Glyphosate Market Outlook:

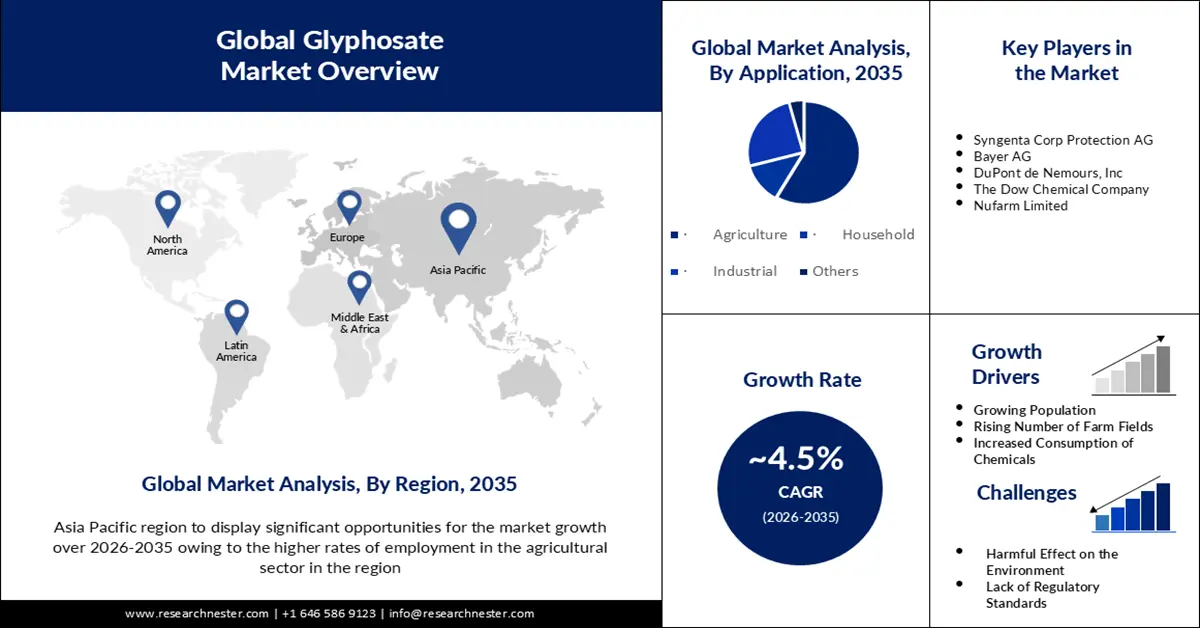

Glyphosate Market size was valued at USD 9.84 Billion in 2025 and is set to exceed USD 15.28 Billion by 2035, registering over 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of glyphosate is estimated at USD 10.24 Billion.

The primary growth factor for the expansion of the market during the forecast period is the large use of agricultural land for varied purposes across the world as glyphosate is an important part of farming. As per the data by the World Bank, the total agricultural land in the world accounted for 36.9% of the total land in 2018. Along with that, the increasing demand for high-value crops along with the high demand for agricultural products is also anticipated to bring lucrative growth opportunities for market growth in the upcoming years.

Glyphosate is an effective chemical formulation that is being highly utilized in the agriculture industry owing to its properties to control weeds in a wide range of crops such as cereals, grains, pulses, fruits, vegetables, tubers, and other crops. The recent advancements in agricultural practices and changing harvesting trends are anticipated to expand the glyphosate market size. Additionally, high focus on Genetically Modified Organism (GMO) crops which are also known as genetically modified crops over the world especially, in East Asia and South Asia, farmers are opting for glyphosate to increase production within short spans and earn huge profits. Also, the increased demand for glyphosate in “pre-planting” treatment is estimated to bring a positive scenario for market growth. Moreover, with increasing urbanization, the number of lawns, turfs, stadiums, and playgrounds has also increased which has also led to a higher demand for glyphosate to control weeds and maintain the grounds.

