase operational costs and require continuous innovation.

-

Recovery costs and efficiency: Conventional measures for recovering gold are costly and require additional tools for ion exchange and electrolysis. While the new photocatalytic method surfacing has great potential, it pointed out that developing effective and efficient methodologies for gold recovery is still lacking. The industrial sector has only begun to embark on the process of developing through greener ways.

Gold Plating Chemicals Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 516.8 million |

|

Forecast Year Market Size (2035) |

USD 779.83 million |

|

Regional Scope |

|

Gold Plating Chemicals Market Segmentation:

By Chemicals

Potassium gold cyanide segment is projected to account for around 37% gold plating chemicals market share by 2035. It finds wide applications in electronics and jewelry industries due to its nature of high purity and efficiency. In March 2022, Spectrum Chemical Manufacturing Corporation developed and introduced one of the 12 new offerings, potassium gold cyanide, which improves the visibility of the company in the market. This is highly important for the required process, where very high precision is required.

Type

By type, the electrolyte solutions segment will hold the dominant share of the gold plating chemicals market by 2035. The growth of this segment is attributed to the vast use of electrolyte solutions in electronics and infrared reflectance, among others, and novel product launches. For instance, in December 2023, Astell&Kern announced the launch of A&ultima SP3000, which adopted some advanced electrolyte solutions to apply superior gold plating. The same is the case with ultra-modern, high-quality audio equipment that requires gold plating solutions which is promoting the segment's growth.

Application

By 2035, electronics segment is anticipated to capture over 41% gold plating chemicals market share, driven by the increasing demand for high-performance electronic devices. Various companies are launching high-purity gold plating solutions, which are adding to the sustained growth of this segment. Consumer preference for feature-rich consumer electronics is another factor for the segment's growth.

Our in-depth analysis of the gold plating chemicals market includes the following segments:

|

Chemicals |

|

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gold Plating Chemicals Market Regional Analysis:

North America Market Insights

North America gold plating chemicals market is anticipated to account for revenue share of more than 35% by the end of 2035. Advanced competencies in manufacturing and an intensely innovative culture help in propelling market growth. Significantly, the USD 86 billion investment by U.S. telecom providers in network infrastructure improvement in 2021 accelerated demand for gold plating chemicals in electronic manufacturing further. As a result, this is likely to attract further investments, thereby supporting continued growth.

The U.S. has the leading position in the North America gold plating chemicals market, owing to technological innovation and high R&D investment. Companies in the U.S. are known for their innovative technologies and advanced gold plating chemical solutions. In February 2021, Pioneer Metal Finishing LLC acquired Electrochem Solutions Inc. to expand its metal finishing capabilities and strengthen its position in the market. High-tech industries and aerospace industries also contribute to market growth.

Canada is also widening its activities in the gold plating chemicals market, and government initiatives on sustainability are a boost to this. According to a report released in 2023 by Environment and Climate Change Canada, regulations have been laid down to cap the quantum of dangerous waste. This, in turn, drives the transition toward greener gold plating solution options. In this way, the market prospects have improved due to an increase in the electronics manufacturing segment of Canada.

Asia Pacific Market Insights

Asia Pacific is expected to witness rapid expansion during the forecast period due to its robust industrialization and an increase in demand from the electronics market. Large manufacturing sectors with continuous investment in high-tech industries provide a good growth opportunity for this gold plating chemicals market. Growth in the middle-class population with increased disposable incomes is another driver of Asia Pacific gold plating chemicals industry. Such factors enable international giants to plan expansion and merger strategies to reach emerging markets in Asia Pacific.

Among the emerging countries in Asia Pacific, India is gaining ground through its fast-growing industry as well as the increasing consumption of modern quality electronics. This demand fuels the adoption of gold plating chemicals and further invites players to expand on the opportunity. In November 2022, Besra Gold Inc. entered a contract to ensure financial support at $300 million under Quantum Metals Recovery Inc. Furthermore, supportive government initiatives for manufacturing these products are promoting market growth.

The large manufacturing hub and technological advancement in China continue to be the leading shareholder in Asia Pacific. The initiatives of sustainability best practices and innovation take the country further. In 2023, the Ministry of Industry and Information Technology, China, announced that remarkable investments were found in eco-friendly plating technologies. In addition, continuous development in smart manufacturing technologies propels the growth factors further.

Gold Plating Chemicals Market Players:

- Atotech Deutschland GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Technic, Inc.

- Umicore Group

- DOW Chemical Company

- HEESEMANN Maschinenfabrik GmbH

- Coventya Holding SAS

- Johnson Matthey Plc

- Heraeus Holding GmbH

- Legor Group S.p.A.

- American Elements

Competition is fragmented in the gold plating chemicals market, with players engaging in strategies aimed at growing their market share through innovative solutions and strategic partnerships. Major contributions by EEJA, Umicore, Pioneer Metal Finishing LLC, and Spectrum Chemical set the pace in the marketplace through continuous R&D investments related to the development of advanced and sustainable plating solutions. The competitive landscape is also influenced by strategic mergers and acquisitions activities.

In October 2023, Umicore confirmed the expansion of its EV-battery materials production footprint with CAM and pCAM plant in Ontario, Canada, apparently responding to surging demand for electric vehicles and the related need for a stable supply of critical raw materials. Such factors are likely to continue increasing the demand for gold plating solutions until 2037. Additionally, over the next few years, the demand for gold-plated components in growing sectors such as electronics, automobiles, and more are expected to steadily increase the market growth.

Companies Dominating the Gold Plating Chemicals Landscape:

Recent Developments

- In August 2024, Stryker announced the launch of its new Pangea Plating system, designed to enhance the manufacturing process of medical devices with advanced gold plating capabilities. This innovative system aims to improve the performance and durability of medical implants and instruments, reflecting a growing trend in the healthcare industry to adopt specialized gold plating solutions.

- In September 2023, Ag-Nono System LLC announced the development of a gold plating replacement aimed at providing a more sustainable and cost-effective alternative to traditional gold plating methods. This innovation could significantly influence the gold plating chemicals market by reducing reliance on conventional gold plating chemicals and driving demand for new formulations that meet industry requirements while addressing environmental concerns.

- In October 2022, Omni Hiraya introduced the world's first solar-powered, 24-karat gold-plated facial gua sha tool. This launch underscores the rising popularity of gold plating in the beauty and personal care markets, indicating a potential expansion of the gold plating chemicals market beyond traditional industrial applications.

- Report ID: 6397

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gold Plating Chemicals Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.