Key Glyphosate Market Insights Summary:

Regional Highlights:

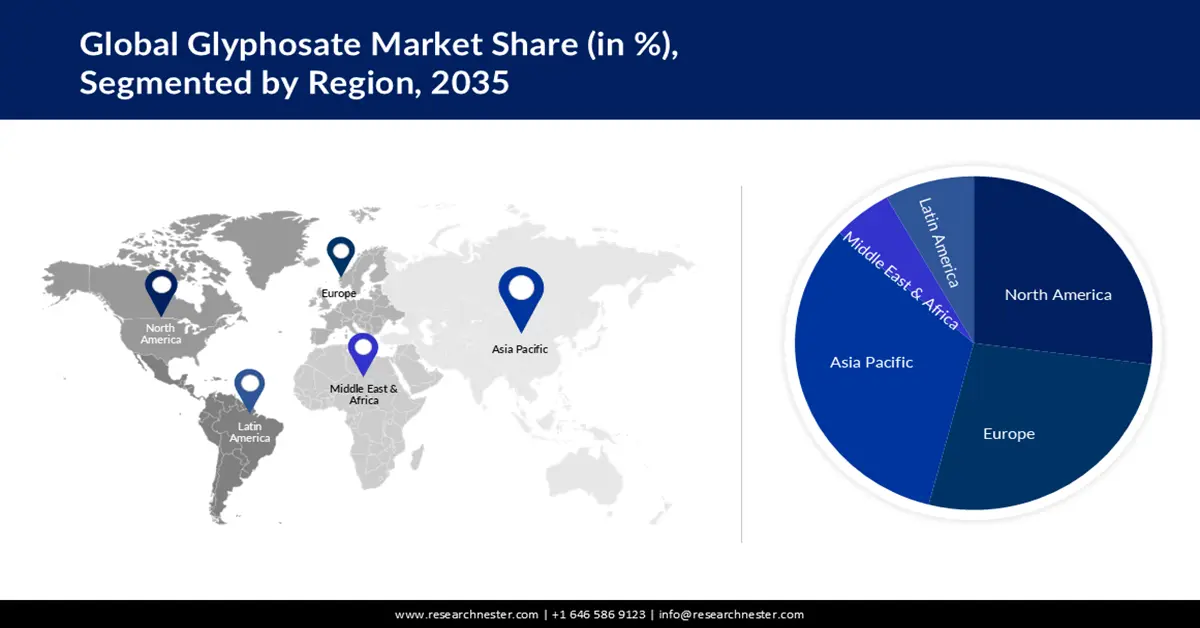

- Asia Pacific’s glyphosate market holds the largest share by 2035, attributed to high agricultural employment, large agricultural land area, and rising chemical consumption.

- North America market will achieve significant revenue share by 2035, driven by increased use of modern agricultural products, preference for genetically modified crops, and supportive agricultural policies.

Segment Insights:

- The agriculture segment in the glyphosate market is expected to hold the largest share by 2035, fueled by high demand for food and agricultural products and widespread glyphosate usage across farming stages.

- The genetically modified crops segment in the glyphosate market is poised for substantial growth during 2026-2035, driven by increasing adoption of genetically modified crops and the need for advanced herbicides.

Key Growth Trends:

- Burgeoning Population

- Rising number of Farm-Fields Across the World

Major Challenges:

- Harmful Effect on Environment

- Lack of Regulatory Standards

Key Players: Syngenta Crop Protection AG, Bayer AG, DuPont de Nemours, Inc., The Dow Chemical Company, Nufarm Limited, Nantong Jiangshan Agrochemical & Chemicals Limited Liability Co., ADAMA Agricultural Solutions Limited, UPL Limited, India, American Vanguard Corporation, Corteva Agriscience.

Global Glyphosate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.84 Billion

- 2026 Market Size: USD 10.24 Billion

- Projected Market Size: USD 15.28 Billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Brazil, India, Argentina

- Emerging Countries: China, India, Brazil, Argentina, Mexico

Last updated on : 9 September, 2025

Glyphosate Market Growth Drivers and Challenges:

Growth Drivers

-

Burgeoning Population – The increased demand for food products to satisfy the needs of the burgeoning population is expected to rise the sales of glyphosate for agricultural purposes. As per the World Bank, the global population stood up at 7.84 billion in 2021 which is expected to be 10 billion by 2050.

-

Rising number of Farm-Fields Across the World – As the demand for agricultural products has increased, the number of farm fields has also increased. Protecting the fields from weeds and harmful plants and making them fit for growing plantations is estimated to increase the demand for glyphosate across the world. Recent estimates suggest that there were approximately 650 million farms worldwide in 2020.

-

A Rise in the Production of Food grains – To meet the demand for food grains from the burgeoning population has led to an escalation of farming processes. As a result, the utilization rate of glyphosate is projected to surge. The production of food grains in India rose by almost 6 million tons in the year 2021-2022 to 320 million tons.

-

Maturity of Agricultural Industry – Recently, it has been calculated that the agriculture, food, and related industries of the United States generated almost USD 1 trillion to the nation’s gross domestic product (GDP) in the year 2020.

-

Increased Consumption of Chemicals – Global chemical consumption in 2021 accounted for USD 3.96 trillion.

Challenges

-

Harmful Effect on Environment – Although glyphosate is useful in eliminating weeds and other substances, it is manufactured with toxic ingredients which are harmful to the environment and humans after consumption. This trend is anticipated to hinder the utilization rate of glyphosate in the fore coming years.

-

Lack of Regulatory Standards

-

Additional Expenses Incurred in the Production Process

Glyphosate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 9.84 Billion |

|

Forecast Year Market Size (2035) |

USD 15.28 Billion |

|

Regional Scope |

|

Glyphosate Market Segmentation:

Application Segment Analysis

The global glyphosate market is segmented and analyzed for demand and supply by application in agriculture, household, industrial, and others. Out of these, the agriculture segment is attributed to garner the largest market share by 2035 on the back of a large employment share in agriculture, owing to the high demand for food and agricultural products. The World Bank stated that employment in agriculture accounted for at least 27% of total employment in 2019. Glyphosate is being used in every stage of agricultural farming from “pre-planting” to “after-planting”. By controlling and eradicating undesirable vegetation, farmers use glyphosate to protect plants and crops. As the population grows, the demand for food and agricultural products also increases which requires glyphosate to let crops grow faster by removing weeds from the land so that they cannot compete with the crops.

Crop Type Segment Analysis

The global glyphosate market is also segmented and analyzed for demand and supply by crop type into genetically modified crops, and conventional crops. Out of these two segments, the genetically modified crops segment is attributed to holding the largest share by the end of the assessment period. Genetically modified crops are grown by transferring new DNA into plant cells which require advanced herbicides and pesticides. Thus, the need for glyphosate increases with a rising focus on growing genetically modified crops. Further, people adopting genetically modified crops such as cornstarch, corn syrup, corn oil, soybean oil, canola oil, or granulated sugar and fresh fruits and vegetables including potatoes, summer squash, apples, papayas, and pink pineapples to fulfill a daily nutrient need is also anticipated to increase the demand for glyphosate for growing high-nutritious crops without pests and insects.

Our in-depth analysis of the global market includes the following segments:

|

By Crop Type |

|

|

By Form |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Glyphosate Market Regional Analysis:

APAC Market Insights

The Asia Pacific glyphosate market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035. The share of agricultural employment in India is a primary growth factor for the adoption of glyphosate and the growth of the market. The high employment rate signifies the dominance of agriculture in the region which in turn is expected for a high adoption rate of glyphosate in agricultural and farming processes. India's overall agricultural employment increased from 37% in 2018–2019 to 38% in 2019–2020. Further, a large amount of agricultural land in the region is another growth factor that prompts the usage of glyphosate for producing agricultural and food products. According to the World Bank, agricultural land in East Asia and the Pacific accounted for approximately 47.7% of the total land area in 2018. Additionally, investments in research and development activities and growth in GDP level coupled with high chemical consumption are anticipated to be other growth factors. In 2021, domestic chemical sales in Asia Pacific garnered approximately USD 3 trillion.

North American Market Insights

On the other hand, the market in North America is also anticipated to hold a significant market share during the forecast period. The increased usage of modern agricultural products along with the rising preference for genetically modified crops is anticipated to be the major factor for market expansion in the upcoming years. Apart from this, the initiation of agricultural supportive policies by several agencies such as the Environmental Protection Agency (EPA) and the Food and Agricultural Organization (FAO) to address the rising concerns and consumer consciousness on health effects and the environment is projected to increase the utilization rate of glyphosate in the next few years. Further, the rapidly growing agriculture sector and the need for glyphosate for soil enhancement are also anticipated to positively contribute to market expansion.

Glyphosate Market Players:

- Syngenta Crop Protection AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bayer AG

- DuPont de Nemours, Inc.

- The Dow Chemical Company

- Nufarm Limited

- Nantong Jiangshan Agrochemical & Chemicals Limited Liability Co.

- ADAMA Agricultural Solutions Limited

- UPL Limited, India

- American Vanguard Corporation

- Corteva Agriscience

Recent Developments

-

Bayer AG and Bunge, along with Chevron U.S.A Inc. have together signed a shareholder's agreement regarding the decision of Bayer's acquisition of CoverCress, Inc., a winter oilseed producer, which covers 65% of ownership.

-

Syngenta Crop Protection AG has agreed with HL Hutchinson (HLH) to supply agronomists and farmers with an advanced soil mapping and sampling service initially in continental and Eastern Europe.

- Report ID: 4333

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Glyphosate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.